Although it may seem premature to start investing when you’re still a teenager, you’ll be better off the earlier you do. In actuality, one of the most well-known investors in history, Warren Buffet, purchased his first stock at the age of eleven!

Teenagers and those who may not have achieved the legal adulthood age should invest for a variety of reasons. The time they have to let their investments grow and appreciate in value is by far the biggest benefit.

Although it doesn’t always appear clear where to start, it can occasionally seem that way. When young people start investing, there are a lot of tools and tactics available to support them. We outline the key investing information that teenagers should be aware of in this post.

Before we dive into what is the correct age for teens to start investing, let us discuss the benefits of teenage investing:

Table of Contents

What are the Benefits of Investing from an Early Age?

Below are some of the benefits if you start investing from Early Age:

1. Developing Financial Literacy At An Early Age

Before children become adults and are responsible for managing their own finances, they should learn money management skills. In the absence of financial education, young adults risk making poor financial judgments about their own finances that may take decades to correct.

Adults must make financial decisions every day that may have an impact on their long-term financial security. Since having money is a necessary part of living in a society, everyone needs to know how to handle it sensibly.

Though it’s rare, arithmetic concepts are taught in schools, not how to apply them to financial planning.

By the time they graduate, kids might be proficient with numbers, but there are many more ideas in financial planning, like controlling debt, time value of money, emergency or lucrative savings, and effective budgeting.

It is crucial to teach today’s youth the value of money, from counting pennies in kindergarten to handling their own company’s finances in the future.

Teenagers could start learning about finances through various resources like online courses, e-books, financial YouTube channels, financial blogs, etc.

2. The Power of Compounding and Long-Term Investments.

When using compound interest to develop money, time is a crucial component. Over time, you will make more money if they begin investing sooner.

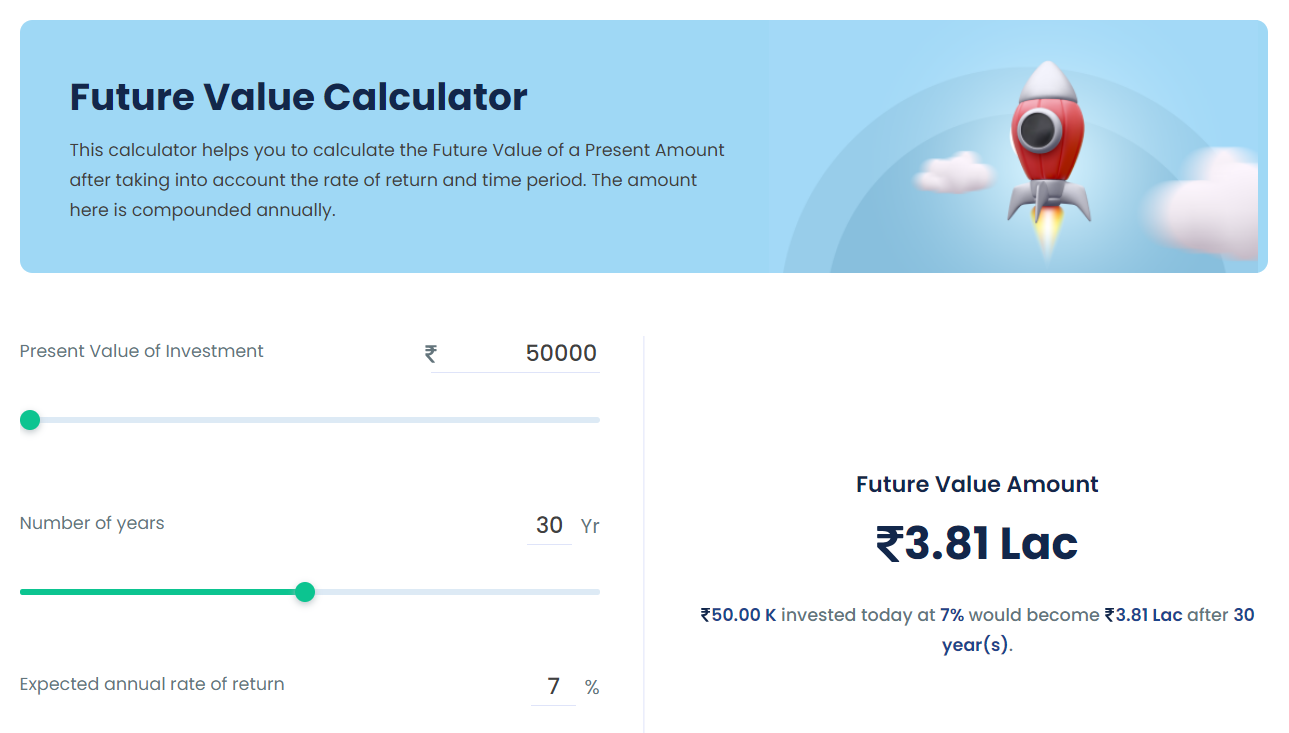

If you don’t believe us, then use the compound interest calculator to create a graph showing Rs. 50,000 investment compounded monthly over 30 years at 7% interest. In the absence of further investment, the Rs. 50,000 increases to nearly 3.81 lakhs.

You will continue to earn interest on top of interest whenever they invest money and it begins to generate revenue. Even if you never increase the initial investment, you will witness the “magic” or power of compounding if you leave the money invested for several decades.

5 Steps to Start Investing For Teenagers

What comes next for a young person who has made the decision to invest some of their money?

Here are some steps with the help of which you can start investing:

1. Educate Yourself

To assist you in understanding the fundamentals, there are a ton of printed and web resources available. You can also ask someone with investment experience, like your parents, to impart their knowledge.

Below are some of the resources through which you can learn about finances and money management:

2. Setting Your Investment Goals

It’s important to be transparent about your ultimate goal.

How would you like to use the funds?

Is your objective a long way off?

Establishing definite objectives will assist you in choosing an investing plan that suits your needs.

3. Selecting Investment

It might be intimidating to explore possible investments because there are so many possibilities accessible.

It is crucial to consider what kind of investment has the best potential to assist you in achieving your objectives.

4. Opening Your Brokerage Account

It is necessary for you to open an account in order to purchase and retain your investment assets. If you are under the age of majority, you will not be able to open a brokerage account on your own, but you can open a custodial or joint account with a parent, guardian, or other trusted adult and start investing.

5. Buying Your Selected Investment

It’s now time to implement your investment strategy. You should be able to purchase practically any asset via the website or mobile app of your brokerage platform, albeit the procedure may differ depending on the investment you’ve selected.

At What Age Teenagers Can Legally Invest?

A standard brokerage account cannot be owned outright by someone under the age of 18. It’s never too early to begin managing your finances, though, if you have the support of a parent, guardian, or other responsible adult.

You can start a custodial account under the supervision of an adult, and the adult will handle the investments until you become an adult and can acquire official ownership. As an alternative, you can form a joint account in which the assets are lawfully owned by you and another adult.

What are Investment Options for Teenagers?

As a beginner, you can start investing in mutual funds through SIPs which are managed by professionals. Later on, when you have full knowledge about the financial markets, you can start with the following-

1. Stocks

Purchasing a stock gives you a little ownership stake, or equity, in a business that is publicly traded. You can make money with stocks in two ways:

- Dividends are payments made by many businesses to their shareholders.

- The worth of a firm is determined by the market, and if the price of your stock increases, you may be able to sell it for a profit.

Stocks can be dangerous due to their value fluctuations, which are referred to as volatility in the markets. It’s possible that the shares you bought will be worth less if the firm in which you invested starts to struggle. However, since there is a greater chance of profit associated with this risk, stocks are a good option for younger investors.

2. Funds

Stocks are a share in a single firm, but you may also purchase shares of funds that make various stock and asset allocations. Mutual funds, which are managed by experienced money managers, make investments in a variety of assets according to a prospectus-described goal.

Similar to mutual funds, exchange-traded funds (ETFs) are investment baskets made up of many assets. However, unlike mutual funds, ETFs are traded on the stock market and are intended to track a particular market index, industry, or other asset class.

Younger investors can benefit greatly from funds in several ways. Funds provide inherent diversification because they are collections of numerous investments into one. Put differently, because investors in a fund automatically possess a range of assets, their investment will not be entirely lost if one of the components loses value.

While actively managing a portfolio might come with hefty fees in some mutual funds, passively managed and index-tracking funds often have modest costs and a track record of delivering strong returns, especially over the long run.

3. Bonds

Bonds are one kind of debt instrument as opposed to equity, or ownership in a corporation. Purchasing a bond is tantamount to lending money to the bond issuer, who promises to reimburse you for the original amount borrowed plus interest. Both firms and governments can be bond issuers.

Because bonds have fixed payments over a predetermined length of time, they are categorized as fixed-income investments.

They are especially helpful for investors who want to make a consistent income. They do, however, carry less risk than stocks, which means that their potential for return is lower.

4. Other Investment

Some younger investors might be better off with different kinds of investing assets. For example, you can get a fixed interest rate on your investment for a predetermined period of time if you invest in certificates of deposit (CDs). Similar to a savings account, certificates of deposit (CDs) yield greater interest rates because you commit to leaving the money alone for the term of the investment.

CDs have a smaller potential return but a more moderate risk profile than stocks or bonds, making them more prudent investments.

There are still more possible investments on the list. There are several methods to invest your money, ranging from high-risk cryptocurrencies to derivatives like futures and options. However, these tools are more appropriate because they are more complicated and risky.

What risk is involved when investing?

Younger people should understand the risks as much as the benefits of making frequent, early investments. Naturally, the biggest drawback of investing is the potential for partial or complete loss of your capital.

You cannot escape the reality of prospective losses, but you can choose how much risk you are willing to take by knowing which assets are riskier than others. Generally speaking, an investment has a larger potential to yield higher returns the riskier it is.

Bottomline

While minors will require assistance from a parent or other adult before they may start investing, teenagers have the distinct advantage of having time on their side. Joint and custodial accounts give teenagers the chance to start accumulating cash early on.

Frequently Asked Questions (FAQs)

At what age should you start investing in the stock market?

Your child must be at least eighteen years old to create a brokerage account before they may begin investing in stocks independently. Although they can begin sooner, they will require the opening of a custodial account by a parent or legal guardian.

Should I start investing at 16?

Early investment exposure will help teenagers comprehend the basics of money management, preparing them for more sophisticated investments as adults. Teens who invest in the market have the chance to create genuine money and give themselves a good start in life. This may present chances and allow them the flexibility to realize their aspirations.

Is 18 too early to start investing?

It’s tempting to spend every penny you make when you’re young, but making investments when you’re 18 or younger puts you well ahead of the game in the long run. Your investments may increase significantly, and you’ll gain a deeper comprehension of the financial system.