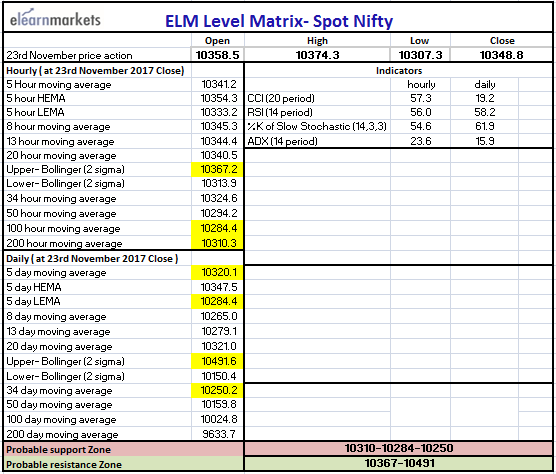

Nifty (Close 10348.8): Nifty closed 10 points below its opening level but continued to stay above the previous day’s close for the 3rd consecutive day.

Hourly Technicals: In the hourly chart, Nifty continued to stay range bound. The second half of today’s session started off with heavy selling but was quick to find buying support.

On the downside, the first probable support comes at the important level of 200 Hourly Moving Average (presently at approx. 10310.3). The 100 hourly Moving Average (presently at approx. 10284.4) forms the second probable support level.

The index may face resistance at the Upper Bollinger Line (presently at approx. 10367.2).

CCI, RSI and Stochastic are all well within their normal range and ADX shows weakness in momentum. Overall Nifty thus, remains completely neutral.

Figure: Nifty Hourly Chart

Daily Technicals: In the hourly chart, Nifty closes slightly above the previous day close for the 3rd consecutive day. Moreover, the index continued to remain slightly above 5 Day High EMA. Nifty, thus, continues to be mildly bullish.

The probable support levels are at the 5 Day moving Average (presently at approx. 10320.1), the 5 Day Low EMA (presently at approx. 10284.4) and the 34 Day Moving Average (presently at approx. 10250.2).

On the upside, Upper Bollinger Line (presently at approx. 10491.6) may act as a resistance.

CCI, RSI and Stochastic stay above the mid-point levels of their normal range. However, ADX continues to show lack of momentum. Overall Nifty continues to be completely neutral.

Figure: Nifty Daily Chart

Figure: Nifty Tech Table