The bull call spread strategy is one of the simplest option strategies that an option trader can use when trading in options.

Spread Strategies are multi-leg strategies that involve more than two options.

By multi-leg strategies, we mean the strategy that has more than 2 option transactions.

When the trader has an outlook of moderate bullish on a stock or an index, then the spread strategy like Bull Call Spread can be implemented.

To implement this strategy, the trader should have an outlook of moderately bullish.

| Table of Contents |

|---|

| What is Bull Call Spread Strategy? |

| How does it work? |

| Bull Call Spread Example |

| Pay-off Diagram of Bull Call Spread |

| Benefits of Bull Spread |

Let us discuss in detail what is this strategy all about and how does it work.

What is Bull Call Spread Strategy?

A Bull Call Spread strategy is meant for those traders who are moderately bullish on a stock or an index and they are expecting a rise in the underlying price.

Suppose a stock that you have been analyzing is in the downtrend for a while.

It has touched 52 weeks low and it may reverse from this support.

But as the stock is still in the downtrend you cannot be completely sure that it may reverse.

For this type of situation, we can implement Bull Call Spread Strategy as we are moderately bullish on the stock.

The strategy involves buying a Call Option and selling a Call Option.

The risk as well as the reward in this strategy is limited.

Now, let us discuss how this trading strategy works with an example:

How does it work?

This strategy involves buying 1 ATM call option and selling 1 OTM call option.

One should remember that when you are buying and selling call options, both of them should be of the same expiry series and involve the same number of options.

Learn basics of Options with Option Trading Made Easy course by Market Experts

Before we go into discussing the example, below are few points that can be kept in mind:

- The breakeven point is where there is neither loss nor profit. The breakeven point for a bull call spread is Lower Strike + Net Debit.

- The loss is limited in this strategy

- The profit is capped in this strategy.

Bull Call Spread Example:

Suppose you are moderately bullish on the Nifty 50 Index, so you buy 1 ATM option at 11700 CE, the premium being Rs.62, and sell 1 OTM at 11800 CE, the premium being Rs.19.

The spot price of Nifty is 11720.

As we are buying 1 ATM option at the premium of Rs.62, it means that the premium is getting debited from our account and is going out.

As we are selling 1 OTM option at the premium of Rs.19, it means that the premium is getting credited to our account and is coming in.

Thus, the Net loss or Net Debit will be Rs. (-62+19) = Rs. (43)

It means that our loss will be limited to Rs.43

This is the reason why Bull Call Spread is also known as the Debit Bull Spread.

Now let us take scenarios to explain how this strategy will work in different situations.

1. When the market expires at 11600 CE:

First, we need to find the intrinsic value as the value of call options depend on it.

The intrinsic value= Max [0, Spot-Strike] = Max [0, 11600-11700] = Max [0, -100] = 0

One should remember that the intrinsic value can never be less than zero, as the option buyer will not exercise the option if it is giving negative cash flow.

As intrinsic value is 0 in this case, the whole premium i.e. Rs.62 will be lost but as we have sold 11800 CE, we will get a premium of Rs.19.

Thus the net loss, in this case, will be Rs. (-62+19) = Rs. (43)

2. When the market expires at ATM i.e at 11700 CE:

As we have already found out the intrinsic value in the above scenario, the intrinsic value, in this case, will be also 0 and the net loss will be Rs.43.

3. When the market expires at OTM i.e at 11800 CE:

The intrinsic value, in this case, will be =

Max [0, Spot-Strike] = Max [0, 11800-11700] = Max [0, 100] = 100

We will get profit of Rs.(100-62) = Rs.38

Also as we have sold 1 call option we will get a net profit of Rs(38+19)= Rs. 57

4. When the market expires at 11900 CE:

In this case, both the call options will have a positive intrinsic value

11700 CE would have an intrinsic value of 200, and the 11800 CE would have an intrinsic value of 100.

On the 11700 CE, we will make a profit of 200 – 62 = Rs.138 and on the 11800 CE we would lose 100 – 19 = 81

Total profit= 138 – 81 = Rs.57

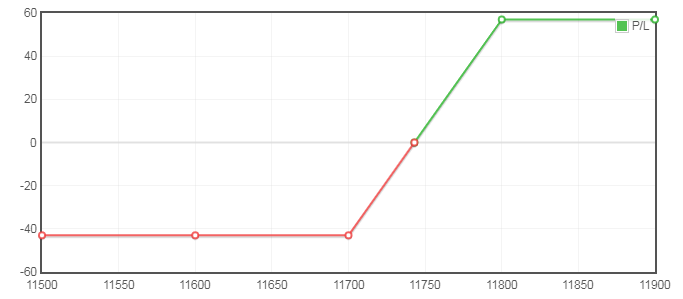

Pay-off Diagram;

The payoff diagram of the Bull Call Spread Strategy is as follows:

From this pay-off diagram we can observe that:

- The breakeven point is where there is neither loss nor profit. The breakeven point for a bull call spread is Lower Strike + Net Debit, thus it is (11700+43)=11743

- Loss is limited to Rs. 43 if it expires below the breakeven point.

- Profit is limited to Rs. 57 if it expires above the breakeven point.

Benefits of Bull Spread:

As we have discussed above, the bull call spread strategy limits its loss to the net premium or debit paid for the options.

The bull call spread strategy also caps profits to the options strike price

But one should remember that this strategy is not suited for every market condition.

This strategy works best in markets where the prices of the underlying asset are rising moderately.

Key Takeaways:

- A Bull Call Spread strategy is meant for those traders who are moderately bullish on a stock or an index and they are expecting a rise in the underlying price.

- When you are buying and selling call options, both of them should be of the same expiry series and involve the same number of options.

- The bull call spread strategy limits its loss to the net premium or debit paid for the options.

In order to get the latest updates on Financial Markets visit StockEdge.

Happy Learning!