Options Strategies? Sounds heavy? Already worrying you? Well, fret not! We shall help you crack this one quite easily.

Let’s start off by discussing the model of the game “lotto”, where we bet on a lottery ticket, and the odds of winning the lottery are very low. However, if we win, we hit a jackpot. Similarly, when we trade in options, we know it involves a certain level of risk, but we still participate in them with the anticipation of a jackpot like the game above. But if you look at advanced options traders, they generally treat options as a hedging instrument or as a strategising instrument where the goal is to maximise profits while minimizing losses. That’s exactly where one wants to be!

In reality, some option trading strategies exist, and they are designed to limit the risk quotient and open a portal to unlimited profits.

In this blog, we shall discuss 12 strategies for options trading with examples that every trader should be aware of when trading options.

First things first, let’s find out what this heavy options-related jargon means. So, what are option trading strategies?

Option Trading Strategies refer to buying calls put options or selling calls, put options or both together for the purpose of limiting losses and gaining unlimited profits. Basically, utilising one or more combinations for the best outcome possible based on our defined parameters.

Call options give the holder the right but not the obligation to buy the underlying stock, whereas put options give the owner the right but not the obligation to sell the underlying stock at a pre-determined price by a set expiration time.

Option Trading Strategies can be classified into bullish, bearish or neutral option trading strategies. Sounds interesting until here? Well, there’s more to get your excitement levels up.

Let us discuss 12 types of option trading strategies every trader should know and can use to level up the game of their option in the stock market!

12 Different Strategies of Options Trading with Examples

Everyone loves a bull market, and we see maximum retail participation in the stock market when the indices are flying high, so we start off with Bullish Options Strategies:

Bullish Options Strategies

1. Bull Call Spread

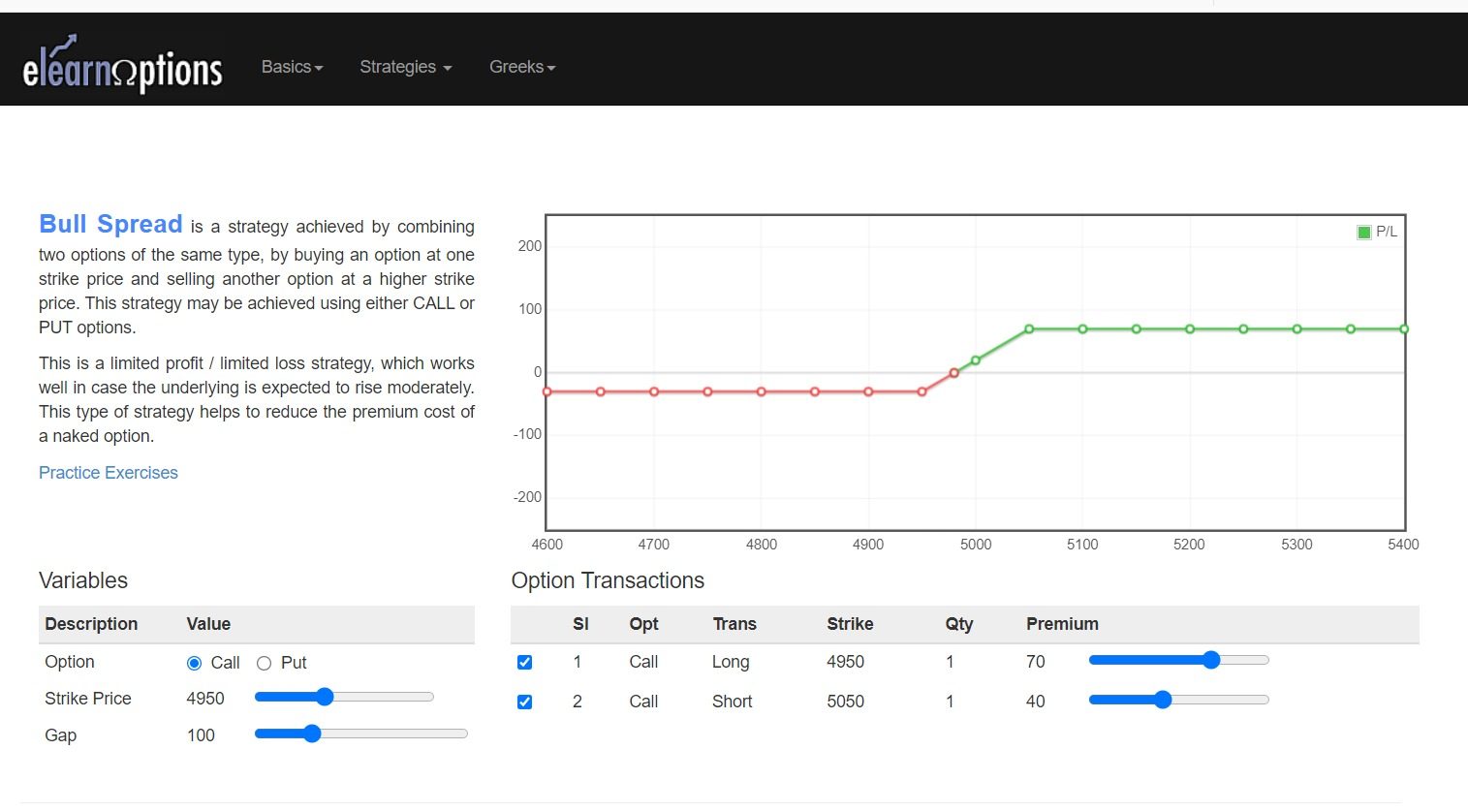

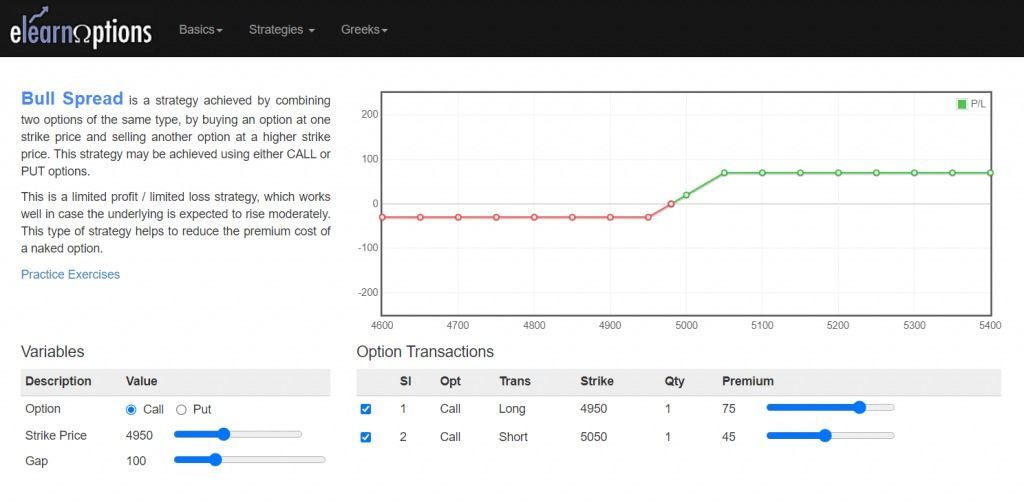

A bull call spread is a bullish options strategy that involves buying one At-The-Money (ATM) call option and selling the Out-Of-The-Money call option.

One should note that both the calls should have the same underlying stock and the same expiration date.

In this strategy, profit is made when the price of the underlying stock increases, which is equal to spread minus net debit and loss is incurred when the stock price falls, which is equal to the net debit. Net Debit is equal to the Premium Paid for a lower strike minus the Premium Received for a higher strike. The Spread refers to the difference between the higher and lower strike price

Bull Call Spread helps in protecting when the prices fall and the profit amount is also limited.

From the above example from elearnoptions, we can say that both the profit and loss are capped.

This strategy is a great alternative to just buying a call option when the traders are not aggressively bullish on a stock.

2. Bull Put Spread

Bull Put Spread is one of the bullish options strategies that options traders can implement when they are a little bullish on the underlying asset’s movement.

This strategy is similar to the bull call spread, in which instead of buying calls, we buy puts. It involves buying 1 OTM Put option and selling 1 ITM Put option.

One should note that both puts should have the same underlying stock and also the same expiration date.

A bull put spread is formed for a net credit or net amount received and it incurs profit from a rising stock price that is limited to the net credit received, on the other hand, the potential loss is limited and occurs when the price of the stock falls below the strike price of the long put.

3. Call Ratio Back Spread

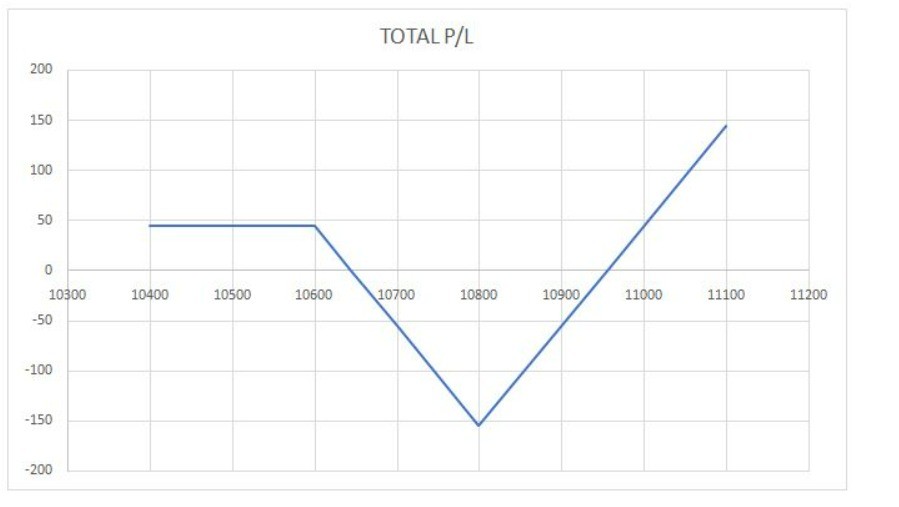

The Call Ratio Back Spread is one of the simplest options strategies and this strategy is implemented when one is very bullish on a stock or index.

In this strategy, traders can make unlimited profits when the market goes up and limited profits if the market goes down. The loss is made only if the market stays within a specific range. In other words, traders can make a profit when the market moves in either direction.

This three-leg strategy consists of buying two OTM call options and selling one ITM call option.

The above P/L diagram shows that we make profits when the price moves in either direction.

4. Synthetic Call

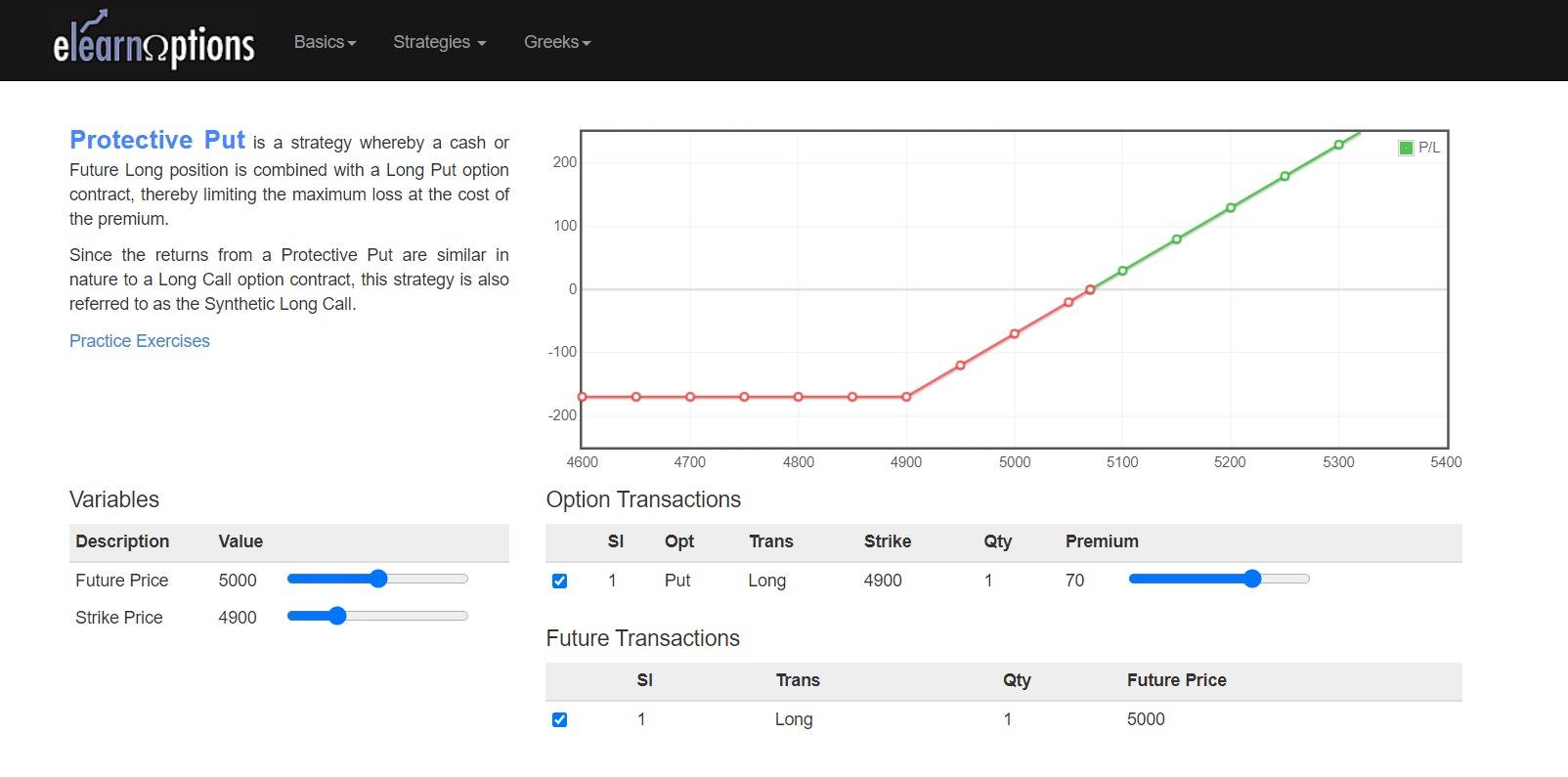

A Synthetic Call is one of the bullish options strategies used by traders who have a bullish view of the stock for the long term but are also worried about the downside risks. This strategy offers unlimited potential profits with limited risk.

The strategy involves buying put options of the stock that we are holding and on which we have a bullish view. If the price of the underlying rises, then we shall make profits, whereas if the price falls, then the loss will be limited to the premium that is paid for the put option. This strategy is similar to the Protective Put options strategy.

From the above payoff diagram, we can see the risk is limited to the premium, whereas the potential profit is unlimited.

Read more about Options Strategies from our ELM School Module

Well, the world works on demand and supply, and so does the stock market. When you see people flying high during a bullish market, there is always a lot looking at bearish option trading strategies. There is always a group of “Manu Mandoriyas” (Reference: Scam 1992) hoping for a downside. So, let’s take the discussion further and look at bearish option strategies.

Bearish Options Strategies

5. Bear Call Spread

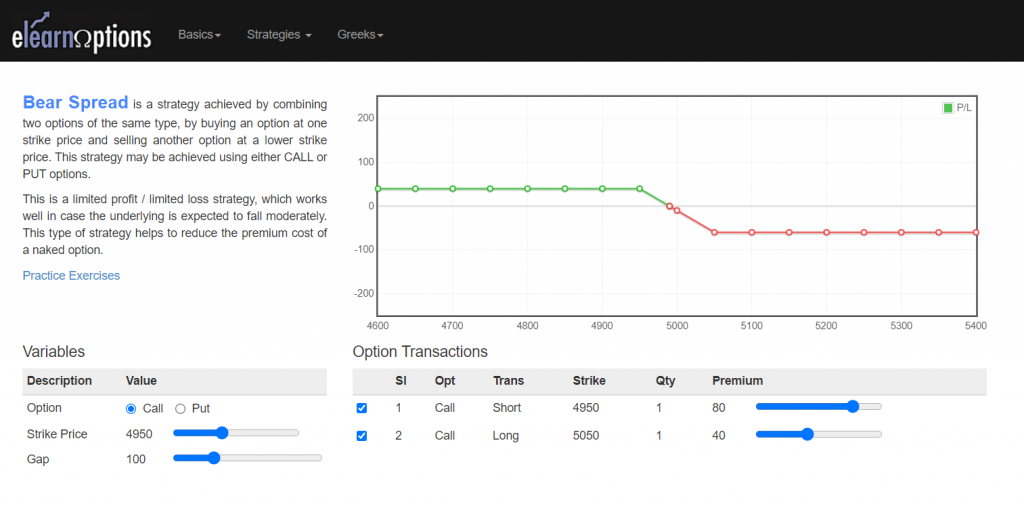

The Bear Call Spread is one of the 2-leg bearish options strategies implemented by options traders with a ‘moderately bearish’ view on the market.

This strategy involves buying 1 OTM Call option, which has a higher strike price, and selling 1 ITM Call option, which has a lower strike price. One should note that both calls should have the same underlying stock and the same expiration date.

A bear call spread is formed for the net credit and profits are made from this strategy when the stock prices fall. The potential profit is limited to the net credit, and the potential loss is limited to the spread minus net credit. The Net Credit equals the Premium Received minus the Premium Paid.

From the above P/L diagram, we can see that this strategy involves limited gains, which are equal to the net credit and loss is limited, which is equal to the spread minus the net credit.

6. Bear Put Spread

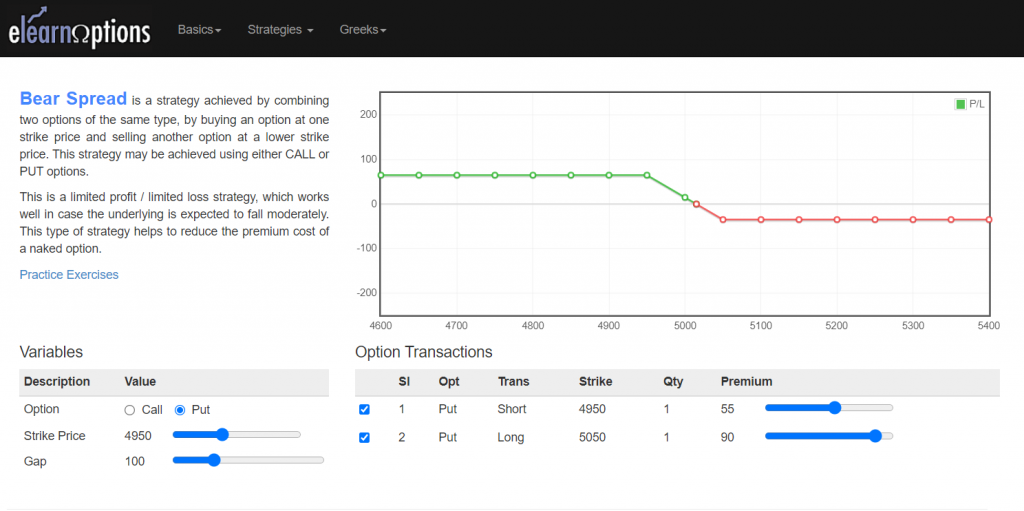

This strategy is quite similar to the Bull Call Spread and also quite easy to implement. Traders would implement this strategy when their view of the market is moderately bearish, i.e., when they expect the market to go down but not too much.

The Bear Put Spread strategy involves buying the ITM Put option and selling the OTM Put option. Both puts should have the same underlying stock and the same expiration date. This strategy is formed for a net debit or net cost and profits as the underlying stock falls in price.

From the above diagram, we can say that the profit is limited and equal to the spread minus the net debit, and the loss is equal to the net debit. The Net Debit equals the Premium Paid minus the Premium Received.

7. Strip

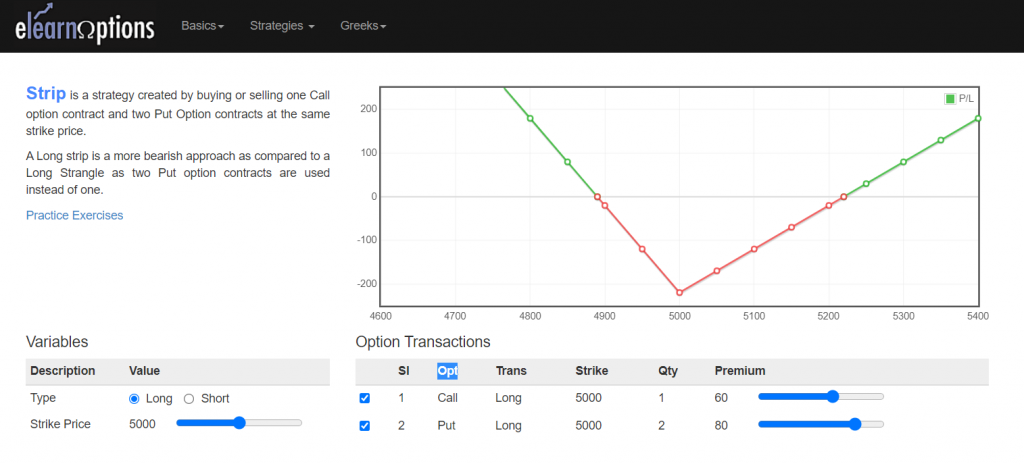

A strip is a bearish to neutral options strategy that involves buying 1 ATM Call and 2 ATM Puts.

Note that these options should be bought on the same underlying, with the same strike price and expiry date.

Traders can earn profits when the price of the underlying stock makes a strong move up or down at the time of expiration, but generally, huge profits are earned when the prices move down.

As we can see from the above example, the maximum profit is unlimited and the total loss associated with this strategy is limited to the net premium paid.

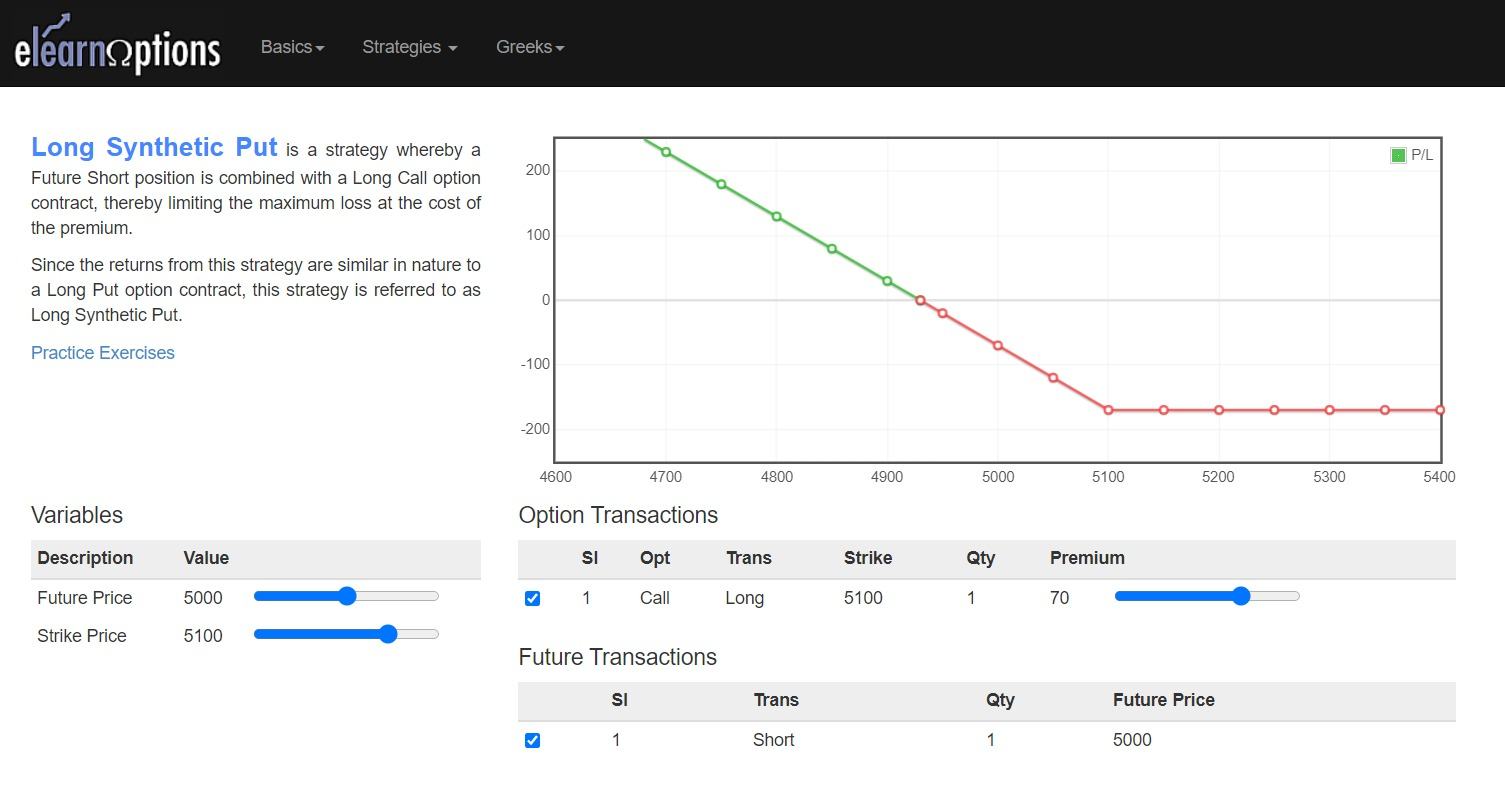

8. Synthetic Put

Synthetic put is one of the bearish options strategies that is implemented when investors have a bearish view of the stock and are concerned about potential near-term strength in that stock.

The profit from this strategy is made when there is a decline in the underlying stock’s price, which is why this strategy is also known as the synthetic long put.

The synthetic long put is so named as this strategy has the same profit potential as the long put.

From the above example, we can see that the maximum profit is unlimited and the maximum loss.

You can also watch our webinar on MASTERCLASS WEBINAR SERIES: TRADING STRATEGY WITH OPTIONS BY CHETAN

So, we’ve seen bullish and bearish options strategies, but what about those with no stance? There are always a bunch of people who don’t see any clear one-sided direction in the near term and want to remain unaffected by it. There are neutral options strategies for such views, where profits don’t depend on the market direction.

Neutral Options Strategies

9. Long & Short Straddles

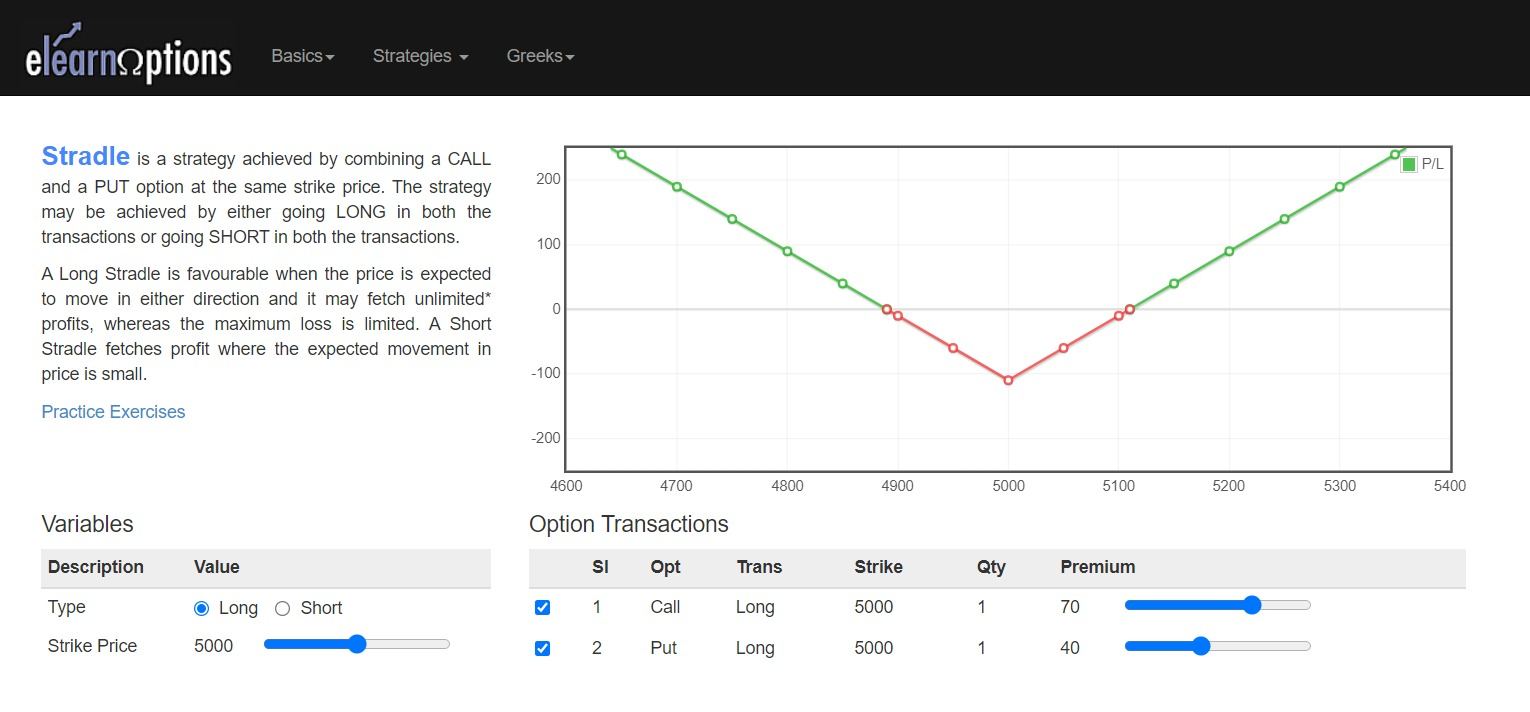

The long straddle options strategy is one of the simplest market-neutral option trading strategies to implement, and when implemented, the P&L is not affected by the direction in which the market moves.

This strategy involves buying the ATM Call and Put options. One should note that both the options should belong to the same underlying, should have the same expiry and also belong to the same strike.

As we see from the above image, the profits are unlimited and the loss is limited.

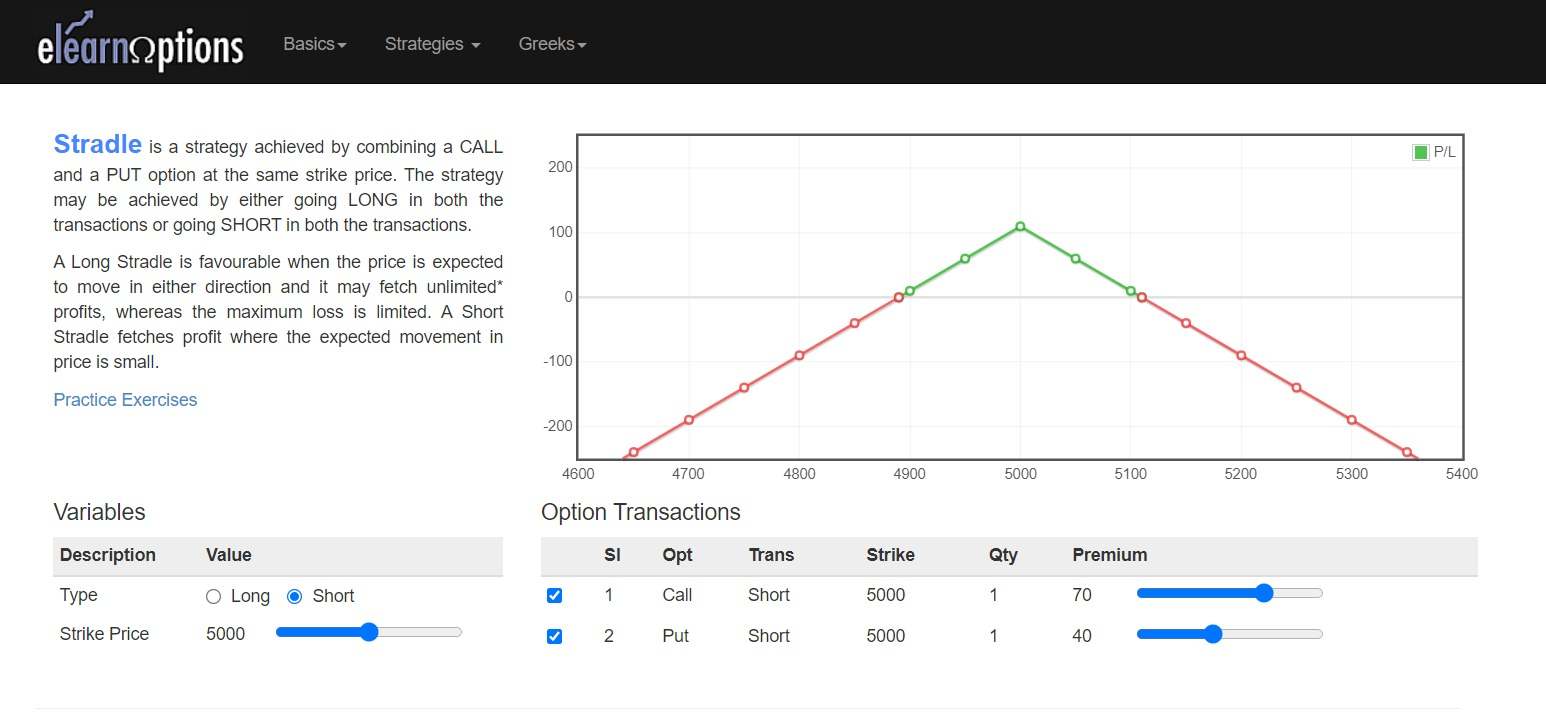

Short Straddle involves selling the ATM Call and Put option as opposed to Long Straddle. Here, the profit is equal to the total premium received and maximum loss is unlimited as shown below:

You can use our Options Strategies Builder-eLearnOptions

10. Long & Short Strangles

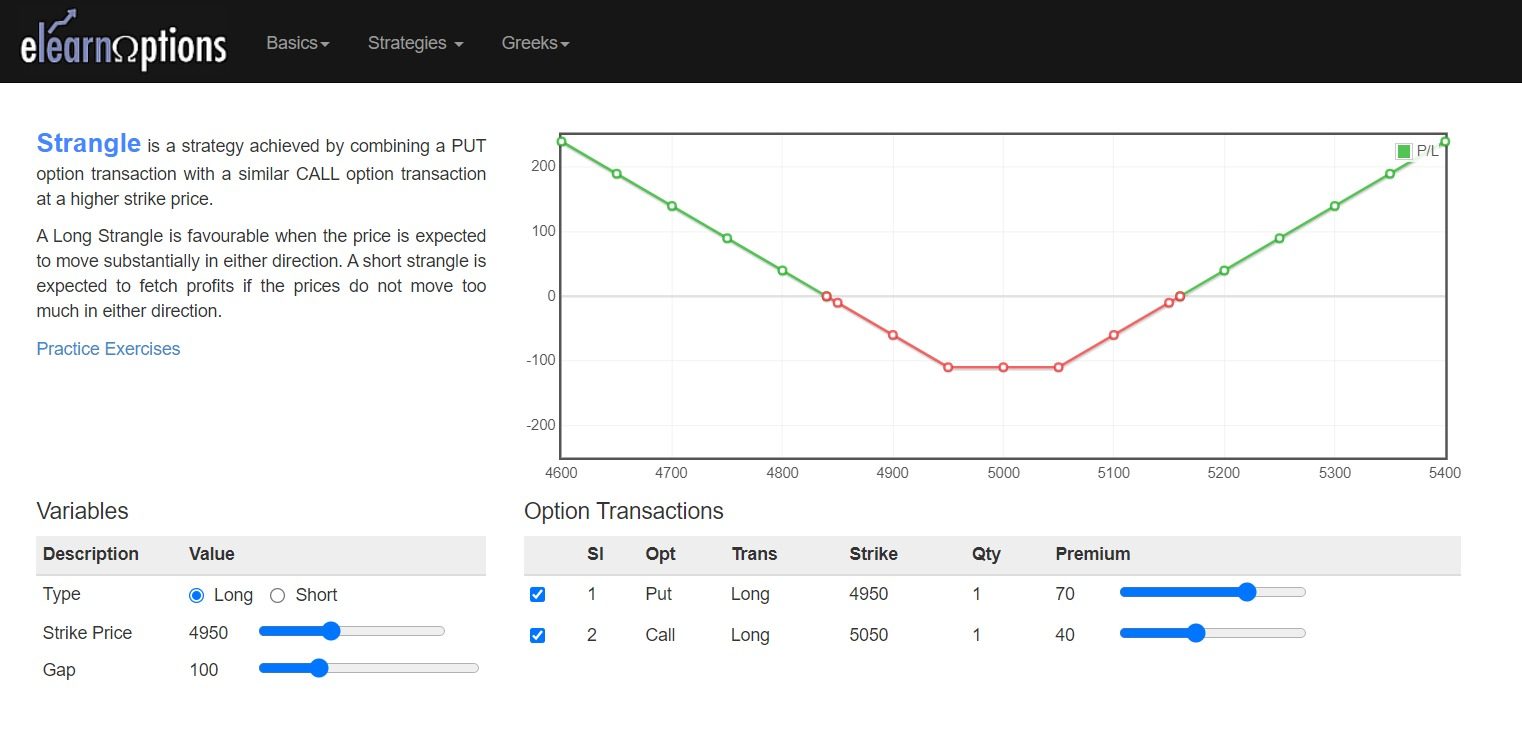

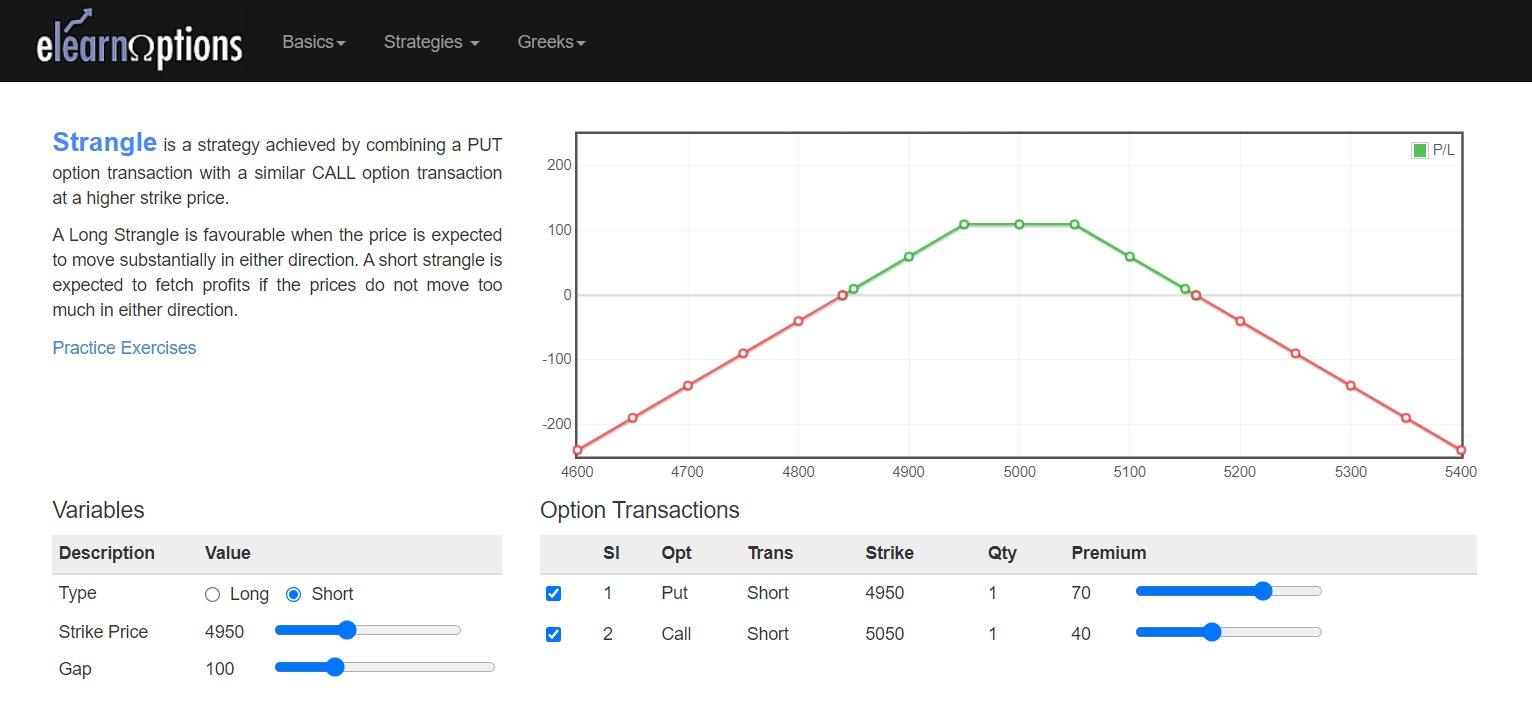

The options strategies strangle is similar to the straddle, but the only difference between them is that- in a straddle, we are required to buy call and put options of the ATM strike price, whereas the strangle involves buying OTM call and put options.

Long Strangle involves buying one OTM put and one OTM call option. Here, the profit is unlimited and the maximum loss is equal to the net premium flow.

Whereas the Short Strangle involves selling a put and call OTM options. From the below example, we can see that the maximum loss is unlimited as the price rises or falls and the maximum profit is equal to the total premium received.

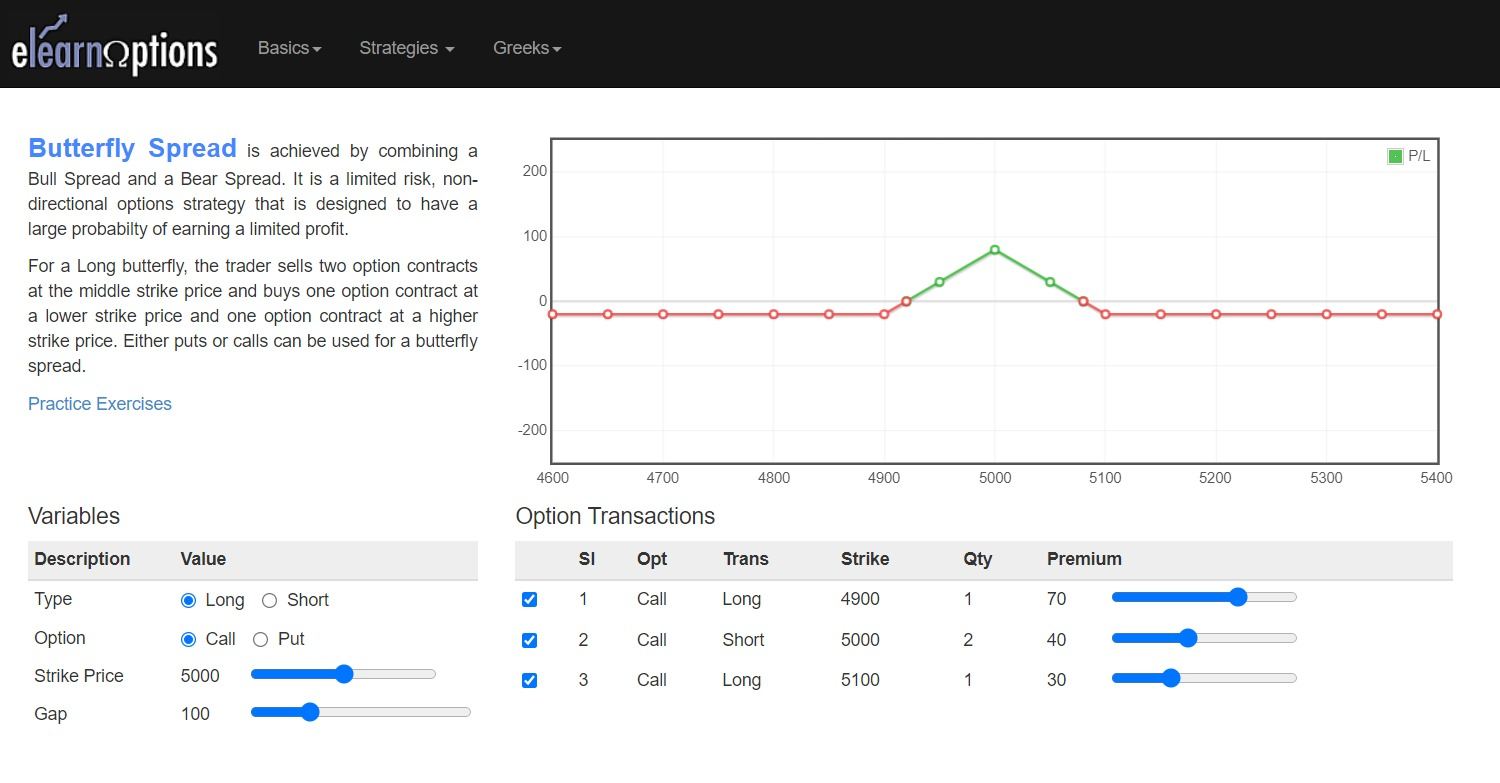

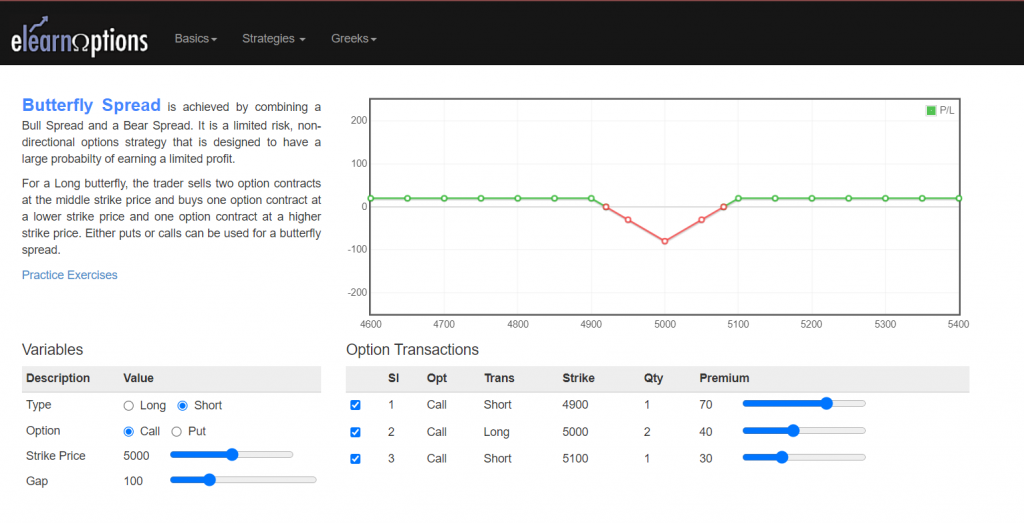

11. Long & Short Butterfly

A butterfly spread is one of the neutral options strategies that combine bull and bear spreads, with a fixed risk and limited profit. The options with higher and lower strike prices have the same distance from the at-the-money options.

The long butterfly call spread involves: Buying one ITM call option, writing two ATM call options, and then buying one OTM call option.

The short butterfly spread strategy involves selling one in-the-money call option, buying two at-the-money call options, and selling an out-of-the-money call option.

You can also join our course on CERTIFICATION IN ONLINE OPTIONS STRATEGIES

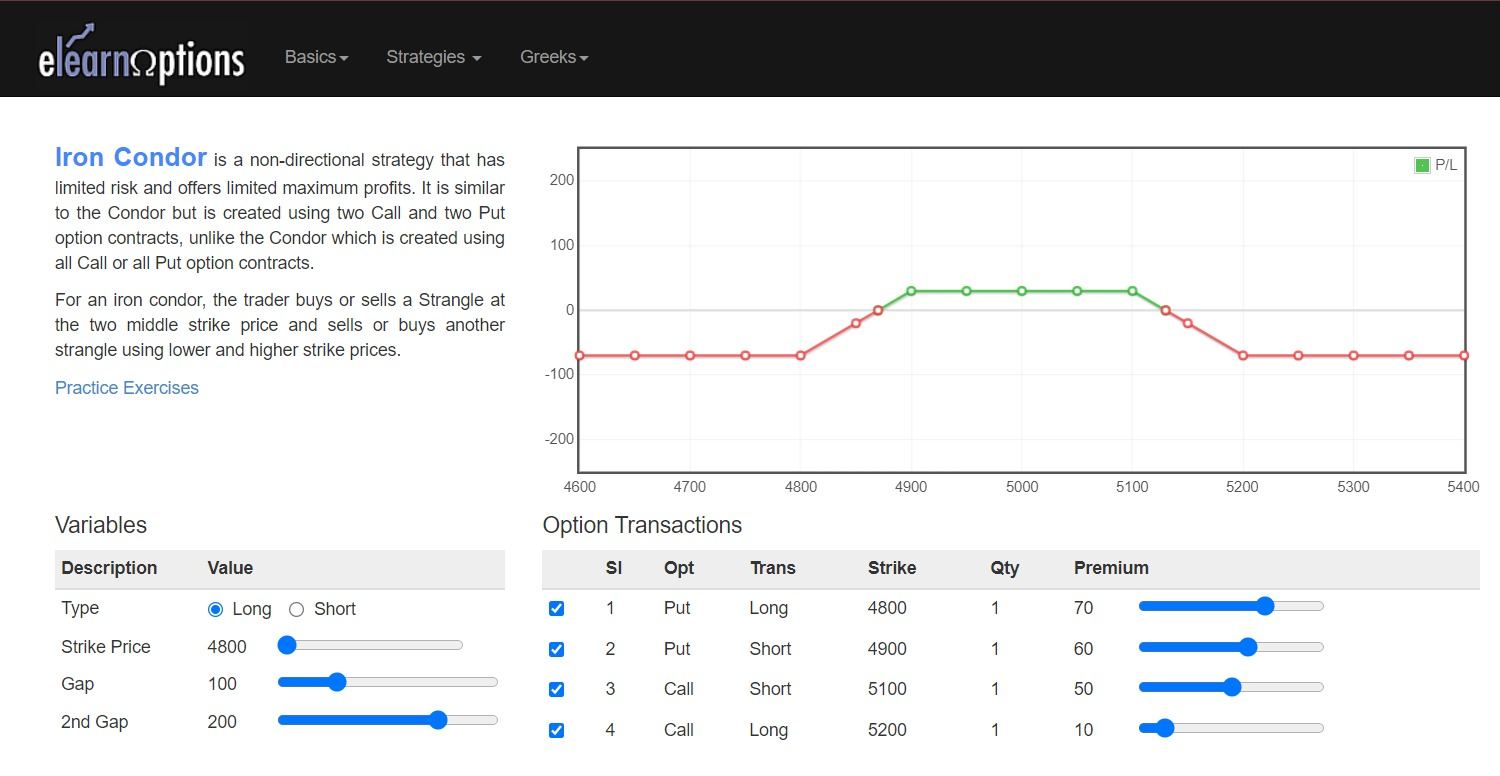

12. Long & Short Iron Condor

An iron condor is one of the options strategies that consists of two puts (one long and one short) and two calls (one long and one short), and four strike prices. All must have the same expiration date.

The maximum profit is incurred when the underlying asset closes between the middle strike prices at expiration.

Watch our video on Options Strategies

Bottomline

To sum up, trading options provide a variety of approaches to handle risk and navigate erratic markets. Knowing options, from fundamental ideas to sophisticated strategies, enables traders to take advantage of market opportunities while reducing possible losses. Traders can leverage options to reach their financial objectives through a diverse approach, rigorous execution, and ongoing learning. Develop, test, and refine your methods to succeed in the ever-changing world of options trading.

Ready to master the Top 12 Options Strategies? Elevate your trading skills with our comprehensive Options Trading Courses now!

Frequently Asked Questions

1. What are the options strategies?

Options strategies are preset methods for trading options contracts that combine several positions to accomplish particular investing goals.

2. What are some common options strategies?

Covered calls, protected puts, straddles, strangles, spreads (vertical, horizontal, and diagonal), butterflies, and condors are examples of common options strategies.

3. How do I choose the right options strategy?

Based on your trading goals, risk tolerance, and market forecast, choose an options strategy. Take into account variables like time decay, volatility, and the price movement of the underlying asset.

Very Well explained the Option Strategies.

Every new comer will understand very well to start with options.

Hi,

We really appreciated that you liked our blog.

Keep Reading!

Thank you 😊

Hi,

We really appreciated that you liked our blog.

Keep Reading!

Informative article on the various options trading strategies one should be aware of. Good read!

Hi,

We really appreciated that you liked our blog.

Keep Reading!

Loved it!

Hi,

We really appreciated that you liked our blog.

Keep Reading!

thanks

Hi,

We really appreciated that you liked our blog.

Keep Reading!

Nice

Hi,

We really appreciated that you liked our blog! Thank you for your feedback!

Keep Reading!

I really like this blog post. keep posting such kind of important posts.

Hi,

We really appreciated that you liked our blog!

Thank you for Reading!

Keep Reading!