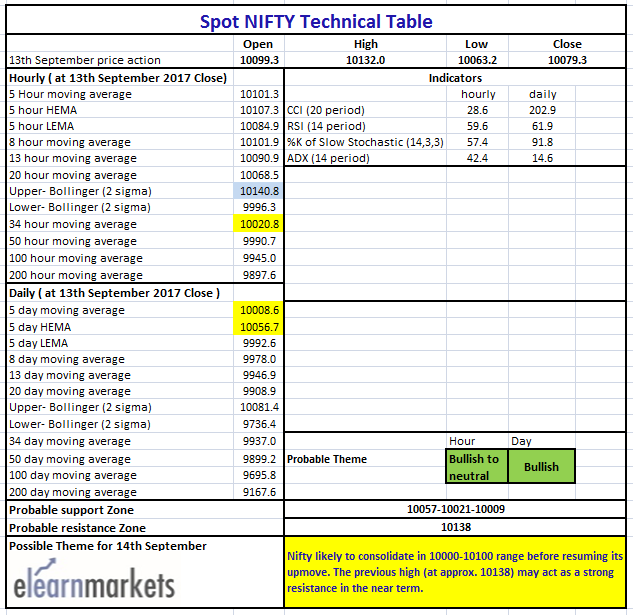

Nifty close 10079.3: Nifty opened flat and sees profit booking near its life time high (at approx. 10138). As mentioned in last day’s report that previous high may act as a resistance in the short term and Nifty was unable to breach that level in today’s session.

Hourly Technical:

In the Hourly chart, Nifty consolidated near its lifetime high and saw some correction in the second half. The probable support in the hourly chart comes at 34 Hourly moving average (presently at approx. 10020.8).

On the upside, Nifty may face resistance at upper Bollinger line (presently at approx. 10140.8).

Hourly CCI, RSI, Stochastic have entered the normal zone from the overbought zone. Moreover, ADX has also turned down indicating loss of momentum. Overall Nifty remains Bullish to neutral in Hourly timeframe.

Figure: Hourly Chart

Daily Technical:

Nifty may likely to consolidate in 10000-10100 range for sometime before it will resume its next leg of up move. Today’s correction at the top was very likely but however the underlying strength is still intact.

The probable support in the Daily chart comes at 5 Day High EMA (presently at approx. 10056.7) and 5 DMA (presently at approx.10008.6).

On the upside, Nifty may face resistance at all time high (at approx 10138).

Daily Stochastic and CCI are in overbought zone and RSI is close to the upper bound of the normal zone. Daily ADX has finally turned up thus indicating gain in momentum, but this strength will increase once it goes above 20 levels. Overall Nifty remains Bullish in Daily timeframe.

Figure: Daily Chart

Figure: Tech Table