Options scalping is a dynamic and rapid trading strategy that involves making quick, short-term trades on options contracts to capitalize on minor price fluctuations.

Traders employing this approach aim to exploit small market movements, often holding positions for a brief duration, in pursuit of incremental profits within a condensed time frame

The trading strategy known as “scalping” focuses on quickly turning a profit on resale and taking advantage of slight price movements.

When scalping, a trader must have a precise exit strategy because a single, significant loss could wipe out all of the numerous incremental wins the trader has laboured to achieve.

Therefore, for this technique to be successful, you need to have the necessary tools—like a live feed, a direct-access broker, and the endurance to conduct numerous trades.

In today’s blog, let us discuss how traders can use a scalping trading strategy:

Table of Contents

How Does Scalping Trading Strategy Work?

The foundation of scalping is the belief that the majority of stocks will finish a movement’s initial phase. It’s unclear where it will go from there, though. Some equities stop moving forward after that first phase, while others keep moving forward.

The goal of a discounter is to make as many tiny profits as they can. The “let your profits run” mentality, on the other hand, aims to maximize profitable trading outcomes by boosting the size of winning trades.

By increasing the number of winners while decreasing the magnitude of the victories, this technique produces the desired effects.

A trader with a longer time horizon may still turn a profit even if they win only half of their transactions, or even less; the gains will simply be greater than the losses.

On the other hand, a profitable stock scalper will maintain gains that are either slightly greater than losses or approximately equal to losses, with a far higher ratio of winning transactions to losing ones.

Example

Let’s say a trader uses scalping to benefit from changes in price for a Rs. 10 stock called ABC. The trader will purchase and sell a sizable block of ABC shares—let’s say 50,000—selling them at the right times when the price is moving in little increments.

For instance, because they are buying and selling in bulk, they can decide to buy and sell in price increments of Rs. 0.05, earning little profits that mount up over time.

But how is this trading strategy different from swing trading?

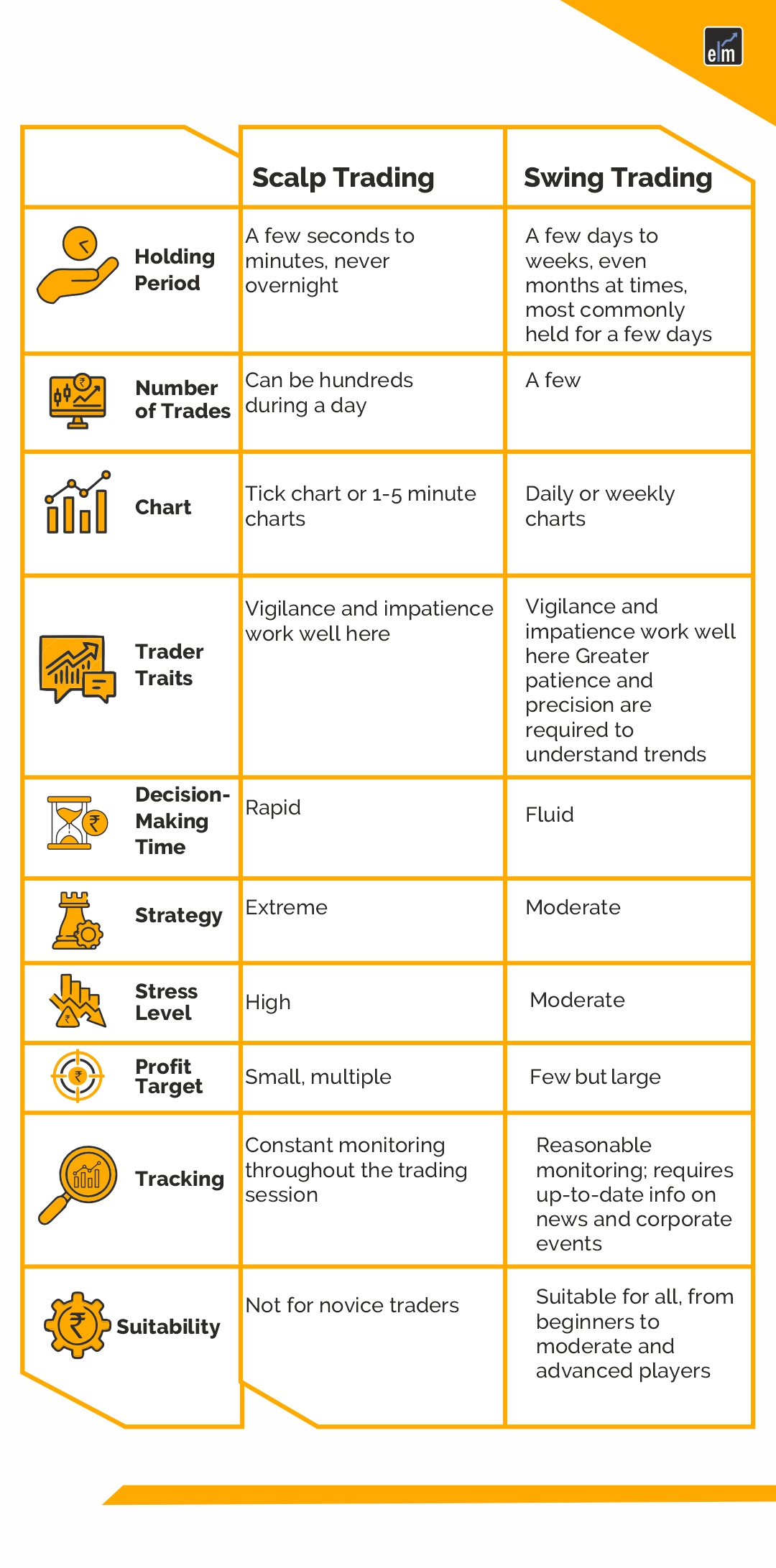

Scalping Vs Swing Trading

Finding the trend and playing within it are key components of the swing trading approach.

For instance, swing traders typically select a stock that is trending strongly following a correction or consolidation, and they would quit the trade just before the stock is set to climb once more, having made a profit. To make money, these buying and selling techniques are repeated.

Below is the difference between scalping trading and swing trading-

This type of strategy can also be used in options trading. But first, let us understand what options trading is all about-

What is Options Trading?

When trading stocks, there are two ways to make money: take a long or short position on a specific stock. If you expected the value of a particular stock to rise, you would take a long position by purchasing it to sell it later at a higher price.

If you expected a particular stock’s value to fall, you would take a short position by short-selling it and hoping to repurchase it later at a lower price.

There is more flexibility in how trades can be executed in options trading and many more ways to profit.

It should be noted that options trading is far more complicated than stock trading, and the entire concept of what is involved can be very intimidating to beginners. There is certainly a lot you should learn before you start options trading.

Having said that, most of the fundamentals aren’t that difficult to grasp. Once you’ve mastered the fundamentals, it’ll be much easier to understand what options trading is.

Purchasing an options contract is similar to purchasing stock. You are taking a long position on that option, expecting its value to rise. You can buy options contracts by deciding what you want and how many you want to buy and then placing a buy-to-open order with a broker. This order was named after you are opening a position by purchasing options.

There are essentially two ways to sell options contracts. If you have previously purchased contracts and wish to realise profits or reduce losses, you would sell them by placing a sell-to-close order. Because you are closing your position by selling options contracts, the order is named as such.

What is Options Scalping?

A short-term trading technique called options scalping focuses on taking advantage of minute price changes in options contracts.

By making many trades in a short amount of time, traders using this approach, hope to profit from small, rapid movements in the price of the underlying asset.

Options scalping is the practice of quickly purchasing and selling positions in the market, usually for a short time. Its successful execution depends on technical analysis, market indicators, and accurate timing.

The focus on capturing small price movements while reducing exposure to market volatility is what distinguishes this technique.

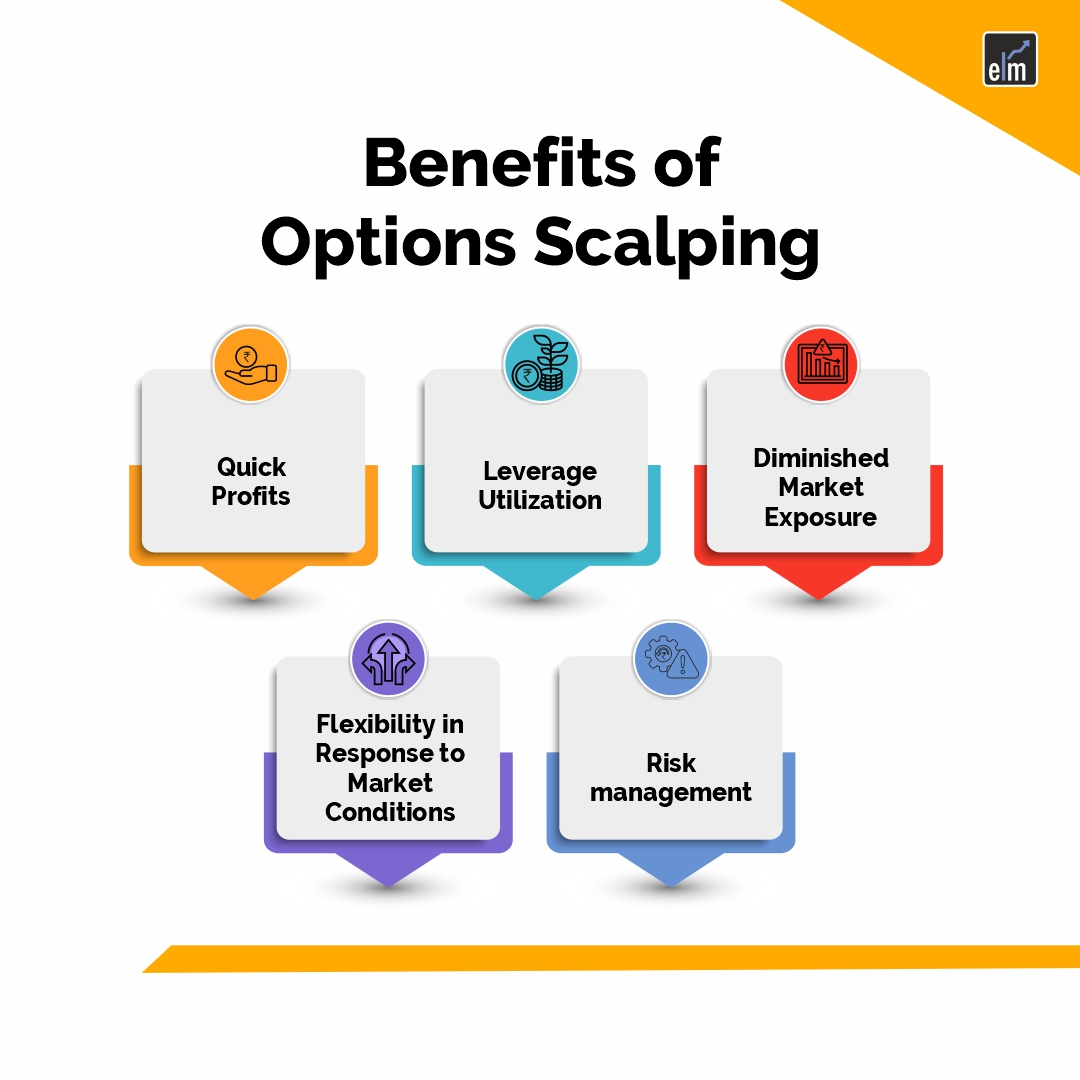

Benefits of Options Scalping

As a trading method, options scalping has a number of potential advantages for traders who apply discipline and ability in its use. Here are a few benefits:

1. Quick Profits

By taking advantage of minor price fluctuations, options scalping tries to help traders make quick money. The method is based on making a lot of deals in a short amount of time, each resulting in a tiny profit.

2. Leverage Utilization

Because options, by their very nature, offer leverage, traders can manage a greater position with a smaller investment. In turn, this might increase the profits from profitable scalping transactions.

3. Diminished Market Exposure

In options scalping, positions are held for a very brief period of time, frequently minutes or even seconds. This lessens the vulnerability to short-term or long-term market risks, lessening the effect of unforeseen circumstances.

4. Flexibility in Response to Market Conditions

You can use scalping in a variety of market situations, such as rising or falling markets. It’s a flexible strategy that adept scalpers can modify to fit current market conditions.

5. Risk management

Scalping is usually used to help traders control and minimize any losses by placing tight stop-loss orders. In the erratic world of trading, this emphasis on risk management is essential for protecting wealth.

Master the art of Options Scalping with our comprehensive online option trading course. Unlock profitable strategies today!

Learn Options Scalping Trading Strategy by Sivakumar Jayachandran

Watch our video on Mastering Options Scalping: Strategies, Emotions, and Profits–

Bottomline

You should familiarize yourself with scalping if day trading is something you’re interested in. For traders who choose to utilize it as their main strategy or even those who use it to complement other trading methods, scalping can be quite profitable.

Following the precise exit strategy is essential to allowing tiny profits to grow into substantial ones. The frequent modest trades and limited market exposure are the main characteristics that make this technique well-liked by a wide range of traders.

Frequently Asked Questions (FAQs)

Can you do scalping with options?

Short-duration option contracts fit well with the short-term nature of scalp transactions and the inclination to risk smaller amounts of capital. Trading short-term options always carry some risk, but scalpers reduce it significantly by entering and leaving transactions before much time has passed at all.

Is scalping riskier?

Scalp trading is just as risky because it necessitates a trader with extensive understanding of advanced technical analysis to offset the risk. A trader should also be well-versed in trading psychology and refrain from allowing their feelings to influence their trading decisions.

What is the 1-minute scalping strategy?

When a trader analyzes and executes trades using the 1-minute chart, this is known as a 1-minute scalping approach. Each bar on a 1-minute chart typically represents one minute, so you can monitor the movement of the bars in real-time.