In 2016, the Centre had announced that the country would be adopting to be BS-VI norms in 2020 instead of BS-V altogether as it felt that there is an urgent need to shift to cleaner fuels in India in order to cut down pollution after CHINA’s instance.

What is BS-VI emission standard?

It is basically the emission standard set by the Government to check the pollutant levels emitted by vehicles. It is stricter emission norm than the BS-IV standard. It will help the vehicles move to cleaner fuels and will help to curb the world’s most toxic air.

Disadvantages:

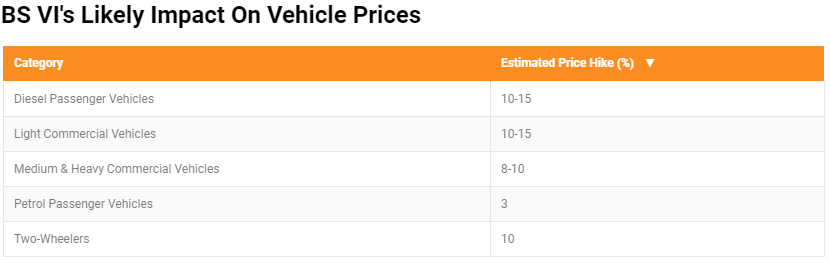

- Shifting to a totally new emission standard is not that simple. It takes years for the automakers to develop a new kind of engine to meet with the new emission standards. All this comes at a cost which eventually makes the vehicles expensive for the end consumers.

- Increase in the price of the vehicle is a major concern for the Auto Industry as it would affect the demand of the vehicles. Also the rise in the crude prices is acting as a major catalyst to this uncertainty within the industry.

- Already the sector has been facing headwinds like increase in crude oil prices and insurance costs which have led to lower demand and thus huge pileup of inventory which even with huge discounts could not be cleared.

- There has been certain regulatory changes like inclusion of mandatory safety features which has also increased the prices of the vehicles.

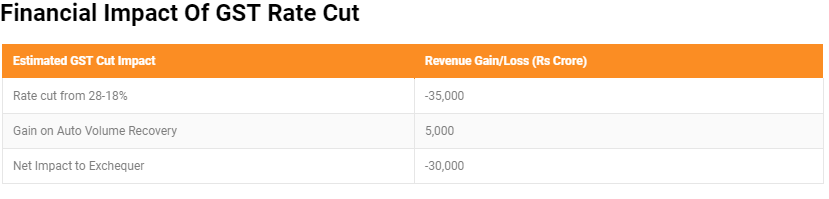

- The Vehicles are levied 28 per cent GST, whereas the auto companies are hardly able to generate 7-8 per cent returns. Thus, to be able to recoup the growth story in the sector the auto manufacturers have requested the government to lower the tax rate from 28 per cent to 18 per cent.

- Fuel for the BS-VI complaint vehicles is one of the important change which has to be made as the auto companies won’t be able to sell the vehicles unless there is enough fuel available across India which are BS-VI complaint.

- The automakers are forced to cut down the production due to inventory pile up of BS-III and BS-IV vehicles. Now the new emission norms are like a wall in front of the Auto Sector.

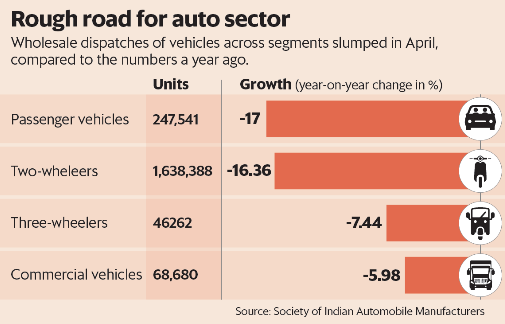

Currently due to various negative factors prevailing in the economy there has been a major slowdown in the consumption sector which includes the Auto Sector as well.It is expected that the Auto Sector will grow at a pace of around 7-9 per cent in FY 20.

It has been reported by the Society of Indian Automobile Manufacturers (SIAM) that the companies already have a stock of around 8.24 lakh of BS-III compliant which the manufacturers are not allowed to sell anymore.

Battling such challenges in the sector, the automotive industry has requested the government to reduce the Goods and Services Tax in order to offset higher costs of the vehicles due to the implementation of safety and cleaner BS-VI emissions standard.

The decrease in the tax rate will help to offset the high price of the vehicles which would further help to grow the demand of the vehicles.

Solutions forward:

From the past it has been seen that in December 2009, due to a 6 per cent tax rate cut, there had been 25 per cent volume led growth between FY10 and FY12. Also a duty cut of 4 per cent in February-December 2014 had aided growth in the following few months.

Similarly, a GST cut would lead to a 10 per cent increase in volume estimates and also a 15 per cent increase in operating profits due to lower discounting pressures on the segments where it’s being implemented.

Future Path:

- For the implementation of the BS-VI, the automakers are gearing up for the changes that need to make in the vehicles which included company like Maruti stopping its production of Diesel cars due to high cost in shifting to the new norms.

- The Government has to made huge investments in order to make cleaner fuels required for the newer version of vehicles.

- The Automakers need to make sure that they speed up the R&D process and make changes in its manufacturing facilities for starting the production process of BS-VI compliant vehicles.

- The cost of the vehicles have to be checked so that it does not become a burden on the potential customers along with that margins also needs to be maintained for the companies to continue its operations.

- It is expected that during the transition period it might hurt the sales.

- Even though it is not clear about the Indian government policies but still it can be assumed seeing the global market circumstances that the focus is towards clean fuel and Hybrid segment vehicles in the coming 10 years.

Key Takeaways:

- The centre had made a decision of shifting from BS-IV to BS-VI complaint in order to cut down the air pollution caused by the vehicles in India.

- Due to various negative factors in the economy the consumption sector has slowed down from the last three quarters resulting in the slowdown of the Auto sector too.

- Factors affecting the demand growth for the auto sector are weak festive season, fluctuations in the crude oil prices, trade wars and increase in the insurance costs.

- Shifting to the new emission complaint will bring in higher price of the vehicles which will ultimately affect the demand of the consumers.

- To offset the high cost of the vehicles, the auto manufacturers have urged the government to lower the GST rate.

- Lowering the GST will bring down the price of the vehicles and thus it might ultimately help in bringing up the volume led growth.