Most investment research professionals in order to conduct the equity research look at the earnings growth, return on equity, competitive position etc.

However, they ignore or pay very less attention to the quality of people running the business.

In fact, both factors matter equally.

It’s really important for a business to have a sound management team since a strong management acts as a backbone of any successful company.

Warren Buffet emphasises the importance of evaluating the people running the business. He said-

Charlie and I look for companies that have … able and trustworthy management

The management is responsible for the strategic decisions taken at the company and can be compared to the captain of the ship, who physically doesn’t drive the boat but direct others to look at various factors which ensures a safe trip.

Company’s management is responsible for creating value for shareholders and to run company in the interest of the shareholders.

However, managers are human beings and it is practically impossible that they will think only about the shareholders and not for personal gain.

The problem arises when manager’s interest differs from that of shareholders.

Hence in order to solve this conflict, it’s better to tie the compensation of management with the interest of shareholders.

The main problem lies in analyzing company management is that there is no dedicated formula for doing so and most aspect of the job is intangible in nature.

However, you can follow the mentioned guidelines in evaluating the quality of management.

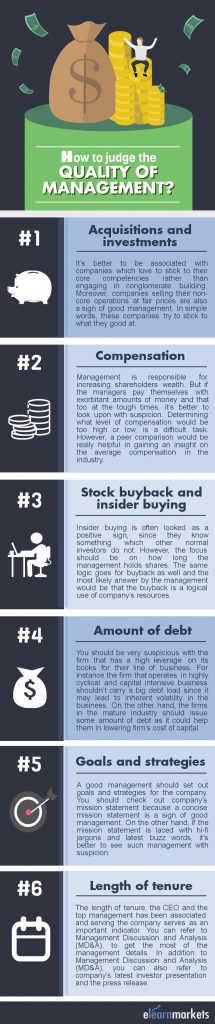

1. Acquisitions and investments

It’s better to be associated with companies which love to stick to their core competencies rather than engaging in the conglomerate building.

Moreover, companies selling their non-core operations at fair prices are also a sign of good management. In simple words, these companies try to stick to what they good at.

There are numerous examples where companies engaged in a number of acquisitions to diversify their business, ends up destroying shareholders wealth.

2. Compensation

Management is responsible for increasing shareholders wealth over a period of time.

But if the managers pay themselves with exorbitant amounts of money and that too at the tough times, it’s better to look upon with suspicion.

Determining what level of compensation would be too high or low, is a difficult task.

However, a peer comparison would be really helpful in gaining an insight into the average compensation in the industry.

You’d be highly suspicious if the compensation of the management in the same industry differs significantly.

3. Stock buyback and insider buying

Insider buying is often looked as a positive sign since they know something which other normal investors do not.

However, the focus should be on how long the management holds shares.

The same logic goes for buyback as well and the most likely answer by the management would be that the buyback is a logical use of company’s resources.

However, if a company is truly undervalued, a buyback would increase shareholder’s value.

Also Read: Why Buyback of Shares is Done?

4. Amount of debt

Management and debt often go hand in hand.

Good management and debt can create shareholder’s wealth while bad management and debt may have a devastating effect and have a tendency to destroy the shareholder’s money.

You should be very suspicious of the firm that has a high leverage on its books for their line of business. For instance, the firm that operates in highly cyclical and capital-intensive business shouldn’t carry a big debt load since it may lead to inherent volatility in the business.

Also Read: Business Risk Analysis and Leverage (Part-1)

On the other hand, the firms in the mature industry should issue some amount of debt as it could help them in lowering firm’s cost of capital.

5. Goals and Strategies

A good management should set out goals and strategies for the company.

You should check out company’s mission statement because a concise mission statement is a sign of good management.

On the other hand, if the mission statement is laced with hi-fi jargons and latest buzz words, it’s better to see such management with suspicion.

So, you should always evaluate a company management strategies to get an idea about company’s performance in the future.

6. Length of tenure

The length of tenure, the CEO and the top management has been associated and serving the company serves as an important indicator.

This is one of the important investment criteria for Warren Buffett to look for stable managements who stick to their business for the long term.

You can refer to Management Discussion and Analysis (MD&A), to get the most of the management details.

In addition to Management Discussion and Analysis (MD&A), you can also refer to company’s latest investor presentation and the press release.

In order to judge the viability of company’s management whether it delivers what it promises, you can compare the accomplished results from the latest MD&A.

To have a better understanding, you can compare the current and past MDA.

Bottomline:

There are no dedicated guidelines for evaluating the company’s management but above-mentioned points will provide you with some idea of analyzing a company.

NSE Academy Certified Equity Research Analysis is a program which will help to strengthen your skills in analyzing a company.

Financial results on a standalone basis will not tell the complete story, rather you should spend some time researching about the people responsible for those numbers.

We’ll leave you with a lovely quote by Warren Buffett-

You need two things—a moat around the castle and you need a knight in the castle who is trying to widen the moat around the castle.

Take care and keep learning!!