In the last year 2020, we saw how Nifty 50 went on a roller coaster ride from making a low of 7,511 in the month of March to reaching its all-time high at 14,024 at the year-end.

The performance of the stock market witnessed a sharp fall in the month of March when Nifty 50 went from 11380 levels to 7500 levels mainly due to coronavirus panic.

The Government announced the Union Budget on 1st February 2020 with the coronavirus panic led to the SENSEX fall by 2%.

Later on WHO announced Coronavirus as a pandemic on February 28th, 2020 due to which the Nifty and the Sensex witnessed the worst weekly fall since 2009.

Let us go through the timeline of events of 2020 which affected the price movements of the Indian Stock Markets:

Performance of Stock Market in 2020:

Here is how the performance of the stock market varied in 2020 –

- In the beginning of January, Nifty 50 touched an all-time high at the 12400 levels.

- On January 27th, the first case of COVID-19 was reported in India.

- On 1st February 2020, the Union Budget was announced and the market fell in the next session by 250 points.

- On 6th March, we saw the biggest one day fall in obsolete terms when Nifty fell by 868 points among global selling.

- Nifty ended 431.55 points down at 11.201 and thus made the worst weekly fall for Nifty since 2009.

- On 24th March, the 21 days lockdown was declared.

- On 25th March, a big recovery came in the market as Nifty surged 708 points.

- 1000 cases are registered in India by mid-April.

- On 19th May, cases in India crossed the 1 lakh mark.

- Economic stimulus worth 20 lakh crores were announced and push for Make in India.

- At the end of May, India and China border tensions escalated.

- At the beginning of August month, Gold touches an all-time high of 57,000 as interest continued in safe heaven.

- India’s GDP contracted by 23.9%.

- In the month of October sales in many sectors reached the Pre-COVID level and green shoot in economic indicators with GST collection, Petrol Demand, PMI recovering to Pre-COVID levels.

- In the months of November and December Nifty continued to make new highs.

Despite all the above events, Nifty has climbed higher specially at the end of the year and gave us some signals on what lies in the year, 2021.

What to expect from the Indian Stock Market in the year 2021:

It is expected that in the year 2021 the Indian economy would return to normalcy.

In the first few months of 2021 certain events like the COVID vaccination, the Union budget, and the US government’s new policies will be the key driving factors.

Learn basics of stock market with Stock Market Made Easy by Market Experts

This New Year we can also expect to see the performance of the stock market and economy align with each other.

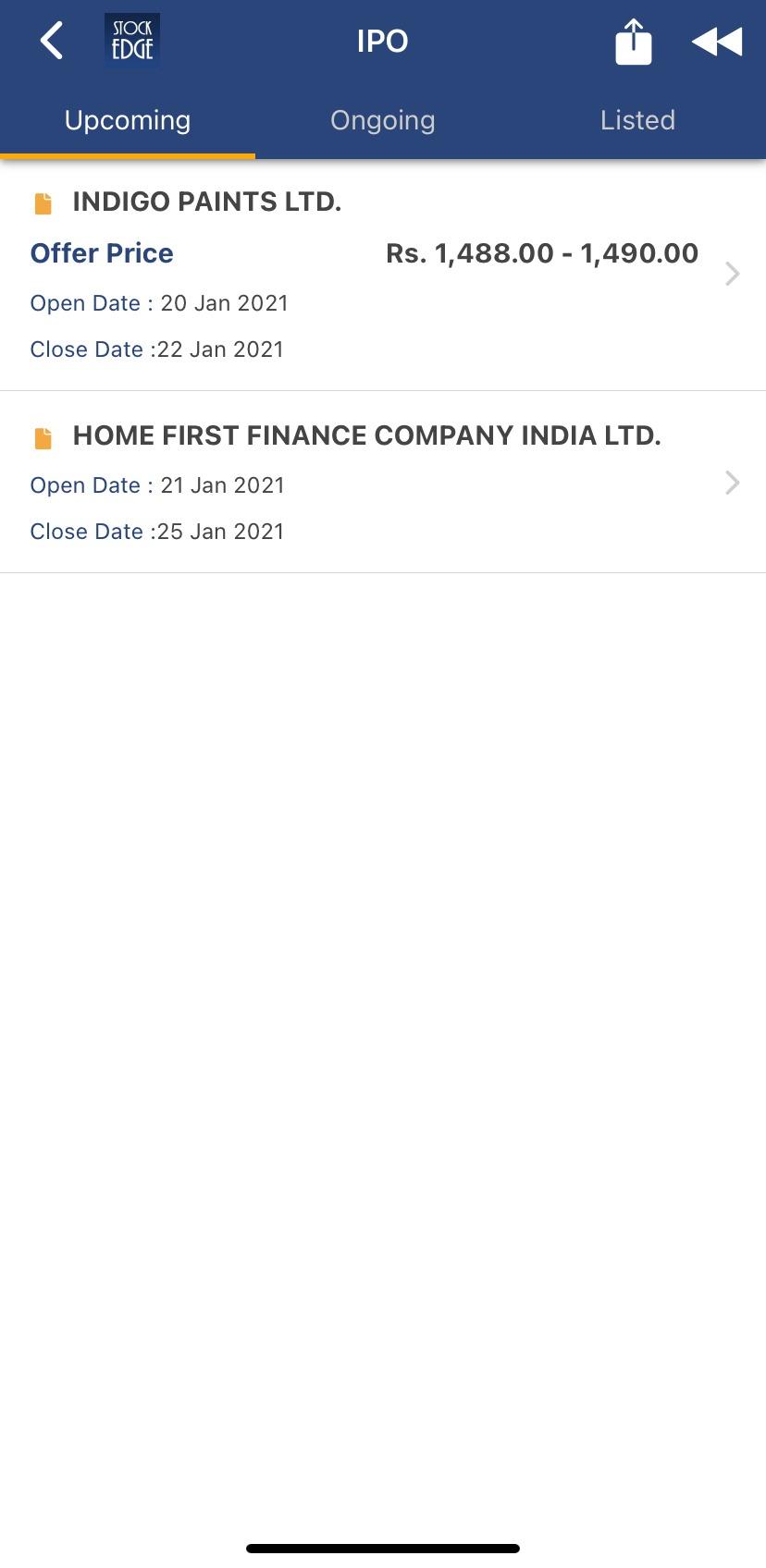

Also, there are many IPOs like Indian Railway Finance Corporation, Indigo Paints Ltd., Home First Finance Company India Ltd. this year that will greatly benefit the overall Indian economy, and will also provide capital to the companies which will drive the overall Indian economic growth.

You can check the upcoming IPOs

Happy Learning!