Bank Nifty opened above its 5 Day Low EMA (25262 approx) today . The Index traded in a range of 332 points and closed above its opening price.

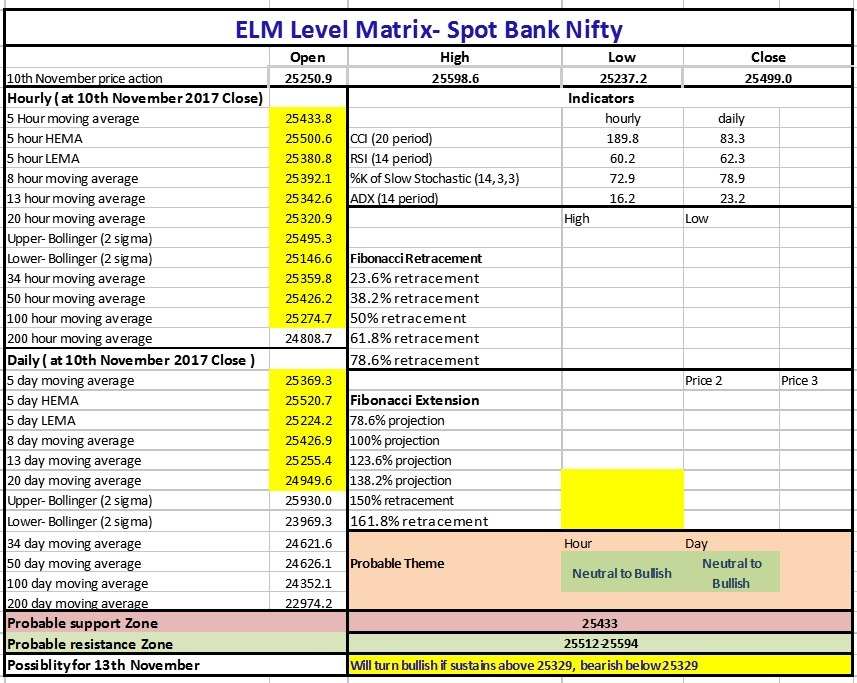

Hourly Technicals:

In the Hourly Chart, Bank Nifty has closed above its 5 Hour Low EMA of (25380 approx).The Index is likely to face immediate resistance above its 5 hourly high EMA (25512 approx). Bank Nifty will find its next support around the 5 Hourly Moving Average ( 25433 approx) .

Hourly RSI stands close to the lower end of the normal range while the CCI is indicating that sentiments are very positive. ADX is indicating that Bank-Nifty might not undergo major volatility yet.

Figure: Bank-Nifty Hourly Chart

Daily Technicals:

The daily chart indicates that Bank Nifty has closed marginally below its 5 day high EMA (25520 approx). The Index will face immediate resistance around its intraday high(25594 approx). On the downside however, if Bank Nifty breaks and closes below its 13 DMA (25224 approx), it could find support at its 20 DMA (24949 approx).

The daily RSI indicator has closed near the upper end of the normal range.The CCI indicator however is indicating that sentiments are still positive.The ADX indicates that momentum might remain slack.

Figure: Bank-Nifty Daily Chart

Weekly Technicals:

The weekly chart indicates that Bank Nifty has closed above its 5 week high EMA (25325 approx). The Index will face immediate resistance around its upper Bollinger Band (25551 approx). On the downside however, if Bank Nifty breaks and closes below its 5 weekly MA (24937 approx), it could find support at its 8 weekly MA (24662 approx).

The weekly RSI indicator stands close to the upper end of the normal range.The CCI indicator however is indicating that sentiments are l positive.The ADX indicates that momentum might be picking up.

Figure: Bank-Nifty Weekly Chart

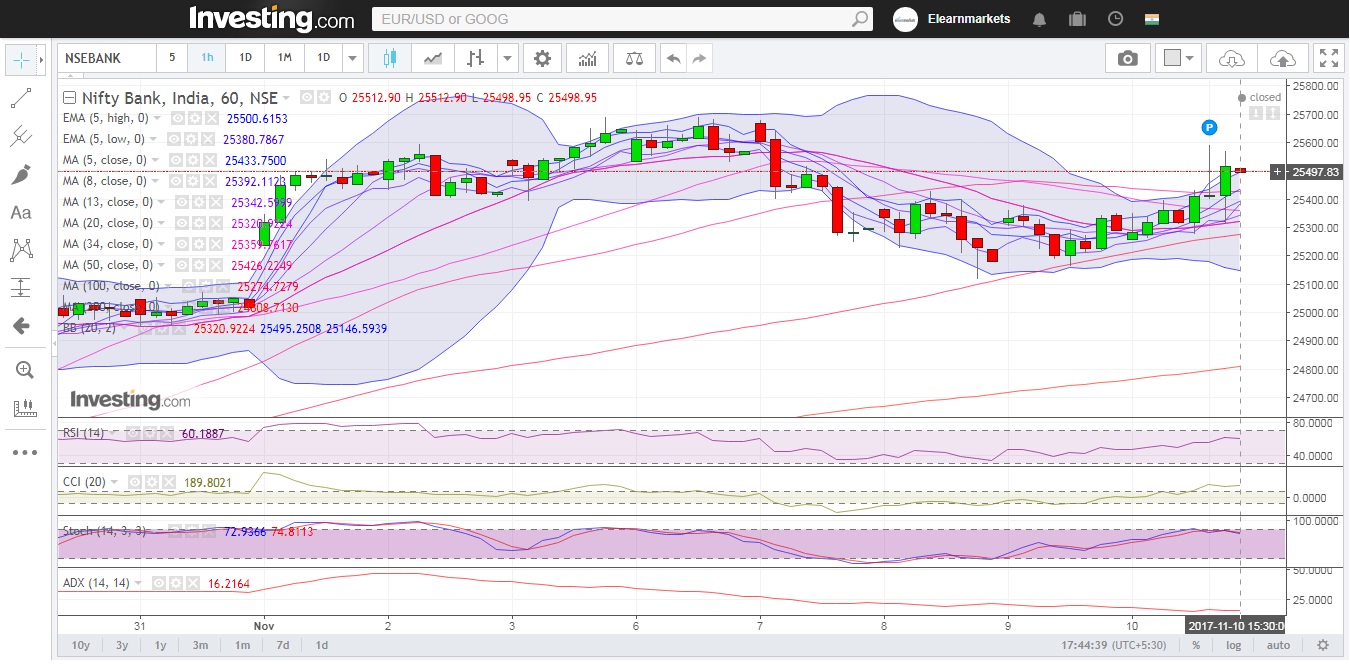

Figure: Bank-Nifty Tech Table

Good Info…