| Table of Contents |

|---|

| What is the Intrinsic Value? |

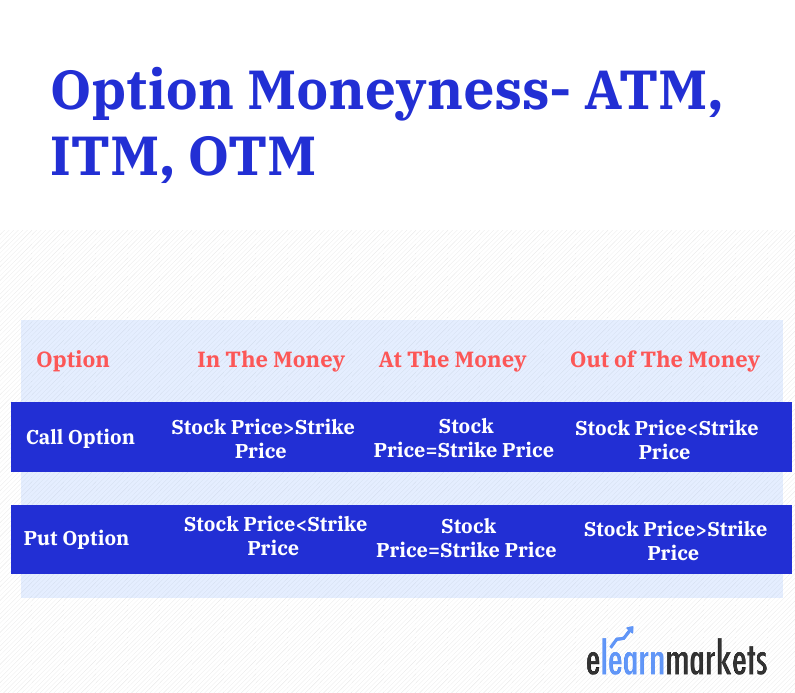

| What is ITM, ATM & OTM? |

| Option Moneyness Example |

| Key Takeaways |

Options can be classified into three categories that are also referred to as moneyness. Options Moneyness is used as an indicator to decide if the option contract will make money if it were immediately exercised.

These three categories are At The Money (ATM), Out of The Money (OTM), and In The Money (ITM). This classification helps the trader in deciding which strike price to trade, given a particular situation in the market.

Before we go into the details of these three categories, let us discuss the concept of intrinsic value: –

What is the Intrinsic Value?

Intrinsic value refers to the value of an option that the buyer makes from the option who has the right for exercising that option on a particular day.

The formula for calculating the intrinsic value of the option is:

Call option Intrinsic Value: Spot Price – Strike Price

Put option Intrinsic Value: Strike Price – Spot Price

The intrinsic value is always positive and it is never negative.

Let us understand the intrinsic value with an example:

Suppose Nifty 50 is trading at the spot price of 11415 CE and the strike price is 11400 CE and you have the right to exercise this option today.

When you exercise this option, then the money that you will make from this contract will be equal to the intrinsic value minus the premium.

Let us forget about the premium for the time being.

The intrinsic value will be: Spot Price- Strike Price = 11415-11400 = Rs.15

Learn option trading strategies with Option Trading Made Easy course by Market Experts

Thus, if you exercise your options contract today, then you will earn a profit of Rs.15 not taking the premium into the account.

What is ITM, ATM & OTM?

1. In The Money (ITM)

If the option contract is ITM, then it has an intrinsic value.

A call option is ITM if the stock price is higher than the strike price.

On the other hand, a put option is ITM, if the stock price is lesser than the strike price.

2. At The Money (ATM)

If the options contract strike price is the same as the stock price then it is said to be ATM.

The same rule applies to both call options as well as put options.

3. Out of The Money (OTM)

If an option contract is OTM, then it does not have intrinsic value.

A call option is OTM if the stock price is lower than the strike price.

On the other hand, a put option is OTM, if the stock price is more than the strike price.

From the above, we can conclude that:

Option Moneyness Example:

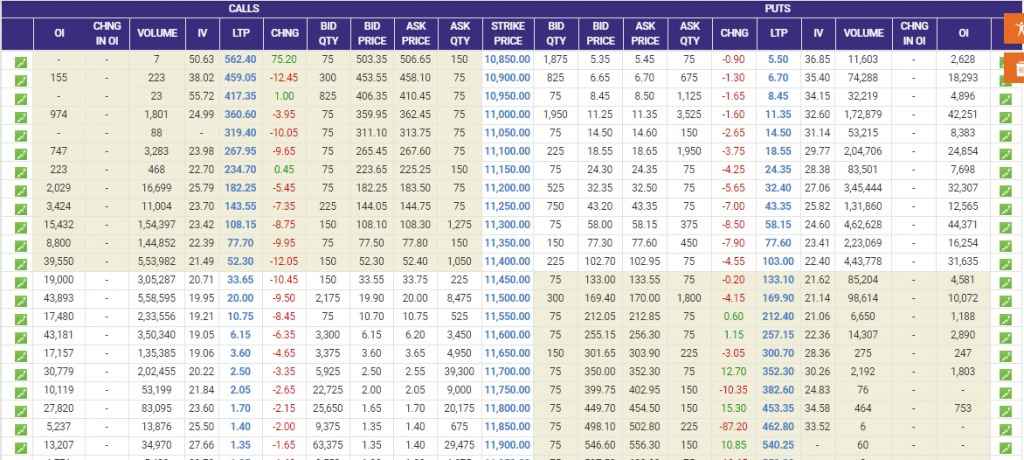

The above concepts can be better understood by the example of options chain Nifty 50 as explained below:

Suppose currently Nifty 50 is trading at 11,400. The ATM will be at 11,400 for both the put and call options.

For call options:

- All option strikes that are lower than ATM options are ITM option, thus they have a grey background

- All option strikes that are higher than ATM options are OTM options, thus they have a white background

Similarly for put options:

- All option strikes that are higher than ATM are ITM options, thus they have a grey background

- All option strikes that are lower than ATM are OTM options, thus they have a white background

When the option buyer or seller has to decide how much of a premium they want to pay, then they should take into consideration whether the underlying asset has intrinsic value or not.

Key Takeaways:

- Option Moneyness can be classified into three categories, At The Money (ATM), Out of The Money (OTM), and In The Money (ITM).

- Intrinsic value refers to the value of an option that the buyer makes from the options that has the right for exercising that option on a particular day.

- A call option is ITM if the stock price is higher than the strike price.

- If the options contract strike price is the same as the stock price then it is said to be ATM

- If an option contract is OTM, then it does not have intrinsic value.

Happy Learning!