In an interesting session as part of the highly popular MarketShala series conducted by Elearnmarkets, Mr. Vivek Bajaj, Co-founder Elearnmarkets, and Mr. Chetan Panchamia a prolific intraday trader and trainer with many years of experience came together to decode How to earn money by doing part-time Trading in the Stock Market.

Here is a short discussion of this session. If you want to get a practical understanding of How to earn money by doing part-time trading in the stock market watch the full video at the end of this blog.

In India, most of the traders trade along with their jobs. These kinds of traders cannot be full-time actively involved during the trading session as they have client meetings, appointments, etc.

Part-time trading can be done by analyzing the whole day’s price movement and delivery.

| Table of Contents |

|---|

Trading during the day can be divided into the different zone which we will be discussing here:

Different Part-Time Trading Periods:

1. Opening Range (First 1 – 1.5 hours)

The first half an hour or an hour is the most active traded period for trading and also the volume is more than the average volume of the day during that period.

The market opens at 9:15 and at that time whatever global news comes overnight has an impact on the stock market is known as the sentiment analysis.

So our market opens with the sentiments of the overnight global news.

Secondly, when the market closes, a lot of news comes after which affects the opening of the trading session on the next day.

These two factors are the early morning discounting factors.

So traders who do not have time to trade during the day can trade in the first hour of the morning trade zone.

Where the traders can enter in the first 10-15 minutes and exit after an hour.

Learn the basics of swing trading in 25 mins

2. Mid- Markets (From 11- 12.30 pm)

After 10:30 there is dullness in the market in which volume also decreases, as there is no trigger in the market there is a decrease in the volume.

The movement has already come in the market but because of lack of volume, traders start taking trades against the volume which is known as the anti-trend trades.

So anti-trend traders start making the market move during 11-12:30 toward the opposite direction.

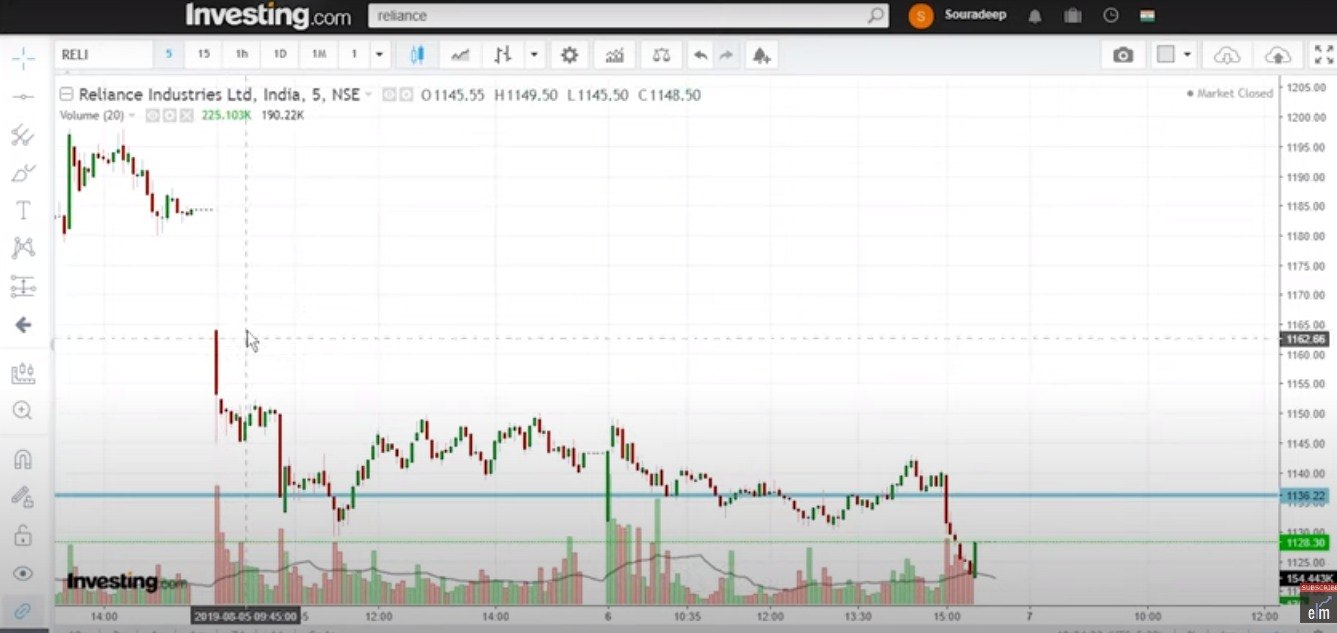

From the above chart of Reliance, we can see that the market opens and the volume of the first three candles is good and have maintained for the first one hour. Start analyzing stocks using the stockedge web app.

After 11, it has taken anti-trend trade till noon as the movement as slow and moves after making a new high or low.

2. Trading Period (1-2:30 pm)-

After 12:30 p.m. the liquidity in the market rises as the European markets open which affects the Indian stock market.

The volume also increases and there is an increase in the movements of the prices of the stocks because of the opening of the global market.

3. Trading Period (2:30-3:30 pm)-

It has been observed that the institutional buyers get more active during the end of the market closing.

So institutional players who want to buy or sell do during this period.

So the traders will be able to see a trend after 1:30 which flows till 3:30 p.m.

In which trading period should part-time traders trade-in?

If you are a momentum trader then you can trade in the first 1 hour. You should research the stocks in which you want to trade-in before the market opens whether in which sector buying or selling is happening.

The second most momentum period is between 1:15 pm and 2 pm in which part-time traders can also trade.

So these two time periods are the most profitable zones for part-time traders.

You can watch the full video here:

Happy Investing!

Enroll in our FREE face 2 face series to learn more about part-time trading