Britain has been an integral part of the European Union (EU).

This has led to many advantages for the countries forming part of this union like free trade, free movement of goods between the countries borders and many other things.

But in 2016, Britain decided to leave the European Union and this event was termed as BREXIT.

This would primarily lead to the revocation of the privileges previously enjoyed by the member countries and Britain.

Thus negative for some companies and countries and positive for others.

The Big Overhang

The biggest overhang which existed in this BREXIT was the issue pertaining to the treatment of North Ireland.

Previously under the leadership of Former British PM Theresa May, this decision was not convincing enough for the people and hence the deal failed thrice.

But with the New PM Johnson, the deal seems to be sailing.

The new outcome of the issue is that UK would be completely outside the scope of EU zone and customs union with the exception of North Ireland which would maintain a dual custom zone.

This means that the Irish Sea would have a customs border and the goods would be subject to duty as per the terms decided after the final outcome.

Positive for India

It is being anticipated that Brexit might be a boon for the ties between India and UK.

UK is India’s 12th largest trade partner.

More Indian students will be opting for education in UK after Brexit due to cordial UK India relations.

Britain’s demand for skilled labour workforce could be fulfilled by Indians migrating to UK.

India will be viewed as a safe haven due to the uncertainties that would arise due to Brexit being both stable and strong.

Negative for India

The Indian companies operating in UK will be affected badly during the Brexit.

The Indian companies will be exposed to the uncertainties being piled up in their economy.

The uncertainty that would arise in their currency could cause hindrance to the Indian Rupee in the short run. Thus cross currency headwinds to impact profitability, capex and growth.

Stocks to be impacted

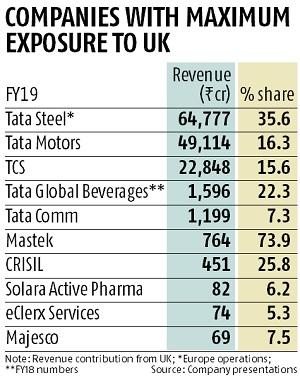

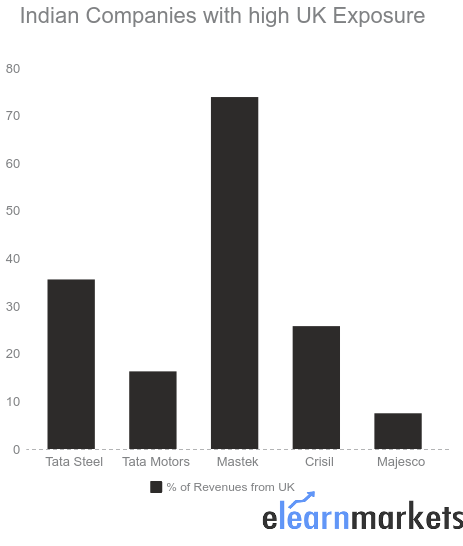

There are many Indian companies which have exposure to UK.

There are many companies with significant operations in UK.

Further it can be assumed that India will not only be viewed as a back office for UK but also for the front office work if both the government strikes an interesting deal.

Tata motors owns the luxury car brand Jaguar Land Rover and was concerned about the uncertainty regarding the deal as it has significant exposure in the market.

Tata Steel which is among the largest Steel makers of the region was poised to be affected if the uncertainties prevailed regarding the deal.

Various other companies like Eicher Motors which have significant market in Europe, Bajaj Auto which had announced a partnership with UK Based Triumph Motors in recent past for making mid weight motorcycles, Mastek which derives its maximum revenues from the region, Crisil, Majesco and many other companies.

Key Takeaways

The main thing to watch out for is the final terms on which the deal is getting sealed to perfection.

To measure if at all the companies can benefit and to what extent.

It is really premature to conclude that the final verdict has been passed and the deal has been done.

These recent developments are yet to be passed by the British Parliament and a few more steps for the final outcome.

Hence, we should carefully watch the further developments and watch out what actually happens.