Nifty close 10214.8: The index rebounded sharply after three day of consecutive losses. As mentioned in last day’s Tech table that there was a high possibility of bounce back from 50 DMA line which hold good in today’s trading session.

Hourly Technical:

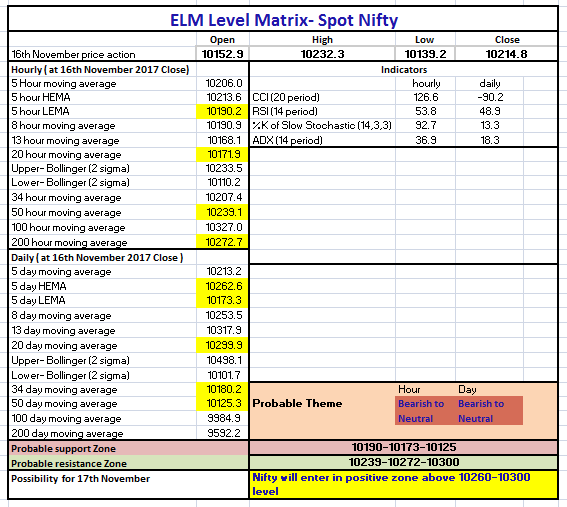

In Hourly chart, Nifty opened with marginal gap up and was in a steady up move throughout in today’s trading session. The probable support in the hourly chart comes at 5 Hour Low EMA (presently at approx.10190.2) and 20 Hour Moving average (presently at approx.10171.9).

On the upside, Nifty may face resistance at 50 Hour Moving average (presently at approx.10239.1) and 200 Hour Moving average (presently at approx. 10272.7).

Hourly Stochastic and CCI have entered the overbought zone while RSI is still in the normal zone. ADX has turned down suggesting weakness in downside momentum. Overall Nifty remains neutral to bearish in the Hourly chart.

Figure: Nifty Hourly Chart

Daily Technical:

In the daily chart, Nifty bounced sharply from the 50 DMA level and entered the 5 Day High-Low band. Moreover, the bounce in RSI from the 40 level indicates that the bullish trend is very much intact.

The probable support in the Daily chart comes at 34 DMA (presently at approx.10180.2), 5 Day Low EMA (presently at approx.10173.3) and 50 DMA (presently at approx.10125.3).

On the upside, Nifty may face resistance at 5 Day High EMA (presently at approx.10262.6) and 20 DMA (presently at approx. 10299.9).

Daily Stochastic is still in the oversold zone while CCI and RSI is in the normal zone. Overall Nifty remains neutral to bearish in the daily chart.

Figure: Nifty Daily Chart

Figure: Nifty Tech Table