Bengali: এই ব্লগটি এখানে বাংলায় পড়ুন।

Key Takeaways:

- This is a very different type of situation which the globe is undergoing. The corona virus has been spreading beyond the initial expectations and is also beyond anticipation that when finally will the virus slowdown.

- Due to continuous pandemic in China, the Global companies relying heavily on China for its requirements want to shift base to India as it remains the only destination that can cope with huge global requirements.

- We should very carefully analyze the companies and their impact during the pandemic and the gradual recovery which can start after the pandemic gets curtailed.

- There might exist companies that could have positive or no impact in a negative sector because of their model.

The economic impact of Covid-19 (Novel Corona virus) to the world will be bigger than the consequence of SARS in 2003 which did not impact the world economy.

If the situation takes longer to stabilize, the impact on the world economy will be higher.

In wake of the novel corona virus (Covid-19) outbreak, over 50 percent of Indian companies see impact on their operations and nearly 80 per cent have witnessed decline in cash flows, says a survey.

| Table of Contents |

|---|

| The sectors which will be negatively impacted |

| The sectors which will be positively impacted: |

The pandemic has significantly impacted the cash flow at organizations with almost 80 percent reporting a decrease in cash flow.

Nearly 42 per cent of the respondents feel that it could take up to three months for normalcy to return. The country is already experiencing a slowdown in growth.

In the third quarter of the current fiscal, the economy grew at 4.7 per cent, slowest in six year according to FICCI. Goldman Sachs Sees India GDP Growth Plunge To 1.6% In FY21 compared to earlier projection of 3.3%. So far Fitch Ratings and ICRA Ltd had pegged India’s FY21 growth at 2% while S&P and Moody’s have projected India to grow at 3.5% and 2.5%, respectively.

Rating agencies, both global and domestic, are unanimous that the corona virus pandemic will be an economic tsunami for India.

Even though the country may not slip into a recession, unlike the Eurozone, the US, or Asia-Pacific that have stronger trade ties to China, analysts believe the impact on India’s GDP growth will be significant.

Suggested Read : Sectors to Benefit post Lockdown

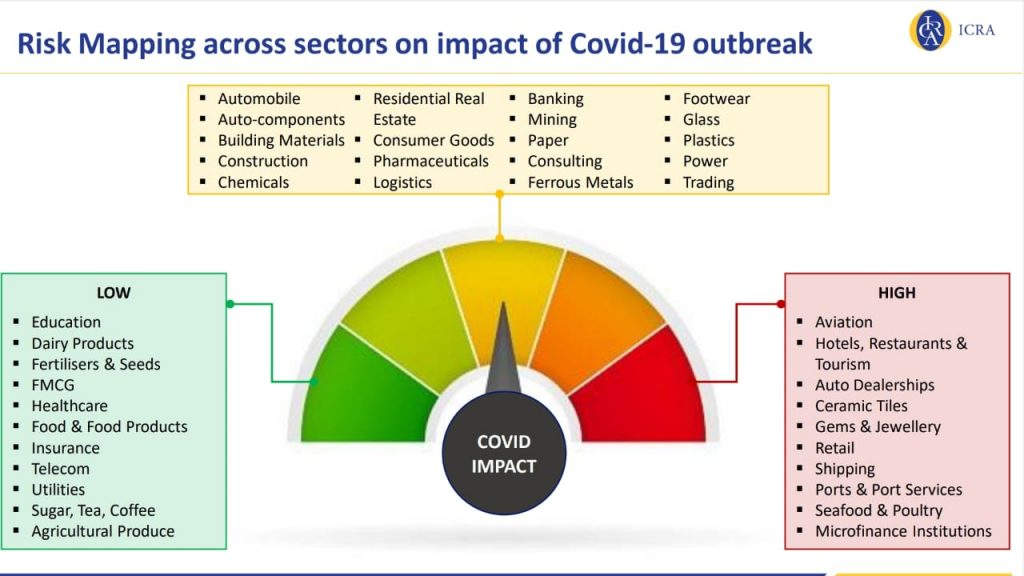

So lets find out Who are Negatively and Positively impacted from the same:

The sectors which will be negatively impacted:

1. Auto and Auto Ancillary:

- In the last 5 years import of 2/3 wheeler equipment’s from China has gone up by 46% (from USD 3.5 million to USD 5.1 million). It will marginally disrupt inventory management. The current inventory cycle is 30 days.

- During 9M FY20, net sales of the automobile OEMs witnessed a y-o-y decline of about 14% vis-a-vis a growth of about 16% witnessed during 9M FY19 while auto ancillary players (including tyres) witnessed a decline of about 11.7% vis-à-vis a growth of 14.7% during 9M FY19

- With the already existing slowdown during FY20 and corona virus, the Industry is likely to suffer huge losses going forward. It is also to be noted here, that even if the pandemic is curtailed, the consumer sentiments are expected to be unfavorable and demand is expected to remain muted during H1 FY21 led by fluctuating and uncertain economic conditions.

2. Aviation:

- With the spread of the novel corona virus (COVID-19) to geographies beyond the epicenter of its origin the airline industry has been hit badly as countries all over the world are imposing travel restrictions amid complete lockdown.

- With most of the countries under lockdown banning/imposing restriction on entry of foreign nationals, airline carriers world over are mulling their operations due to lack of demand.

- Even as the macros of the Indian aviation industry may be in favor of propelling its growth, the Industry may not fully recover any time soon post the effects of the pandemic which has affected business operations, travel, and tourism and economies world over.

3. Hotels & Tourism:

- Given various travel restrictions imposed by the Indian Government as well as Governments across the globe due to growing corona virus, bookings for various conferences and leisure travel bookings to foreign destinations have already been canceled.

- Hotel entities with recent expansions or groups with a higher portfolio of new assets compared to mature assets will face additional heat on their already weak financials. With high debt repayments and squeezed profitability, these entities may witness tightening in their liquidity and credit profile.

- The operational parameters (Occupancy rates – ORs & Average room rates – ARRs) of the hotel players are expected to get adversely impacted for the next couple of quarters.

4. Capital Goods:

- Of the total imports, engineering goods contribute 31% with dairy machinery (5.5%), Electric machinery (3.8%), Refrigeration machinery (2.4%), Metals(8%) being the major contributors.

- Electronic goods contribute 32% of total imports with mobile and telephone equipment contributing 10.5%, electronic components 8.3% and computer hardware 5.7%. China accounts for 85% of the total value of components used in smartphones and 75% on television. Prices are likely to increase with the launch of new models expected to be delayed.

- Supply disruption of components like compressors for refrigerators and air conditioners, television panels, LED chips and motors, etc, will lead to a rise in prices and shortage of supply of products in various channels.

- The export of the sector has been modest and India is the 25th exporter of the total capital goods sector contributing around 0.6% of the total global sector.

5. Non Banking Financial Institutions (NBFC)/ Housing Finance Companies (HFC):

- The microloan and MSME loan portfolios of NBFCs and MFIs would experience a significant increase in delinquency levels during the period. The effects would be seen in the urban and semi-urban portfolios before spreading to the rural portfolios.

- The impact might be higher in MFIs focussing on urban areas as the customer profile will involve small businesses or workers engaged on contractual basis losing man-days of work due to prevailing corona virus. If the duration of lockdown remains limited, the impact on rural MFI customers is likely to be limited and vice a versa.

- The NBFC/HFC sector which has managed to sustain amidst challenging funding scenarios by taking various mitigating steps will now have to weather the Covid-19 disruption. While the sector remains fairly well-capitalized, the trend in delinquencies retail asset classes will be a key parameter to monitor for the sector over the next few quarters along with resource raising capabilities of the NBFCs/HFCs.

6. Chemicals:

- Domestic specialty and Agro-chemicals players with a strong supply chain & with global export footprints to benefit from a hike in international prices.

- Supply disruptions of basic raw material and intermediates will lead to an increase in prices.

- Few crop protection companies globally source their active ingredient requirements from China. Hence, any disruption in supply may lead to increased costs for these companies and impact margins

7. Metal & Mining:

In the near term, demand is expected to be down due to lower global growth which may affect the pricing power of metal companies. Currently, imports from China to India stand at around USD 5,500 million while exports are below USD 800 million, which signifies a huge opportunity for Indian players to meet domestic demand.

8. Solar Power:

- The solar power project developers in India continue to source solar modules from China. Modules account for nearly 60 percent of a solar project’s total cost.

- Chinese companies dominate the Indian solar components market, supplying about 80 percent of solar cells and modules used here, given their competitive pricing.

- Chinese vendors have intimated Indian developers about delays happening in production, quality checks and transport of components, due to the outbreak

9. Oil & Gas:

- Fall in crude oil prices may lead to inventory losses and impact Gross refining margins and profitability of OMCs in the short term.

- However, the companies will have twin shock of a global supply glut and demand fall in the current situation.

- The performance of the companies in the following quarters will be hugely impacted by the double whammy impact of supply and demand concerns.

The sectors which will be positively impacted:

1. FMCG:

- Crude oil price to moderate in the near term, offering cost benefits to players relying on crude and it’s derivatives

- The outbreak has a marginal benefit on FMCG’s due to a drop in crude and derivative prices.

- Also, with the lockdown, the consumption of the goods will increase and hence will improve the revenues for these companies.

2. Education:

- The education system won’t be affected as the revenues in the form of fees from a student will continue. There won’t be any impact on the revenues from students to the educational institutions.

- Moreover, with the education sector undergoing the e-transformation, it will likely yield benefits for both students and the institutions. Various e-portals have been providing services for glitch-free and smooth access to education.

- The cash flows of the educational institute might get a temporary delayed due to some late fees being paid by the student but this is a temporary problem which won’t impact the model of the institutes and hence this sector would be positively impacted by the introduction of e-learning.

3. Media & Entertainment:

- The sector is valued at around Rs 1887 bn as per the FY2019. Segments such as digital media, online gaming, radio and Over The Top (OTT) platform shall benefit as individuals are forced to stay home and use such mediums as their only source of entertainment.

- Multiple events including concerts and sports events were scheduled in the year 2020, including the Tokyo Olympics, Hockey Pro League, Asia Cup, UEFA Champions League, Cricket IPL, etc. While some are postponed, few are expected to be canceled.

- The sector is set off by the demand of OTT based contents, recasting of their existing content which will somewhat reduce the negative impact of the shut down of theatres. The loss from one part will be reduced by the push of demand from other segments like OTT etc.

4. Textiles:

- China’s 40% share in the global textile & apparel trade may fall in the near term which is seen positive for Indian exporters considering the scalability and strong cotton base in the country. The exposure of sourcing from China is negligible.

- Domestic companies outsourcing from China to be in short of supplies in the near term. Sourcing raw materials and supplies from new destinations can impact margins significantly.

5. Healthcare:

- Post the pandemic, the healthcare sector will be in the limelight with the type of health awareness being developed among the individuals. The Healthcare sector will go into a transformation with more focus towards this sector.

- The pandemic won’t be able to negatively impact this sector as this is the need of the hour. The healthcare, the awareness which was being lacked in our country would take a front seat and the healthcare services would improve to meet the needs of the individuals.

- People have realized the need and voracity of medical Insurance thus this pandemic would make Individuals save for their medical bills and increase kitty of Life Insurance and medical Insurance in their saving model. Thus Life insurance and medical Insurance companies to benefit from the same.

6. Telecom:

- The telecom space has undergone consolidation in the past few years post the entry of one of the biggest players in the industry i.e. JIO. The industry has been consolidated with the closing of many companies and merging into bigger companies too.

- This crisis has been a boon for the telecom sector in terms of the increased usage of their services. With the advent of technology, the usage of the services of telecom have increased and which have not much impacted the business of the companies.

- The data usage by the users to continue their business through virtual mode and also the other services being offered like the content of digital media are also dependent on the telecom services.

7. Pharma:

- Indian pharmaceutical companies imports both bulk drugs (API) and intermediates constituting around 68% of total imports of the raw material. It will help Indian companies increase their in-house production of drugs and API which is possible.

- Export opportunity which was struggling due to the competitive intensity in US has stabilized. The need to maintain supply will be prominent over the need to control prices.

- Incidences like this are expected to spearhead steps on increasing API manufacturing within India by way of quick regulatory approvals. India has enough capacity to manufacture API for many medicines. Currently, many such facilities are underutilized.

- Also with a few drugs in which the Indian Pharma company products have been in demand due to the huge demand from the global markets. Also, the pharma companies will likely witness huge demand with the ongoing pandemic in terms of the wide basket of medicines, api, drugs that they produce.

Interested in related topics but want to learn them in Hindi? Join our share market learning in hindi and enhance your skills.

In order to get the latest updates on Financial Markets visit Stockedge