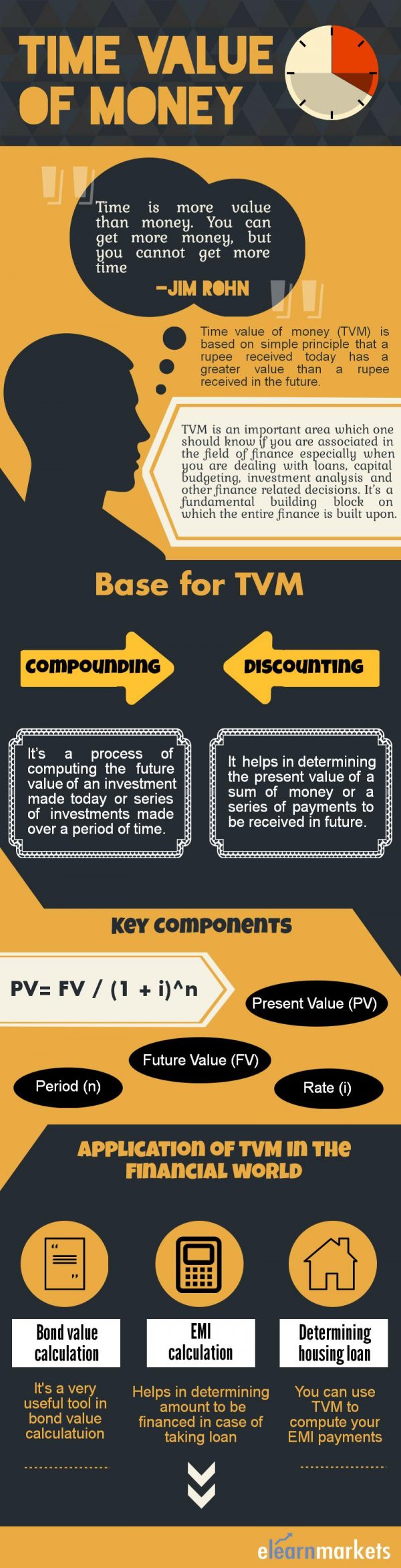

Time value of money is an important area which one should know if you are associated in the field of finance especially when you are dealing with loans, capital budgeting, investment analysis and other finance-related decisions.

It’s a fundamental building block on which the entire finance is built upon.

But, the question is that why does money have time value?

TVM is based on the simple principle that a rupee received today has a greater value than a rupee received in the future

| Table of Contents |

|---|

| Time is Money |

| Compounding and Discounting: a Base for TVM |

| Key components of the time value of money |

| TVM timeline |

| Application of time value of money in the Financial World |

| Bottomline |

Let’s take a simple example to understand this.

Say if you have to choose between taking Rs 10,00,000 today or after say 50 years.

Which option would you have opted for?

Of course, the first one, right?

There are reasons to justify this-

1. High purchasing power– A sum of money can be exchanged for more goods and services today than after 40-50 years.

For instance 100 years ago, 1000 rupees had a huge value than today.

Learn in 2 hours – Money Management – The Key to Successful Trading

2. Risks involved– There’s a risk involved in getting money back that you already have today.

Say you lend the money to a person for one year and the person goes bankrupt or runs away, you may lose your money.

Time is Money

You must have heard your elders say -“Time is money” and frankly speaking, they are right.

Since money has time value, the present value of future cash flows worth less the longer you wait to receive it.

This is why we expect the future value to be greater than present value due to the time value of money.

However, the difference the future and present value depend upon the interest rate and the compounding period.

Moreover, receiving the money quickly also reduces the chances of default.

Compounding and discounting: a Base for TVM

TVM involves two major aspect- compounding and discounting, which helps us in computing future and present value respectively.

It’s important to have an understanding of these terms before getting into details of the time value of money.

Compounding

It’s a process of computing the future value of an investment made today or series of investments made over a period of time.

In simple words, it’s about moving your sum of money forward in time.

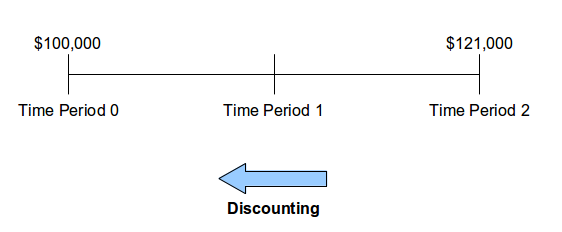

Say your investment of Rs 1,00,000 at an interest of 10% p.a. will turn into Rs 1,21,000 in a period of 2 years.

Also Read: How Does Power of Compounding Work

Discounting

It helps in determining the present value of a sum of money or a series of payments to be received in future. It’s about moving your money back in time.

Say you’ll receive a Rs 12,1000 after 2 years from now, so the present value of it stands at Rs 1,00,000.

Read more: How to calculate intrinsic value

Key components of the time value of money

After discussing a brief on time value of money, let’s go through the key elements of the time value of money.

These are the 5 main elements which are very important in solving the time value of money problems.

1. Rate (i)– It is a discount rate or an interest rate which is used in compounding or discounting a sum of money.

2. Periods (n) – It is a total number of periods in the overall time frame which can be weekly, monthly, quarterly, semi-annually, annually and so on.

3. Present value (PV)– It represents a sum total of future cash flows at a present date. It is done by discounting the future cash flows.

4. Future value (FV)– It implies a sum of money to be received at a future date which is obtained by compounding the present cash flow.

5. Payment (PMT)– It represents equal periodic payments to be paid or received each period. It’s a positive value when you receive the payments while it’s negative in case you make the payments.

Let’s take a simple time value of money problem to understand more clearly.

Suggested Read: Understanding the Time Value of Money

Say you went to purchase a television and the shopkeeper gives you a choice to pay either Rs 40,000 now or to opt for five installments of Rs 10,000 at the end of each year for the next five years.

It would be very wrong if you simply add the five installments (i.e. Rs 50,000) and compare it with the alternative (Rs 40,000 today).

You should rather use TVM to determine the present value of the installments and then make a comparison.

Present value computation

n=5

I/Y= 10%

PMT= Rs 10,000

PV= ?

PV = PMT[(1 – (1 / (1+ i)^n)) / i]

PV= 10,000[1-(1/(1+0.1) ^5))/0.1]

PV = 10,000[(1 – (1 / (1.10)^5)) / 0.1].

Raise the number inside the parentheses to the power of the exponent. In the example, raise 1.10 to the power of 5, which equals 1.61051. This leaves “PV = 10,000[(1 – (1 / 1.61051)) / 0.1].”

Divide the numerator by the denominator of the fraction inside the parentheses. In the example, divide 1 by 1.61051, which equals 0.6209. This leaves “PV = 10,000[(1 – 0.6209) / 0.1].”

Subtract the result from 1 inside the parentheses. In the example, subtract 0.6209 from 1, which equals 0.3791. This leaves “PV = 10,000(0.3791 / 0.1).”

Divide the numerator by the denominator of the fraction inside the parentheses. In the example, divide 0.3791 by 0.1, which equals 3.791. This leaves “PV = 10,000(3.791).”= Rs. 37,910

Feed the data into the calculator or spreadsheet and the value comes at Rs 37910.

As you can see that going with the installment option is a better choice.

This is the reason time value of money is so important.

Want to get a better idea of the use of time value of money in financial decisions? Enroll in NSE Academy Certified Equity Research Analysis course on Elearnmarkets.

TVM timeline

You can solve time value of money problems using simple horizontal timeline.

If you’re new to this topic, it’s better to draw the five components (FV, PV, PMT, n, i) of the problem on a timeline in order to visualize and solve easily.

Simply feed the four known components and solve the unknown one.

You can solve your time value of money problems in a number of ways including financial calculators, spreadsheets, regular calculators, and software.

Here’s a simple timeline showing the various components:

Application of time value of money in the Financial World

There are a number of applications of time value of money in the real world and we often use it in our day to day life.

Some of the common ones are stated below-

1. Bond value calculation

It’s a very useful tool in bond value calculation.

Say a bond fetches an interest of 10% and will pay Rs 1,00,000 after it expires in 5 years.

You can simply calculate the present value of all those future cash flows (including coupon payment and principal amount) to compare it with the sum you pay today to judge, whether investment in bonds really makes sense or not.

Know More: Do you Know the Relation between Bond Price and Yield?

2. EMI calculations

You can use time value of money to compute your EMI payments and also the amount which you will finally pay along with the interest.

3. Determining house loan

It helps in determining the amount of down payment and amount to be financed in case of taking loan amount.

Apart from this, it is used in case of credit card calculations, mortgages etc.

Bottomline

Time is your greatest asset if you can use it wisely.

The importance of money is that it buys us time and opportunity.

So if you’re smart enough, you should use your money to create more of it.

Get latest stock market updates on Stockedge.