Investors reading Asset Management Company’s (AMCs) commentary in a published monthly report(or factsheet) often come across terms like underweight or overweight on a stock or a sector.

All AMCs or mutual funds benchmark their portfolio’s performance based on an index.

For instance, large-cap funds may benchmark Nifty’s performance.

The overweight or underweight of a fund vis-a-vis its benchmark gives a good insight about the sectoral view and its expectation.

Meaning of underweight or overweight on a sector

An index is usually constructed to provide a fair view of all important sectors of the economy.

Also Read: A quick introduction to the term index and its concepts

Portfolio management is of two types- Active and passive.

Both funds are often linked or benchmarked to a suitable index.

However, portfolio manager seeks to generate higher returns than the benchmark index with the help of active portfolio management (where the weights on a particular sector or stock may be altered based on the outlook unlike passive management which simply imitates the benchmark).

A fund manager may underweight or overweight a particular sector based on the good prospect in a particular sector.

For instance, a portfolio manager is underweight in IT implies that he holds lesser weight in that particular sector vis-a-vis benchmark index (say Nifty).

To be more precise, say IT sector’s weight in the Nifty stands at 20% and portfolio manager holding in his scheme stands at 15%, it implies that he is underweight.

To become an expert in identifying overweight and underweight sectors,enroll in NSE Academy Certified Equity Research Analysis course on Elearnmarkets.

Why do fund manager go underweight or overweight on a stock or a sector?

A fund manager may go underweight if he has a negative view on some sectors in the index.

For instance, say the banking index in the benchmark Nifty stands at 18%, and the holding under the fund manager’s scheme is 12%, he seems to be underweight.

The more the fund manager is underweight in a particular sector, the lower prospect he/she’s looking into it, this may be due to diminishing prospect or sector becoming too overvalued.

Likewise, a fund manager may be overweight on a particular sector if he believes that sector will outperform other sectors in the index.

The higher the difference between the weight of the sector in the fund and the index, more is the overweight on that particular sector.

The reason for such significant overweight in a particular sector could be that he believes that sector will give higher returns.

Lastly, the fund manager may play safe by holding the same weight as that of the index, if he holds the neutral view of a sector in the fund.

Bottomline

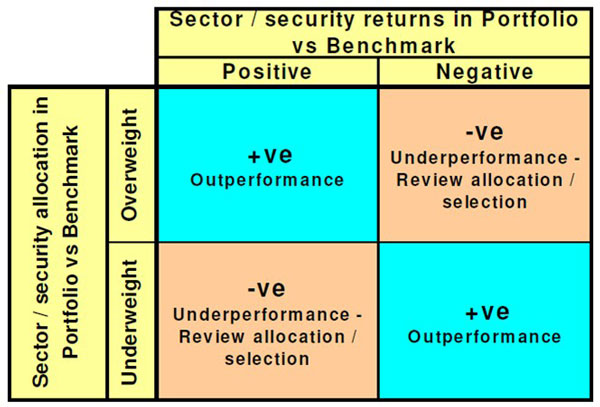

Through active portfolio management, the fund manager simply seeks to generate a higher return than the index.

By becoming overweight, he wishes to increase sectoral contribution, thus increasing fund’s overall return vis-a-vis its benchmark.

Similarly, he may also reduce exposure due to obvious reasons.

The fund manager is able to beat its benchmark handsomely if his sectoral view plans out well.