Key Takeaways

- Tariff Threat: Donald Trump has proposed a 25% tariff on India, with possible penalties for buying oil and defence products from Russia.

- Negotiation Pattern: Trump often starts with high tariff threats, then negotiates down, as seen with the EU, China, and Indonesia.

- Trade Imbalance: The US cites India’s high tariffs on goods like cars, dairy, and wine, with a $46 billion goods trade surplus in India’s favour.

- Investor Watch: Companies with over 50% revenue from the US market face the highest risk if tariffs remain long term.

Will Trump’s 25% Tariff Threat Break India-US Ties?

Remember that grand welcome former US President Donald Trump received in India five years ago, with millions greeting him in a stadium?

It seems that friendship might be on shaky ground, at least according to his recent actions. Just recently, Donald Trump took to his social media platform to announce a potential 25% tariff on India.

And it doesn’t stop there, he even threatened additional tariffs if India continues to purchase oil and defense products from Russia as a penalty.

This move has many wondering: What kind of friendship involves penalties?

This announcement has sparked widespread questions about its potential impact on the Indian economy, the stock market, and whether Trump might just backtrack, as he has often done in the past.

Trump’s Unique Negotiation Style

This isn’t Trump’s first rodeo when it comes to tariff threats. His strategy is often to first threaten a high tariff, then engage in discussions with the country, eventually settling on a lower, final rate.

We’ve seen this play out with several nations:

- Deals Completed: The US has successfully closed tariff deals with the UK, Indonesia, Japan, and the European Union.

- Temporary Deals: With China, Trump initially imposed a massive 145% tariff, which was later reduced to 30%.

- One-sided Deals: Vietnam, Cambodia, and the Philippines also faced one-sided deals.

- Other Countries: Brazil faced a 50% tariff, and Canada a 30% tariff.

For instance, with Indonesia, a 19% tariff was imposed, under which Indonesia agreed to buy significant amounts of agricultural products, aircraft, and energy products from the US.

Similarly, after threatening the European Union with a 30% tariff, negotiations brought the figure down to 15%. Given this pattern, experts believe that the 25% figure for India is likely a starting point for negotiation, and the final rate could settle between 15% to 18%. India, for its part, has stated it will analyze the situation and work on a response.

Why the Discontent? The Trade Imbalance Argument

One of the core reasons behind Trump’s dissatisfaction stems from what the US perceives as an unfair trade balance with India. The US argues that India imposes very high tariffs on many American products:

- Dairy Products: 30% to 60%

- Farm Products: 30% to 50%

- Automobiles: 70% to 100%

- Wines: 100% to 150%

In 2024, the trade between the US and India amounted to $129 billion. From the US perspective, India’s exports to the US were higher at $87 billion, while US exports to India were lower at $42 billion. This means India exported $46 billion more to the US than it imported, a situation the US apparently dislikes.

The Hidden Truth: The Service Sector Angle

However, there’s a significant aspect that the US government under Trump often doesn’t count, which paints a very different picture.

The US earns over $80 billion from India through the service sector. This includes a wide range of services like education, digital services, financial operations, and crucially, intellectual property royalties.

Consider this: when you buy a product like an NKE (Nike) shoe in India, a percentage of that sale goes back to the parent company in the US as royalty or intellectual property payment.

YouTube and many other companies operate similarly. If these substantial service sector earnings were factored into the trade balance, the US would actually be in a trade surplus with India. However, Trump’s administration does not consider these as trade.

Potential Impact on India and the US

For India as a whole, the overall economic impact of these tariffs is expected to be minimal. India’s domestic market is vast, capable of fulfilling much of its own needs, meaning it’s not overly dependent on exports to the extent that smaller economies like Vietnam might be. In fact, the ability of the Indian market to meet its own requirements could lead to significant growth.

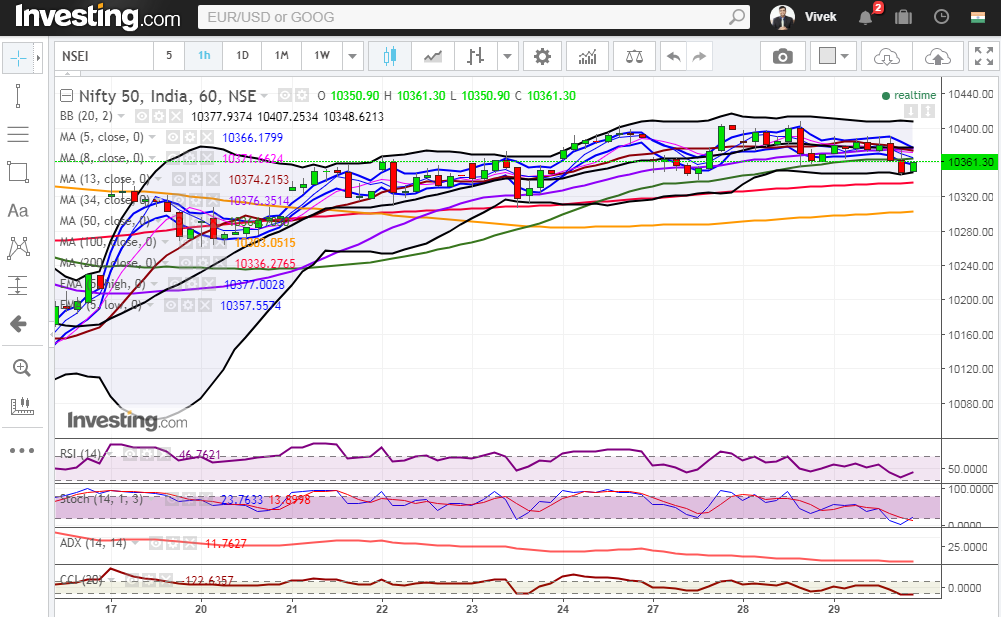

Therefore, the general market is expected to normalize after an initial day or two of fluctuations.

However, if the 25% tariff were to persist, some specific sectors and companies would face a significant impact, especially those with high exposure to the US market.

Here are some of the key areas and companies that could be affected:

• Electronics & Electrical Exports (Total $12 billion to US):

- Dixon Technologies: Around 9% of its revenue comes from exports, including Google Pixel exports to the US.

- Samvardhana Motherson International Ltd: Roughly 65% of its revenue is from exports, with the US contributing 20% to 25% of that.

- Exxaro Tiles: 20-30% of its revenue is from exports, and 5-10% from the US.

• Automobile Sector (Component Forgings):

- Sona BLW Precision Forgings: A significant 40% of its revenue comes from the US.

- Ramkrishna Forgings: 27% of its revenue is from the US.

- Bharat Forge: 35% to 38% of its revenue is from the US.

- Tata Motors: Has a 23% exposure to the US market through its Jaguar Land Rover brand.

• Gems & Jewelry (Total $9.15 billion to US):

- Rajesh Exports

- Vaibhav Global

- Titan

- Kalyan (to some extent)

Companies with over 50% dependency on the US market would be particularly hard hit if the 25% tariff were to remain in place long-term.

Interestingly, these protectionist policies championed by Trump might ultimately hurt the US more than they help. Such tariffs can lead to increased inflation within the US.

His vision of bringing all manufacturing back to the US could make products significantly more expensive for American consumers, potentially leading to protests once the economic impacts become more apparent.

The Bottom Line

In negotiations, the side that doesn’t desperately need the deal often has the upper hand.

Given India’s large domestic market and its relatively lower reliance on exports compared to smaller nations, it stands a strong chance of winning this negotiation.

While there might be some short-term market fluctuations, the overall impact on the Indian market is expected to normalize. However, for investors, it’s crucial to assess the US exposure of any company they are analyzing, especially if the 25% tariff were to remain a long-term reality.