Options can be used to make the most of bullish market conditions, just as bearish options strategies can be used to make the most of bearish market conditions. The beauty of options is that they allow you to work markets in both directions. Moreover, because options are non-linear, you can combine them with other options and futures to create elegant hybrid strategies to trade on bearish market opportunities.

So, if you expect the market to fall, you won’t be concerned about falling prices. Rather, you can profit from the fall by utilising the power of options. You can choose between being moderately bearish and being bearish with conviction.

Options can be used alone and in conjunction with futures and options. Such combinations are known as hybrids. First, let us try to understand the use of bearish option strategies, which means trading options in bear markets. Trading options in bear markets necessitates a distinct set of strategies to make the most of the situation.

So, in today’s blog, we will discuss 7 best bearish options strategies when we have a bearish outlook on the stock or index:

7 Best Bearish Options Strategies

1. Bear Call Spread

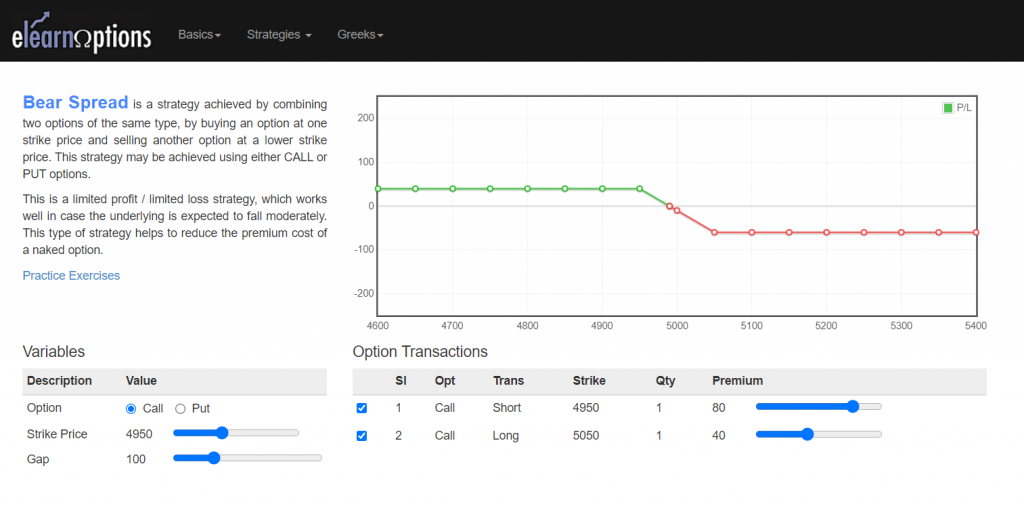

A Bear Call Spread Strategy involves purchasing and selling a Call Option with a lower strike price on the same underlying asset and expiry date.

When you sell a Call Option, you are compensated with a premium; when you buy a Call Option, you are compensated with a premium. As a result, your investment cost is significantly reduced. Furthermore, the technique is less risky because the return is limited to the difference between the premium received and paid.

This strategy is used when a trader believes the underlying asset price will fall moderately. This method is known as the bear call credit spread because it receives a net credit upon entering the trade.

The maximum risk is the difference between the strike prices minus the net credit received, including commissions. The potential profit is limited to the net credit, and the potential loss is limited to the spread minus net credit.

Below is the payoff diagram of this strategy:

2. Bear Put Spread

The investor must buy an in-the-money (higher) put option and sell an out-of-the-money (lower) put option on the same company with the same expiration date to execute this strategy. The investor incurs a net loss as a result of this technique.

The Bear Put Spread strategy’s overall effect is to lower the cost of buying a Put and raise the breakeven point (Long Put). Because the investor will only profit if the stock price/index declines, the approach requires a bearish perspective. This method comes with low risk and a low profit.

The maximum profit is realized if the stock price is at or below the Short Put (lower strike) strike price at expiration. The maximum risk is equal to the spread cost, including commissions.

Below is the payoff diagram of this strategy:

3. Strip

The Strip Option Strategy has a strong bearish bias and opts for a volatile market. The Strip is a net debit approach that is a little bit modified from the Long Straddle. With this minor tweak, we are long on Put with one more lot as we have a bearish bias. In the long strap, we are long on ATM Call and Put option with equal lots.

The maximum profit is unlimited. When the underlying price closes at the Strike Price of the Call and Put purchased, the Maximum Loss under Strip will occur.

Below is the payoff diagram of this strategy:

4. Synthetic Put

To represent a long-put option, the synthetic put options strategy combines a short stock position with a long call option on the same stock. It’s also known as a long synthetic put. An investor who is short a stock buys an at-the-money call option on that same stock. This action is taken to protect the stock’s price from rising.

The maximum risk is limited to the strike price- the price at which the underlying is sold + the call premium paid- but the profit is unlimited.

Below is the payoff diagram of this strategy:

5. Bear Butterfly Spread

In the short butterfly spread, the two long calls at the middle strike (or ATM) and one short call at the lower and upper strikes make up this strategy. The expiration dates of each option must match. Additionally, the centre strike must have equal distances from the upper and lower strikes (also known as wings) (or body).

The maximum loss is limited to Net Premium Paid. The net credit obtained less commissions represents the highest profit potential, and there are two ways this profit could be made.

Below is the payoff diagram of this strategy:

6, Bear Iron Condor Spread

A short iron condor spread is a four-part trading strategy that consists of a bear call spread and a bull put spread where the short Put’s strike price is lower than the short call’s strike price. The same day is the expiration date for each choice.

The maximum risk is equal to the difference between the strike prices of the bull put spread (or bear call spread) less the net credit received. The maximum profit potential is equal to the net credit received less commissions.

Below is the payoff diagram of this strategy:

7. Bear Put Ladder Spread

The bear put ladder spread is a variation on the bear put spread. This options trading strategy is also used to profit from a security’s price decline, but it includes an additional transaction that lowers the initial investment required to establish the spread.

Like the bear put spread, it is best used when the security price is not expected to fall significantly. It is also known as the long put ladder spread, and it can result in significant losses if the downward price movement is greater than expected.

The potential profit is limited, and the maximum profit is made when the underlying security’s price falls somewhere between the strike prices of the put options written.

You can also join our course on Advanced Options Strategies

Master bearish options strategies today! Explore our course and learn option trading for confident investing

Bottomline

These bearish options strategies can be adjusted to suit particular market conditions and trader preferences, and they offer a variety of risk-reward profiles. To reduce possible losses, traders must use risk management strategies and comprehend the dynamics of each method.

Frequently Asked Questions

What are bearish options strategies?

Investors that believe the price of an underlying asset will drop will employ bearish options methods. With the use of these techniques, investors can benefit when the price of the underlying security or asset declines.

What are some common bearish options strategies?

Purchasing put options, bear put spreads, long put butterflies, short call spreads, ratio spreads, long put condors, and short straddles are a few popular bearish options trading techniques.

How do buying put options work as a bearish strategy?

By purchasing put options, the holder can profit in the event that the underlying asset’s price drops. The holder of a put option has the choice, but not the duty, to sell the underlying asset at the strike price within the designated time frame (expiration date).

You can also visit web.stockedge.com, a unique platform that is 100% focused on research and analytics.

best. best. best

best best best