“MSCI Index semi-annual rebalancing will happen in May 2023 at its scheduled date”

“Top 5 stocks which can benefit from MSCI rebalancing”

“India’s Weightage is increased to 8.07% in the MSCI Index”

You all must have come across these headlines or read some short news.

Those who know a bit about financial markets and terms might have got some understanding of the same. But those of you who did get it, don’t worry; we always got your back!

In today’s blog, we will discuss the MSCI Rebalancing Index and how it affects Indian Stock Market:

What is MSCI Index?

In 1969 MSCI (Morgan Stanley Capital International) published the Developed Markets Index, which covers countries considered developed, such as the United States, Canada, and the United Kingdom.

Emerging Markets also appeared in 1987 (he is now one of the most popular and most visited indices) Index. The index currently covers 26 countries and includes over 1,400 stocks. India has also been included in the index since 1994.

MSCI has approximately 1,60,000 indices, most of which are market capitalization indices. Now let’s see how these indexes work. MSCI has several comprehensive indices, such as Emerging Markets and Developed Markets, that include many stocks from multiple countries. Apart from that, each country has its index. Each country has multiple MSCI indices containing different stocks based on industry research.

MSCI weights each of these stocks in their respective indices based on market capitalization at the end of the trading day. Market capitalization is calculated as follows:

Market Capitalization = Stock price ꭓ Number of shares outstanding

Stocks with the highest market capitalization receive the highest weight. The reason is that large companies have a greater impact on the economy. This reflects a better picture of the economy than we see for mid-and small-cap companies.

What is MSCI Index India?

The MSCI India Index is designed to measure the performance of the large- and mid-cap segment of the Indian market. The index has 114 constituents and covers approximately 85% of Indian equities. The MSCI India Index was launched in the year 1994.

Here are the top 10 constitutes of the Indian Index-

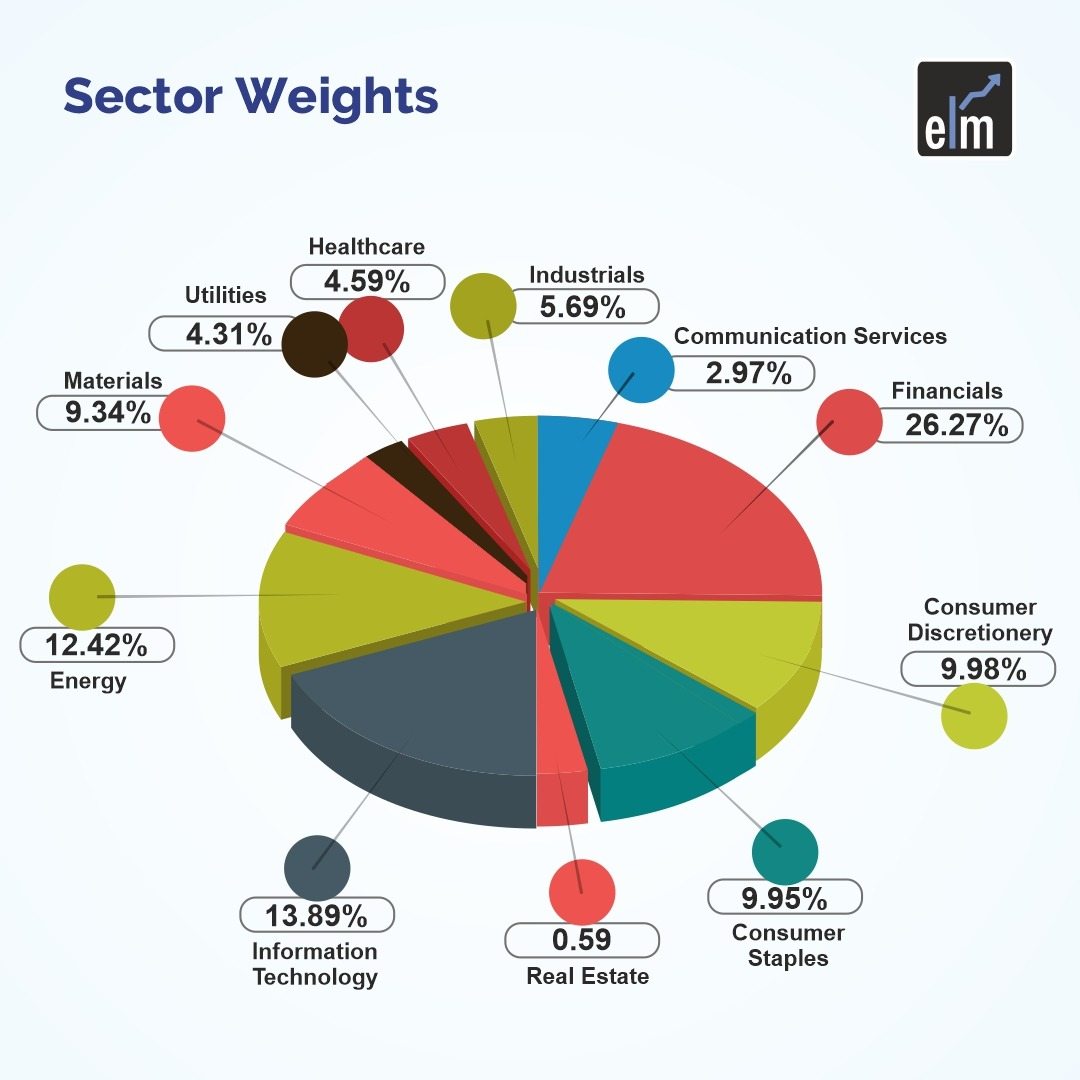

Below is the Sector Weight-

What is meant by the Rebalancing of the Index?

Rebalancing is the process of readjusting the weights of assets or stocks within a portfolio or index. Rebalancing can be based on pre-determined weights (as in portfolio management) or aimed at providing true economic and market conditions (as in indices). increase.

Now you know that MSCI has multiple indices that weigh different economies, economic groups, and even individual countries. It is, therefore, important that the index is reviewed regularly (quarterly) and rebalanced (twice a year) to provide a true picture of the underlying economy.

This activity is important because major ETFs base their portfolios on these indices. Apart from these ETFs, many leading mutual funds and pension funds also track these indices due to our precision and expertise as a global research firm. To maintain this reputation, MSCI reviews all indices quarterly and rebalances them twice each semester.

Impact of Rebalancing on the Stock Market

When MSCI Index rebalances an index, all ETFs based on those indices must rebalance their portfolios according to MSCI’s latest rebalancing index. This results in passive inflows and outflows of foreign capital across countries.

MSCI Index has given ETFs 14 days to rebalance their portfolios. Apart from passive capital flows, active capital also flows between countries, as many active funds also track the MSCI index to some extent.

Stock weights in the index are based on market capitalization formulas. Therefore, an upward rebalancing (no new additions or deletions to existing securities) by sector weight or by country will result in outflows to large caps and inflows to large caps. This is based on the principle of relative realignment.

The addition or removal of securities as a result of rebalancing has a significant impact on foreign capital flows.

Securities added to the index receive foreign money, and securities removed lose foreign money. The added safety also attracts active funds and domestic players, resulting in prices rising while those removed/reduced from the index (in terms of weight) fall.

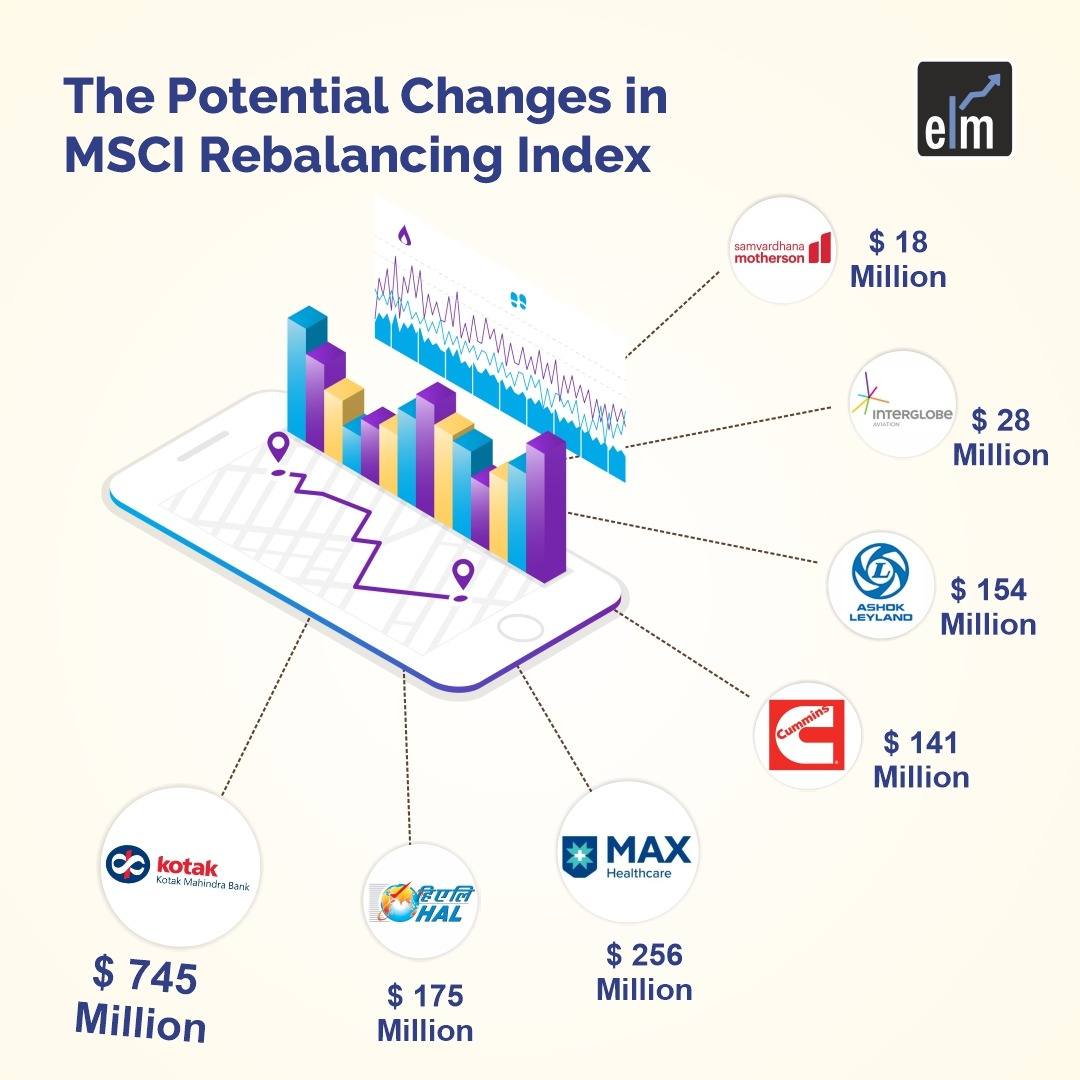

The Potential Changes in the MSCI Indian Index

The MSCI Rebalancing will be announced on the morning of May 12. The Potential changes could be:

You can also do our course on Masterclass on Short-term Momentum Trading

Changes in MSCI Index as Announced on 12th May

Included in MSCI India Index:

| Stock | Inflow |

| MaxHealth | 504.05 |

| Sona BLW Precision | 554 |

| Hindustan Aeronautics | 2981 |

Exclusion in MSCI India Index:

| Stock | Outflow |

| Adani Transmission | $ 201 Million |

| Adani Total Gas | $ 186 Million |

| Indus Towers | $ 84 Million |

Weightage Increase:

| Stock | Increase | Inflow |

| Kotak Mahindra Bank | 1.35 bps | $ 810 Mn |

| Maruti Suzuki | 0.14 bps | $ 87 Mn |

| ONGC | 0.12 bps | $ 74 Mn |

| Ultratech | 0.12 bps | $ 72 Mn |

| Zomato | 0.10 bps | $ 59 Mn |

Weightage Decrease

| Stock | Decrease | Outflow |

| Infosys | 0.22 bps | $ 810 Mn |

| ICICI Bank | 0.16 bps | $ 87 Mn |

| JSW Steel | 0.13 bps | $ 74 Mn |

| HDFC | 0.12 bps | $ 72 Mn |

| TCS | 0.10 bps | $ 59 Mn |

Bottomline

We hope you found this blog informative and use the information to its maximum potential in the practical world. Also, show some love by sharing this blog with your family and friends and helping us spread financial literacy.

Also, wish to increase your Financial skills but language is an hinderance? Join our courses like share market course hindi and enhance your Knowledge.

Happy Investing!

To get the latest updates about Financial Markets, visit StockEdge