Algorithmic trading with high-speed trade execution, a huge volume of transactions, and a very short investment horizon are known as high-frequency trading (HFT).

The previous several decades have seen a substantial drop in the price of information and a rise in the number of participants in the stock market due to the rapid expansion of trading, which has been facilitated by greater use of technology. One could consider high-frequency trading to be an example of this evolution.

HFT uses specialised computers to execute trades as quickly as feasible. Due to its complexity, big institutional investors like hedge funds and investment banks are the ones who use it the most.

In today’s blog, let us discuss about High-Frequency Trading (HFT)-

Table of Contents

What is High-Frequency Trading (HFT)?

High-frequency trading, or HFT, is a type of trading in which quick trade transactions are carried out by using complex algorithms and technology.

Taking advantage of small price differences in the market depends on speed and automation. HFT traders execute trades at breakneck rates in an attempt to capitalise on these transient chances.

The concepts of efficiency and speed are the foundation of high-frequency trading. HFT companies use state-of-the-art hardware and robust computers to analyse enormous amounts of market data instantly.

These algorithms spot trends, patterns, and discrepancies in price that can be made money off of. Automated algorithms take advantage of even the slightest price differentials by executing trades within microseconds of detecting a favourable opportunity.

How HFT Works?

An automated trading method is known as high-frequency trading. Algorithms are used in order to find trading opportunities. Banks, financial institutions, and institutional investors often employ HFT.

These entities are able to quickly execute large quantities of trades because of it. Everything is computerised, which makes trading simple.

Liquidity is supplied to the market by HFT. However, it eliminates the human element from the equation and may lead to significant market fluctuations.

The concepts of efficiency and speed are the foundation of high-frequency trading. HFT companies use state-of-the-art hardware and robust computers to analyse enormous amounts of market data instantly. These algorithms spot trends, patterns, and discrepancies in price that can be made money off of. Automated algorithms take advantage of even the slightest price differentials by executing trades within microseconds of detecting a favourable opportunity.

Trading Strategies

Here are some trading strategies for HFT-

1. Market Making

HFT companies use a technique called “market making,” which provides liquidity by constantly quoting buy and sell prices for particular assets.

They get revenue from the bid-ask spread and provide a liquid market by continuously being eager to buy or sell.

2. Quote Stuffing

HFT traders utilize a tactic called stuffing to rapidly flood a trading venue with buy or sell orders. This strategy seeks to confuse the market and interfere with other players’ ability to make decisions.

3. Tick Trading

HFT companies use a tactic called “tick trading” to profit on minute changes in a security’s price, or “ticks.” Their goal is to quickly execute numerous trades in order to profit from these slight price differentials.

4. Statistical Arbitrage

The tactic known as “Statistical Arbitrage” entails locating and taking advantage of pricing disparities between related financial products. HFT companies look for patterns and correlations in historical data and statistical models and then place trades when these patterns diverge from their predicted values.

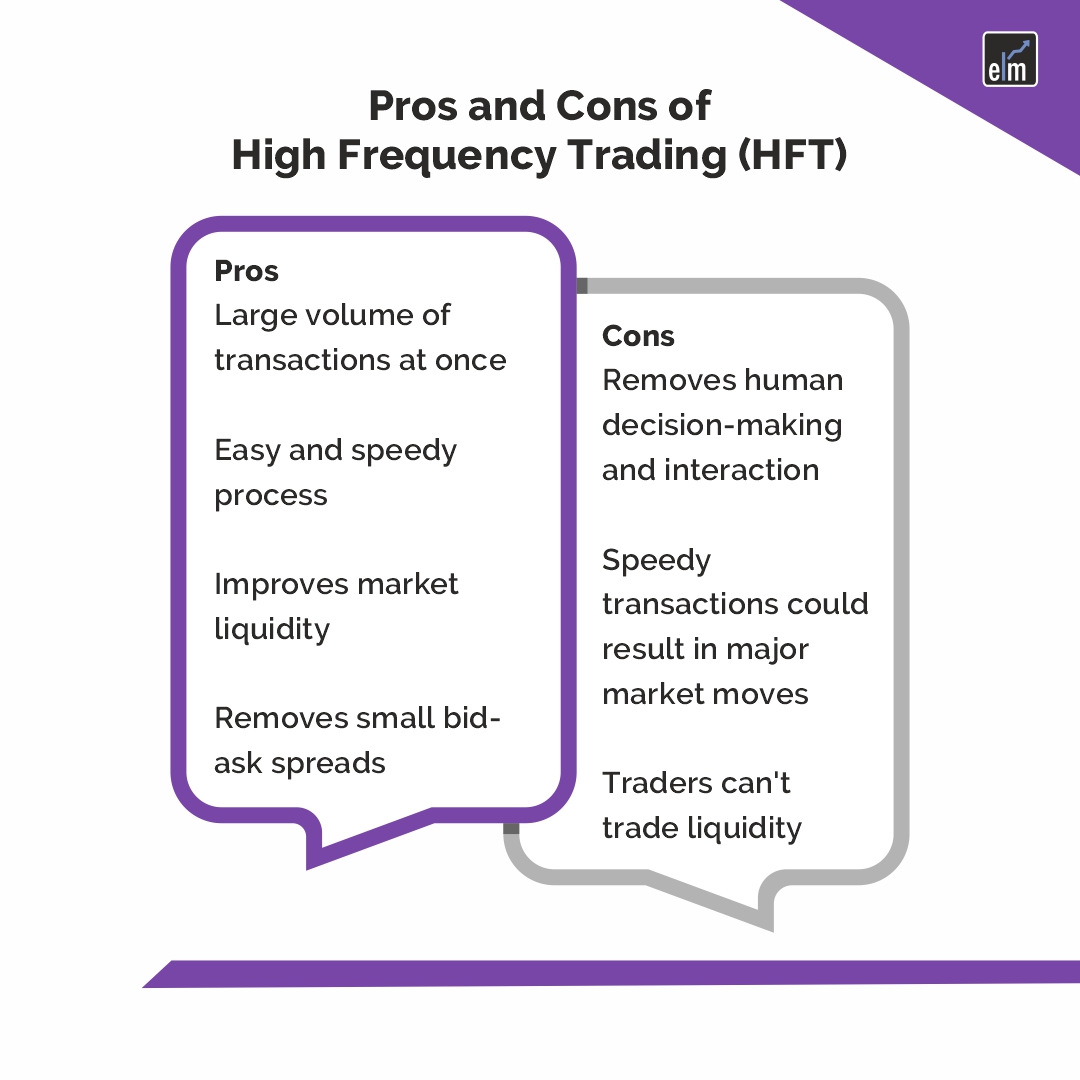

Pros and Cons of HFT

Here are the advantages and disadvantages associated with HFT-

Advantages

High-frequency trading’s primary advantages are its ease of use and quick transaction execution. Banks and other traders have the capacity to complete a huge number of trades quickly—typically in a matter of seconds.

Increased market liquidity and the elimination of bid-ask spreads that would have been too tiny were two benefits of HFT. Fees were added to HFT in order to test this, which caused bid-ask spreads to rise. One study evaluated the impact of government-imposed HFT fees on Canadian bid-ask spreads.

Risks

HFT is associated with several risks, such as

- Operational risks: Serious financial losses may arise from technical hiccups, system malfunctions, or connectivity problems.

- Regulatory risks: In order to stop unfair practices and market manipulation, HFT operations are strictly controlled and supervised. Regulation violations may result in legal ramifications as well as harm to one’s reputation.

- Model risks: HFT tactics mostly depend on intricate models and algorithms. Significant losses may arise from models that are inaccurate or defective.

Bottomline

High-frequency trading, or HFT, is a trading method that takes advantage of cutting-edge technology, sophisticated algorithms, and quick execution to profit from small fluctuations in market prices. It has benefits, including better price discovery and greater liquidity, but it also has drawbacks and hazards. Fostering a fair and effective trade environment requires striking a balance between market integrity and technical improvements.

For more Market Updates, Visit StockEdge

Frequently Asked Questions (FAQs)

What are the risks of HFT trading?

Compared to the traditional investor that employs a long-term strategy, the ratio is significantly higher. Sometimes a high-frequency trader will only make a tiny profit—just a few pennies—which gives them the opportunity to make gains all day long but also raises the possibility of suffering a huge loss.

How does HFT affect the market?

HFT is sophisticated algorithmic trading where a lot of orders are filled quickly. It reduces tiny bid-ask spreads and increases market liquidity. HFT is chastised for giving big businesses the advantage in trading.

What is market making in HFT?

“Market making” is how HFT businesses refer to their high-frequency trading tactics, which entail putting a limit order to buy (or bid) or a limit order to sell (or offer) in order to profit from the bid-ask spread. Market makers offer a counterbalance to incoming market orders by doing this.