During our school or college, either our parents or our teachers used to forecast our results before its announcements and we used to be very panicky about its outcome. Right ? Similarly, the companies before announcing their results have a mechanism in place by analysts who use sales forecasting method to understand their results based on some data points.

Thus Forecasting is a technique that uses historical data as inputs for making estimates that are predictive in determining the direction of future trends.

| Table of Contents |

|---|

| Historical Average |

| Industry growth |

| EIC Analysis |

| Bottomline |

Sales forecasting method is the process of estimating future sales. It is one of the most important components of stock analysis.

Making forward projections requires numerous inputs, some come from quantitative data and others are more subjective.

To forecast sales, investors can gather data from the Company’s annual report, Con calls, Industry report, brokerage houses reports, rating agencies report, and global organizations like IMF.

There are various sales forecasting method that investor can use to predict future sales of the company.

In this article, we will focus on these methods i.e.,

(1) Historical average,

(2) Industry growth,

(3) EIC analysis

1) Historical Average:-

This method is one of the simplest and easy to follow forecasting sales forecasting method. This method requires analysis of the company’s historical sales figure to get the sales growth trend which helps in predicting the future sales growth of the company.

In the example provided below, we will look at how Historical average forecasting can be done.

The first step in Historical average forecasting is to take 5-year sales figure of the company.

We have taken Hindustan Unilever Ltd. as an example:

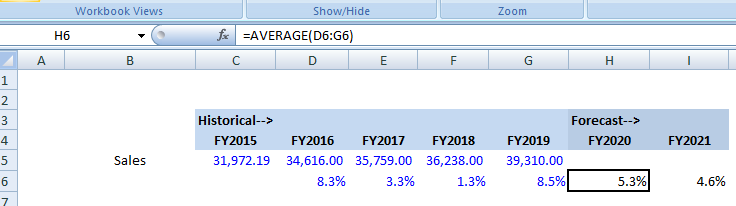

To calculate the sales growth in the excel sheet, we use the formula:- (Current year/Previous year-1) and by using =AVERAGE formula we can find out the sales growth rate of the company for FY2020 i.e., 5.3% for HUL.

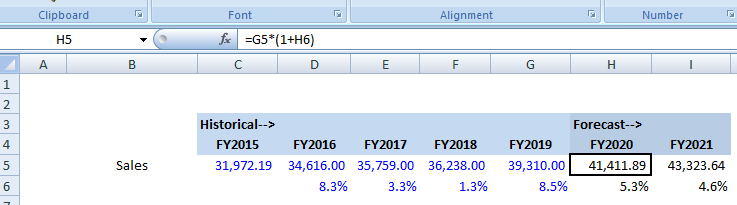

To forecast future Sales, we take the previous year’s figure and multiply it by the growth rate of FY2020.

The formula used to calculate FY2020 sales is =G5*(1+H6). After that select cell H5 to I5, then use Ctrl+R to copy the formula all the way to the right.

2) Industry growth:-

Industry growth analysis help in understanding the industry’s overall growth. This method requires analysis of Company’s (in the same industry) sales growth figure to get the industry growth. With the help of industry growth, we can calculate the company growth.

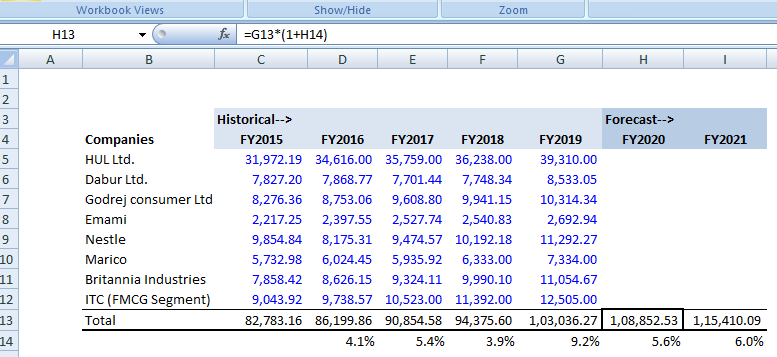

For calculating the industry growth, we will take the sales figure of peer companies and find the growth trend of the industry.

In case of Hindustan Unilever Ltd, we have collected the sales data of few of its close peers in the FMCG Industry.

We will add all the sales figure of the companies and find the Year on Year growth of the industry.

Learn about Company Valuation with the help of Market Experts

After that we apply =AVERAGE formula, to get the forecasted industry growth rate i.e., 5.6% for FY2020 and 6% For FY2021.

With the help of FY2020 growth rate, we calculate the Total industry sales for FY2020 as given below.

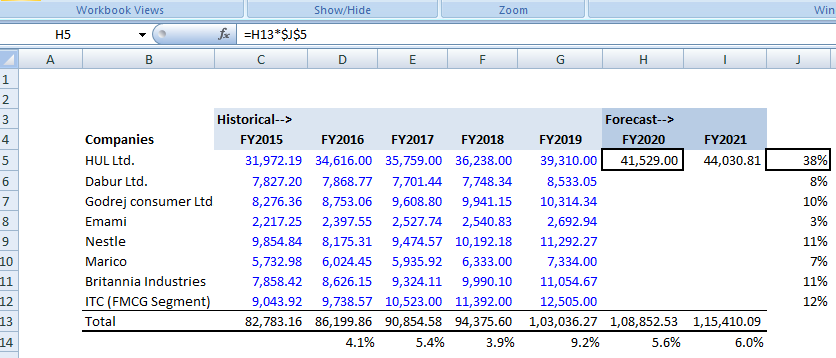

Now we have to calculate the Hindustan Unilever Ltd. contribution as a % of Total industry.

For calculating this, we will do G5/G13*100 of FY2019.

After that we will multiply FY2020 Total with 38% (HUL contribution as a percentage of sales) to get the Forecasted sales figure of Hindustan Unilever ltd. for FY2020 which is Rs. 41,529 crore as given below.

3) EIC Analysis:-

EIC Analysis is the abbreviation of economic, Industry and Company Analysis. It is one of the best sales forecasting method.

Under Economy analysis, we will check how the economy has performed in the past, how is it performing in the present and how is it expected to perform in future.

Industry and company growth are interlinked and largely depend upon economic growth.

Economic growth is measured by GDP. We can use IMF (International Monetary Fund) forecasted GDP growth rate to analyse which is 7% for FY2020.

We will go step by step for further calculation.

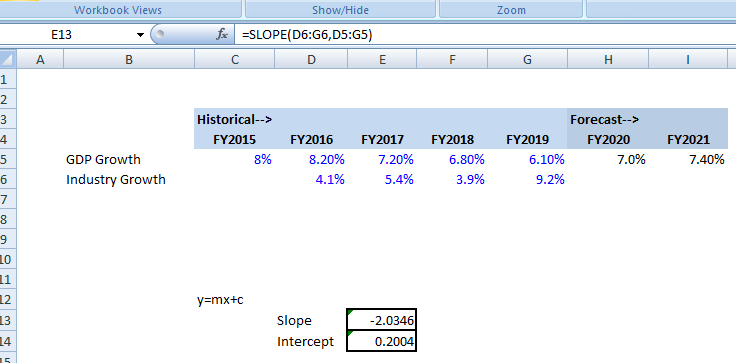

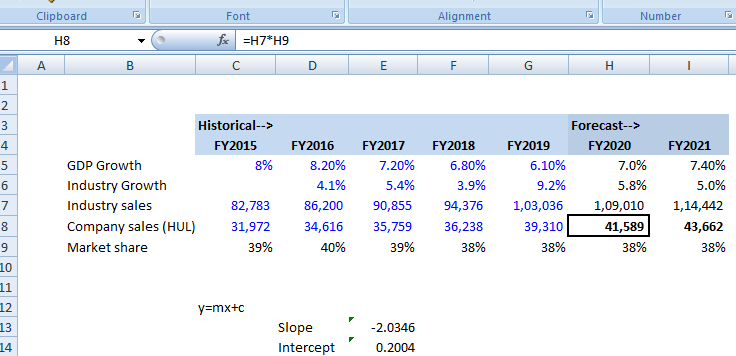

Step 1:- To find the industry growth rate we will use the equation i.e., y=mx+c.

y = mx + c is the equation of a straight line where m is the slope of the line and c is the intercept.

To find the slope, we will use the formula i.e., =SLOPE (Industry growth, GDP growth) and for calculating intercept, we use the formula i.e., =INTERCEPT (Industry growth, GDP growth) of previous years as shown in the example.

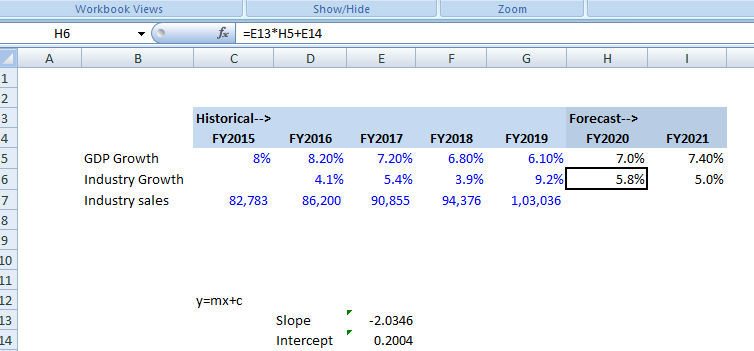

Step 2:- By using the slope and Intercept, we will calculate the industry growth rate for FY2020.

For this we will use formula {slope (m)*GDP growth of FY20+Intercept (c)} and we get the Industry growth rate i.e., 5.8% for FY2020 as shown in the image below.

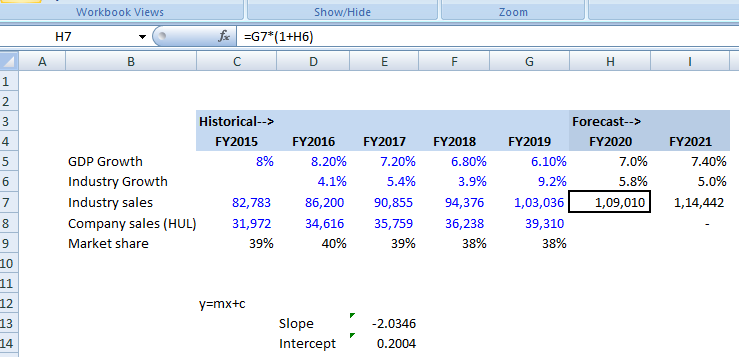

Step 3:- As we know the industry growth rate for FY2020, we can easily calculate industry sales for FY2020. For this we will do (FY2019 Industry sales*(1+FY2020 Industry growth rate) i.e., 1,09,010 crore.

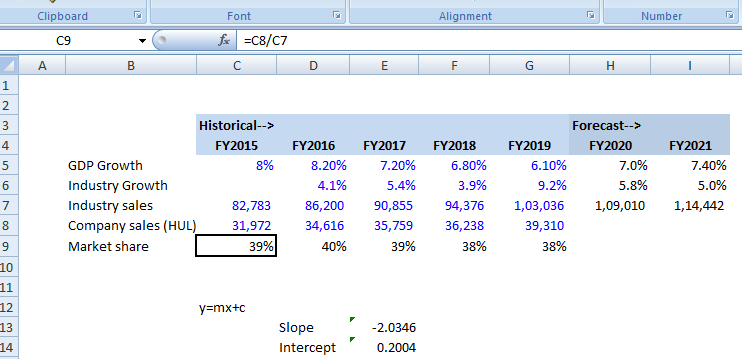

Step 4:– Now we will take Hindustan Unilever sales of the previous year. With the help of Hindustan Unilever (company) sales and industry sales, we will calculate the market share of the company in the industry.

For calculating market share we will do (Company sales/Industry sales*100) as given in the image.

Step 5:- By analyzing the market share of previous years, we are taking 38% for FY20 and FY21.

With the help of forecasted market share, we can easily calculate the company sales for FY2020.

For this we multiply (Industry sales for FY2020*Market share of FY2020). We get Rs. 41,589 crore sales in FY2020 for HUL as shown in the image.

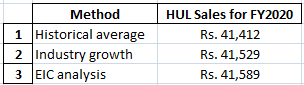

By Forecasting from three methods, we get the sales of Hindustan Uniliver limited for FY2020.i.e.,

Also Read: Free Cash Flow to Firm (FCFF) – Forecasting P/L, B/S & C/F Statements

There are various factors an investor should also focus while forecasting the sales of the company because these factors can affect the sales growth of the company.

Penetration into new or existing markets by the company.

Launching new products or services.

Expansion of company’s distribution networks/ channels and improving customer service.

Change in marketing strategy by the management.

Gaining market share in the industry.

Gain advanced data analysis skills with Advanced Excel Course. Join our course and start making data-driven decisions today!

Bottomline

Sales forecast requires the compilation of subjective determination and many quantitative data points from a variety of sources.

If a company is cyclical in nature, then these methods of forecasting will not be used.

Sales growth forecast of a company varies on the respective analyst’s assumption.

Investors can use forecasting to determine company’s sales growth in future because it can affect the prices of share in that company.

Many a time, management is able to provide sales growth guidance for the coming years. Investor can use that guidance in your forecast and estimate the sales in the coming years.

Ready to master predicting trends? Learn futures and options trading for accurate sales forecasting insights!

We hope this has been a helping guide for those of you who want to forecast the sales of the company. The other forecasting also works on a similar manner.