Retirement is a fact that each and every one of us has to face. There will come a day when we will not be able to earn. However, expenses won’t stop. Life is like a bucket with a hole under a tap. On one hand, you pour in water and on the other hand, water goes out through the hole. Now consider a situation when the tap stops working. The bucket will soon be empty. Retirement is that stage of life when the tap stops working.

Retirement is a time when one finally gets enough time in hand to follow a passion. No one would like to spend retirement thinking of where the next penny will come from.

There are two stages in retirement – accumulation stage and distribution stage. Accumulation stage is when savings and investment help to build the retirement corpus. 50s probably comes in the later half of the accumulation stage and if you haven’t started thinking of retirement even by now, you need to buckle up your shoes cause you might just miss the train.

Why plan for Retirement?

As explained earlier, the inflow of funds will stop once a customer retires. Unfortunately, unlike the developed world, India does not have the concept of social security. While employees in the Government sector do have a Government pension, however, often, the amount is frugal to meet the expenses.

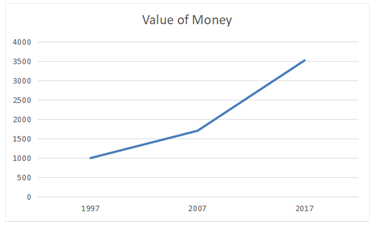

Things are becoming more and more expensive day by day and the value of money is falling. As per inflation calculator, Rs 1000 in the year 2007 is worth Rs 2065 in the year 2017. That is an increase of 100% in 10 years. The same Rs 1000 of 1997 is worth Rs 3521 in 2017. This falls in line with the basic principle of Time Value of Money- “Money today is worth more than money tomorrow”

Coupled with this, as you become older, the risk of unforeseen illnesses increase. With inflation, the cost of medical treatments and medicines are also going up in today’s time. Hence, retirement planning is of utmost importance.

Read article: How To Become Your Financial Planner?

Although the amount of corpus required after retirement entirely depends on the lifestyle of a person, the age of retirement, medical condition of the person, number of dependents, etc. Let us give you a rough idea of how much one has to save in order to build a corpus required by an average person. According to standard retirement calculators , if you are 30-years-old with an annual income of Rs 5 lakhs, you will need to save Rs 4000 a month to accumulate a corpus of Rs 44 lakhs by the time you retire. Considering your income will increase over the years, a 35-year-old person with an annual income of Rs 10,00,000 will have to save Rs 8000 a month to accumulate a corpus of Rs 88 lakhs. The retirement age considered here is 60 years and the rate of growth of the corpus is considered at a modest 8%.

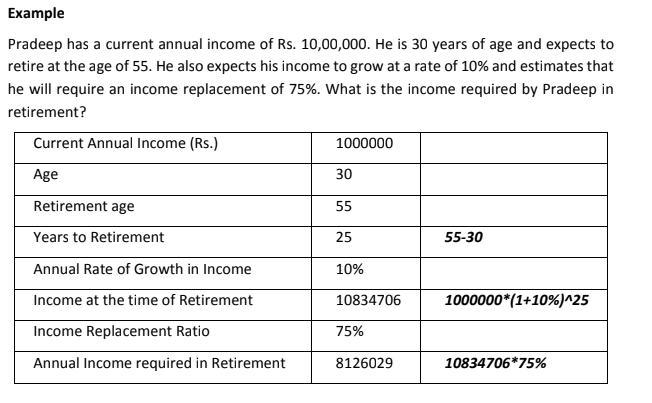

You may calculate your retirement corpus using the Income Replacement approach. The income replacement ratio is the percentage of the income just before retirement that will be required by an individual to maintain the desired standard of living in retirement. While estimating this ratio, the current income has to be adjusted for a few heads of expenses that may no longer be relevant in retirement. At the same time, there may be a larger outlay on other heads of expense such as medical and healthcare. Some people may also like to have higher discretionary income for travel or entertainment.

Retirement Planning Calculator

This is a very interesting tool which will help you calculate your retirement needs. You will find several banks like HDFC, ICICI, SBI providing their own online version of this tool, available completely free of cost. They have algorithmic calculations fed in their respective tools which convert your financial needs into numbers after accounting for various factors like age, salary, expected retirement age, current savings amount and whether post retirement accommodation will be rented or owned.

Retirement Planning Pointers:

- Evaluate your retirement savings and expenses: 50s is the prime age when one needs to max out his retirement savings and bottom out his expenses. To do this in a systematic way, budgeting is advisable. Analyse the current financial situation to determine the savings possible. By maxing out savings, we mean that you need to save “enough”. You may feel enough is an arbitrary amount but in truth, it is equivalent to that amount which will help you not only provide for your expected lifestyle but also enable you to financially provide for your loved ones. Thus, it is important to have a clear picture of what you need to accomplish so that you can save accordingly. 50s is not the age for luxurious spending, you have the life after retirement to have an extravagant life. This is the age to “plan for” that extravagant life and reduce or eliminate all unnecessary expenses.

- Identify the investment products for investing your savings: This is crucial along with monitoring of the performance of these products. Choice of category of investments usually depends on your risk appetite which may change with age. A man 25 years of age can take in more portion of equity in his investment portfolio than one who is 50 years old.

- Higher income, higher taxation: As most people earn maximum around their 50s, tax planning is crucial. This is because with higher income comes the burden of higher taxes. Tax evasion is highly castigated but tax avoidance is legal and advisable, where one uses the tax laws legally to reduce their tax burden. Smart selection of retirement products is also essential for saving taxes.

- Review the adequacy of the retirement corpus- Whenever there is a change in the personal situation that has an impact on your income or expenses, you need to revaluate the adequacy of your retirement corpus.

A corollary to the above explanation on importance of retirement planning would be to modify the famous quote “It’s never too late” into “It’s never too early to start planning.”

It is obviously advisable to start early and not wait till your 50s to start planning and saving for your retirement needs. Average age would be between 30-35 years. However, as specified earlier, you can always start earlier so that smaller contributions made can contribute to the corpus significantly with the benefit of compounding. Another added benefit of starting early is that the amount that needs to be contributed periodically to reach the retirement corpus is lesser.

If you are at late 30s or late 40s and confused about how to go about your financial planning or how to plan for your retirement, you can check for our Personal Finance Management course.