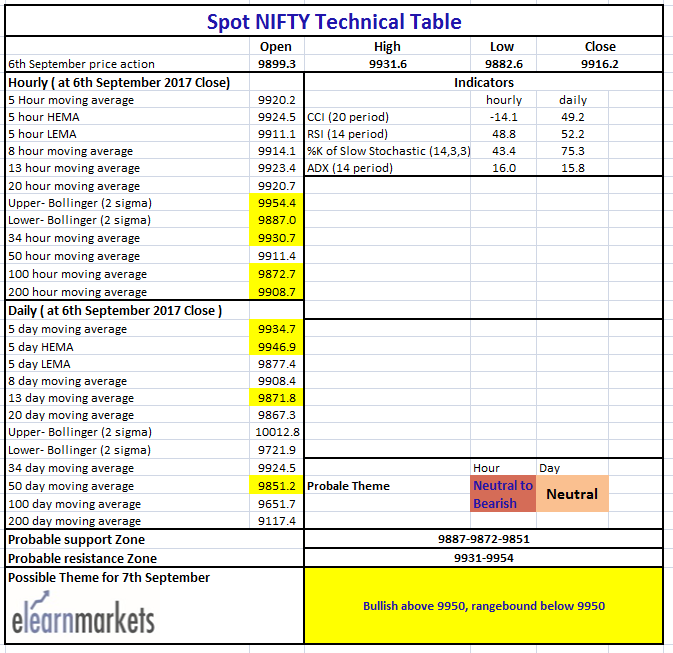

Nifty (Close 9916.2) After a gap down of more than 50 points, it recovered from its lows and closed above 9900.

Hourly Technical

Nifty consolidated in a very tight range in today’s session. However, it closed just above 200 Hourly Moving Average (Presently at approx. 9908.7). The probable support in the hourly chart comes at 200 Hourly moving average (Presently at approx. 9908.7), lower Bollinger line (Presently at approx.9887) and 100 Hourly moving average (Presently at approx. 9972.7).

On the upside, Nifty may face resistance at 34 Hour moving average (Presently at approx. 9930.7) and Upper Bollinger line (Presently at approx. 9954).

Hourly CCI, RSI and Stochastic are in the normal zone. However, ADX is still falling indicating fall in momentum.

Figure: Hourly Chart

Daily Technical

Nifty looks neutral in the daily time frame. In the Daily chart, Nifty may face some resistance at 5 DMA (Presently at approx. 9934.7) and 5 Day High EMA (Presently at approx. 9946.9).

The probable support comes at 13 DMA (Presently at approx. 9871.8) and 50 DMA (Presently at approx. 9851.2).

Daily Stochastic and CCI are close to the upper bound of the overbought zone. RSI are still in the normal zone. The falling ADX indicates fall in momentum.

Figure: Daily Chart

Figure: Tech Table