- What is Savings?

- What is the Purpose of Savings?

- 8 Creative Ways of Developing Saving Habits

- What is the Role of Emergency Funds?

- Why Do Emergency Funds Matter?

- How to Determine the Emergency Fund’s Size?

- How to Build Your Emergency Fund?

- Where to Keep Your Savings and Emergency Fund?

- When to Use Your Emergency Fund?

- Conclusion

- Frequently Asked Questions (FAQs)

What was your New Year 2024 resolution? To Save More and Spend Less?

Have you started with it? Or have you thought of postponing the new financial year 2024-2025?

If you haven’t started with this resolution, then the new financial year 2024-2025 is the right time to start this resolution.

Having a strong financial safety net is crucial for stability and peace of mind in the uncertain world we live in today.

The first step in any financial journey, be it retirement planning, emergency fund building, or dream trip savings, is to set aside money.

In this blog, we’ll examine the importance of emergency savings and funds, how to grow them, and methods for preserving financial stability.

What is Savings?

The amount of money that people or households lay aside for future needs as opposed to spending it right away is known as savings. It entails putting money aside in accounts like investment portfolios, retirement accounts, savings accounts, or certificates of deposit (CDs).

Savings might also include material assets such as real estate or priceless items that appreciate in value over time.

What is the Purpose of Savings?

Savings have several uses and support stability and financial security in different ways.

1. Emergency Fund

Savings act as a safety net against unforeseen costs, such as urgent medical care, auto repairs, or an abrupt layoff.

Having an emergency fund guarantees that people won’t have to resort to high-interest debt to get through difficult financial times.

2. Making Savings a Habit

A habit of conserving money is essential for long-term financial security. People who regularly save aside a percentage of their income protect themselves from future objectives and unexpected expenses.

Budgeting, prioritizing needs over wants, and automating savings are all part of developing this habit. Disciplined saving creates opportunities for investment and wealth accumulation over time and financial resiliency.

Let us discuss some of the ways in which savings can be made as a habit-

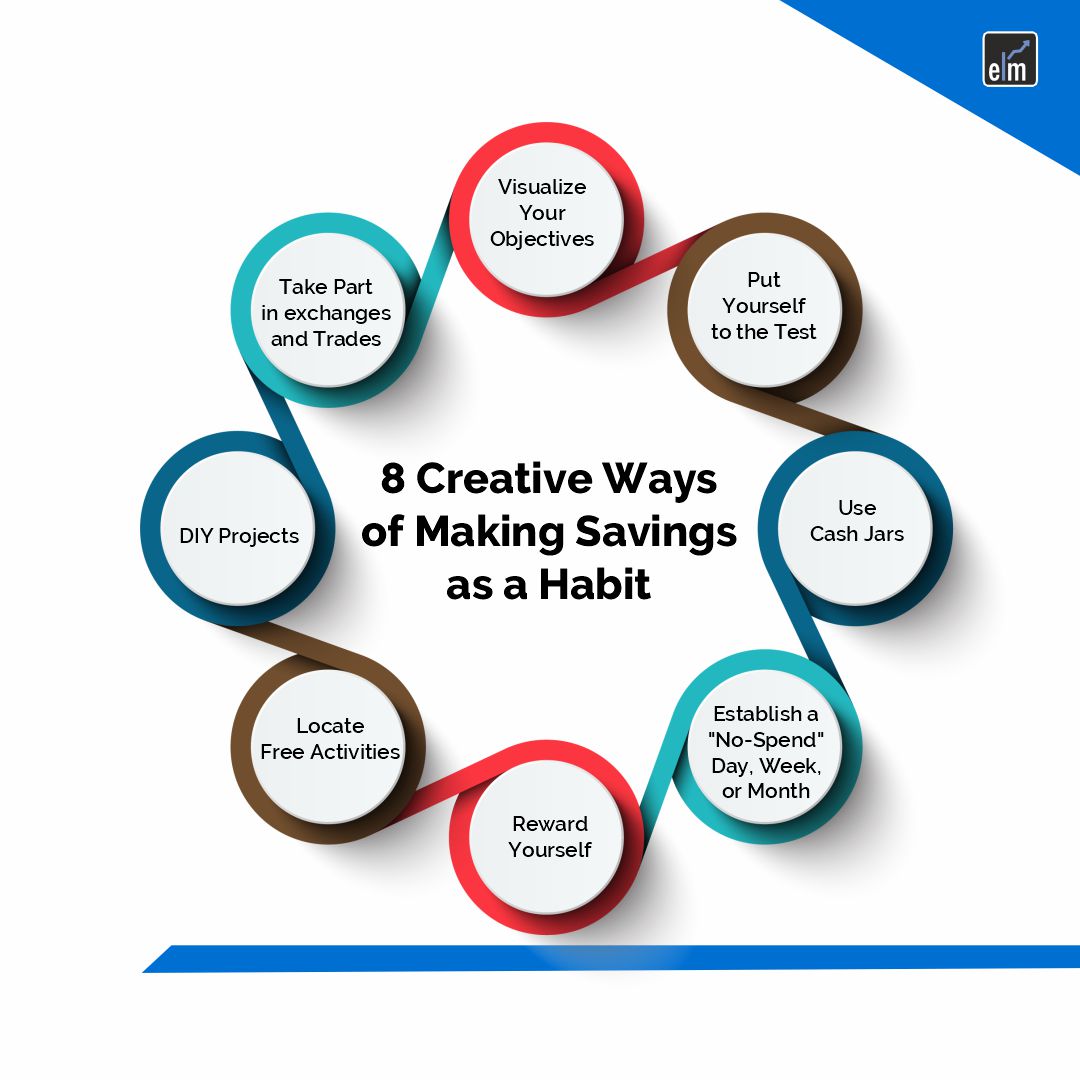

8 Creative Ways of Developing Saving Habits

- Visualize Your Objectives: To help you visualize your savings objectives, make a vision board or utilize an app that tracks your savings. Making progress might inspire one.

- Put Yourself to the Test: Arrange savings competitions with loved ones. Challenge each other to save the most money or to be the first to hit a savings goal.

- Use Cash Jars: Put cash into cash-marked jars designated for various savings objectives. It can be satisfying to watch the jars fill full.

- Establish a “No-Spend” Day, Week, or Month: Decide on a day, week, or month to dedicate yourself to not wasting any money on things that are not necessities. Transfer the funds that were saved to your savings account.

- Reward Yourself: Establish a system whereby, each time you hit a savings milestone, you treat yourself to a small treat.

- Locate Free Activities: Look into inexpensive or free pastimes and pastimes that you can enjoy without going over budget. Transfer money to savings that you would have otherwise spent on pricey excursions.

- DIY Projects: Rather than spending a lot of money on services or goods, try your hand at do-it-yourself projects. This is not only cost-effective, but it can also serve as an enjoyable and imaginative hobby.

- Take Part in exchanges and Trades: To get new stuff without paying money, arrange clothes exchanges or item trades with friends or in your neighbourhood.

What is the Role of Emergency Funds?

Savings put aside expressly to deal with unforeseen costs or financial problems are known as emergency funds. These accounts provide as a source of stability and financial security in difficult times.

Why Do Emergency Funds Matter?

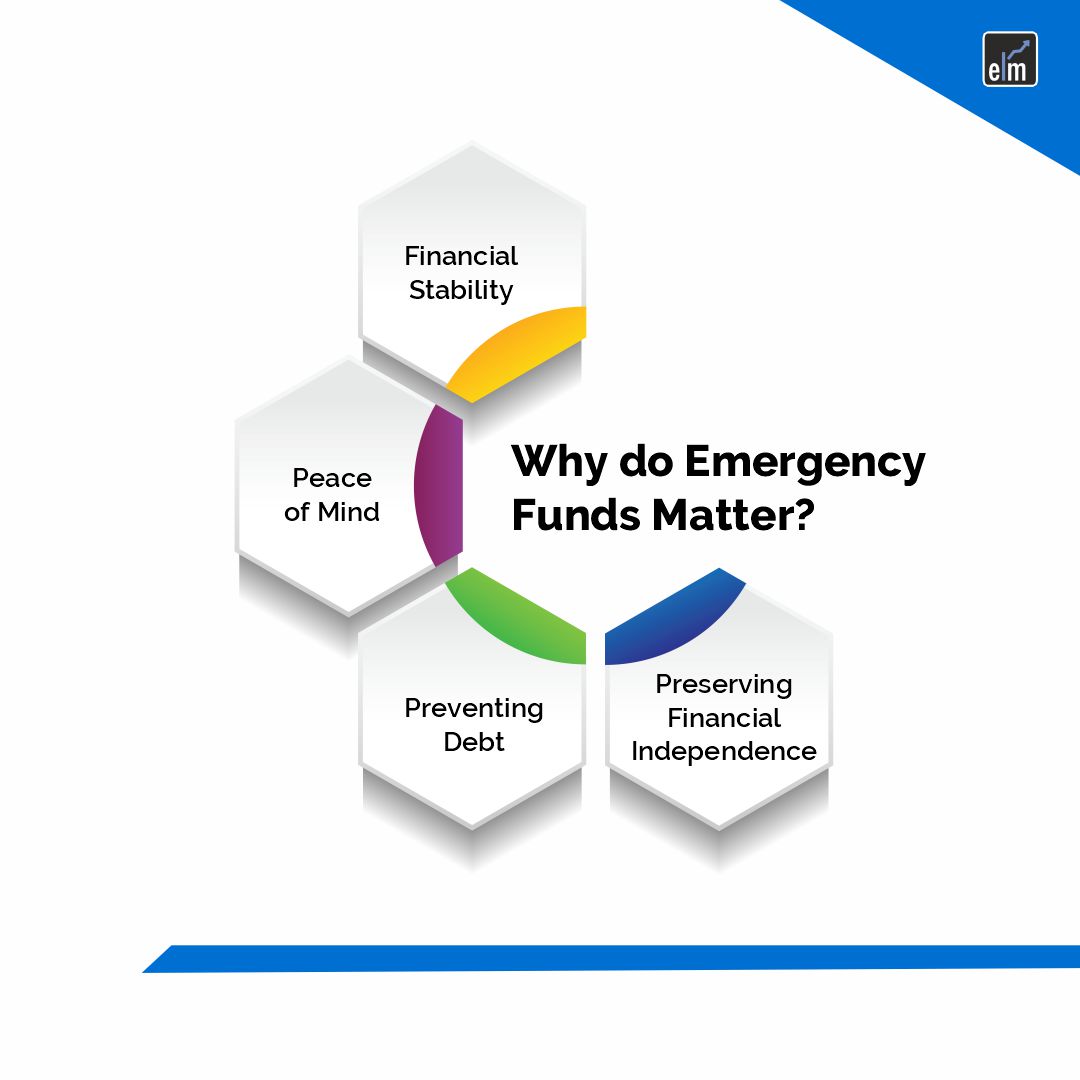

Emergency cash is important for a number of reasons:

1. Financial Stability

Emergency savings serve as a buffer against unforeseen expenses like job loss, urgent medical care, or expensive auto repairs. This safety net guarantees that people can pay for necessities without taking on high-interest debt or exhausting long-term savings.

2. Peace of Mind

You can feel more at ease knowing that you have money set up for unexpected expenses. It eases the tension and anxiety brought on by unforeseen costs, freeing people to concentrate on other facets of their lives rather than worrying about money problems all the time.

3. Preventing Debt

People may be compelled to use credit cards, personal loans, or payday loans in order to pay for unforeseen bills if they do not have emergency money. These debt types frequently have exorbitant interest rates and other costs, which can easily get out of hand and ultimately make financial difficulties worse.

4. Preserving Financial Independence

Financial independence is maintained by keeping an emergency fund on hand. It keeps people from depending on friends or family for financial support when things get hard, protecting friendships and self-respect.

4. Flexibility and Adaptability

Emergency savings give people the freedom to deal with unforeseen events in their lives or downturns in the economy. They enable people to adjust to shifting conditions without having to make significant sacrifices or adjustments to their way of life.

How to Determine the Emergency Fund’s Size?

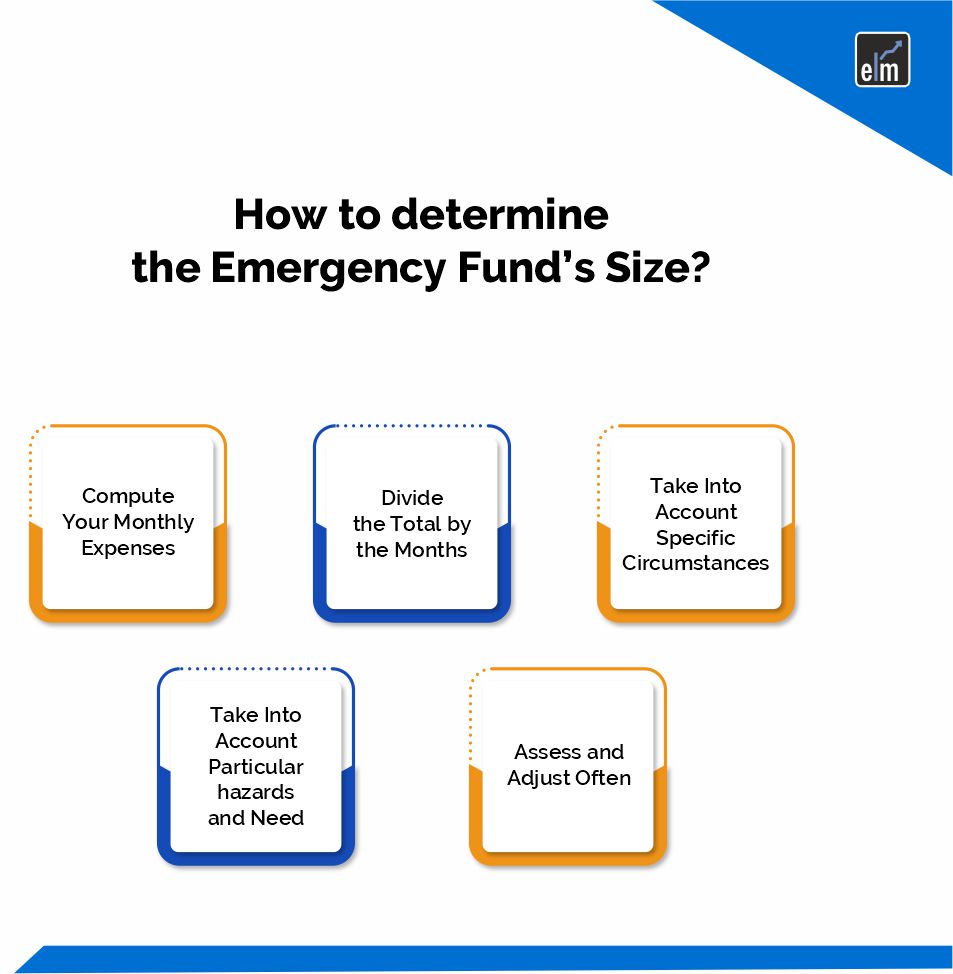

The amount of an emergency fund depends on a number of variables and costs. This is how to figure it out:

Compute Your Monthly Expenses

Include all of your monthly outgoings, such as rent or mortgage, utilities, groceries, car payments, insurance premiums, loan repayments, and other necessary expenses. Let’s take an example of your monthly expenses coming to ₹40,000.

Divide the Total by the Months

Calculate the amount of expenses you want your emergency fund to cover in a month. Experts in finance usually advise setting aside enough money to cover three to six months’ worth of spending. If you want to save for six months, for instance, multiply ₹40,000 by six to get ₹2,40,000.

Take Into Account Specific Circumstances

Modify the quantity in accordance with your particular situation. You might need to save extra money in order to cover unforeseen expenses if you have dependents, inconsistent income, or particular health issues.

Take Into Account Particular hazards and Need

Take into account any particular hazards or prospective costs that are particular to your case. You might wish to raise your emergency fund, for instance, if you work in an industry where job uncertainty is more common or if you have a chronic health condition.

Assess and Adjust Often

As your financial circumstances change, assess and adjust the amount of your emergency fund on a regular basis. Your savings objectives may need to be adjusted in response to life events like marriage, having children, changing jobs, or making large expenditures.

Let us know how to build your emergency fund-

How to Build Your Emergency Fund?

Creating an emergency fund is putting money away on a regular basis to deal with unforeseen costs. Here are some ideas of how to increase your emergency savings:

- Establish a Target Amount: Choose the maximum amount you wish to put aside for a contingency fund. Assume for the moment that you choose to set your initial goal at ₹1,00,000.

- Divide it Up: Divide the desired quantity into more manageable chunks. For instance, you would need to save about ₹8,333 every month to reach ₹1,00,000 in a year.

- Establish a Budget: Examine your monthly earnings and outgoings to find areas where you might make savings contributions and reduce spending. For example, you may choose to cut back on discretionary spending on entertainment or eating out.

- Set up an automated monthly transfer from your checking account to your savings account to automate savings. For instance, you can arrange for an automated payment of ₹8,333 to be made each month when you get paid.

- Boost Savings Over Time: As your spending patterns and budget become more comfortable, consider raising your monthly savings. If you get a bonus or pay increase, for example, put some money into your emergency fund.

- Make Use of Windfalls Use your money wisely: If you get a surprise payment, like a tax refund or a gift card, think about transferring some of it to your emergency fund. Set aside some of your tax refund (for instance, ₹5,000) to contribute to your savings target.

- Remain Consistent: Be steadfast in your savings efforts despite outside pressure to make rash purchases. Remember that creating an emergency fund takes dedication and self-control.

Where to Keep Your Savings and Emergency Fund?

Your financial objectives, risk tolerance, and liquidity requirements will all play a role in where you decide to maintain your savings and emergency fund. Here are a few choices:

1. High-Yield Savings Account

A high-yield savings account offers a higher interest rate than conventional savings accounts. It offers quick access to your money and a competitive interest rate. This choice is appropriate for short-term savings objectives and emergency finances where liquidity is crucial.

2. Money Market Account

Compared to standard savings accounts, money market accounts provide greater interest rates and frequently allow you to write checks. They are a good choice for emergency cash because they are FDIC-insured and offer liquidity.

3. Certificates of Deposit (CDs)

Compared to savings accounts, CDs offer greater interest rates, but you must lock in your money for a predetermined amount of time, usually a few months or years. Despite their higher returns, CDs might not be the best option for emergency money because of the early withdrawal penalty.

4. Short-Term Investment Funds

Because they offer liquidity and the possibility of higher returns, short-term investment funds, such as mutual funds or exchange-traded funds (ETFs), are a good place to put some of your resources. But be aware of possible losses and market volatility.

5. Liquid Assets

Short-term bonds, money market mutual funds, and Treasury bills are examples of liquid assets that provide quick access to capital while maintaining safety. These choices are stable and appropriate for short-term savings objectives as well as emergency funds.

6. Individual Retirement Accounts

Although its primary purpose is retirement, you can take penalty-free withdrawals of contributions (not earnings) from an IRA at any time, which makes them a viable choice for emergency savings. But before utilizing a Roth IRA for emergencies, think about how it would affect your retirement funds over the long run.

When to Use Your Emergency Fund?

An emergency fund is a financial resource that can help you pay for unforeseen costs or crises without resorting to debt-inducing credit cards or loans.

Depending on the severity and immediacy of the problem, you must decide when to spend your emergency money. The following circumstances may warrant the use of your emergency fund:

1. Job Loss

Your emergency fund can help pay your living expenses until you locate new employment if you suddenly lose your job and don’t have another source of income lined up.

2. Medical Emergencies

Your emergency fund can assist in paying for medical bills and related expenses in the event that you or a family member suffers from a sickness or emergency that necessitates expensive treatment or hospitalization.

3. Home or Car Repairs

Major repairs, like replacing a blown gearbox or fixing a broken furnace, can be costly for both your house and vehicle. To preserve your standard of living, you can use your emergency fund to partially offset the cost of these repairs.

4. Unplanned Travel

Unexpected events, like a funeral or family emergency, can force you to travel quickly. Travel expenditures, such as accommodation and transportation, can be partially covered by your emergency fund.

5. Natural Catastrophes

Your emergency fund can assist in paying for temporary housing, evacuation costs, and other expenditures related to disaster recovery if you reside in a region that frequently experiences natural catastrophes like hurricanes, earthquakes, or floods.

6. Unexpected Expenses

Unexpected expenses can happen at any time. Examples include an unexpected tax payment, a damaged appliance, or a pet that needs emergency veterinarian care. Your emergency fund acts as a safety net to assist you in handling unforeseen expenses without going over your spending plan.

Conclusion

A safety net during unanticipated events like job loss, medical problems, and unplanned bills can be established and maintained by setting up and managing an emergency fund. People can promote financial security and peace of mind by making monthly contributions to this fund, which can help reduce the need for expensive loans or high-interest credit cards during difficult times. Recall that while accumulating an emergency fund requires patience and self-control, the security it provides is priceless. Be patient, start small, and keep an eye on your emergency savings.

For Market-Related Updates, Visit StockEdge

Frequently Asked Questions (FAQs)

1. What is an emergency fund, and why is it important?

A savings account set up expressly to handle unforeseen costs or financial emergencies is known as an emergency fund. It’s crucial because it keeps people out of debt in the event of unforeseen expenses like big repairs, job loss, or medical problems.

2. How much should I save in my emergency fund?

The standard recommendation from financial gurus is to have three to six months’ worth of living expenses saved up in an emergency fund. The precise amount, however, may differ based on a person’s unique situation, including monthly spending, financial responsibilities, and stable income.

3. Where should I keep my emergency fund?

An account that is extremely liquid and convenient to access, such a savings account or money market account, is where you should keep your emergency cash. These accounts provide security