Macroeconomic factors– What are they?

When trading in the Indian Stock Market, how often do you track the Dollar Index?

Do you know that the Dollar index which is one of the Macroeconomic factors can help you in understanding the present scenario of the Indian Stock Markets?

Well if not then we are here to how to explain how these Macroeconomic factors help us in trading in the Indian Stock Markets.

Indian Stock market movements are affected by many factors. These factors are mainly classified into two broad categories: Macroeconomic and Microeconomic factors

Macroeconomic factors affect the entire economy or all the sectors, including the individual stocks which are affected by the micro factors.

Indian Stock markets are affected by these factors over time, or the prices move in anticipation of these events or developments in the economy, a sector or particular stocks.

So, In this blog, we will discuss factors affecting the stock market in India and what are the five most important Macroeconomic factors that affect the Indian Stock Market.

What is meant by Macroeconomic factors?

Let us begin with explaining what is actually meant by these macroeconomic factors:

The world markets are interconnected and impacts can be transmitted quite fast across markets through portfolio investors and hedge funds.

We saw how the world market crashed in the year 2008 due to the financial industry.

Deregulation in the financial industry was the main cause of the financial crash of 2008.

The financial industry had allowed speculation on derivatives that were backed by cheap mortgages that were available even to those who had questionable creditworthiness.

The rise in property values and easy mortgages attracted many people to avail of home loans that created the housing market bubble.

In 2004 the Fed raised interest rates which led to an increase in mortgage payments and squeezed home borrowers’ abilities to pay which led to the bubble burst in 2007.

Due to the 2008 financial crash, the Indian stock markets declined around 20% by mid-2008 which was in tandem with other global stock markets.

Having understood how these macroeconomic factors affected the Indian stock market from a global standpoint, now let us understand which are the macroeconomic factors that affect the Indian Stock Market.

Five Most Important Macroeconomic Factors that Affect Indian Stock Market:

Below are the five most important macroeconomic indicators that affect the Indian stock market:

1. Dollar Index:

The dollar index is one of the macroeconomic factors which affects the Indian Stock Markets greatly.

Traders should note that there is an inverse relationship between the dollar index and the Indian stock market.

If you look at the chart below of the past 20 years data, it shows that both the NIFTY 50 index and USD movements share a strong inverse relationship.

From the above chart, we can see that if the USD is rising then the NIFTY 50 depreciates and vice-versa.

The reason behind this is that when the dollar index falls, FIIs (Foreign Institutional Investors) invest more in Indian stocks as they give higher returns as compared to returns from dollars which can be understood from the FII DII Data.

Read our blog on FII and DII Analysis relative to NIFTY price movement

The technical analyst can easily analyse the dollar index with NIFTY 50 for finding out the ongoing scenario of the market.

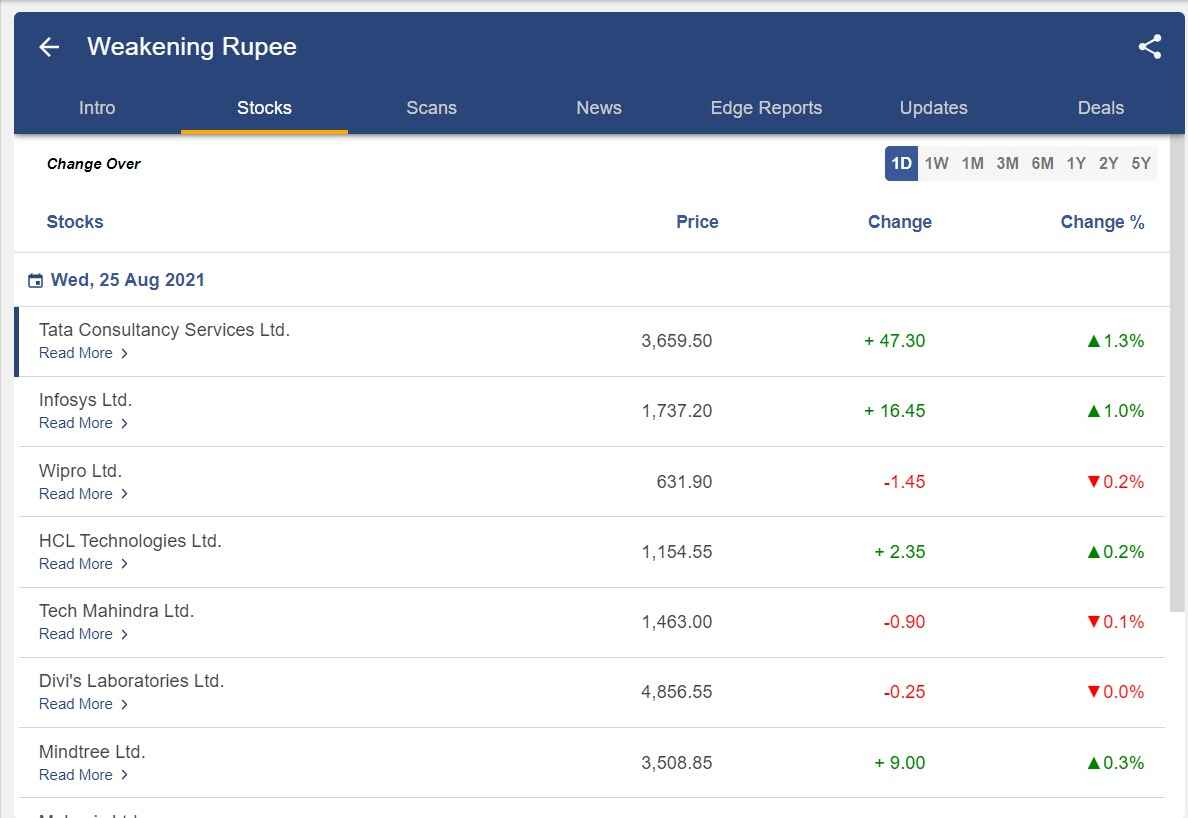

As a result of rising dollar value, the Indian stock markets suffer. There are few sectors in the Indian stock market that suffer a lot in comparison to other sectors.

Thus, when the dollar index rises, it is likely to cause a fall in the share prices of those companies, especially in cyclical sectors and domestic consumption sectors such as Banking, Automobiles stocks, Oil and Gas, Capital Goods stocks, Metals, etc.

Thus, if you are a regular trader then you can get benefits from tracking or comparing the dollar index with the NIFTY 50 index in technical analysis using technical charts.

You can also check the investment idea section in StockEdge to see what stocks are affected by the weakening rupee that is when the dollar is increasing:

2. Crude oil:

There is also an inverse relationship between the crude oil price and the Indian equity market.

The reason behind this is that the Indian oil industry is a major importer of oil. Thus industries like tyre, logistics, refinery, airlines, lubricants, paints, etc are affected by a change in oil prices directly.

As we know that the energy stocks have around 12.5% weightage in Nifty 50 and nearly 15% weightage in Sensex.

Thus, strength in crude oil prices adversely affects these sectors that are oil-dependent and weakness in oil prices results in the rise in these companies’ stock prices.

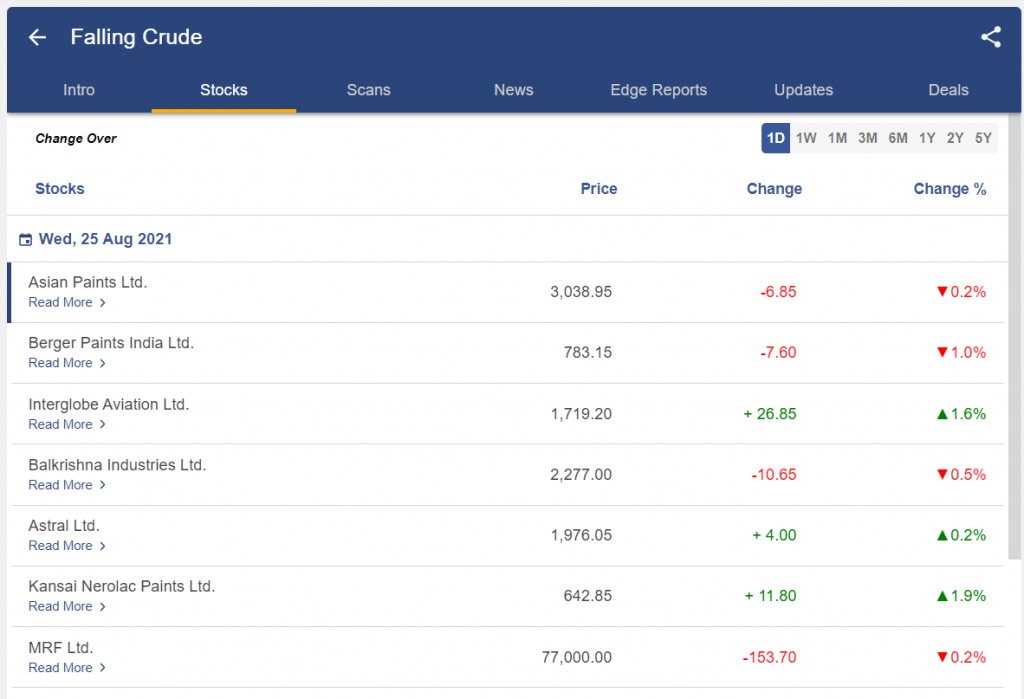

You can also check the investment idea section in StockEdge to see what stocks are affected by the rising or falling crude oil prices:

Suppose companies like Asian paints, Kansai Nerolac, etc in the paint industry use oil as a major ingredient in their paint.

Thus, any rise or fall in oil prices will directly impact their performance in the stock market.

3. US 10-year yield:

The US bond yields are very influential globally as they attract funds from investors all across the world.

Also investing in the US treasuries is one of the safest investment tools and when these bond yields rise then they become more attractive.

When the yields increase then it also indicates that the Fed might raise interest rates for controlling inflation.

Due to this reason, many FIIs and global investors may pull out their money from Indian Stock Markets and invest in these bonds.

As a result, the prices of the stocks in the Indian stock markets may fall.

Read our ELM School Module on Macroeconomic Indicators affecting Stock Markets

4. US market indices:

Due to globalisation, the whole world has become a single economy and the financial markets of all over the world work in sync.

As we are connected with the whole world through various businesses, every company is connected directly or indirectly to another for fulfilling their business purpose.

As we all know, the US economy is the largest economy in the world. Whenever there is any negative news in the US markets, it largely affects the global markets, especially Indian Stock Markets.

As we have discussed above, the example of the 2008 Crash affected almost every country’s economy.

The Indian stock markets went down sharply and also the overall world’s housing price started to drop creating huge tension around the world.

Thus, we can say that by looking at the 5 years charts of Nifty 50 and Dow Jones Industrial Average, both the markets have a direct correlation with each other.

5. All Indian market indices:

When analysing the Indian Stock Markets, one should look at all the indices be it Nifty Midcap, Nifty Smallcap, Nifty Pharma, Nifty Metals, Sensex etc.

According to one of the Dow Theories, the averages should confirm each other and if they do not confirm then reversal might come.

Watch the video below to know the impact of SGX Nifty on the Indian Stock Market:

Bottomline:

As discussed above we can see how all the above macroeconomic factors play an important role in the price movements of the Indian Stock Markets. Traders who regularly trade in the stock market should see all the above macroeconomic factors at least once a week to analyse the present Indian stock market scenario.

Happy Investing!