In an insightful session as a part of the highly popular Face2Face series conducted by Elearnmarkets, Mr Vivek Bajaj, Co-founder of Elearnmarkets, invited Mr Saket Mehrotra, a fund manager, to decode how to become your own asset manager.

Mr Saket Mehrotra has been following the Sensex since 2009 and has taken an active interest in understanding the equity markets in India. He currently works as a Fund Manager with Tusk Investments, where his mandate is to deploy capital in listed public equities in the Indian markets. With his newsletter, “Beta to Alpha,” he shares curated insights with over 2,400 members, simplifying investment complexities and offering recommendations inspired by diverse topics.

Let us understand how portfolio managers construct a strategic framework for managing our portfolio according to risk appetite and know how to identify the theme and allocate your money to make profitable investing decisions.

Table of Contents

HNI characteristics based on Asset Manager

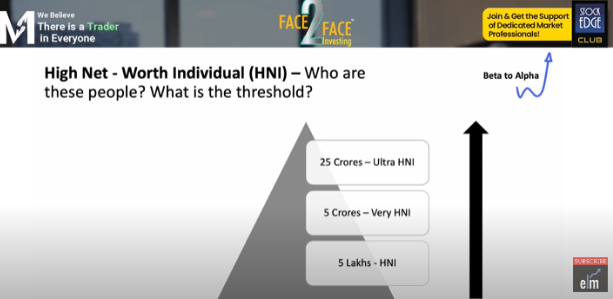

High net worth individuals, often referred to as HNWIs or HNIs, are a class of individuals who are distinguished from other retail segments based on their net wealth, assets and investible surplus. They are individuals who have a significant amount of wealth and financial assets. The definition of HNIs varies with the geographical area as well as financial markets and institutions. However, a person with a net worth of more than ₹5 crore is usually considered HNI.

According to him, HNIs can be further categorized into different wealth segments based on their net worth. As we understand, many asset managers advise differently and select different asset classes.

Common Challenges Faced by Investors

He discussed that every group of HNIs are generally served by various asset managers according to their net worth.

However, according to him, every product has underlying asset classes, and every asset class has a risk-adjusted return, i.e. how much degree of volatility against the return generated from the assets.

To simplify this, your investment decisions should not be influenced by others but determined by your financial objectives and risk tolerance.

The Myth of Risk and Return

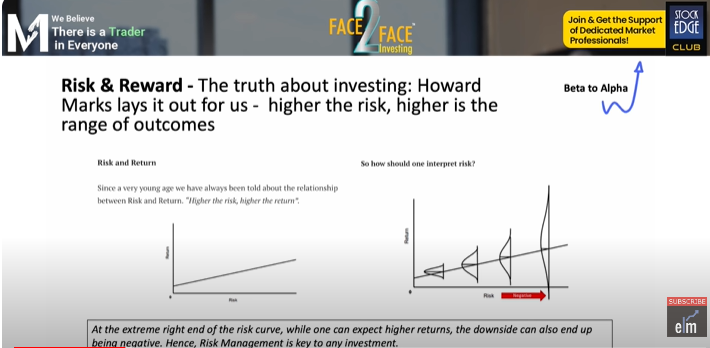

One common assumption is that taking more risks generates higher returns. Despite the fact that this concept is prevalent, it is important for us to evaluate the relationship between risk and return. According to Howard Marks, a renowned investor, the higher the risk, the higher the range of outcomes. And at the extreme right end of the risk curve, while one can expect higher returns, the downside can also end up being negative. Hence, Risk Management is key to any investment.

In layman’s language, we can say that risk and return are not inversely proportional, so there is a wide range of potential outcomes for each amount of risk. For instance, investing in a fixed deposit (FD) may offer a relatively lower return with minimal risk. On the other hand, investing in cryptocurrencies may offer high returns but comes with the potential for significant losses.

Key Questions to Ask Before You Invest

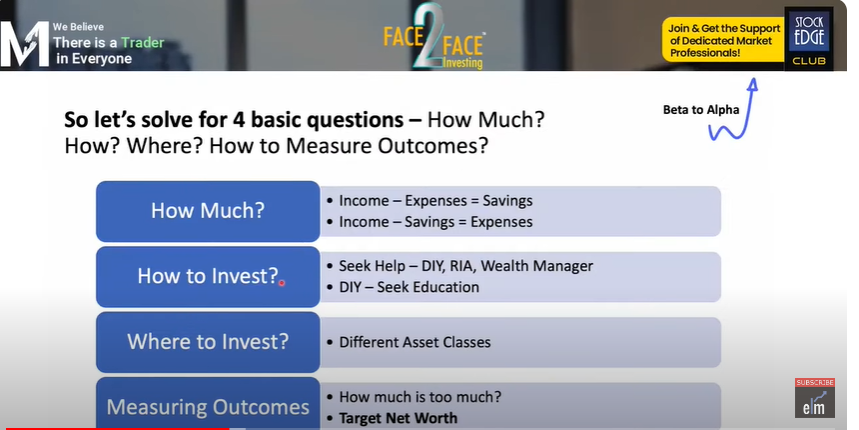

As portfolio managers, according to him, there are some key questions that should be asked before you start building your investment portfolio. To create a successful investment strategy, you need to address four key questions:

- How much to Invest?

- How to Invest?

- Where to Invest?

- How to Set Target Outcomes?

An Overview of the Investment Process

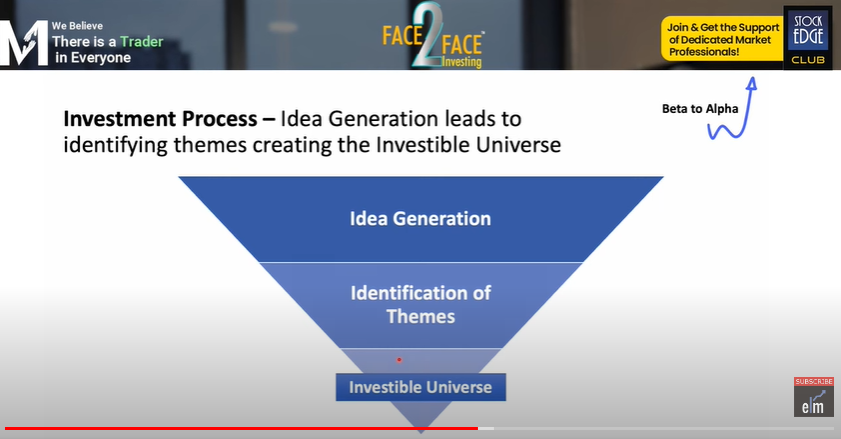

Then, he will discuss the step-by-step guide to start the investment process to grow your wealth, secure your financial future, and achieve your financial goals. Here, he will discuss the key steps of the investment process to help you become an asset manager and make informed decisions.

- Idea Generation: Generating investment ideas is a crucial step in building a strong equity portfolio. There are multiple avenues in which you can generate ideas, and you just need to keep an eye out.

- Identification of Theme: The next step is to identify investment themes, as they act as the foundation for your investment strategy. It influences your stock selection and helps in forming your investing decisions.

- Investible Universe: At last, creating an investible universe to finalize investing decisions. After identifying the theme, we have to analyze their potential businesses and understand their business model in order to evaluate their investment decisions.

You can watch the full Face2Face video from here:

Bottomline

One should note that managing your own assets is a rewarding journey that demands commitment and continuous learning. And always keep in mind that investment decisions should be influenced by the risk appetite. So, before making an investment decision, you should measure risk.