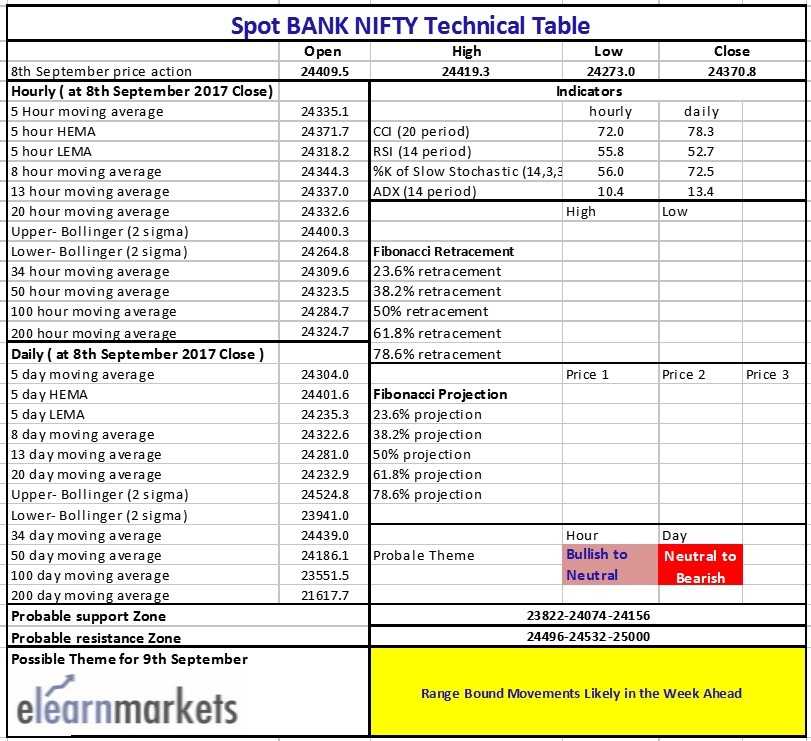

Bank Nifty opened above its 5 Day High EMA (24417 approx) today the 8th of September. The Index traded in a range of 140 points throughout the day and closed below the 5 day high EMA of (24401 approx)

Hourly Technicals:

In the Hourly Chart, Bank Nifty has closed at its 5 Hour High EMA of (24371 approx).The Index is likely to face immediate resistance above the upper Bollinger Band (24417 approx) mark. Bank Nifty has to close convincingly above 24417 for the markets to be clearly in the buy zone.

Hourly RSI and CCI stands around the higher end of the normal range while the ADX is indicating that Bank-Nifty will not undergo major volatility.

Figure: Bank-Nifty Hourly Chart

Daily Technicals:

The daily chart indicates that Bank Nifty has closed marginally below the 5 day high EMA of (24402 approx). If the Index breaks above the 24532 mark, the next resistance will be 25000. On the downside however, if Bank Nifty breaks and closes below its 5 Day low EMA (24230 approx), it could find support at the lower end of the Bollinger Band (24000 approx).

The daily RSI indicator has closed near its normal range.The CCI indicator however has closed near its upper range, while the ADX indicates lack of momentum.

Figure: Bank-Nifty Daily Chart

Weekly Technicals:

The weekly chart indicates that Bank Nifty has closed marginally below the 8 Weekly Moving Average of (24371 approx). If the Index breaks above the 24500 mark, the next resistance will be 25000. On the downside Bank Nifty has a strong support around the 13 weekly Moving Average (24052 approx).

The Weekly RSI has closed precariously close to the 70 mark. The weekly CCI to is at the higher side of its normal range. Weekly ADX indicates that volatility is expected in the days ahead.

Figure: Bank-Nifty Weekly Chart

Table