Are you aware about the new Rs 2000 note?

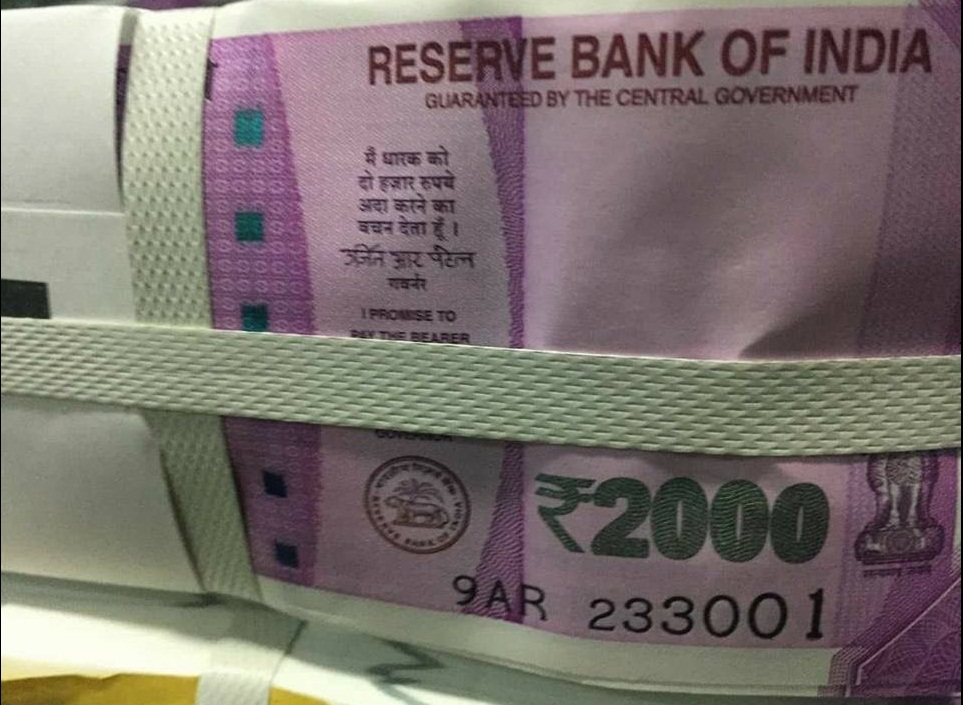

Since few days, the 2000 rupees bank note has been circulating heavily on social media and it has already gone viral. Though it’s not clear that the images circulated on the micro-blogging sites are genuine or not, since no official notification is present on the RBI website.

The Hindu Business Line on 21st October reported, “Banknotes of the denomination of Rs 2000 will be in circulation soon. The Reserve Bank of India has very nearly completed preparations for introducing this new high-value currency.”

This bigger denomination note is not new to India. Back in the year 1938 and 1954, RBI had come up with the Rs 10000 note. However, they were demonetized in 1946 and 1978 respectively.

Concern over Higher Value Note

Generally, the higher value note is seen as a sign of rising inflation which basically helps in reducing the volume of banknotes in the economy. Many people in India are against the introduction of bigger currency notes as it will increase the amount of black money in the economy and for that reason, few state governments have given a proposal for banning higher denomination notes in the past.

About 2000 Rupee Note

The new note seems way different from the earlier currency notes both in terms of design and color (pink). This even seems to be the first note which does not contain Mahatma Gandhi’s image but his presence can still be felt on the bottom left in the form of his signature glasses.

Moreover, the note also has the signature of our new RBI governor, Urjit Patel who took over Raghuram Rajan this year lately.

The note has been designed with the motive to eradicate the black money using state of the art indigenous nanotechnology. Every note is embedded with Nano GPS chip.

The Working Mechanism of Embedded NGC Technology

The differentiating feature of this chip is that it does not need any power source and acts only as a signal reflector. So when the satellite sends the signal to the location, the signal gets reflected by the NGC, providing exact location and the serial number of the currency to the satellite. This is how the NSG embedded currency can easily be tracked and located even it is kept 120 km below the ground level.

How will 2000 Rupee Note Solve the Problem of Black Money?

The satellite will easily be able to locate the exact amount of money stored in a particular location with the NGC technology embedded in the currency. Say if a relatively higher sum of money is kept and stored at a suspicious location for a long time period other than banks and other financial institution, the information will be straightaway passed on to the Income Tax department for later investigation.

Also Read: Places Where You Can Still Use Your Old 500 and 1000 Rupees Notes

Bottomline

People in social media stated that this note will be launched in February 2017. However, there is no official update from RBI or government. However, elearnmarkets.com could not independently verify the authenticity of the images leaked in the social media.

Register for NISM Series I – Currency Derivatives + Multiple Mock Tests on Elearnmarkets.