Hindi: आप इस लेख को हिंदी में भी पढ़ सकते है|

Key Takeaways:

- Trading Psychology:Trading psychology is driven by greed and fear, leading to emotional decisions.

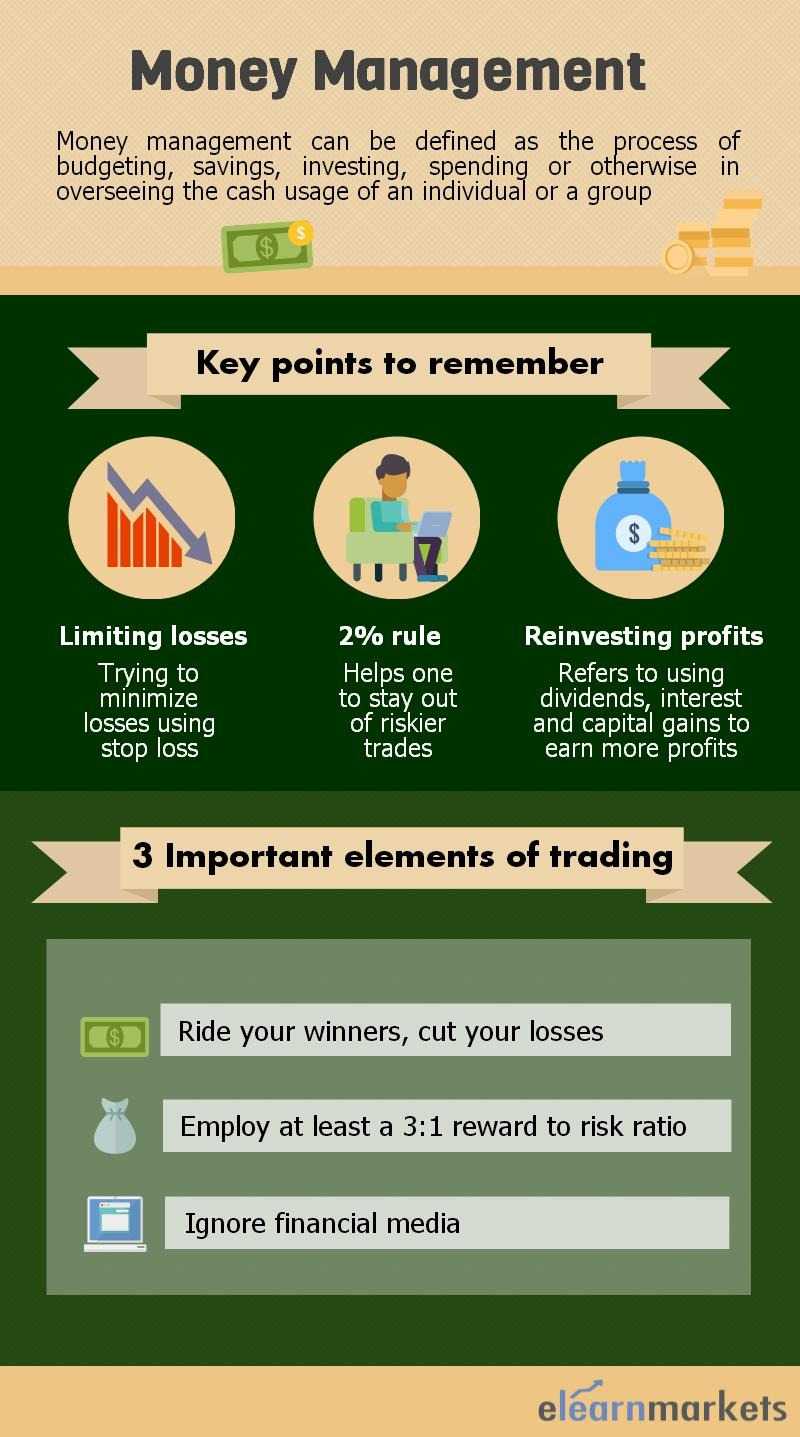

- Money management: It can either make or break a trade and thus an integral part of risk management.

- Portfolio Management: Manage risk by diversifying and limiting exposure. Smart portfolio management protects capital and supports growth.

- 2 Percent Rule: Risk only 2% of your capital per trade and use a clear trading plan to manage losses and stay disciplined.

- Money management Techniques: The techniques are maximizing profits, taking partial profits, managing risk and maintaining a favorable risk/reward ratio.

Is gambling an addiction? If so, why? Especially in casinos, you will find people stuck to slot machines pulling the lever compulsively. The trading psychology is somehow similar.

According to predictive analytics, even if some of those people end up winning the jackpot, they would prefer spending all that money back into the slot machine. Isn’t it quite interesting?

Some studies show that many slot machine addicts wear adult diapers because they don’t want to get up even to answer the nature’s call. Fingers crossed. These machines were designed to exploit the variable reinforcement, which is inherent in human behavior. You may Google later.

Trading Psychology

Trading Psychology is defined as any response or action which generates a reward i.e. a person will be motivated to repeat a response if he or she gets a reward for the same.

Humans crave predictability and struggle to find patterns, even in its absence.

Variability is the brain’s cognitive nemesis and our minds make a deduction of cause and effect a priority over other functions like self-control and moderation. This is trading psychology

Variable rewards induce addiction, it keeps our brains occupied.

Learn Trading Psychology in just 2 hours from Market Experts

Let me speculate a bit…

According to Professor Sanjay Bakshi, short-term speculators are like butterflies jumping from one flower to the next because of the presence of a pleasure chemical called dopamine in our brains.

The degree of pleasure is directly proportional to the amount of dopamine released.

Novel experiences like bungee jumping or a one night stand deliver enormous amounts of dopamine to the brain. Another thing which delivers dopamine is unexpected, pleasant surprises.

Day traders get a lot of small amount throughout the whole day.

To your surprise, I want to tell you that a doctor will not be able to distinguish the MRI of brains of a trader who just had a winning trade and a cocaine addict. This is the trading psychology that a trader carries.

You are free to do the experiment.

As today is the first day of the remainder of our lives, so you and I, being a participant of the stock market, should take it seriously.

Also Read: Basic Toolkit for Stock Market Beginners

Thus, predicting that you will continue to read this article, I decide to proceed.

I dug into the matter and found out that it really makes us blind. It persuades us and pushes us into the rat race, i.e. a vicious circle of two emotions “greed” and “fear”.

There is an old saying on Wall Street that the market is driven by just two emotions which are greed and fear.

These two intrinsic emotional states relate the word “uncertainty” to the stock market.

Succumbing to these emotions can have an “utter and deleterious effect” on investors’ portfolios and the stock market.

It’s always better not to advertise our ignorance. So, being a common man, I want to share some common “Gyan”.

What is Greed?

It is an inherent nature of human being to crave for more once he or she gets something. This is one of the essential part of trading psychology as well

Please don’t feel alone as a victim, I am with you.

It generates chemical rush through our brains and makes us bias by blocking our logical faculty in the brain. We get addicted to it.

What is Fear?

An another form of trading psychology is Fear. It is normally characterized as an inconvenient, stressful situation etc.

One of the most common examples that I can think of now is “Dot-com bubble”, many refer it as “Internet bubble”.

It was created around internet start-up companies, which motivated investors to invest in businesses which had a “dot com” tag.

They became greedy which in turn created further greed which resulted in an overpriced situation, giving birth to a bubble.

For better understanding let me quote Investopedia’s definition of a bubble:

“A bubble is an economic cycle characterized by a rapid escalation of asset prices followed by a contraction. It is created by a surge in asset prices unwarranted by the fundamentals of the asset and driven by exuberant market behavior. When no more investors are willing to buy at the elevated price, a massive selloff occurs, causing the bubble to deflate.”

Please don’t get scared, I can understand that “Fear” is dominating your conscious mind. After the bubble crash, investors swiftly moved out and concentrated on less uncertain purchases.

Believe me, the superfluity of information will drown your head in massive noise if you search Google about the role of greed and fear in the financial world.

To avoid this complexity we can simply create a toolbox named “Risk management”. Though it is beyond the scope of this article to explain you this whole concept. A whole course can be developed based on it.

How to Manage Trade effectively?

As this article focuses on money management, my target is to create a basic understanding of it

It is an integral part of risk management.

A trader will not be able to survive for long without it.

It deals with the question of survival. It increases the odds that the trader will survive to reach the long run. Many potentially successful systems or trading approaches have led to disaster because the trader applying the strategy lacked a method of controlling risk.

It is better to stay on the shore instead of getting drowned in the vast ocean. Hope you agree. Thanks for nodding your head.

A carpenter’s toolbox may make or break furniture. Likewise, a money management can make or break a trade.

Assuming you to be familiar with the term portfolio management. If not, no problem. Go on reading…

What is Portfolio Management?

According to Investopedia “Portfolio management is the art and science of making decisions about investment mix and policy, matching investments to objectives, asset allocation for individuals and institutions, and balancing risk against performance. Portfolio management is all about determining strengths, weaknesses, opportunities, and threats in the choice of debt vs. equity, domestic vs. international, growth vs. safety, and many other trade-offs encountered in the attempt to maximize return at a given appetite for risk.”

You don’t have to be a mathematician or understand portfolio theory to manage risk. Hence, keeping aside all complexities we will approach it here on a relatively simple level.

Also Read: Understanding Short Selling

Please take a deep breath and go through it…

According to Larry Hite, a famous hedge fund manager, we should-

- Never bet our lifestyle – never risk a large chunk of your capital on a single trade, and

- Always know what the worst possible outcome is

Let me share some general money management guidelines by John J Murphy. These guidelines refer primarily to futures trading–

- Total invested funds should be limited to 50% of total capital

- Total commitment in any one market should be limited to 10-15% of total equity

- The total amount risk in any one market should be limited to 5% of total equity

- The total margin in any market group should be limited to 20-25% of total equity

What is 2 percent rule?

2 Percent rule suggest that never risk more than 2% of your capital on any one stock.

Breakdown of 2 percent rule :-

- At first focus on your capital at risk, i.e. 2 % of your trading capital

- To get the maximum permissible risk you should deduct the cost on your buy and sell i.e. brokerage

- Calculate risk per share. To calculate risk per share case of long, you should subtract your stop loss from the buy price and keep a provision for slippage

- In case of short, you should reverse the process, i.e. subtract the buy price from the stop loss before adding slippage

- To arrive at the maximum number of shares, divide the maximum permissible risk by the risk per share

There is a famous maxim, “More the sweat in training, less the blood in war.” Likewise, you should always “Plan your trade and then trade your plan.”

Trying to win in the markets without a trading plan is like trying to build a house without blueprints – costly (and avoidable) mistakes are virtually inevitable.

A trading plan simply requires combining a personal trading method with specific money management and trade entry rules.

Krausz considers the absence of a trading plan as the root of all principal difficulties traders encounter in the markets.

Driehaus stresses that a trading plan should reflect a personal core philosophy.

He explains that without a core philosophy, you are not going to be able to hold on to your positions or stick with your trading plan during really difficult times.

If you want to know more about money management and trading psychology you can enroll for NSE Academy Certified Technical Analysis.

What are Money Management Techniques?

Maximum gains, not the number of wins

Eckhardt explains that human nature does not operate to maximize gain but rather the chance of a gain. The problem with this is that it implies a lack of focus on the magnitudes of gains (and losses) – a flaw that leads to non-optimal performance results.

Pull out Partial profits

Pull a portion of winnings out of the market to prevent trading discipline from deteriorating into complacency. It is far too easy to rationalize overtrading ad procrastination in liquidating losing trades by saying, “Its only profits.” Profits withdrawn from an account are much more likely to be viewed as real money.

Risk control

Minervini believes that one of the common mistakes made by novices is that they “spend too much time trying to discover great entry strategies and not enough time on money management”. Strictly follow the below mentioned steps –

- Stop-loss points

- Reducing the position

- Selecting low-risk positions

- Limiting the initial position size

- Diversification

- Short selling

- Hedged strategies

Always remember that “you must be willing to accept a certain level of risk, or else you will never pull the trigger”.

Risk/Reward ratio

It is most often used as a measure for trading individual stocks.

The optimal ratio differs widely among trading strategies.

Normally, some trial and error are usually required to determine which ratio is best for a given trading strategy.

Empirical study suggests that market strategists consider 1:3 to be the ideal risk/reward ratio

Traders can manage it directly through the use of stop-loss orders and derivatives.

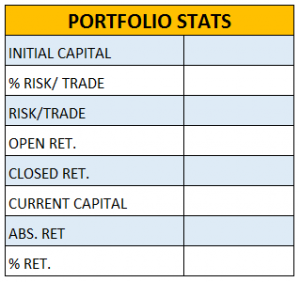

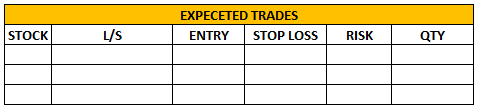

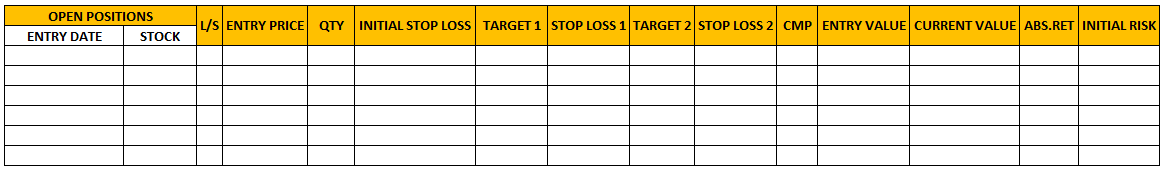

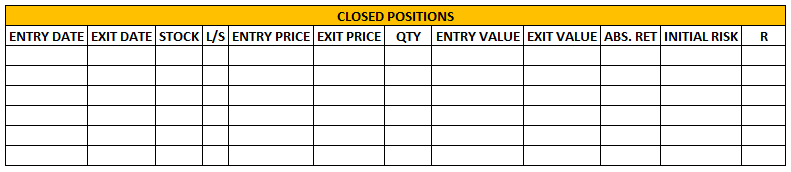

I know you are very serious with each and every single trade of yours, hence, in a simple way, I will provide you some screenshots on how to maintain your portfolio in excel.

According to one statistics, only 10 % of the people read past the first two paragraphs of this article.

So, if you have read this far, I can say you are already ahead in the game.

Not the game of who knows more, but the game where knowing few essential ideas go a long way in reducing errors and increasing the quality of your trade.

After all, ideas are the currencies of the twenty-first century.

Some people lose money because they feel they don’t deserve to win, but more people lose because they never perform the basic tasks necessary to become a winning trader.

Questions must be crisscrossing your conscious mind…

I don’t want to waste your time, hence, just a synopsis

- Develop a competent analytical methodology

- Extract a reasonable trading plan from this methodology

- Formulate rules for this plan that incorporate money management techniques

- Back-test the plan over a sufficiently long period

- Exercise self-management so that you adhere to the plan. The best plan in the world cannot work if you don’t act on it

Let me quote Aristotle, “For the things we have to learn before we can do them, we learn by doing them.”

Believe me, to digest the concept you need not require an IQ Level of more than 130 (as 95% of population scores between 70 and 130).

Okay. Peace. I will explain.

He meant that we need to practice what we have learned in various situations.

These ideas and strategies do no good sitting inside our head like artifacts in a museum, for they need to be taken out and played with.

Bottom Line:

Some of the concepts mentioned here are the results of my speculation based on an article published by Safal Niveshak and books of Jack D. Schwager .

There is a non-zero possibility that the above strategies and conclusions are flawed. Hence, instead of taking them at face value, please consider them as starting points to stimulate your own independent thought process.

I sincerely thank you for going through this article. Feel free to post your suggestions and questions in the comment box below.

In order to get the latest updates on Financial Markets visit https://stockedge.com/

how to calculate risk in a given trade?

As soon as I observed this web site I went on reddit to share some of the love with them.

just multiply the position size * stop loss = risk

nice lesson, because i have learnt this after losing 70k

One of the best blog/article i have ever readed.

All the best to the team.

Hi,

Thank you for Reading!

Keep Reading!

Nice article keeps it up, even in casinos, money management is one of the most needed keys to succeed.

Hi,

We really appreciated that you liked our blog!

Thank you for Reading!

Keep Reading!