A bull put spread strategy is a version of the popular put writing strategy, in which an options investor writes a put on the stock in order to receive premium income and maybe purchase the shares at a discount.

One of the biggest risks of put writing is that the investor is compelled to buy the stock at the put strike price, even if the stock falls well below the strike price, resulting in an immediate and significant loss.

A bull put spread reduces the net premium received while also lowering the risk of the short put position by simultaneously purchasing a put at a lower price. This lowers the net premium received while also reducing the risk of the short put position.

So, in today’s blog, let us discuss the Bull Put Spread Strategy:

What is Bull Put Spread Strategy?

A bull put spread involves writing or short selling a put option while concurrently purchasing another put option with the same expiration date but a lower strike price (on the same underlying asset).

The bull put spread is one of the four basic forms of vertical spreads, with the bull call spread, bear call spread, and bear put spread being the others.

The premium obtained for the short put leg of a bull put spread is always greater than the premium received for the long put, implying that receiving an upfront payment or credit is required to begin this strategy.

As a result, a bull put spread is often referred to as a credit (put) spread or a short put spread.

How does Bull Put Spread Strategy work?

Let us take the stock example so that we can understand this strategy better-

Stock Example- Oil and National Gas Corporation Ltd. – 6.6.2022

1. Outlook

We were bullish on this stock as the prices crossed 200 MA and all other technical indicators turned bullish as shown below. Also, a large bullish marubozu was formed after it crossed the moving average. So a bullish strategy i.e. Bull Put Spread Strategy can be implemented.

2. Strategy

This strategy involves:

- Buy 1 OTM Put option (leg 1)

- Sell 1 ITM Put option (leg 2)

When you do this, ensure –

- All strikes belong to the same underlying

- Belong to the same expiry series

- Each leg involves the same number of options

For example –

Outlook – Moderately bullish (expect the market to go higher)

ONGC spot – 154

Bull Put Spread, trade set up –

- Buy 150 PE by paying Rs.3.25- as a premium; note this is an OTM option. Since money is going out of my account, this is a debit transaction.

- Sell 160 PE and receive Rs. 8.15 /- as premium, do note this is an ITM option. Since I receive money, this is a credit transaction

3. Maximum Gain

Potential profit is limited to the net premium received less commissions, and this profit is realized if the stock price is at or above the strike price of the short put (higher strike) at expiration and both puts expire worthlessly.

So, net premium= 4.9 (8.15-3.25)

One lot=3850 share, so total gain=3850*4.9= Rs. 18,865

You can also read our blog on 12 Common Option Trading Strategies Every Trader Should Know

4. Maximum loss\risk

The maximum risk equals the difference between the strike prices minus the net credit received, including commissions.

In the example above, the difference between the strike prices is 10 (160 – 150), and the net credit is 4.9.

Therefore, the maximum risk is 5.10 (10 – 4.90) per share less commissions. This maximum risk is realized if the stock price is at or below the long put at the expiration strike price.

One lot=3850 shares, so total loss=3850*5.1= Rs. 19,635

5. Breakeven stock price at expiration

The strike price of short put (higher strike) minus net premium received.

In this example: 160 – 4.90 = 155.1

6. Payoff Diagram

Below is the Payoff diagram of the above strategy:

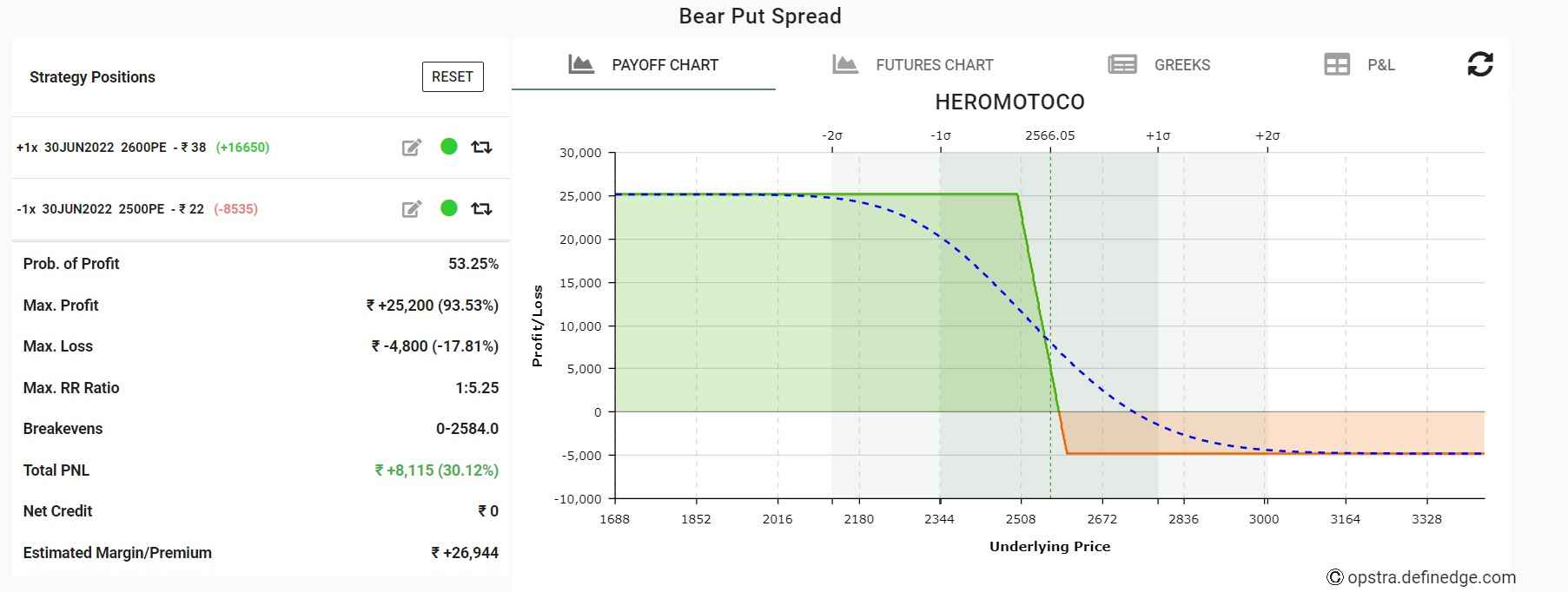

Before we conclude, we would like to show you how our last strategy- Bear Put Spread did that we implemented on Hero MotoCorp Ltd:

You can also join our course on Advanced Options Strategies

Bottomline

We hope you found this blog informative and use it to its maximum potential in the practical world. Also, show some love by sharing this blog with your family and friends and helping us in our mission of spreading financial literacy.

Happy Investing!

You can also visit web.stockedge.com, a unique platform that is 100% focused on research and analytics.