Let us discuss about Demand Draft in details:

Learning about the various methods of money transfers is an important part of the basics of wealth management.

Yesterday I went to my neighborhood bank to update my personal details. As I waited for my turn, I noticed a young man struggling with a form. My “always helping” nature landed me asking him about his frustration, to which I came to know that he is a college student and is attempting to make a demand draft for applying to an MBA college. I did guide him, to which I got a smile and lots of feel-good factors. So I told myself to write a blog on “How to Send a Demand Draft?”.

| Table of Contents |

|---|

| Why People Prefer Demand Draft over Account Payee Cheque? |

| What is a Demand Draft? |

| How to send a Demand Draft? |

Today most of the institutes and organizations accept payments from people in the form of DD instead of Account Payee Cheques.

Why People Prefer Demand Draft over Account Payee Cheque?

The reason being, it is a secure way to transfer the funds than an Account Payee Cheque which has a problem of insufficiency of funds associated with it. For example, when someone wants to apply for a government project, the tender registration fee which is submitted along with tender should be in the form of DD.

What is a Demand Draft?

A DD is a negotiable instrument similar to a Bill of Exchange which is used by individuals to make transfer payment from one bank account to another.

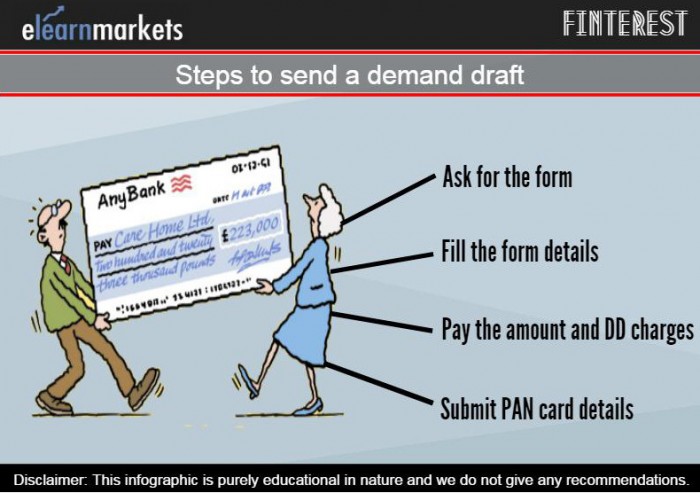

How to send a Demand Draft ?

1. Ask for the Form– Visit any bank and ask for a Demand Draft application form.

2. Form Details– You need to fill up the details like the mode in which you want to pay money to the bank i.e. through cash or from your account, the mode in which we need to pay to the beneficiary, name of the sender and the recipient, the amount which is to be transferred and the place where the money is to be transferred.

3. Demand Draft Charges– The bank will provide the DD once you submit the form along with the money to be transferred and its charges.

4. Pan Card Details– The amount transferred if exceeds more than Rs 50,000, then PAN card details need to be submitted.

However, the charges vary from bank to bank. In case the DD is for a large sum, it’s more sensible to opt for a bank which takes lower charge.

Moreover, it’s not mandatory to have a bank account with the bank to send these drafts.

Stay happy and keep learning!!

Visit Stockedge to get Stock Market Information at your fingertips.

It was very useful and I will try.

Nice of u friend! Highly helpful.. thank you so much..

Sir, Do I need to send the DD paper( which makes the bank) to the person who will take the money ?

Hello Subrata,

Thank you for your comment.

Your question was not very clear.We are assuming by DD papers you meant the Demand Draft.Yes, you will have to send the Demand Draft to the person for whom it is being made or who will take it.

You may read more blogs on banking topics on our site: Elearnmarkets.com

Happy Reading!

I want to send a form,in the form there is written that send through DD ,plz help how to do

Hello Sabita,

Thank you for your comment.

In order to send a demand draft, you will have to follow the following steps:

1. Visit any Bank Branch and ask for the Demand Draft Form.For Demand Draft Purpose it is not mandatory to have a bank account with the bank from which you are taking the demand draft.

2.Fill up the necessary details in the form.

3.Submit the form along with the money to be transferred and the demand draft charges.The demand draft charges vary from bank to bank.If the Demand Draft is for a very large sum it is sensible to opt for a bank with a lower demand draft charge.

4.Once you submit the dd form, the money to be transferred and the demand draft charges, the bank will provide you with the DD.

5.If the amount to be transferred exceeds Rs 50,000 you will have to provide your PAN Card Details.

6.Once you have your Demand Draft, you can attach it with the requisite form and send it.

If you want to read on more banking topics

Happy Reading!

I need your kind help to clarify one query regarding sending DD to Canada for my educational credentials verification.I got reply from them which states-

We do not accept bank drafts that are not negotiable without charge in Canada. This means we will not accept a bank draft that we cannot draw without charge from a Canadian bank. From our experience the State Bank of India bank drafts are no negotiable without charge in Canada. We no longer accept these bank drafts.

So could you please clarify this point.

Regards,

Ranjeet Singha

Hello Ranjeet,

Thank you for your comment.

We do not have domain expertise to help you with regards to the issue faced by you.

Your bank will be the best person to guide you in this regard.

You can read more blogs on banking topics here.

Happy Reading!!

Can I also send the DD via email (i.e. a scanned copy of DD)? Plz reply

Hi,

You can refer to the link here: https://www.imtarunsingh.net/2015/07/how-to-apply-for-demand-draft-online-sbi.html

So, if i already made DD at the bank by offline mode, is it necessary to send to the person via post office and not via email?

Hi Rika,

No it is not necessary to send to the person via the post office and not via email.

Thank you for Reading!!

its very helpul to all .you clarified all things about demand draft very nicely and systematic

manner which is easy to understand.

Its really wonderful post, Thanks for sharing with us.

awesome article sir.

Really informative article..,..

You are really sharing informative details here. thanks

Hi,

Thank you for Reading!

Keep Reading

This is very informative article thank you for this information. But I want to know how am I submit DD cancellation latter in the bank.

Hi,

Make a formal request explicitly to the branch manager in the letter for cancellation of the demand draft. End the DD cancellation letter with your signature and mention your name in detail along with your account number.

Thank you for Reading!

It’s really such a great article posted by you. It is information

Hi,

We really appreciated that you liked our blog.

Keep Reading!