Bank Nifty opened above its 5 Day High EMA (25613 approx) today . The Index traded in a range of 236 points and closed below its opening price.

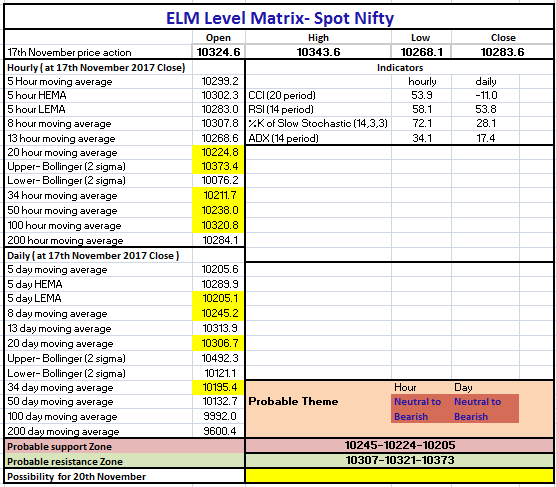

Hourly Technicals:

In the Hourly Chart, Bank Nifty has closed at its 5 hourly low EMA of (25736 approx).The Index is likely to face immediate resistance above its 5 hourly high EMA (25811 approx). Bank Nifty will find its next support around the 13 HMA ( 25664 approx) .

Hourly RSI stands closed near the upper end of the normal range while the CCI is indicating that sentiments are neutral. ADX is indicating that Bank-Nifty might not undergo major volatility yet.

Figure: Bank-Nifty Hourly Chart

Daily Technicals:

The daily chart indicates that Bank Nifty has closed marginally above its 5 day high EMA (25613 approx). The Index will face immediate resistance around its upper bollinger band (26009 approx). On the downside however, if Bank Nifty breaks and closes below its 5 day high EMA (25613 approx), it could find support at its 8 DMA (25376 approx).

The daily RSI indicator has closed near the higher end of the normal range.The CCI indicator however is indicating that sentiments are positive.The ADX indicates that momentum might remain slack.

Figure: Bank-Nifty Daily Chart

Weekly Technicals:

The weekly chart indicates that Bank Nifty has closed above the upper end of the weekly bollinger band (25685 approx). The Index will face immediate resistance around the weekly high (25921 approx). On the downside however, if Bank Nifty breaks and closes below its upper bollinger band (25685 approx), it could find support at its e weekly high EMA (25523 approx).

The weekly RSI indicator has closed near the higher end of the normal range.The CCI indicator however is indicating that sentiments are positive.The ADX indicates that momentum might remain slack.

Figure: Bank-Nifty weekly Chart

Figure: Bank-Nifty Tech Table