How would you respond if we asked you how the stock market indices are doing right now? On the Bombay Stock Exchange, there are over 5,000 listed companies, while on the National Stock Exchange, there are about 2,000.

To check every company, determine whether they are up or down for the day, and then provide a thorough response would be awkward.

Instead, you would examine a few significant companies from various essential industrial areas. If most of these companies are going upward, the markets are said to be up; if most are moving downward, the markets are said to be down; and if there is a mixed trend, the markets are said to be sideways or flat for the day.

Decide on a small number of companies to represent the larger markets. When someone inquires about the state of the markets, you first look at the overall trend of these chosen equities before responding. The stock market index is made up of all of the companies that are listed.

Fortunately, you don’t need to follow these particular companies closely to gain a sense of how the markets are faring. To give you this information, the significant businesses have been pre-packaged and are under constant observation. The “Stock market Index” is the name of this pre-packaged market sentiment indicator.

In today’s blog let us discuss stock market indexes and how to trade in those indexes:

- What are Stock Market Indices?

- Why it is important to track Stock Market Indexes?

- What are Sector-Specific Indices?

- 1. Replicate the Index

- 2. Index Futures and Options

- 3. Index Mutual Funds

- 4. Exchange-Traded Funds or ETFs

- Can we trade indices in India?

- How can I buy Indian indices?

- What is the best way to trade indices?

- Can you trade indices directly?

What are Stock Market Indices?

In India, there are a few significant indexes. The National Stock Exchange is represented by the Nifty 50, while the Bombay Stock Exchange is represented by the S&P BSE Sensex. In addition to these two, there is the well-known Nifty Bank Index (Bank Nifty). The banking industry as a whole is represented by Bank Nifty.

Standard and Poor’s, a major credit rating organisation, is known by the initials S&P. The technological know-how to build the index that S&P has licenced to the BSE. As a result, the index also bears the S&P label. Through a sister, firm called NSE Indices Limited, NSE itself manages the indices.

The most actively traded stocks on the National Stock Exchange make up the Nifty 50; we will shortly talk about the technique used to create these indices. An ideal index provides us with a current, accurate picture of market sentiment.

Why it is important to track Stock Market Indexes?

The changes in the stock market Index show how market participants’ expectations are evolving. When the index rises, market participants believe that things will become better in the future. If market participants have a negative outlook for the future, the index declines.

Let us discuss why is it important to track stock market indexes:

1. Benchmark

Every trade or investment that someone makes needs to be measured against a yardstick. Assume that you invested Rs. 100,000 last year and earned Rs. 20,000 in return, bringing your entire corpus to Rs. 120,000. How would you rate your performance? On the surface, a 20% return appears to be fantastic. What if, though, Nifty increased to 30% in the same year?

You can suddenly think that your performance in the market has been poor. The goal of market players is often to outperform the Index. You can’t now determine how you did in the stock market without the Index. The index to benchmark the performance would be ideal.

2. Trading

One of the most common uses of the index is undoubtedly trading on it. The index is traded by the vast majority of market participants. They formulate a trade based on a broader assessment of the economy or the state of circumstances. To trade the index, the trader typically makes a short-term call.

Consider this scenario as an example. The Finance Minister is scheduled to provide the budget speech at 10:30 AM. The Nifty index is at 18,150 points an hour before the announcement. You anticipate that the budget will benefit the country’s economy. What will happen to the index, in your opinion? The index will inevitably rise.

So you might want to buy the index around 18,150 to exchange your perspective. The index does, after all, represent the overall economy. The budget is sound, and the index rises to 18,450 as expected.

At this moment, you can close the deal at a profit of 300 points and book your earnings. Trades like these are feasible through the market sector known as “Derivative.” One should keep in mind that index trading is possible through the derivatives markets for the time being.

3. Information

The indicator captures market sentiment and trends as a whole. The index serves as a general indicator of the economy of the nation. People’s optimism about the future is indicated by an uptick in the stock market index. In a similar vein, when the stock market index goes down, people are gloomy about the future.

Now that we have discussed why is it important to track indexes, let us discuss index calculation methodology-

How to do Index Calculation?

It’s crucial to understand the index calculation if one hopes to become a successful index trader. As we previously covered, the Index is made up of numerous equities from various industries that indicate the state of the economy.

For a stock to be included in the index, it must meet specific requirements. As long as it meets the requirements, it should continue to be eligible as an index stock. The stock is replaced by another stock that meets the requirements if it fails to maintain the criteria.

The selection process is used to populate the list of stocks. A certain weighting should be given to each stock in the index. In plainer terms, weightage designates the relative importance of a given stock inside the index to the other stocks. For instance, if ITC Limited is weighted at 3.85% in the Nifty 50 index, then 3.85% of the movement of the Nifty can be attributed to ITC.

The logical question is: How do we give the stocks that make up the Index weights?

Weights can be assigned in a variety of methods, but the Indian stock exchange uses the free-float market capitalization technique. Based on the company’s free-float market capitalisation, the weights are assigned. The weight increases with the market capitalisation

The total number of outstanding shares on the market multiplied by the stock price results in the free float market capitalization.

For instance, if Company ABC has 100 outstanding shares and a share price of 50, its free-float market capitalization is 100*50, or Rs. 5,000.

What are Sector-Specific Indices?

Sensex and Nifty are the two important indexes for the Indian stock market. The shares of 30 companies listed on the BSE are included in the oldest market index for stocks, known as the Sensex. It was made in 1986 and offers time series data starting in April 1979

The Standard and Poor’s CNX Nifty index is another option; it comprises 50 shares listed on the NSE. It was made in 1996 and offers time series data starting in July 1990.

While the Sensex and Nifty represent the larger markets, other indices stand in for particular industries. The term for this is sectoral indices.

For instance, the Bank Nifty on the NSE symbolises the sentiment unique to the banking sector. The behaviour of all IT stocks on the stock markets is represented by the CNX IT on the NSE. Sector-specific indexes are available on the BSE and NSE.

Below is a list of the Major Sectoral Indexes in India:

How to Invest in Indices?

How can I trade or invest in the Indian Sectoral Indexes? Although you cannot directly buy indexes, there are three techniques or tools you can use to mimic or duplicate an index investment in stocks.

1. Replicate the Index

This procedure is referred to as indexing. By doing this, you essentially build a portfolio of stocks that most accurately reflects an index, such as the Nifty or Sensex. The stocks and allocation weightings would be identical to those in the actual index.

However, this is a time-consuming and difficult process, making it difficult to purchase the index as a basket at one time. As a result, spillages may result in a higher buying price.

A variation of the aforementioned indexing strategy known as the “Smart Beta approach” is a widely popular way to invest in index funds. What precisely is the smart beta method. In essence, it is an effort to maximise profits while minimising risk for an underlying portfolio or index.

This is a hybrid between being fully active and fully passive. Smart beta seeks to outperform the index, as opposed to conventional indexing.

2. Index Futures and Options

As we will see later, this is a significantly trickier and perhaps riskier method of investing in an index than buying ETFs or performing pure indexing. You can purchase index futures or index options if you participate in the F&O market.

For instance, the Nifty and Bank Nifty futures in India are quite liquid and may be purchased as approximate representations of the index with a low probability of inaccuracy or spread out in price. To duplicate the index, you can also purchase options with at-the-money or slightly out-of-the-money strikes. This is a recognised indexing technique.

Using index futures, a trader can purchase or sell a financial index today for a future settlement date. Index futures are a useful tool for making predictions about the course of an index’s price movement, such as the Nifty or Sensex. But ideally, this is done to protect against market index risk or to protect against a stock portfolio.

The other technique is to purchase index options, which are very liquid in India. The owner of an index option has the option, but not the responsibility, to purchase or sell the underlying index. Index options are a type of financial derivative. Every futures and options contract has an expiration date and is only cash-settled in India.

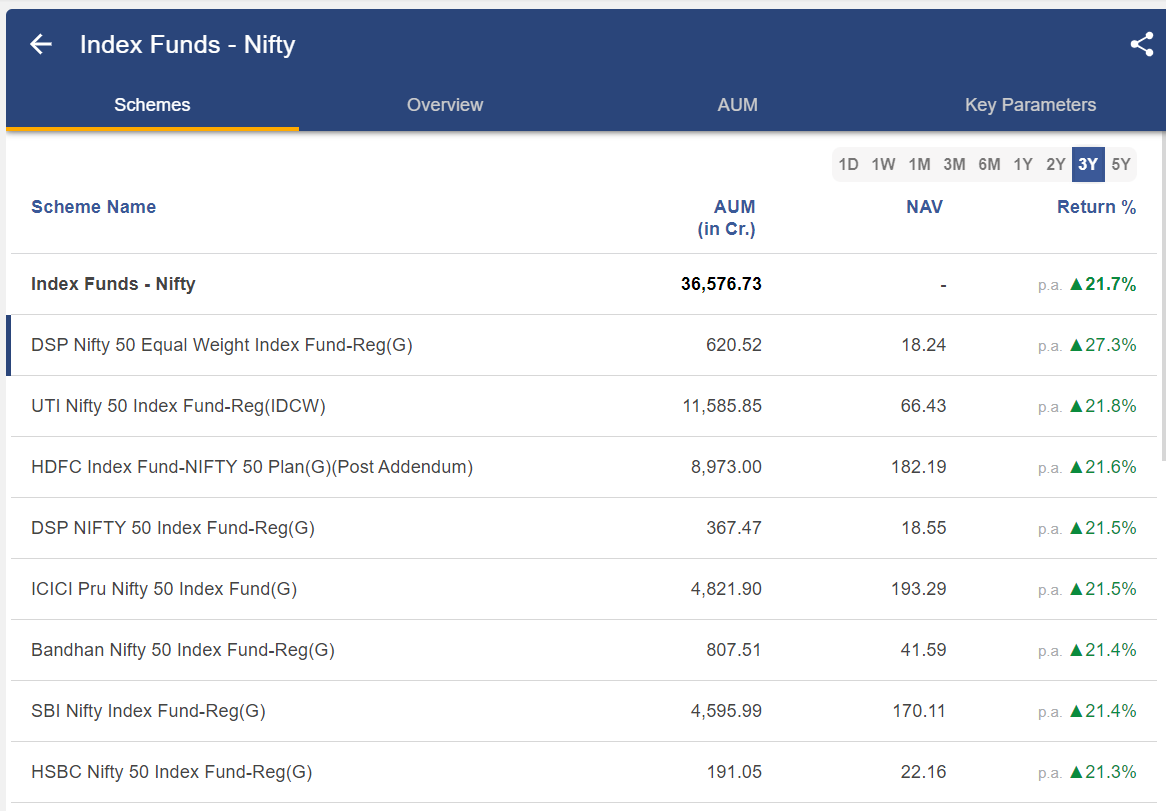

3. Index Mutual Funds

Index funds are a crucial way to purchase the index. Index funds benchmarked on the Nifty or the Sensex are currently offered by most mutual funds in India. These are frequently closely mirrored index funds with low tracking errors. Both the risk and the cost are little.

4. Exchange-Traded Funds or ETFs

Exchange-traded funds (ETFs) are divided into tradable units and traded in real-time, and they track an underlying asset. The ETF provides real-time buy and sell prices on the indices, in contrast to index funds, which only provide day-end purchase and redemption prices. ETFs can be used to duplicate an index and have lower costs than index funds.

Keep in mind that index funds and ETFs both have relatively low active management requirements and are meant to replicate the market or a particular industry. Additionally, these index funds and exchange-traded funds (ETFs) provide diversification at a significantly lower price.

What are the Advantages of Investing in Indices?

Now let’s examine some of the main benefits or virtues of investing via index funds.

- It has been repeatedly demonstrated that it is difficult to outperform the market. In most developed nations, nearly 80% of fund managers report struggling to outperform the markets, but India is getting there. For such circumstances, indexing provides a far more straightforward and reliable solution.

- Investing in index funds can significantly lower costs. Typically, the annual fees for passive investing are around 0.20%, while they are roughly 1.75% for active investing. This kind of cost-saving can significantly impact your returns on investment over a longer period. This is more true in markets that are cutthroat.

- You shouldn’t be concerned about rotating your portfolio because the ETF or index fund takes care of that. This reduces your tax expense. Additionally, you always have the most recent version of the index, which is impossible if you index manually. There is pressure to outperform the market, unlike active investment, only to lower the tracking error.

- Passive or index investing is primarily about discipline. By relying on an index fund’s built-in strategy, you remove yourself from the trading decision. Your investment procedure becomes more methodical and detached as a result.

Bottomline

While stock indices are well-liked trading instruments, they cannot be traded directly. Simply said, an index is a group of stocks (or other assets) that fluctuates in line with the equities contained therein. The index and the futures/options contract that traders are interested in trading can both be studied by traders. Trading the correct contract is important since indexes do not expire, whereas futures and options contracts do.

You can learn more about stockmarket concepts through our stock market course online.

Frequently Asked Questions (FAQs)

Can we trade indices in India?

Instead of trading individual equities, traders in India can bet on a variety of worldwide market moves by trading indices. In addition, trading indices give more diversification than trading individual shares.

How can I buy Indian indices?

Index funds are a crucial way to purchase the index. Index funds benchmarked on the Nifty or the Sensex are currently offered by most mutual funds in India. These are frequently closely mirrored index funds with low tracking errors. Both the risk and the cost are little.

What is the best way to trade indices?

Below are the steps for trading indices-

- Select an index trading strategy.

- Log in after creating an account.

- Choose whether to trade futures, options, or cash indices.

- You can trade an index by choosing it.

- Choose between going long or short.

- Decide on your limits and stops.

- Open and keep an eye on your whereabouts.

Can you trade indices directly?

Traders frequently believe they are traded similarly to individual equities. Stock indices, however, cannot be traded directly. Instead, they serve as a means to track the performance of a group of stocks and are simply there for informational purposes.