It is always great to have a higher return on our deposits. But by the term deposit, some of us may understand it as bank fixed deposit but there is also another type of deposit available in the market which is Company Fixed Deposit. Just like the Bank Fixed Deposit, Company Fixed Deposit works in the same manner but the difference lies in the return or interest they are offering and there is also a chance of default. Want to know more about other investment options? The Certification in Online Financial Planning & Wealth Management course will help you gain knowledge about various profitable investment options.

Then why should you invest in Company Fixed Deposit right?

The answer is very simple – to get the benefit of high return.

In this article, we will discuss the ‘know how’ and the procedure to choose the right fund for yourself.

What is a Corporate/Company Fixed Deposit?

Fixed deposits which are issued by private and public companies are called Company/Corporate Fixed Deposit. The interest of Corporate Fixed deposits may vary from company to company. But the risk is also associated with the return they are offering. Higher the interest rates higher the chances of default.

Features of a Company FDs:

Following are the five important features of a Company/Corporate Fixed Deposit:

- Types of Company Fixed Deposits: In general, there are two different types of Company Fixed Deposit schemes:

- Cumulative Schemes: In the cumulative schemes, interests are accumulating with the principle amount.

- Non -Cumulative Schemes: In the case of Non-Cumulative schemes, earned interests are paid off on regular basis. It can be annually as well as a half-yearly basis.

It is but obvious that Cumulative Corporate Fixed Deposits have higher returns as compared to Non-Cumulative FDs.

- Types of Company Fixed Deposits: In general, there are two different types of Company Fixed Deposit schemes:

- Company Ratings: CRISIL or ICRA are the two main organizations which give ratings to these types of fund and this rating is based on the fund quality and the Net Owned Fund (NOF).Net owned funds mean – Addition of the following: Paid up capital, Reserve and Surplus (excluding revaluation reserve), Long-term liabilities (to be paid after one year), and Deduction of the following – Trading Investment, Fictitious assets (like preliminary exp., debit balance of P & L) Based on the rating of these funds an investor may choose the Corporate Fixed Deposit’s to invest in. A Brief understanding on Credit Rating Agencies will help you know more about Rating Agencies.

- Term: A term is the duration period of the investment and it is regulated by RBI.Generally, a company Fixed Deposit’s term is very less; it varies from 1 year to 5 years. The company fundamentals, performance, rating etc. are the variable factors for regulation of Corporate Fixed Deposits.

- Interest Factors: Compared to Bank Fixed Deposit’s, company fd rates are much higher.The interest rate on Bank Fixed Deposits at present vary from 6% to 8% whereas Company Fixed Deposit’s interest rates at present vary from 9% to 12.5%. This higher interest rate in Company Fixed Deposits attracts more people to it. This interest rate is regulated by RBI and it changes from time to time.

- Premature Withdrawals: These investments have a lock-in period of 3 months, however, premature withdrawals are also available. By doing a premature withdrawal an investor may face penalties as per the company’s terms and conditions.

Benefits:

There are three simple reasons to invest in Company Fixed Deposits:

- Interest rate is higher compared to regular Bank Fixed Deposits.

- Systematic Interest payment options (Monthly, quarterly, half-yearly, annually)

- Most of the Fixed Deposits are rated by credit rating agencies so that the investor can choose wisely.

Disadvantages:

- Default Risk: Unlike Bank FDs, Company FDs face default risk. So before investing in a Company FD always look for the company background and its credit ratings.

- Taxability: The interest earned from a company/corporate fixed deposit is fully taxable.

Company Fixed Deposit Interest Rates:

The interest rate on a company fixed deposit varies according to different scenarios. Let’s explore them one by one:

- There are two different types of interest rate offered by a Company Fixed Deposit Scheme:

(a) Cumulative and (b) Non-Cumulative

- There are two different types of interest rate offered by a Company Fixed Deposit Scheme:

- Interest rates are slightly higher for the senior citizens but it varies from company to company.

- Interest rates are usually high for the company’s employees who apply for Fixed Deposit with them and it also depends on the company terms and rules.

- Based on the time duration of the fixed deposits, interest rates are also subject to change.

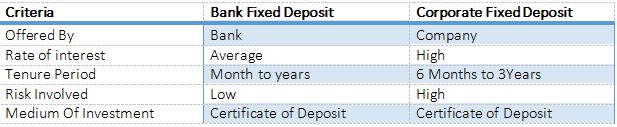

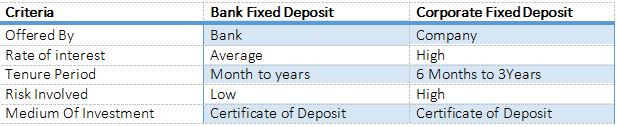

Company Fixed Deposit vs Bank Fixed Deposit:

Eligibility Criteria for investing in Company Fixed Deposit:

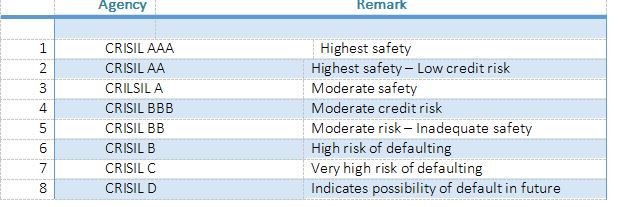

CRISIL Ratings on Company FDs:

CRISIL, one of the topmost credit rating agencies in the world assign ratings to Company Fixed Deposits based on the Net-Owned Funds (NOFs).

The rating starts from AAA and goes down till D. The rating shows the fund quality and its chance of default.

Source: CRISIL

How to choose a Company Fixed Deposit?

Following are some steps that an investor can undertake before choosing any Company/Corporate Fixed Deposit:

- Rating of that Fixed Deposit

- Even if the rating is good to choose the company which has a good reputation.

- Go for better interest rates but be prudent

- Check the minimum and maximum amount. Select only those with which you are comfortable.

- Look for the time duration. It is advisable to go for 1 years to 3 years because company fundamentals and other related factors change from time to time.

- Involve your financial planner in case you are in doubt.

Some Frequently Asked Questions

1. What is the difference between a bank FD and a company FD?

Ans. Both Fixed Deposits carry the same features but the main difference is the risk factor which is attached to the Company Fixed Deposits.

2. Are corporate FD’s and company FD’s the same?

Ans. Yes, they are pretty much similar.

3. Is there any premature withdrawal available?

Ans. For most of the cases it is yes and depending upon the company terms and conditions, in some cases penalties are also applicable.

4. How to apply for a company Fixed Deposit?

Ans. An investor can directly contact the firm where he/she wants to invest or it can be done directly online.

5. Are FD receipts issued?

Ans. Receipt of the FD’s can be issued only to that investor who has applied for the FD’s via offline.

6. Is the interest rate high for senior citizens?

Ans. For most of the cases, it is yes.

7. How interest is paid to the deposit holder?

Ans. Interest is paid monthly, quarterly, half-yearly and annually. It depends on the chosen frequency. Interest is paid directly to the holder’s bank account which is attached to that deposit.

8. Can I apply online for a company FD?

Ans. Yes.

9. Is there any chance of default?

Ans. Yes, there can be default risk, so choose your fund wisely.

10. Does lower Interest rate means low risk but assured return?

Ans. Lower interest means low risk, but a certain level of risk is always attached to Company FD’s thus assured return can’t be guaranteed.

11. Is TDS applicable even for Company FD’s?

Ans. Yes, TDS is applicable to Company FD’s.

Precautions before investing in Corporate Fixed Deposit

As we understand, investing in a Company Fixed Deposit is risky but it also provides high returns. So the investor should be cautious and choose its investment wisely.

Some important factors are mentioned which can be useful for a wise investor:

- Make sure the company rating is high.

- Choose a reputed company.

- Company should be more than 5 years old.

- Company should at least be making profits for at least 3 years in a row.

- Company should provide dividends on regular basis to its share holders.

- Don’t just jump for the high return choose a company who is offering a realistic return.

- Make sure the Company is listed in the Stock Exchange.

Bottom Line:

A company fixed deposit provides a higher return than that of an ordinary bank fixed deposit but the risks associated with the company fixed deposit is also much higher. Thus an investor should be careful while deciding to invest in a Company/Corporate Fixed Deposit.

Really it’s a great blog. Thanks for sharing the valuable information about India Grid InvIT IPO –Company Fixed Deposits – Are they safe to invest in.

Hi Rahul,

Thank you for reading the blog.

Keep Reading!

Really great information, thanks for the share and insights! I will recommend this to my friends for sure.

Hi,

Thank you for Reading!

Keep Reading

Nice blog. Thanks for sharing the valuable information.

Hi,

We really appreciated that you liked our blog! Thank you for your feedback!

Keep Reading!