Trading Strategies for the long term involve analysing the key financial ratios of a business to determine its financial health and to provide an estimate of the value of the business.

“We want to perceive ourselves as winners, but successful traders are always focusing on their losses” -Peter Borish, Chief Strategist, Quad Group.

Trading is a profession that dates back to the times of the Barter exchange. Two parties came together to strike a deal for goods that each party needed and the other had. That formed the basic groundwork of the system of trading.

A stock market is simply a place of congregation of buyers and sellers of stocks, which represent the ownership claims on businesses. These businesses may include securities listed on a public stock exchange and securities that are traded privately.

The first modern stock was traded on the Nieuwe Brug in Amsterdam for the Dutch East India Company in 1602. The first derivatives were traded in 1607 for that single company, with the dividend being distributed after some years. Futures trading and short-selling were also invented in Amsterdam after a few years.

As of May 2021, the Market Cap of the National Stock Exchange is US$ 3.1 Trillion, with a listing of 1952 companies.

Trading is a noble profession in India and is a subject of interest to thousands of traders. While there are many success stories, the market remains to be a place where people have lost a lot of money. The bottom line? Trading on emotions, by fluke and not following certain fundamental rules. Let’s discover some of the trading strategies to always stay in profit:

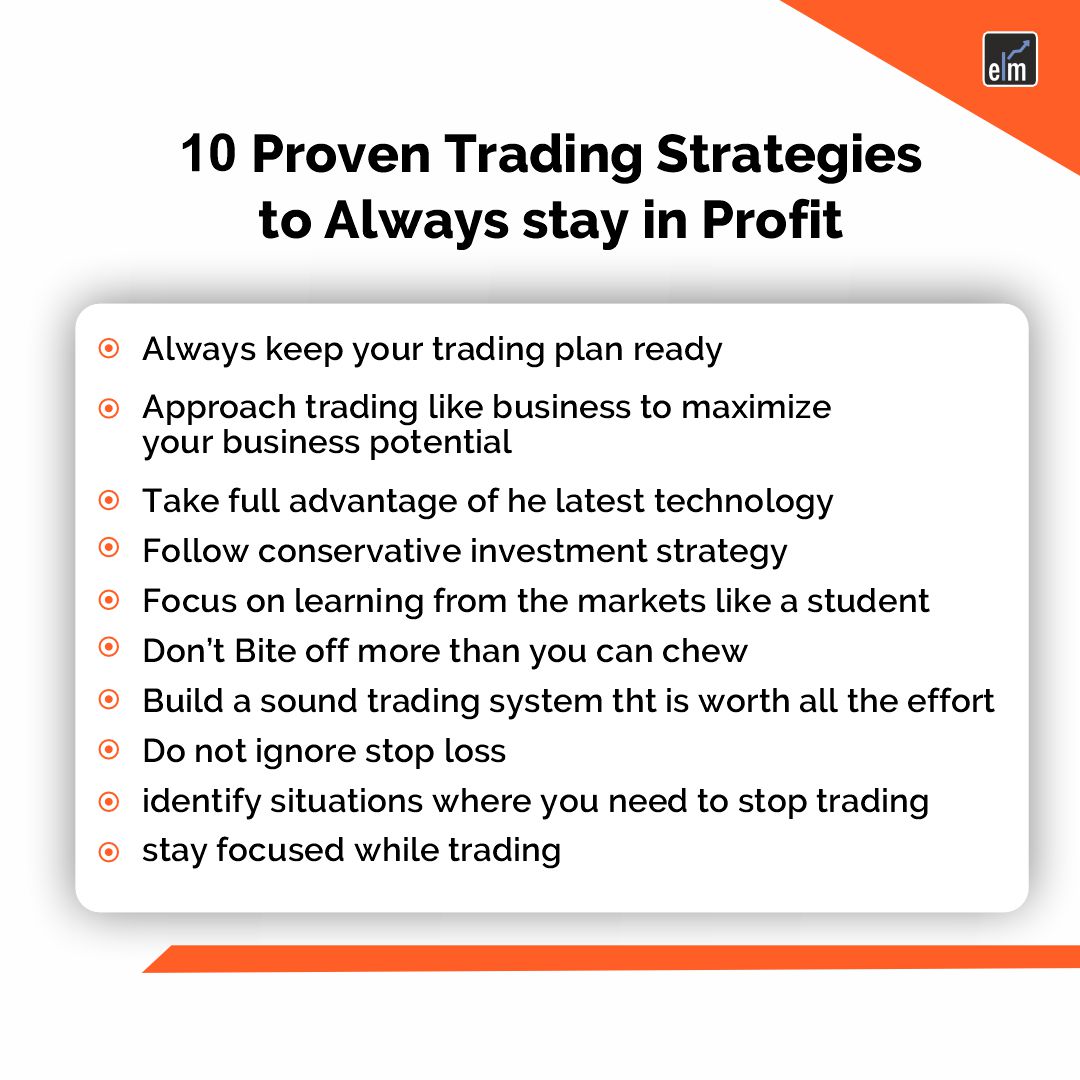

Here are 10 proven Trading Strategies–

Rule 1

Always Keep your trading strategies ready: Without a plan, is a sure-shot way of exposing yourself to danger. A trading plan is a bridge that consists of one or more strategies that will take you to a successful future.

Explore advanced Trading Strategies to navigate stock market crashes. Unlock new insights now!

A general trading plan is to set a target price based on a particular trend while setting the maximum loss you can bear. It is extremely important to have a rule-based trading system that stops you from trading on emotions.

Rule 2

Approach trading like a business to maximize your business’ potential: Trading is no different from a business. The job of a business is to cut expenses and enhance profits. Similarly, the job of a trader is to cut losses and maximise profits. If you notice continuous losses in your trades, there must be something wrong with your methodology.

Rule 3

Take full advantage of the latest technology: Today, traders have a lot more indicators at their disposal compared to the traders in, say, the 70s. As a trader, your job is to keep yourself updated with the latest developments in price movements, charts, and tables. Another crucial aspect of trading is to stay updated with the latest news all around the world.

Installing the latest technology is a must. You do not want to be stuck in situations where some orders did not go through because of a lag in your tools!

Rule 4

Follow a conservative investment strategy: It is always better to be sceptical in the Stock Market. Conservative investing is prioritizing the preservation of Capital overgrowth or market returns. Create a trading system where you can bear some losses, but only once in a while. This should always be an exceptional scenario.

Rule 5

Focus on learning from the markets like a student: Here’s a fact about successful investors: they never stop learning. Whether your trades are successful or not, knowledge is something you should always be a priority. Writing down your mistakes is a good practice traders often undertake. Try not to repeat your past mistakes. Make use of the various tools available in the stock market. If you try to go against the tide in the market, it will eventually humble you.

Rule 6

Don’t Bite off More than you can chew: There’s a reason why trading is risky and fixed deposits are not. If you have started your trading journey, you should know the risks that come along with this occupation. Try to follow the famous “2% capital” rule, which minimizes the extra risk.

If you are new to the world of Stocks, STOP TRADING WITH HIGH LEVERAGE. Unless you are sure of the price movements, leverage can cost you huge amounts of money. Set up your position sizes beforehand, and never trade on impulse.

Rule 7

Build a sound trading system that is worth all the effort: The art of trading requires tremendous practice. It is all about rules, methods, discipline, and patience. Professional traders never let emotions cloud their decision-making. Trading emotionally might just pay off a few times, but, in the long run, you need to have a trading system that sticks to rules and not emotions. All the effort you put into building that strategy is worth it.

Rule 8

DO NOT ignore stop loss: It is almost impossible not to suffer losses at times. All your technical analysis might fail during this time. At times, you just have to book losses to survive in the long run. This is precisely what stop loss does. One golden rule of trading is that while you are on the lookout for profits, you should always protect your downside. Stop-loss takes care of that.

Rule 9

Identify situations where you need to stop trading: What most traders don’t realize is that not trading is also a type of trading. Whenever we let emotions take over the numbers, there is a problem. During a choppy market situation, it is better to stay away for a while. Always remember: the market does not care about your ego and emotions.

Rule 10

Stay focused while trading: Complacency and ignorance cause more harm than good in the world of trading. Making money by trading is already a difficult task.

Devoting your attention fully helps you understand the market trends better.

“We simply attempt to be fearful when others are greedy, and to be greedy only when others are fearful” -Warren Buffett

Bottomline

There is absolutely no doubt that making money with trading is for everyone. It is REALLY, REALLY TOUGH, but, with the correct guidance and knowledge base, it is possible. Surf the internet. Attend webinars, enrol in courses and learn from leading market experts. Your efforts will pay off.

Frequently Asked Questions (FAQs)

1. What are trading strategies?

Trading Strategies are pre-established plans or techniques used by traders to decide which financial products, like stocks, bonds, currencies, or commodities, to purchase and sell in the financial markets.

2. Why do traders use trading strategies?

Trading methods help traders make more profitable deals by directing their decision-making process. Traders can better assess market circumstances, spot openings, control risk, and exercise discipline when trading with the use of strategies.

For more stock related queries visit StockEdge