Nifty close 10452.5: Nifty opened at fresh life time high of 10461.7 and ended marginally lower on Friday’s session.

Hourly Technical:

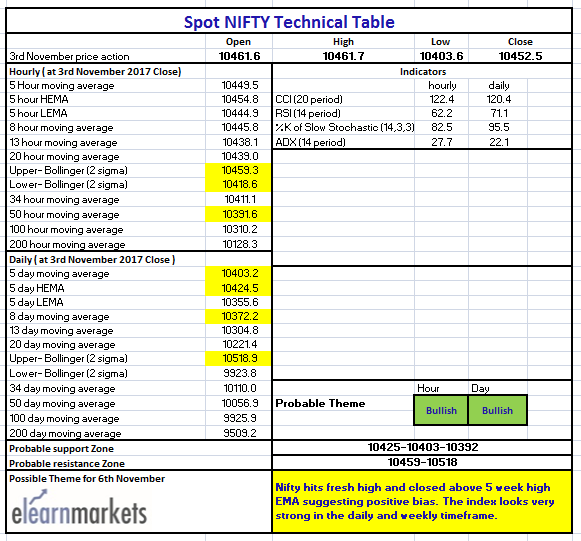

In the hourly chart, Nifty opened marginally higher but ended in a narrow range bound session. The probable support in the hourly chart comes at lower Bollinger line (presently at approx.10418.6) and 50 Hour moving average (presently at approx.10391.6).

On the upside, Nifty may face resistance at Upper Bollinger line (presently at approx.10459.3).

Hourly Stochastic are in the normal zone while CCI and RSI are in the overbought zone. ADX has turned down suggesting some loss of momentum and some profit booking near the lifetime high area. Overall Nifty remains bullish in the Hourly chart.

Figure: Nifty Hourly Chart

Daily Technical:

In the daily chart, Nifty is still above 5 Day High EMA and also above all short term moving averages indicating a positive bias. The probable support in the daily chart comes at 5 Day High EMA (presently at approx. 10424.5), 5 DMA (presently at approx.10403.2) and 8 (presently at approx.10372.2).

On the upside, Nifty may face resistance at Upper Bollinger line (presently at approx.10518.9).

Stochastic, CCI and RSI are in the overbought zone and ADX is still up indicating gain in upside momentum. Overall Nifty remains bullish in the daily chart.

Figure: Nifty Daily Chart

Weekly Technical:

Nifty closed above 5 week High EMA and most moving averages indicating strong control of the bulls over bears.

Weekly Stochastic, CCI and RSI are in the overbought zone and ADX has again turned up indicating increase in momentum. Overall Nifty remains very bullish in the weekly chart.

Figure: Nifty Weekly Chart

Figure: Nifty Tech Table