If my salary is Rs. 30,000 per month, then how should I pay for my house rent, insurance, food, health care, debt payment, and other expenses?

Also, apart from my expenses, what amount should I save every month?

The answer to all of this is by making a budget.

A written plan that determines how much money you will spend each month is called a budget.

You can ensure that you will have adequate money each month by creating a budget. You could run out of money before you get paid again if you don’t have a budget.

A budget demonstrates how much money you earn and how you use it

So, we can say that the foundation of good financial management is budgeting, which enables people to manage their money wisely and reach their financial objectives.

In today’s blog, let us discuss how to create a sound budget so that you can manage your finances in an efficient way-

Table of Contents

What is a budget and its Significance in Financial Planning?

A budget is a financial plan that shows you how to divide your income over a given time period, usually a month or a year, to pay for savings, investments, and spending. It acts as a guide for handling your money and reaching your financial objectives. Budgets are important in financial planning for the following reasons:

1. Financial Awareness

To create a budget, you must keep track of your earnings and outlays. This gives you a clear image of your financial status and promotes improved financial awareness by helping you understand where your money is going and where it is coming from.

2. Setting Financial Goals

With a budget, you can designate certain spending amounts and devote resources to reaching your targets. A budget aids in setting priorities and achieving financial goals, such as debt repayment, vacation savings, house purchase, retirement savings, and debt reduction.

3. Savings and Investing

By designating money for investment portfolios, retirement accounts, and savings accounts, budgets help people save and invest systematically. By systematically allocating funds for investments and savings, you can accumulate wealth over time and attain stability in your finances.

4. Expense Management

By setting boundaries and rules for different expense categories, budgeting enables you to keep tabs on your spending. It enables you to make changes to better match your spending to your financial priorities and assists in identifying areas where you could be overspending.

What are the key components of a budget?

When we start making a budget, here are the key components that we should keep in mind-

1. Income

This component includes all of your household’s sources of revenue, including commissions, bonuses, salaries, wages, and any money received from investments or rentals.

2. Expenses

Expenses are the sum of money spent on a variety of items and services, including groceries, dining out, entertainment, healthcare, insurance premiums, debt payments (credit cards, loans), utilities (gas, water, electricity), housing (rent or mortgage payments), groceries, and other discretionary spending.

- Fixed Expenses are regular monthly costs that don’t vary much, such as rent or mortgage payments, loan payments, insurance premiums, and subscription services.

- Variable Expenses: These can include groceries, eating out, entertainment, and discretionary expenditures; they can also vary from month to month. These costs are frequently more modifiable and can be changed in accordance with your goals.

3. Savings and Investments

A budget’s most important component is allocating money for investment portfolios, savings accounts, retirement accounts, and other long-term financial objectives. This category ensures that making investments and saving for the future is a priority.

Having understood about the basics of budgeting, let us start discussing how

Assessing Your Financial Situation

In order to reach your financial objectives and preserve your financial stability, you must first evaluate your existing financial status. When assessing your financial situation, keep the following points in mind:

Income

Determine your total household income from all sources, including salaries, wages, bonuses, freelance work, rental income, etc. Let us take an example-

- Salary: ₹50,000

- Freelance work: ₹10,000

- Rental income: ₹5,000

Thus, total monthly income = ₹50,000 + ₹10,000 + ₹5,000 = ₹65,000

Expenses

Keep track of your monthly spending in several categories. For example:

- Rent/Mortgage: ₹15,000

- Utilities (electricity, water, gas): ₹5,000

- Groceries: ₹8,000

- Transportation (fuel, public transport): ₹3,000

- Dining out/Entertainment: ₹4,000

- Loan payments (EMIs): ₹10,000

Total Monthly Expenses = ₹15,000 + ₹5,000 + ₹8,000 + ₹3,000 + ₹4,000 + ₹10,000 = ₹45,000

Assets

Make a list of everything you own, including valuables, real estate, investments (stocks, bonds, mutual funds), savings accounts, and real estate. Understanding your assets can help you make plans for your future finances and determine your net worth.

Example-

- Savings Account: ₹1,00,000

- Fixed Deposits: ₹3,00,000

- Mutual Funds: ₹2,00,000

- Gold Jewellery: ₹1,50,000

- Stocks: ₹50,000

Total Assets = ₹1,00,000 + ₹3,00,000 + ₹2,00,000 + ₹1,50,000 + ₹50,000 = ₹8,00,000

Liabilities

List all of your obligations and liabilities, including credit card debt, mortgages, student loans, auto loans, and personal loans. Determine the total amount due and be aware of the interest rates and terms of each debt’s payback.

- Credit Card Balance: ₹50,000

Net worth

Subtract all of your liabilities from all of your assets to determine your net worth.

Net Worth = Total Assets – Total Liabilities

= ₹8,00,000 – ₹50,000

Total = ₹7,50,000

Other than manually, there are many budget applications available through which you can track your finances every day.

Methods For Tracking Income and Expenses

Budgeting Apps are made for mobile money management; they allow you to set aside a specific amount of your monthly spendable income based on your income and expenses. If you’re prepared to put in the effort, track your purchases, and stay below your spending limit, these kinds of apps will work.

Here are some of the budgeting apps that you can browse to track your expenses and income-

Top 5 Budgeting Apps in India

1. Walnut

Walnut is a well-liked personal finance management app in India that helps users track spending, split bills, examine spending trends, and establish savings objectives. It tracks spending automatically using SMS and bank message analysis.

2. Money Lover

This all-in-one budgeting and expense-tracking app lets users monitor their spending, income, bills, and spending limits. It also features budget planning, bill reminders, and thorough financial reporting.

3. ET Money

ET Money is an app for investing and financial planning that also has budgeting tools. It offers users bank account links, spending logs, investment management, and goal-setting. The app also provides tailored advice and insights into spending trends.

4. Expense Manager

This straightforward yet effective program for tracking spending lets users keep track of their bills, income, and out-of-pocket costs. It provides tracking of budgets, customisable categories, and thorough spending summaries.

5. Monefy

It is an easy-to-use tool for tracking expenses that enable users to effectively manage their finances. It provides a straightforward user interface for tracking earnings and costs, transferring data between devices, and displaying spending trends in the form of graphs and charts.

Now that we know how to track our income, expenses and investment, let us discuss how we can set our financial goals-

Setting Financial Goals

For efficient financial planning and wealth management, setting SMART financial goals is essential.

Here’s why each SMART goal component matters:

Specific

Well-defined objectives offer lucidity and concentration on your desired outcomes. Unlike broad objectives like “save money” or “pay off debt,” specific goals specify the precise result you aim to achieve.

For example, it is essential to set clear and unambiguous goals, such as “Pay off ₹20,000 credit card debt within six months” or “Save ₹50,000 for a down payment on a home. “

Measurable

Measurable goals let you monitor your development and assess your accomplishment of the goal. Measuring your goals using precise metrics, such as percentages, quantities, or deadlines, makes determining your progress toward them easier. Setting measurable objectives will keep you accountable and motivated while you track your financial progress.

Achievable

Establishing goals that are within your existing financial status, capabilities, and resources guarantees that they are both reasonable and reachable. While having high aspirations is vital, aiming too high or making unreasonable goals can cause disappointment and dissatisfaction. Setting attainable goals helps you stay motivated and confident as you progress toward your goals.

Relevant

Relevant objectives are in line with your long-term objectives, values, and overall financial priorities. They focus on particular chances for growth or areas where your financial life might be improved. Relevance guarantees that your objectives—whether they involve investing in school, saving for retirement, or creating an emergency fund—are worthwhile and advance your overall financial well-being.

Time-bound

Time-bound goals have a set completion date or schedule, which instils a sense of urgency and aids in maintaining focus on your goals. By keeping you accountable and discouraging procrastination, deadlines motivate you to consistently work toward your objectives. Setting time-bound goals also helps you to break down more ambitious goals into smaller, more achievable milestones.

How to Prioritize Goals?

Setting priorities for finances includes deciding which financial goals are short-term and long-term and then allocating resources appropriately.

Here are some examples of how to set priorities for your financial objectives:

Short-Term Goals

a. Paying Off High-Interest Debt: Give paying off high-interest personal loans or credit card debt the first priority. For instance, if you have a ₹50,000 credit card debt with an 18% interest rate, pay it off quickly to reduce interest expenses and strengthen your financial situation.

a. Establishing an Emergency Fund: Set aside money to start an emergency fund that will be used to pay for unforeseen costs like car repairs, medical problems, or job loss. Save enough money to cover your living expenses for at least three or six months. If your monthly expenses are ₹30,000, for example, your emergency fund should have between ₹90,000 and ₹1,80,000 saved as a priority.

c. Making a Budget and Managing Expenses: Control your spending by tracking your outlays, finding places to save, and allocating money to your financial objectives. To free up money for savings and debt repayment, for instance, cut back on entertainment costs, eating out, and non-essential expenditures.

Long Term Goals

A portion of your income should be set aside for retirement savings in order to secure your financial future in later life. For example, make consistent contributions to a retirement account, such as a Voluntary Provident Fund (VPF) or Provident Fund (PF), with the goal of maximizing contributions while staying within permitted limitations.

Establish a special education fund or make investments in education savings plans to help you pay for your children’s educational costs. To finance your child’s further education, for instance, give careful consideration to making contributions to tax-efficient investment vehicles like a Public Provident Fund (PPF) or a Sukanya Samriddhi Yojana (SSY).

To increase your wealth over time, put money into assets like stocks, mutual funds, real estate, and other investment vehicles. When choosing investing options, take your financial objectives, investment horizon, and risk tolerance into account. Invest money in a diverse portfolio, for instance, that strikes a balance between possible return and risk.

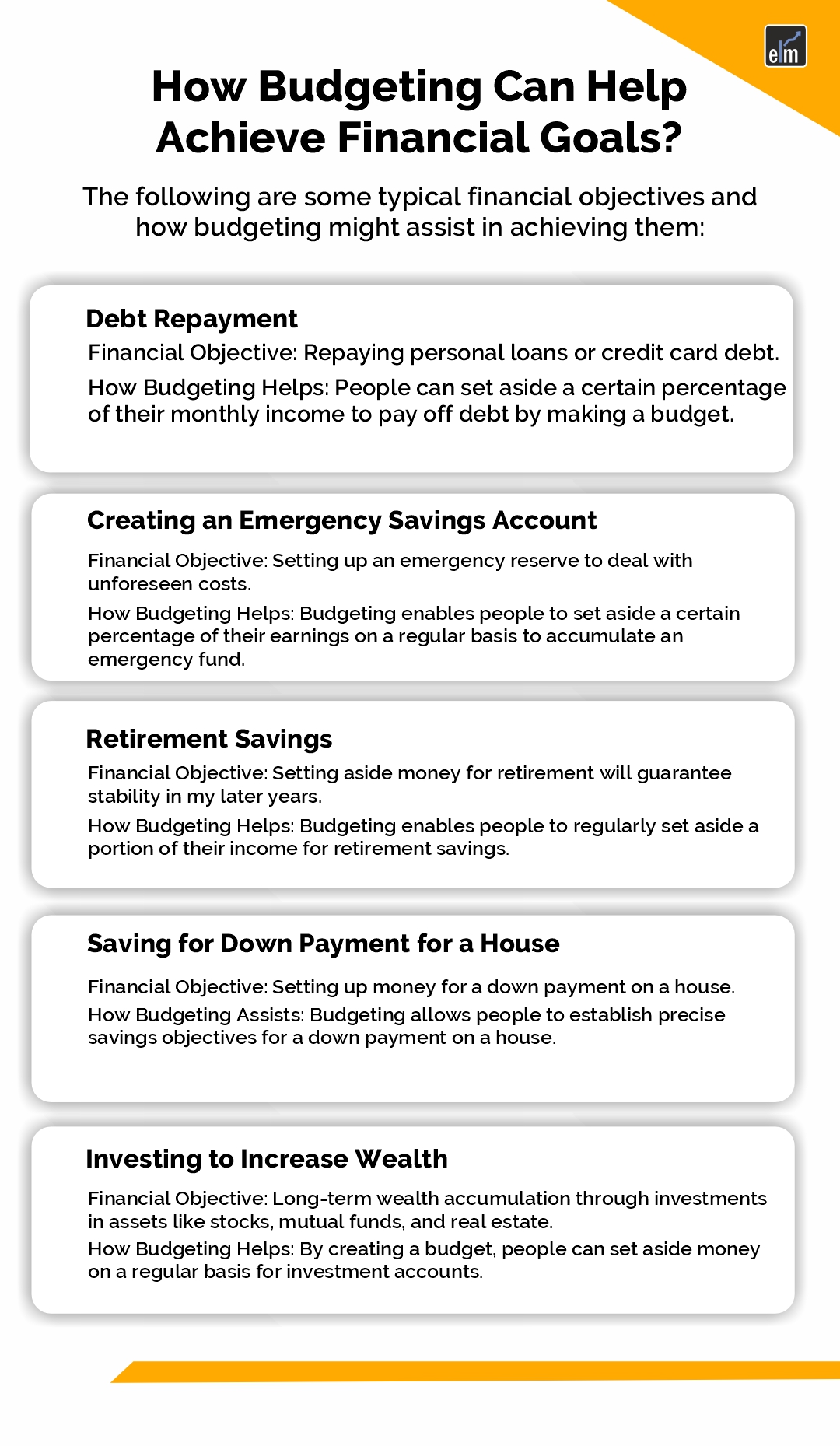

How Budgeting Can Help Achieve Financial Goals?

Budgeting is essential to reaching financial goals because it offers a disciplined framework for managing income, expenses, and savings.

The following are some typical financial objectives and how budgeting might assist in achieving them:

Debt Repayment

Financial Objective: Repaying personal loans or credit card debt.

How Budgeting Helps: By making a budget, people can set aside a certain percentage of their monthly income to pay off debt.

By highlighting areas where costs can be cut or eliminated, budgeting assists in setting priorities for debt repayment and frees up additional cash for debt payback. People can move closer to being debt-free by adhering to a budget and regularly making debt payments.

Creating an Emergency Savings Account

Financial Objective: Setting up an emergency reserve to deal with unforeseen costs.

How Budgeting Helps: Budgeting enables people to set aside a certain percentage of their earnings on a regular basis to accumulate an emergency fund.

People can progressively save money by setting away a certain amount each month to cover unforeseen costs like auto repairs, medical emergencies, or job loss. Budgeting ensures that savings are consistent and disciplined, which helps the emergency fund accumulate over time to offer financial security.

Retirement Savings

Financial Objective: Setting aside money for retirement will guarantee stability in my later years.

How Budgeting Helps: Budgeting enables people to regularly set aside a portion of their income for retirement savings.

People can contribute to retirement accounts or pension plans by setting away money each month for retirement. By using a budget, people can invest in diversified portfolios that are suited to their risk tolerance and financial objectives while also maximizing their retirement contributions within permitted limitations.

Saving for a Down Payment for a House

Financial Objective: Setting up money for a down payment on a house.

How Budgeting Assists: Budgeting allows people to establish precise savings objectives for a down payment on a house.

People might find areas where spending can be cut or redirected toward saving for a down payment by making a budget. By creating a budget, people may monitor their progress toward their savings target and modify their spending patterns accordingly. A budget and steady savings for a down payment help people reach their homeownership goals more successfully.

Investing to Increase Wealth

Financial Objective: Long-term wealth accumulation through investments in assets like stocks, mutual funds, and real estate.

How Budgeting Helps: By creating a budget, people can set aside money on a regular basis for investment accounts.

Making a budget allows people to prioritize their investments and determine the amount of money left over after deducting costs, savings, and other financial commitments.

Creating a Budget Plan

Carefully considering income, costs, savings goals, and spending habits is necessary when creating a budget plan that fits a person’s lifestyle and financial goals.

The following useful advice can be used to create a customized budget plan:

1. Establish Specific Financial Objectives

Define both immediate and long-term financial objectives, such as debt repayment, emergency fund accumulation, retirement savings, or house purchase. Setting clear priorities for expenditure and savings aids in decision-making.

2. Track Revenue and Expenses

To start, keep track of all your revenue sources and group your out-of-pocket costs for a given time frame, such as a month. To obtain insight into spending patterns, include both fixed and variable expenses (e.g., food, entertainment) in addition to fixed expenses (e.g., utilities, rent or mortgage).

3. Distinguish Between Needs and Wants

Distinguish between necessary (needs) and optional (wants) costs. Set priorities for critical spending and assess discretionary spending to find areas where costs can be cut or eliminated.

Different Budgeting Methods

Here are some of the budgeting methods that will help you in making and maintaining your budget:

1. 50/30/20 Rule

According to the 50/30/20 rule, you should divide your after-tax income into three categories:

- 50% to Needs: Set aside 50% of your income for living costs, utilities, groceries, groceries, travel, and the minimal amount owed on debt.

- 30% to Wants: Set aside 30% of your take-home pay for frivolous expenses like entertainment, dining out, shopping, and hobbies.

- 20% for Savings and Debt Repayment: Set aside 20% of your income for debt repayment, savings, and other financial objectives including emergency fund accumulation, retirement savings, or debt paydown acceleration.

The 50/30/20 rule offers a straightforward framework for allocating spending among necessities, wants, and savings targets, assisting people in setting priorities and practising sound financial management.

2. Zero-Based Budgeting

In zero-based budgeting, each rupee of income must have a designated purpose in order to guarantee that total income less total expenses equals zero. Put otherwise, each rupee is assigned to one of the following: debt repayment, savings, investments, or spending.

Zero-based budgeting operates as follows:

- Enumerate every source of revenue and divide spending into categories that are constant and changeable.

- Make sure that total expenses equal total income by allocating money to debt repayment, savings, investments, and expenses until every rupee is accounted for.

- Budget allocations should be adjusted as necessary to prioritize financial objectives, rein in spending, and keep the budget balanced.

Zero-based budgeting empowers people to optimize savings, meet financial objectives, and live within their means by promoting proactive financial planning, thoughtful spending choices, and accountability for every rupee.

3. Envelope System

The envelope system is a cash-based budgeting technique in which money is physically placed into envelopes labeled with particular categories of expenditure. A separate budget category, such as grocery, eating out, entertainment, travel, and other miscellaneous costs, is represented by each envelope.

The envelope system operates as follows:

- Assign funds from your budget to each category of spending in accordance with your priorities and revenue.

- Take out the necessary amount of cash for each budget category and deposit it into the correct envelope.

- Throughout the month, pay for your expenses in each category using cash from the assigned envelopes.

- When all the money in an envelope is gone, don’t add to it until the following budgetary cycle.

The envelope method encourages economic spending, assists people in staying within their means, and offers a visual.

Implementing and Adjusting Your Budget

Implementing a budget plan and sticking to it requires commitment, discipline, and regular monitoring of your finances.

Increasing savings and cutting costs are crucial elements of sound financial management. These tactics will assist you in reaching your objectives:

Track Your Spending

Start by tracking your expenditures to find areas where you may make savings and reduce costs. Use spreadsheets, handwritten records, or budgeting apps to monitor your spending patterns and organize your expenses. Recognizing where your money is going is the first step in cutting back on wasteful spending.

Eliminate Superfluous Expenses

Examine your spending habits and pinpoint areas where you may reduce non-essential spending. Take into account cutting back on discretionary spending on things like eating out, entertainment, subscriptions, and impulsive buys. Seek ways to cut costs without compromising your standard of living.

Negotiate Bills and Expenses

To cut costs and save money, be proactive in negotiating bills and expenses. Get in touch with service providers to find out about special offers, reduced prices, and promotions from cable, internet, phone, and insurance companies. Try negotiating a reduced interest rate with lenders for credit cards or loans, or look for ways to combine debt to lessen your monthly payments.

Conclusion

Maintaining financial health, adjusting to changing circumstances, and achieving long-term financial success all depend on regular budget reviews and adjustments. Through proactive, adaptable, and disciplined money management, people may make the most of their resources, reach their financial objectives, and create a stable financial future for themselves and their families.

It takes time, focus, and dedication to incorporate budgeting into one’s financial routine. It’s a road that demands commitment and tenacity but pays off greatly in the form of financial independence, mental clarity, and the flexibility to follow goals and objectives without worrying about money.

Frequently Asked Questions (FAQs)

Why is budgeting important?

Budgeting is crucial because it enables people to properly manage their finances, set spending priorities, save money for financial goals, and monitor their progress. It contributes to debt reduction, spending control, and the development of financial security and stability.

How do I create a budget?

Organizing your spending and determining your income streams are the first steps in creating a budget. Determine savings targets, project fixed and variable costs, and distribute money across categories according to importance and need. Keep tabs on your expenses and make any necessary budget adjustments.

What are the different types of budgets?

Several forms of budgets exist, including traditional budgets, zero-based budgeting, incremental budgets, rolling budgets, and activity-based budgets. Each kind handles managing expenses and distributing funds differently.