People these days are ready to take significant risks in their investment choices. One of these is a mutual fund. To get a comprehensive idea about the basics of mutual fund investments you may do: NSE Academy Certified Financial Planning & Wealth Management course on Elearnmarkets.

With the change in preferences, they are moving from conventional investment vehicles like Fixed Deposit, Public Provident Fund (PPF), Post Office Savings etc to aria-label=”professionally managed investment options like Mutual Funds, Shares & Securities etc. (opens in a new tab) professionally managed investment options like Mutual Funds, Shares & Securities etc.

Now, Mutual Funds has emerged as one of the most-preferred investment vehicles during recent times. One of the main reason is that you can start investing in mutual funds with as low as Rs 500/- So it suits to all income groups basically.

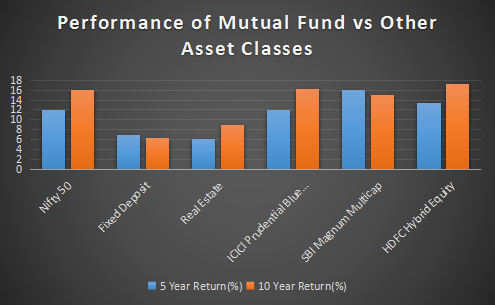

Let’s give a quick view to the Mutual fund performance over the years:

Source: The data is prepared with the help of several sources/ website – SBI domestic term deposit, NSE Historic Index Data, Value Research

In India there are 40 Asset Management Companies with a vast array of schemes under management. Thus, it becomes difficult for investors to select the best mutual fund that suits their requirements, as each mutual fund scheme is unique and serves a certain risk profile.

To get an assistance for selecting the best mutual fund that suits their requirements, you can download Kredent Money App.

There are numerous myths, opinions and perceptions that surround a mutual fund. This usually confuses an investor and sometimes deters them to make investment in mutual funds.

Instead of following opinions given by peers and relatives investors should check few points themselves before making investment.

Only then would they be able to say, Mutual Fund Sahi Hai!

Coming to the point here, there are lot of mutual fund schemes in the market and the major delimna is WHICH ONE TO CHOOSE?

In this blog, we will tell you about the 7 Things that you should KNOW before Buying THE RIGHT MUTUAL FUND:

1. Investment objective

- Every mutual fund scheme, irrespective of the category – whether equity or debt has an investment objective.

- An investor’s financial objective in terms of return, risk and investment horizon should align with that of the scheme.

- Suppose Investor A is looking for capital appreciation as well as willing to take a risk over a long term horizon, can invest in Equity Oriented Mutual Fund.

- While Investor B is willing to invest with the least amount of risk involved then debt oriented mutual fund will serve his objective.

- Balanced funds are suitable for investors who are looking for a combination of safety, income and modest capital appreciation over a medium-term horizon.

- A liquid fund serves those investors best who want to park their surplus cash for a short period of time and earn a return more than a Savings Bank deposits along with reasonable safety of principal and liquidity.

2. Assessing the Asset Management Company (AMC)

- AMC is responsible for ruling the mutual fund and making decision that benefits the investors.

- Investors should pay attention to the assessment of an AMC in terms of its credibility and transparency, i.e whether they adopt good disclosure norms, the performance of the AMC across market cycles, its fee and commission structure among others.

- An investor to check the respective AMC’s CRISIL ranking before selecting the right mutual fund.

3. Fund’s Performance

- Investors should look for funds which have delivered steady and consistent performance across market cycles.

- An investor should evaluate a fund in terms of the risk-adjusted returns over a longer-term period, its portfolio, comparing its performance with its peers in terms of its returns.

- Though history does not always repeat itself, therefore this should be used in conjunction with other discussed parameters while selecting a mutual fund.

4. Experience of Fund Managers

- Investors are required to check the performance as well as the experience of the mutual fund managers. Thus, making sure that the money is incompetent and deserving hands.

- A fund manager with sound proven expertise and ethical history will be an ideal candidate.

Questions to ask yourself when reviewing the fund managers’ performance:

i. Did the fund manager deliver steady and stable performance on a consistent basis and also whether the performance was in line with general market returns?

ii. Was the fund more volatile than the major indexes?

iii. What was the risk-adjusted return the fund achieved?

iv. What is the frequency of portfolio churning?

The answer to all these questions will provide an insight into the fund managers’ performance.

The answer to all these questions will provide an insight into the fund managers’ performance.

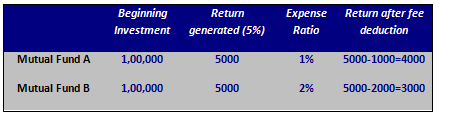

5. Expense Ratio (Fund Operating Expenses Annually)

- As mutual funds are professionally managed they entail an annual fee called Expense Ratio for the same. It is the percentage of assets payable to the fund manager for his services rendered.

- Expense ratio is a combination of three major types of expenses: Management fees, Administrative costs and 12-1b distribution fees (fee for advertising and promotional purposes).

- This ratio has a substantial impact on the net profitability for an investor.

- A lower expense ratio means higher profitability and vice – versa.

EXAMPLE on Expense Ratio:

Thus, from the above table we can understand that 1% difference in expense ratio translates to a whopping 10% difference in net profits.

Though, high expense ratio impacts the fund’s performance, though it is not always so. In case of actively managed funds the higher return generated by the fund manager can be justified and adjusted for the fee they charge.

6. Entry load and Exit load

- Generally, mutual funds charge a fee from investors while entering (entry load) or leaving (exit load) a scheme. This fee is generally referred to as a “Load”.

- In India, since August 2009, SEBI has done away with the concept of charging entry load for mutual funds.

- An exit load is levied when an investor sells the units of a fund within a particular period, usually within one year from the date of purchase . However, in the case of open-ended funds; investors have the choice to exit the fund whenever they want.

- But in some cases like close ended funds they can sell only when the tenure of the fund gets completed according to the objective of the fund. But if they sell in mid then a penalty is charged which is deducted from the corpus redeemed.

- The exit load is a miniscule percentage of the NAV. It is deducted from the NAV and the balance amount is what the investor actually receives if he sells before one year of investment, no exit load is applicable if sold after one year. This along with expense ratio drags down the overall investment value.Thus, it is advisable to invest in a fund with low exit load and wait invested for a longer term.

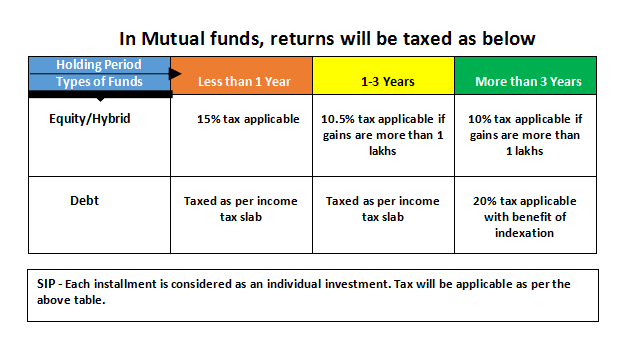

7. Tax implications

In this regard, investors should be aware of:

i. Whether the scheme is tax free or taxable?

ii. What is the tax rate on short term and long term gains on different schemes?

iii. What will be the impact of taxation on the overall return?

Taxation on mutual funds depends upon the type of funds one is investing in and also on the duration of the fund. The following explains how various mutual fund schemes are taxed.

Thus, from the above it is clear that holding on to mutual fund units for a longer period is more tax efficient. As tax on long term gains is much lower as compared to short term gains.

Key takeaways

- Mutual Funds should be assessed both in terms of quantitative and qualitative parameters.

- Investors should choose schemes that align well with their financial objectives and goals.

- The parameters should not be studied in isolation but in conjunction with each other.

- Investors (especially the novice) feels that ‘any’ mutual fund can help them to achieve their goal, however, each mutual fund scheme is unique and serves to certain investment and risk profile of the investors.

- Selecting a mutual fund may seem to be a challenging task but doing a little bit of research, understanding one’s financial objectives and risk appetite and maintaining discipline before selecting a fund will increase an investor’s chances of success.