Investors often get confused about whether to invest in Fixed Deposits Vs. Mutual Funds.

Mutual funds and fixed deposits (FDs) are two popular investing options. However, there are many differences between them.

Mutual funds provide returns based on the performance of the underlying asset’s market and mostly invest in stocks, bonds, and commodities (such as gold).

Whereas, FDs provide a fixed return rate for a predetermined period of time. Fund houses offer mutual funds, whereas banks and non-bank financial companies (NBFCs) offer fixed deposits.

So, before investing, it is important to understand the differences between these two investing options.

In today’s blog, let us know the key differences between Fixed Deposits vs. Mutual Funds so that you can decide whether to invest in either of them.

Table of Contents

What are Fixed Deposits (FDs)?

Banks and non-banking financial firms (NBFCs) provide fixed deposits, which are financial instruments that allow you to deposit a lump sum for a certain amount of time and earn a predetermined rate of interest.

For the term of the deposit, the interest rate on FDs is fixed. You get the principal amount plus any interest accrued at the conclusion of the term.

Because they guarantee the invested money and offer a guaranteed return, FDs are regarded as reasonably safe. You can use the online FD Calculator to determine the amount of your fixed deposit that will mature.

What are the Types of FDs?

In India, different banks provide different kinds of fixed deposits. The two main types are cumulative and non-cumulative FDs.

When a cumulative deposit matures, the principal amount plus interest are paid together; interest is not paid during the deposit’s currency.

Conversely, interest is paid in addition to the deposit’s currency in the event of a non-cumulative deposit. Both types of FDs have the same interest rate.

What are Mutual Funds?

A mutual fund is a type of investment where money is pooled from multiple investors and used to purchase stocks, bonds, and other securities.

The fund’s investors are represented in the investment decisions made by its qualified portfolio managers. The fund’s investment goal and strategy are taken into consideration by the portfolio management when choosing which securities to acquire and sell.

Mutual funds can be passively managed, meaning the fund just monitors a market index, or actively managed, meaning the portfolio manager makes frequent trades to outperform the market.

What are the Types of Mutual Funds?

There are many types of Mutual Funds in India, as discussed below-

- Equity Funds– These kinds of funds invest mainly in stocks of the companies.

- Debt funds: Invest in fixed-income instruments, such as bonds, which have less risk and predictable returns as compared to equity funds.

- Hybrid funds: Depending on the precise allocation, a blend of debt and equity provides a balance between risk and return.

- Sectoral Funds: Concentrate on particular industries, such as healthcare or technology, to offer focused exposure at a higher risk.

- Index funds: These funds follow a market index, such as the Nifty 50, passively in an effort to replicate its performance while paying fewer costs.

Fixed Deposits vs. Mutual Funds

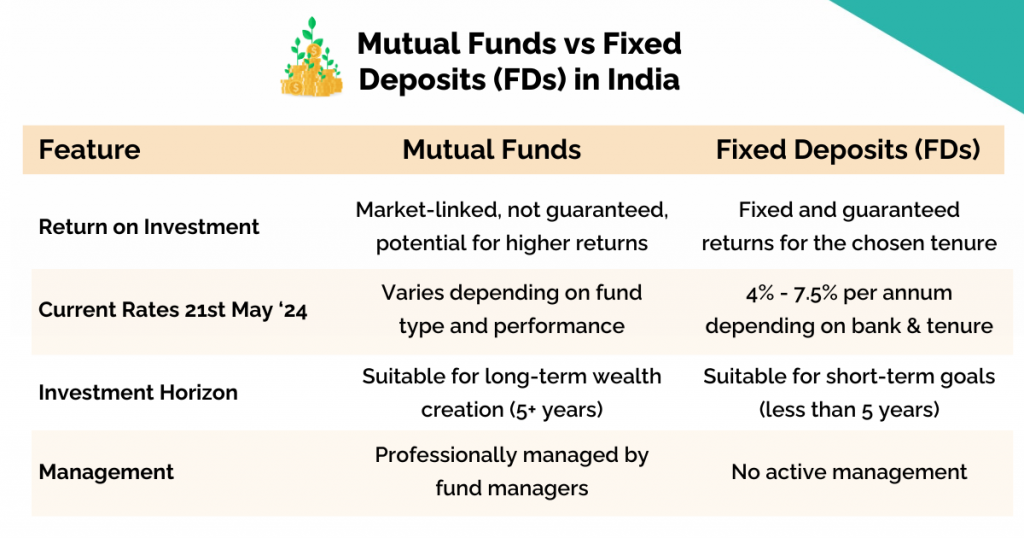

Let us compare between fixed deposits and mutual funds:

1. Risk Comparison

Fixed Deposits are low-risk financial instruments, with the principal amount and return guaranteed. The main risk is the bank or financial institution’s financial stability, which is usually low. There is also a risk that returns may not keep up with inflation.

Mutual funds are subject to market risks, credit risks, and management risks. The value of the investment can fluctuate based on market conditions, economic factors, and the performance of the underlying assets. For debt mutual funds, there is a risk that the issuers of the underlying bonds may default. The decisions of the fund manager can also influence the performance of mutual funds.

2. Returns Comparison

FD returns are fixed and guaranteed for the chosen tenure. You know exactly what you will earn at the time of maturity.

Conversely, mutual funds’ returns are potentially high, unpredictable and not guaranteed.

3. Liquidity and Access

FDS have a pre-determined lock-in period, say – 1, 3, 5 years. If you want to withdraw early, then you may face a penalty; the penalty amount depends on the bank and the term left. If the FD account gets matured, you can renew the FD account.

Mutual Funds are more liquid and accessible than FDs. They can be redeemed on any business day at the NAV in effect at that time, although some funds may have exit loads. Mutual fund providers impose exit loads, or fees, on investors who sell or redeem their units prior to a predetermined timeframe. These charges are meant to offset the expenses incurred by early fund withdrawals and to deter short-term trading.

4. Investment Tenure

FDs are suitable for short-term to medium-term goals, whereas mutual funds are suitable for medium to long-term wealth creation, mainly for those who want to beat inflation and grow wealth over time.

5. Taxation

Interest earned from FDS is considered income from other sources and taxed according to the tax slab. Whereas the taxation on mutual funds depends on the type of fund as well as the holding period.

6. Suitability and Goals

Fixed Deposits are suitable for those investors who are seeking capital preservation and predictable income.

Mutual Funds are suitable for investors seeking capital growth and higher returns, and tools like an SIP calculator can help them plan their investments more effectively.

Frequently Asked Questions (FAQs)

Is FD better than mutual funds?

Your risk tolerance and financial objectives will determine this. Fixed deposits are a safer option if you’re seeking for an investment with minimal risk exposure. However, you ought to think about investing in mutual funds if you’re seeking for substantial risk and respectable returns.

Which is better, SIP or fixed deposit?

You can invest in an FD if your main objective is capital preservation and you do not anticipate significant gains. Invest in a SIP if you’d like to make goal-oriented investments that will yield higher returns. You can invest in a fixed deposit scheme if you have a specific timeframe in mind for your investment.

Which is better, mutual funds or time deposit?

Because they are less volatile and provide guaranteed returns, fixed deposits are the best option for investors with short investment horizons. Conversely, mutual funds are better suited for long-term investment goals since they have the ability to yield larger returns and, over time, lessen the effects of market volatility.

Conclusion

For cautious investors looking for little risk and assured profits, fixed deposits are a good option. For short- to medium-term objectives where capital preservation is crucial, they are perfect.

Investors who are willing to take on more risk in exchange for the possibility of larger returns would be better off investing in mutual funds. They are suitable for people who want to outpace inflation and gradually increase their wealth, as well as for medium- to long-term investing goals.

A financial aim, investment horizon, and risk tolerance should all be considered by investors prior to selecting between mutual funds and fixed deposits. Investing in a variety of asset classes can also be a wise way to manage risk and reward.

You can visit the Mutual Funds section in StockEdge.