Lot of blogs have been written on the expenses attached to the equity transactions. However, many have missed to explain properly the composition of this expense.

In this blog we have categorized the expense into 2 parts:

Part A: Charges

Part B: Taxes

Apart from purchase and sales transaction, it is extremely important to understand the elements of taxation on investment products.

Now, let us first understand that in stock market, the trades done by traders or investors can be classified into two broad categories, based on time period, as mentioned below:

- Intraday– buy and sell shares within the same trading session.

- Delivery based trade – if the stock is not squared off and held for more than one trading session, it is a delivery-based trade.

Before understanding the charges and taxation part, we must know the two types of brokers in India:

- Full Service Brokers – Stock brokers who provide additional services like research and advice, tax tips, retirement planning, etc. other than transaction services. Eg- Kotak Securities, ICICI Direct, Angel Broking, Sharekhan, Edelweiss.

- Discount Brokers – Stock brokers who provide buy and sell transaction services. They offer cheaper brokerages. Eg- Zerodha, 5paisa, Upstox.

PART A – Charges

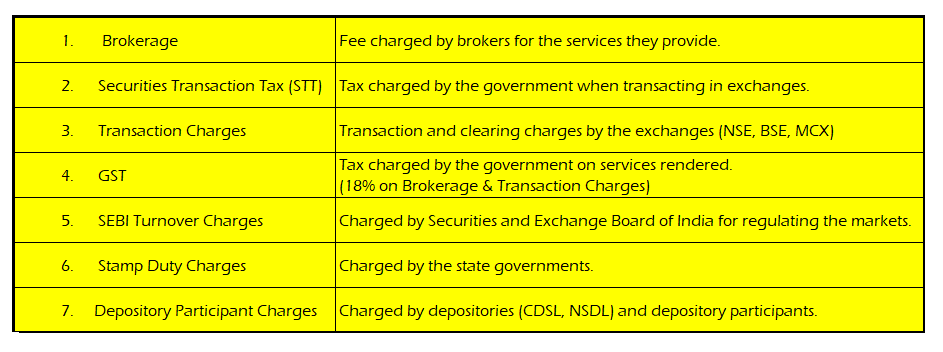

What are the charges levied in equity transaction?

In any equity trade, we have to pay the following charges.

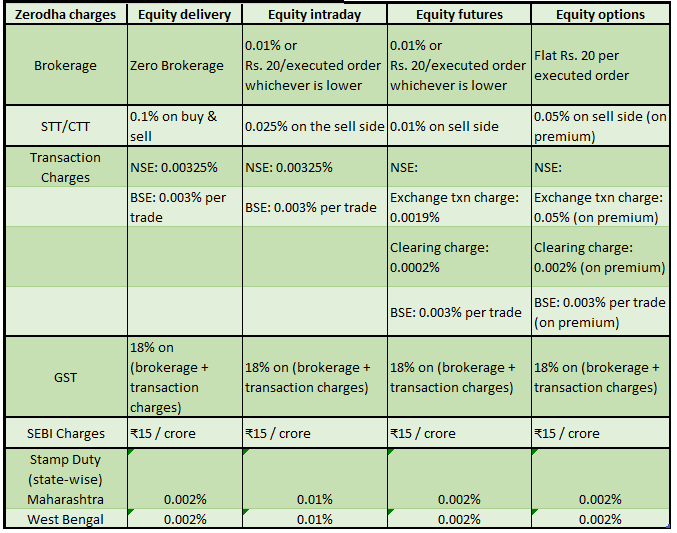

Based on the type of broker, rates vary for different brokerage firms.

For instance, charges by discount broker Zerodha has been shown as an illustrative example.

rates source: zerodha.com/charges

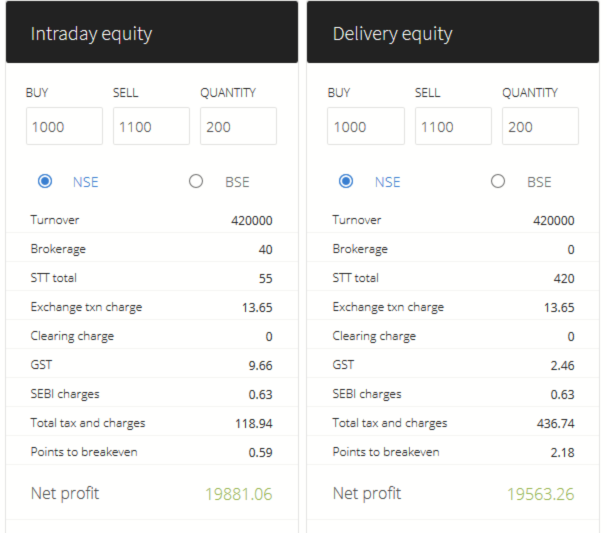

Here is an illustration of charges paid on trades done in intraday equity and delivery equity in Zerodha account.

Part B – TAXES

In this section, we will discuss the taxation structure based on the following two categories:

- Intraday equity trading

- Delivery based equity trading/investing

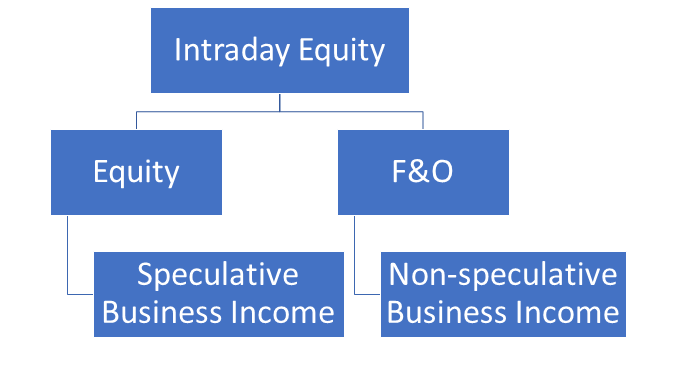

1. Intraday equity trading

If you are involved in intraday equity trading, the income earned is considered as speculative business income as delivery is not taken in such trades.

Income from intraday trading is a business income and taxed as per the tax slab of the individual.

Futures & Options (F&O) Trading

Income from F&O trading is considered non-speculative business income. F&O is considered non-speculative as these instruments are used for hedging purpose and they are defined as non-speculative.

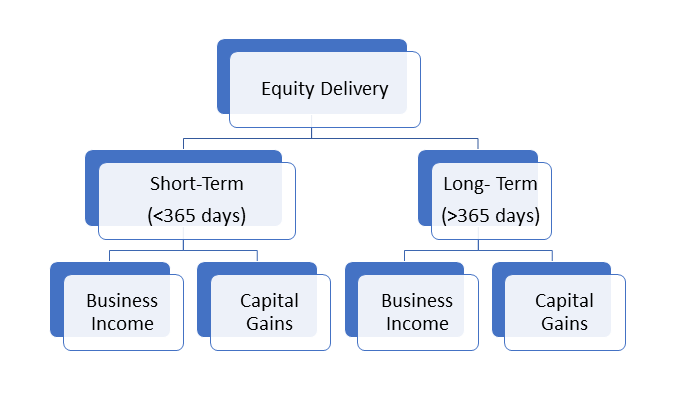

2. Delivery based equity trading/investing

If you hold equity investment for more than 1 trading session, then it is considered delivery based. You are actually taking delivery of the contract in your demat account.

With reference to the above discussion, there was an important circular released by the he Income Tax Department which allows an individual to decide whether his income from equity investments will be treated as “business income” or “capital gains”.

NOTE: The investor has to follow the chosen method consistently for all future years.

This section is the most interesting section of the entire blog as we have categorized the above circular with examples :

Income from equity investment :

When treated as Business Income

If you choose to consider income from equity investment as “business income”, then it will be taxed as per the individual’s tax slab along with any other income such as salary, house rent, capital gain.

Carry forward and set-off

- Speculative losses can be carried forward for next 4 years and can only be set off against speculative gains you make in that period.

- Non-speculative losses can be set off against any other income except salary income in the same year. It means they can be set off against interest income, rental income, capital gains in the same year.

- Non-speculative losses can be set off against speculative gains.

- Non- speculative losses can be carried forward for the next 8 years. Carried forward non-speculative losses can be set off only against non-speculative gains and speculative gains made in that period.

Eg 1:

My salary -Rs. 10,00,000

My interest income – Rs. 2,00,000.

Non-speculative business loss – Rs. 4,50,000.

Speculative loss (intraday) – Rs. 3,00,000.

Non-speculative business loss can be set off against “interest income”. Remaining 2,50,000 (4,50,000 – 2,00,000) can be carried forward for next 8 years.

Speculative loss of 3,00,000 can be carried forward for next 4 years and can be set off against future speculative gains.

Eg 2:

My salary – Rs. 10,00,000

My other income- Rs. 2,50,000

Non-speculative business loss- Rs. 3,00,000

Speculative income (intraday) = Rs. 500,000

Non-speculative business loss of Rs. 3,00,000 will be set off against speculative income.

Total Income:

Salary- Rs. 10,00,000

Other Income – Rs. 2,50,000

Speculative business income – Rs. 2,00,000 (3 lakhs set off)

Total Income= Rs. 14,50,000.

- When treated as Capital Gains

If you choose to consider income from equity investment as capital gains, then further bifurcation in terms of short-term and long-term capital gains should be made.

Short-Term Capital Gain (STCG)

If the stock is held for less than 365 days, income/loss from it is Short-Term Capital Gain or Loss (STCG/ STCL)

Tax on STCG

Short term capital gain from equities is taxed at 15%. If the income of the individual is below the taxable limit of Rs. 2,50,000, the deficit amount can be adjusted from short term capital gain.

Eg:

My Total Income- Rs. 1,80,000 (below Rs. 2,50,000)

STCG from equity – Rs. 1,00,000

Deficit amount = (2,50,000 – 1,80,000) = 70,000

Adjusted from STCG = 70,000

Remaining STCG = (1,00,000 – 70,000) = 30,000

Tax on STCG = 15% of 30,000 = Rs. 4,500

Carry Forward and Set Off of STCG

Short-term capital losses can be carried forward for next 8 years and can be set off against any short-term capital gains.

Eg:

If STCL for present year is Rs. 50,000. This can be carried forward to next year. Suppose, in the next year the STCG is Rs. 80,000. Tax on STCG @ 15% will have to be paid on Rs. 30,000 (80,000- 50,000)

Long Term Capital Gain (LTCG)

If the stock is held for more than 365 days, income/loss from it is Long-Term Capital Gain or Loss (LTCG/LTCL)

Tax on LTCG

LTCG above and over Rs. 1 lakh is taxed at the rate of 10%.

Eg:

My Salary – Rs. 10,00,000

My other income- Rs. 1,20,000

LTCG on equity investing- Rs. 2,25,000

Taxes:

LTCG Tax on equity = 10% of 1,25,000 (2,25,000- 1,00,000) = Rs. 12,500

Total Income:

Salary- Rs. 10,00,000

Other Income- Rs. 1,20,000

Total= Rs. 11,20,000 will be taxed as per normal tax slab rate.

Carry forward and set off of LTCG

Long term capital loss can be carried forward for next 8 years and can be set off against long term capital gain.

Key Takeaways

- Charges paid for equity trading and investing

- Speculative (Intraday) and non-speculative business income

- Tax treatment of business income and capital gains from equity transaction

- Set off and carry forward of losses.

My brother suggested I might like this blog. He was totally right. This post actually made my day. You can not imagine just how much time I had spent for this information! Thanks!

Every person should be this type of knowledge is important. Thanks sir ji

Hi,

We really appreciated that you liked our blog.

Keep Reading!

WONDERFUL INFORMATION

Hi,

We really appreciated that you liked our blog.

Keep Reading!

Much needed information in simplest manner

Hi,

We really appreciated that you liked our blog.

Keep Reading!