What comes to your mind when you think of a typical business? Well, a business can be simply explained as selling some products or services with an objective to earn a profit. Assets for a business are those resources which help a business carry on its operation.To understand any business and finance in general you have to understand assets and liabilities.

What are Assets?

Assets are resources which provides future economic benefit to a business. Assets can be building, machineries, furniture, inventory, cash, etc.

A business uses these assets to carry on its day to day operation. While these assets are tangible and visible, there are other aspects of business which are immensely important for the performance of a business.

Learn about Assets and Liabilities in detail with Macroeconomics made easy by Market Experts

Goodwill or brand of a business determines how well a product or service are sold. A business with a great brand sells much more than rival products. But, in typical accounting these assets are not reported except when acquired from outside at a price. Even the employees or work-culture can be a great asset to a business but then again, they are not valued in numbers and reported.

Types of Assets

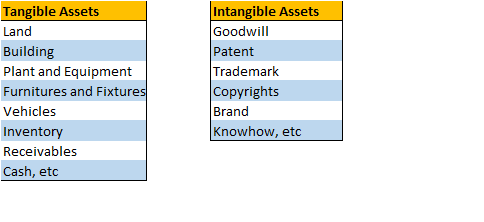

Assets for the purpose of reporting and better understanding are classified into categories. On the basis of their nature, assetsare broadly classified into tangible assets and intangible assets. Tangible assets are those assets which have, a physical form. Intangible assets are assets without a physical form.

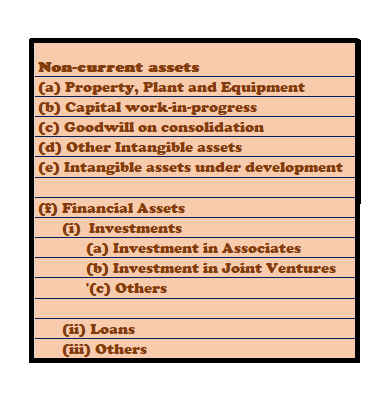

On the basis of period of usage, assets are classified into Non-current assets and Current assets. Non-current assets are expected to be used for a longer duration (at a minimum, more than 12 months).

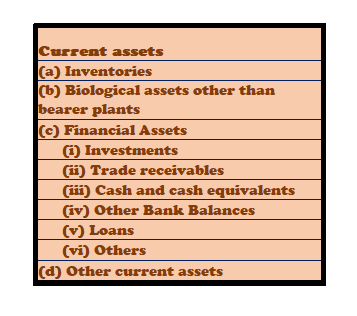

Current assets are assets which are to be consumed, sold or realised within current operating cycle (usually within 12 months).

Valuation of Assets

Assets are valued and reported in financial statements as per the relevant accounting standards. In general, assets are recorded at cost i.e. the price at which they are acquired. Assets are depreciated as per the rates defined by Companies Act and Income Tax Act.

But there are other methods of valuation such as fair value, enterprise value, residual value, etc used for relevant assets and under specific circumstances. Intangible assets are valued differently as per relevant accounting standards.

What are Liabilities?

Liabilities are obligations of a business, the settlement of which is expected to result in an outflow of economic resources. They are short or long-term borrowings, account payables, loans taken, debentures issued, etc.

Types of Liabilities

On the basis on time period of settlement, liabilities are classified as Non-current and Current liabilities.

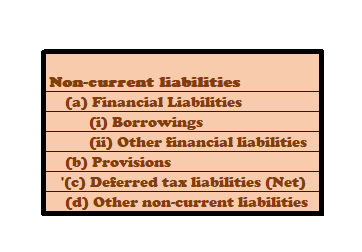

The liabilities which need not be settled within the current operating cycle (within 12 months) are called Non-current liabilities.

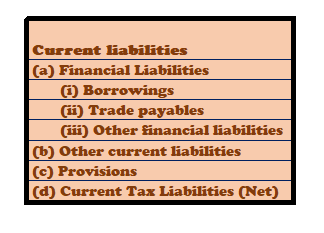

The liabilities which are to be settled within current operating cycle (within 12 months) are called Current Liabilities.

Why are Liabilities not Expenses?

Expenses are different from liabilities. If an expense is overdue on the date of recording of balance sheet, then it is recorded as a liability, which is to say that the firm will pay it on a later date. Suppose a salary is overdue, it will be recorded as outstanding salary, if a supplier is not paid on date of recording, it will be recorded as trade payable (which now is a liability).

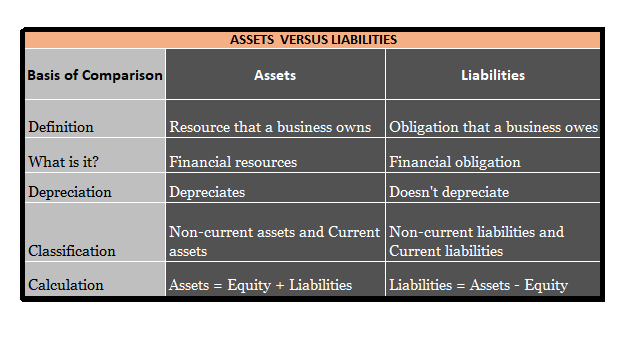

Assets vs Liabilities – Key differences

Assets and Liabilities are two sides of a business. If we follow the Accounting equation which says: Assets = Shareholder’s Equity + Liabilities.

For running a business, assets are required, which is funded either by capital brought in by shareholders or through borrowings from external parties. These borrowings are liabilities, which are to be settled at some point in time.

As per Business Entity Concept in which a business is considered a separate entity from its owners, the Capital brought in by shareholders is also a Liability for the business.

Assets vs Liabilities (Comparison Table)

Bottomline

Understanding assets and liabilities is an important and basic step towards understanding and analyzing a business. They can be said as organs in the body of a business. Their functioning and interaction keep the business running.

Here’s a recommended book summary of Robert Kiyosaki’s “Rich Dad and Poor Dad” on financial literacy.

good content and very much knowledgeable for non finanace persons.

It gives me good confidence as i only heard these terms but now i know about these.

Thanks.

Its like you read my thoughts! You appear to know so much approximately this, like you wrote the guide in it or something. I think that you can do with some to pressure the message house a little bit, however other than that, this is excellent blog. An excellent read. I will definitely be back.