Nifty close 10225: Nifty opened flat but the selling pressure continued throughout in today’s session. The Selling pressure in the final hour of trade dragged the market lower.

Hourly Technical:

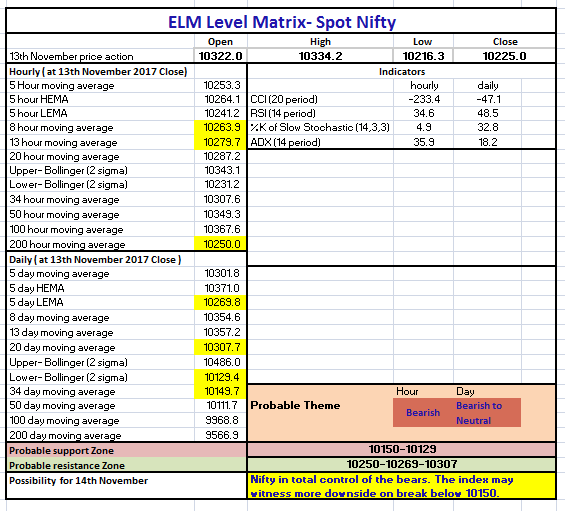

In the Hourly chart, Nifty closes below 200 Hourly moving average and most short term moving averages indicating weakness.

On the upside, Nifty may face resistance at 200 Hour moving average (presently at approx. 10250), 8 Hour moving average (presently at approx. 10263.9) and 13 Hour Moving average (presently at approx. 10279.7).

Hourly Stochastic and CCI are in the oversold zone while RSI is very close to the lower bound. While ADX is steadily going up indicating gain in downside momentum. Overall Nifty remains bearish in the Hourly chart.

Figure: Hourly Chart

Daily Technical:

In the daily chart, Nifty has closed below 20 DMA and 5 Day Low EMA indicating weakness in the near term. The probable support in the Daily chart comes at 34 DMA (presently at approx.10149.7) and Lower Bollinger line (presently at approx.10129.4).

On the upside, Nifty may face resistance at 5 Day Low and EMA (presently at approx. 10269.8) and 20 DMA (presently at approx.10307.7).

Daily Stochastic, RSI and CCI are in the normal zone while ADX is downward sloping indicating loss of momentum. Overall Nifty remains bearish to neutral in the daily chart.

Figure: Daily Chart

Figure: Tech Table