Have you ever come across a situation in your life wherein your expenditure exceeded your budget? Did your plans go all haywire on account of this? Did you ever wonder what caused this difference? Have you heard the term rate of Inflation?

Well……

Inflation is one of the primary reasons that cause a major difference between your planned budget and the actual expenditure. So want to know more about this? Read on to find it.

What is Rate of Inflation?

This can be defined as a sustained rise in the general price levels of goods and services in an economy, over a specified period of time. It is usually measured as an annual percentage of price change. This annual percentage is known as the inflation rate.

Inflation is a Macroeconomics factor and learning about Macroeconomics will help you to understand better.

Let us understand this concept with the help of an example:

Rate of Inflation Example

Suppose you buy groceries from the neighborhood shop every month for Rs 30,000. Suppose the inflation rate is 4%. You buy the same products from the same shop every month and the bill comes as the same.

One month you receive a bill for Rs 31,200 for the same groceries that you buy every month. You go through the bill thoroughly and find that the price of some commodities has increased. Earlier, the goods that cost you Rs 1000(say) now cost Rs 1040(1000+1000*4% ).

This means that the purchasing power of money declines and the money going out from our pocket increases in multiples accordingly. Thus, inflation makes goods and services expensive for us. Thus this forces us to spend more money on purchasing the same quantity of the same product as compared to before.

Headline Inflation versus Core Inflation:

You have come across the terms headline inflation, core inflation in financial newspapers, websites and elsewhere.

So want to know what are the major differences between them?

Learn from Experts – Theory & Principles of Macroeconomics

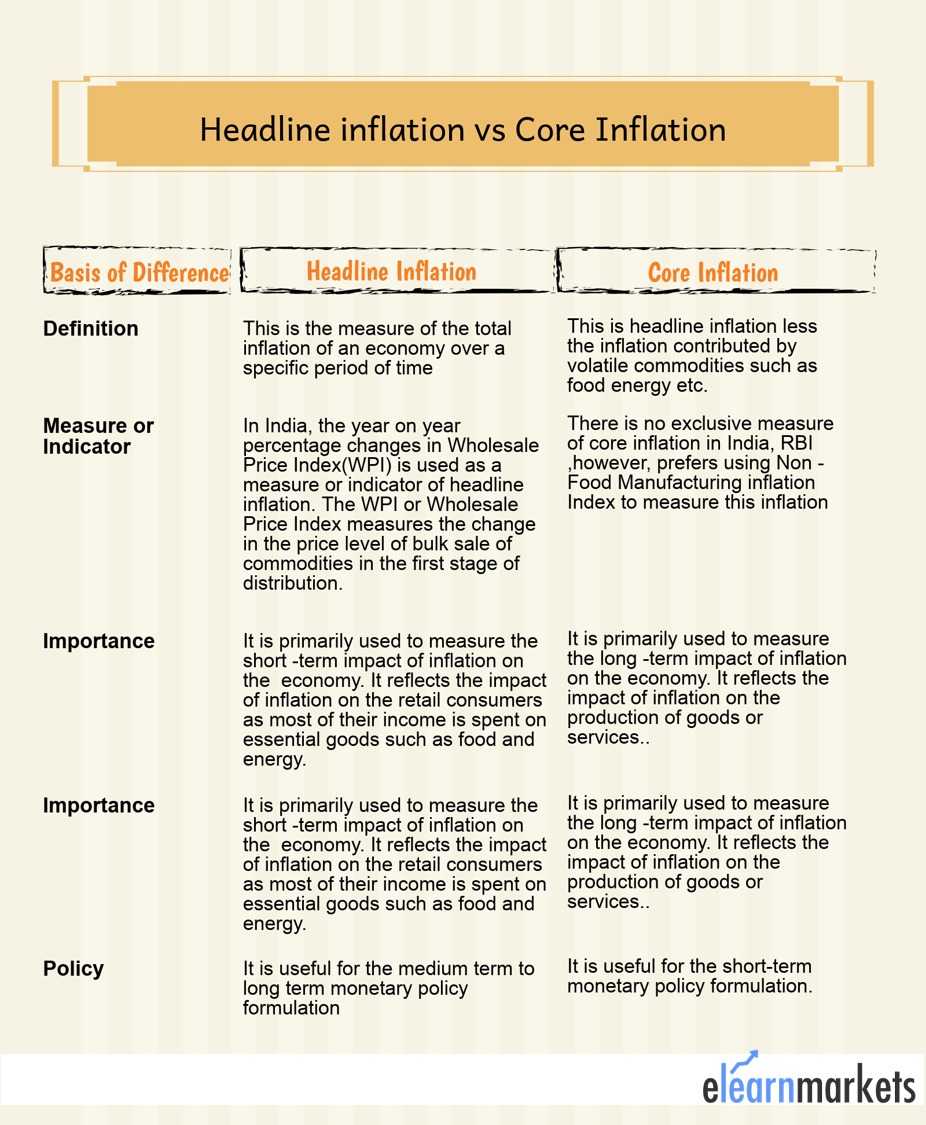

The following infograph gives the major differences between them:

RBI’s Policy Stance on Headline and Core Rate of Inflation:

In the Flexible Inflation Targeting Framework (FIT) newly adopted by Reserve Bank of India (RBI): the Headline Consumer Price Index(CPI) measure is being used as the target rate as headline inflation reflects the price change of essential goods.

Any rise in the price of the essential goods adversely affects the lower income people as they spend a large portion of their income on such goods.

As the primary objective of any monetary policy is to ensure price stability so as to protect the citizens from a sustained rise in the price level, therefore, targeting headline inflation is the right choice. However, it has been observed that in the recent monetary policy statements: the focus has been more on core inflation rather than on headline inflation.

Factors that lead to a rise in rate of Inflation:

This is primarily caused by two different sets of factors:

(1) Demand Side Factors

(2) Supply Side Factors

Demand Side Factors:

When the aggregate demand exceeds the aggregate supply, there is a rise in the overall price level. This type of inflation is known as Demand-Pull Inflation.

Some of the major factors that cause this are:

Expectation of Inflation – When people expect a higher inflation in the future, there will be a rise in the present actual inflation. Suppose you expect a high inflation in the future i.e. you expect the prices of goods and services to rise in the future. So to avoid the rise in price you will buy the good or service today.

Imagine a hundred people doing the same thing. This will increase the demand for that good or service. Now there is only a limited amount(supply) of that good or service so when a hundred people want the same thing not all of them will be able to get it so they will be willing to pay a higher price to get it as such the price level will increase.

Thus a higher inflation expectation will lead to aggregate demand exceeding aggregate supply and hence an increase in overall price level at present.

An Over-Expansionary Monetary Policy – When a government has too much debt, then sometimes to repay such debts, it prints new money. As a result, there is too much money in the economy and not enough goods. Hence the price level rises as people are willing to pay more for a good or service. And, hence inflation rises.

A Discretionary Fiscal Policy – Suppose the government reduces the income tax. As a result, consumers will now have more money in their hand to spend on goods and services. This, in turn, increases aggregate demand. If the aggregate demand exceeds the aggregate supply then the overall price level will increase.

Supply Side Factors:

When the overall price level rises on account of an increase in the cost of wages and other raw materials, it is known as Cost-Push Inflation.

Some important factors that cause this are:

Oil-Price – An increase in oil price will lead to an increase in petrol prices which in turn will increase the transportation costs. As a result, almost all businesses will experience a rise in the cost of production. The businesses will transfer this rise in the cost of production to the consumers in the form of a higher price. As such the overall price level will increase.

Rise in Wages – A rise in wages will lead to a higher cost for the businesses which in turn will lead to a higher price for the goods and services. As a result, there will be a rise in the overall price level.

Exchange Rate – A country which allows a decline in the value of its currency in terms of the foreign currency(devaluation) will experience a higher cost of imports which in turn will lead to a rise in overall price level.

Is Inflation harmful to the economy?

A too high or a too low inflation is harmful to the economy. However, a moderate value is actually good for the economy. We will know about this in more details in the latter part of this article.

Why is a high inflation bad for the economy?

A too high inflation(hyperinflation) leads to people hoarding and stockpiling goods such as durable goods as well as perishable goods in order to avoid the rising prices.

The hoarding of these goods leads to scarcity of these goods which in turn will further increase the price leading to further inflation. This leads to a fall in the value of currency so with too high inflation cash will become worthless and people will lose their life savings.

Banks and other lenders go bankrupt as their loans lose value in such a situation and people no longer make any deposit in them.

As mentioned above, with hyperinflation the value of the domestic currency falls significantly in the foreign exchange market. The importers lose their business as the cost of foreign goods rises extremely high.

As businesses are shut down, unemployment increases and as such government tax revenues fall as people are unable to pay taxes. As such the government is unable to provide even basic services. Thus in such extreme situations, the economy collapses.

Why is a low inflation bad for the economy?

A too low inflation means that prices of goods and services move either very slowly or does not move at all. In such a situation, people and businesses will hold off their purchases as they expect the prices to fall further in the future.

These will reduce consumer spending which is the main lubricant of an economy.

As company sales will fall there will not be any substantial rise in the worker’s wages which in turn will reduce the amount available for consumer spending. When the income remains more or less constant or even falls, then interest payment on loans taken becomes a big financial load.

An extremely low value may lead to deflation(It is the sustained fall in the overall price level when inflation falls below zero percent). Deflation leads to a further fall in the consumer spending which in turn can move the economy into recession.

Effects of rate of Inflation on the economy:

It has the following major effects on the different sectors of an economy:

(1) Debtors and Creditors

Inflation leads to a fall in the real value of money and hence debtors have to pay less while creditors will be receiving less than what they had actually lent.

So this situation is good for debtors and bad for creditors.

(2) Salaried Persons:

Salaried persons lose during periods of inflation as their salaries are slow to rise as compared to the pace at which the price of goods and services are increasing.

(3) Fixed Income Holders:

All fixed income holder such as bondholders, pensioners, recipients of transfer payments, etc all lose during this period of sustained rise in prices as they receive fixed payments while the value of money falls with rising prices.

(4) Equity Investors:

Equity Investors gain during this sustained rise in the overall price level.

This is because as prices are rising businesses expand and earn higher profit which is translated into higher dividend payments (higher than the price rise).

(5) Businesses:

During a period of sustained price rise, producers gain on account of profits exceeding the cost of production.

Also, most businesses borrow money and hence during this period they stand to gain.

Why is moderate rate of inflation good for an economy?

This acts as a stimulant for the economy by providing it with some momentum.

When we start expecting sustained price rise, we increase our spendings in order to beat inflation and as such this stimulates the growth of the economy. As we start spending more, it would increase the profit of the businesses who then start hiring more people or raise the salary of the existing employees or expand. All these, in turn, will help in the growth of the economy. Thus, this acts as an incentive for consumers to spend more, businesses to invest, wages to rise and employment to expand thereby helping the economy to grow.

Bottomline:

Inflation effects more or less all of the aspects of your life be it your investments or your day to day expenditure.

Therefore, it is important that you have a full grasp of it so that you can protect yourself from the adverse effects of inflation.

In order to get the latest updates on Financial Markets visit Stockedge