Trend trading is a highly effective strategy that aligns your investments with the market’s natural direction and flow. Using careful analysis and attention to market patterns, traders can identify the possibility to enter and exit positions at the perfect times, improving their chances of profitability.

Let’s see how trend trading strategy is a great trading strategy that can be mastered using a variety of tactics and instruments.

What is Trend Trading?

The foundation of trend trading lies in the idea that markets often follow identifiable trends over time. An asset’s price moving steadily in one direction, either upward or downward, is referred to as a trend.

Usually, the goal of trend traders is to early detect these trends and ride on them until they exhibit indications of reversing or losing strength. The main objective is to enter a trade at the very beginning of a trend, hold the position as long as the trend remains strong, and exit when the trend starts to weaken or reverse.

The simplicity and profit-making potential of trend trading are among its greatest attractions. This approach can be used in various markets and asset classes, as you can use different tools and indicators to identify entry and exit points based on the trends.

Trend Trading Example

Let us assume that the value of a stock has been growing for a few weeks, gradually reaching higher highs and lower lows. This indicates a positive trend.

Step 1: As a trend trader, you expect the uptrend to continue; therefore, you choose to take a long position once the stock price breaks beyond a recent high.

Step 2: You keep holding your position while the stock price rises over time, keeping an eye on important indicators like volume or moving averages to ensure the trend continues.

Step 3: Before the trend reverses, you choose to sell your position when you see indications of a possible reversal, such as a decline in momentum or a shift in the market environment.

Therefore, the main objective in trend trading is to ride the wave as long as it lasts and get off before it goes away.

Different Types of Trends

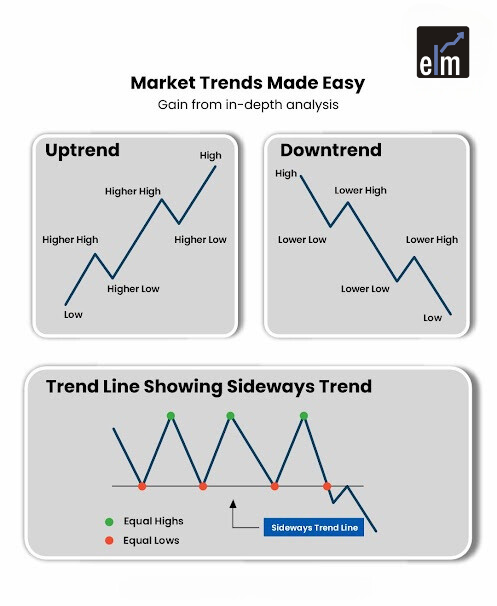

Before we move forward with trend trading strategies, it is essential to understand the 3 main types of market trends:

Uptrend

Over time, prices consistently increase during an upward trend. On a price chart, this trend is typically indicated by higher highs and higher lows. Upward trends generally reflect strong investor confidence and positive market sentiment.

It is suggested to use trend trading indicators like momentum indicators or moving averages as confirmation signals while trading an upward trend. Ride the trend after you enter a trade until you see indications of a reversal.

Sideway Trend

When prices fluctuate within a specific range without apparent direction, this is known as a sideways trend. These patterns frequently signify periods of market hesitation or stability.

Some traders use range-trading techniques to make profits, while others avoid sideways patterns. For example, you may purchase a stock close to the support level, i.e., the lower boundary, and sell it close to the resistance level, i.e., the upper boundary.

Downtrend

A negative trend, sometimes known as a bear trend, is indicated by lower highs and lower lows, which signify a price drop. Usually, this pattern suggests negativity as traders expect more price dips.

Here, the main goals of trend traders are to preserve long holdings or take advantage of short-selling opportunities.

Since these levels might provide information about probable reversal points, identifying significant resistance levels becomes essential for traders looking to manage risk and plan their investments successfully.

Trend Trading Strategies

Moving Averages

The moving average is one of the most commonly utilised techniques in trend trading. They make it simpler to determine the general direction of a trend by averaging out pricing data over a specific period.

There are two types of moving averages in trend trading indicators:

- Simple Moving Average: The SMA determines the average price over a predetermined number of periods.

- Exponential Moving Average: EMA makes it more reactive to fresh data by giving more importance to current prices.

Moving averages are frequently combined to validate patterns.

A “crossover” occurs when a short-term average (such as 50 days) rises or falls over a longer-term average (such as 200 days).

For example, it is often called a “golden cross,” indicating that prices may increase if the short-term average exceeds the long-term average. Conversely, when the short-term moving average crosses below the long-term moving average, it is called a “death cross,” which may signal potential price declines.

Momentum Indicators

With momentum indicators in trend trading, traders can estimate a trend’s strength and decide whether it will likely continue or fade away. Some of the most used momentum indicators are as follows:

- Relative Strength Index: RSI shows if an asset is overbought or oversold by calculating the rate and direction of price changes. The RSI below 30 denotes oversold situations, while an RSI above 70 shows overbought situations.

- Moving Average Convergence Divergence: MACD is a trend-following momentum indicator that displays the correlation between two moving averages of a stock’s price.

In addition to price trend trading indicators, you can use momentum indicators to check if a trend is strong enough to continue or if a reversal is likely due to a loss of market momentum.

Trendlines & Chart Patterns

Trendlines are one of the most straightforward and practical methods for identifying market trends. The lowest and highest points of an uptrend or downtrend are connected to form a trendline, which helps to understand the market’s direction.

The trendline acts as support during an uptrend, where prices typically bounce back after touching it, and as resistance during a downtrend, where prices often fail to rise above it.

To determine the potential direction of the market, traders frequently study chart patterns such as triangles, channels, and flags in addition to trendlines.

For example, if the price breaks out of a triangular formation, it may indicate that the trend will probably continue. Conversely, a “head and shoulders” pattern might suggest that the market is about to turn around and go from an upward to a downward trend.

Conclusion

Gaining expertise in trend trading requires perseverance, self-control, and enough resources. Finding trends is only one aspect of it; another is knowing how to use them to your advantage. With the right information and strategies, you can trade confidently and effectively in a dynamic market.With an emphasis on real-world applications, interactive learning, and practical insights on trend trading, Elearnmarkets equips you with everything needed to achieve your financial goals. Take your trading career to the next level by exploring the resources at Elearnmarkets and unlock your full trading potential today!