Key Takeaways

- Indian Capital Market: Acts as the backbone of the economy by channeling savings into productive investments and powering growth.

- Components of Capital Markets: Includes equity, bonds, money markets, derivatives, exchanges, and intermediaries that keep the system running.

- Securities Markets: Divided into primary market (IPOs/FPOs where companies raise funds) and secondary market (where investors trade listed securities).

- Money Markets: Deals with short-term funds through instruments like T-bills, CPs, and CDs, helping companies manage liquidity needs.

- How Money Moves: Savers invest → companies raise capital → securities trade on exchanges → regulators & intermediaries ensure smooth functioning.

Understanding the capital market isn’t optional if you want your money to work while you sleep. Think of the capital market as a giant, very efficient money elevator: it picks up savings from people and institutions, and drops that capital where companies and governments need it to build, grow or reboot. Below is a crisp, conversational tour, now with real names and recent, fact-checked examples.

Why Capital Markets Matter

Savings sitting in lockers don’t create jobs, factories or apps. When you park money in a bank, buy a bond, or subscribe to an IPO, that capital flows into businesses and government projects powering growth and creating returns for investors.

Retail participation has been surging: total demat accounts in India recently crossed the 20-crore mark, showing how many more people are now plugged into markets.

Learn about the Types of Financial Markets here!

Components of Capital Markets

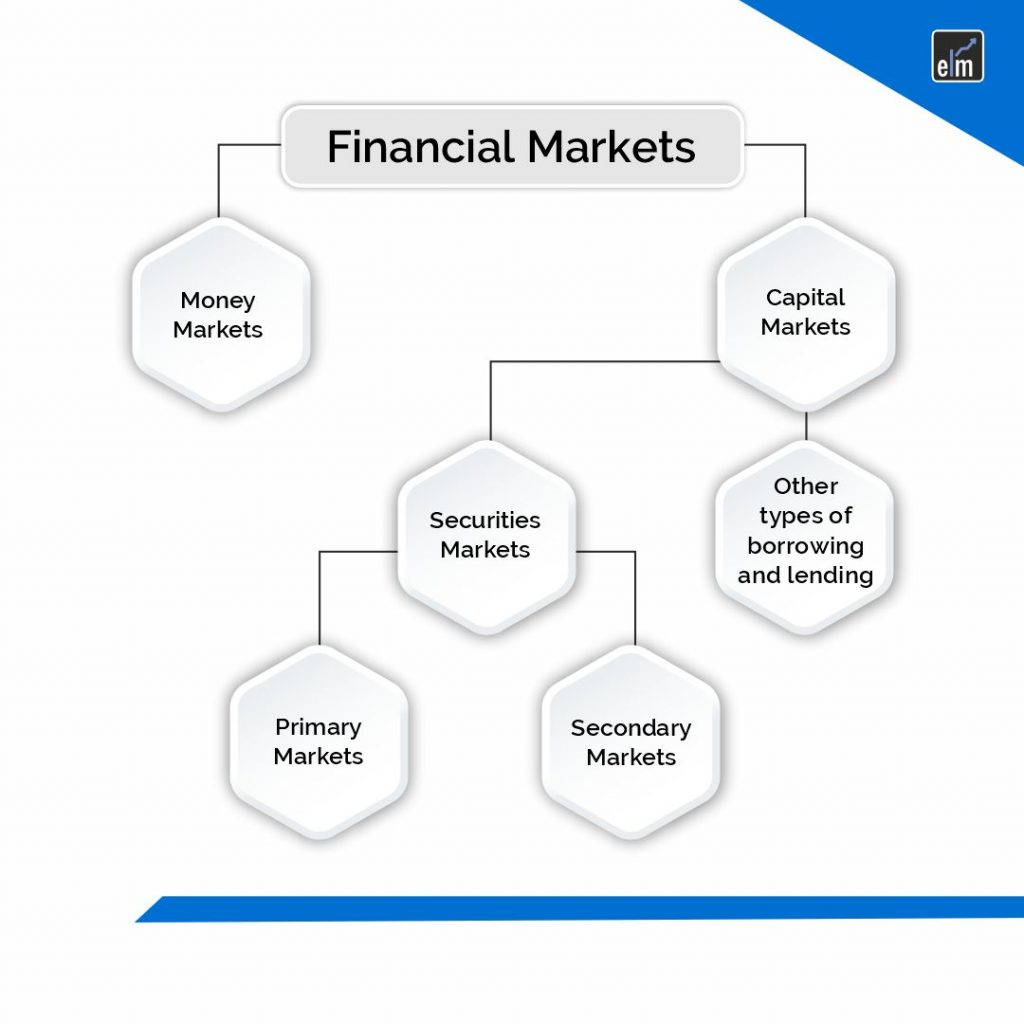

Financial markets are majorly divided into the following components:

- Capital markets — long-term capital (equity, bonds).

- Money markets — short-term liquidity (T-bills, commercial paper).

- Derivatives — futures/options on indices, stocks, commodities.

- Exchanges & intermediaries — NSE, BSE, brokers, depositories, regulators.

What is a Capital Market?

A marketplace where securities (shares, bonds, debentures) are issued and traded. It channels savings into productive investment, gives companies a way to raise long-term finance, and provides investors with liquidity and price discovery. Modern electronic trading connects investors from Mumbai to Melbourne in milliseconds.

The capital market and in particular the stock exchange is referred to as the barometer of the economy. – ICSI study material

What is a Securities Market?

The securities market provides the platform for those financial instruments that are transferable by sale. It further comprises two important components: the primary market and the secondary market. Primary markets deal with newly issued stocks and securities, whereas secondary markets deal with already issued ones.

Two Halves of the Securities Market

1. Primary Market: Where Companies Ask for Money

This is where fresh capital is raised. IPOs and FPOs live here. For example, Tata Capital has been preparing a large IPO as NBFCs and finance houses rethink funding and listings, a reminder that big financial sector listings can reshape investor flows.

Other big candidates on the IPO radar (policy permitting) include high-profile listings such as parts of the Reliance/Jio ecosystem or even the NSE, as regulators have cleared roadblocks that could allow mega-listings. These are the kind of events that deepen markets and draw fresh capital.

2. Secondary Market: Where Investors Trade Existing Securities

Once a security is listed, investors buy and sell it on exchanges like NSE and BSE. Liquidity, the ability to turn assets into cash quickly is a key benefit.

Real-sector snapshots:

- IT sector: Large IT names like TCS and Infosys have seen pressure in 2025 (Nifty IT was one of the weakest sectors in 2025), highlighting cyclical demand and AI/open-automation concerns for services firms. That’s the sort of sector-level risk that moves indices and investor sentiment.

- Autos / EVs: Tata Motors, facing regular gasoline/ICE cycles while also pushing EVs reported mixed monthly sales trends as EV momentum builds. These shifts show how structural themes (EV adoption) can co-exist with short-term demand swings.

- Banking / Financials: Big banks like HDFC Bank and ICICI Bank remain central to credit cycles; their quarterly results and deposit growth data are watched as proxies for domestic demand and lending health. HDFC Bank’s Q1 FY26 presentation shows strong deposit traction — a reminder that banks are the plumbing of credit.

What is a Money Market?

Need funds for a few weeks or months? Instruments such as T-bills, commercial paper and certificates of deposit handle short-term liquidity. These are lower-risk, lower-return tools important for treasury desks and large corporations.

Unlock the secrets of the Indian Capital Market with our Futures Trading Course. Start your journey today!

Regulators & Rule Changes: Why They Matter?

SEBI regularly updates rules to balance market growth and investor protection. One recent example: implementation timelines for margin obligations via pledge/re-pledge were extended to give stakeholders more time, showing regulators aim for orderly transitions rather than abrupt shocks. Rules like these can affect liquidity, broker operations and how leveraged positions are handled.

How the Market Actually Moves Money

- You (the saver) open a demat account and buy shares or bonds.

- Primary market: Companies raise money via IPO/FPO (example: Tata Capital preparing an IPO)

- Secondary market: Investors trade those securities on exchanges; sector news (like IT weakness or Tata Motors’ EV updates) moves prices.

- Intermediaries & regulators (brokers, depositories, SEBI) keep the system running and adapt the rules.

Quick, Modern Examples:

- Retail participation up — demat accounts >20 crore, led by young investors.

- Big IPOs brewing — Tata Capital and structural changes that might allow Reliance Jio / NSE listings. These could be market-making events.

- Sector rotations — IT underperformance in 2025 and the parallel EV push in autos (Tata Motors) show why sector selection matters.

Bottomline

The capital market channels savings into growth. It gives companies capital, investors opportunities, and the economy fuel. The plumbing exchanges, depositories and regulators keeps everything moving, and it’s changing as participation and products evolve. If you want to be more than a spectator: learn the basics, pick a plan (long-term vs short-term), and respect both volatility and the rules that keep markets honest.

Frequently Asked Questions (FAQs)

1. What is a capital market?

A financial market where long-term securities like stocks and bonds are issued and traded.

2. How does the capital market function?

Companies raise funds in the primary market; investors trade in the secondary market; intermediaries and regulators provide infrastructure and protections.

3. What are the primary components of the capital market?

Stock exchanges (NSE, BSE), primary markets (IPOs/FPOs), secondary markets (trading), debt markets, derivatives, and money market instruments.

Hello Shruti! This blog explains about the Indian capital market in great depth..For someone like me, who is new to this market, it was very helpful..Thanks for sharing your knowledge..

@Sukanya – Hi, Thank you for reading through and appreciating.

We will be further coming up with blogs on related topics. Let us know in case of any similar topics you wish us to add further.

Happy Learning

Hi, Thanks for sharing the basic details around Indian capital market and I was searching for details on it. Actually I am currently pursing CFA level 1 exam and am going through all the educational site to give basic insight around finance anf found it very useful

Hi Mudra,

Thank you for appreciating. Let us know in case you need to know about any similar topics.

We would be glad to provide details on same.

Thank you for the information. We can also add Currency markets being the largest market in the world. This includes all aspects of buying, selling and exchanging currencies at current or determined prices. Currency markets is a global decentralized or over-the-counter (OTC) market for the trading of currencies. Foreign Institutional Investors (FIIs) to participate in Indian Currency Exchange platform to trade and/or hedge with lower costs and higher leverage in an organized regulated environment as compared to the OTC market.

I had been freed from the bracket of ambiguity that I involved in. Your blog gives explicit insight about money and capital market. Thank enormously. Improve on

Welcome