Key Takeaways:

Small Profits, Multiple Trades

Target quick gains from several trades to reach ₹500 daily with lower risk.

Trade News-Based Stocks

Focus on stocks with news for better volatility and profit potential.

Use Stop Loss

Limit losses by sticking to a strict stop loss for every trade.

Cut Trading Costs

Choose low-brokerage platforms and avoid overtrading to keep profits intact.

Every individual comes to the stock market with the hope of making money. It is viewed to be the most lucrative money-making avenue as it provides a return better than what the other financial avenues have to offer. Now the question that arises is whether one can earn Rs 500 from the stock market daily.

The answer to this is yes, one can, provided one has the required knowledge, skill, experience, discipline and ability to time the market. However, most of the people fail in this Endeavor and blame the market for it. But one has to keep in mind that the market is always right and gives every trader a chance to make profits, irrespective of the direction it moves in.

Thus, trading is nothing but a strategy-based art. Some people may consider it as a game of gambling but for others, it’s a huge source of income. Keeping the above in mind, along with hard work and practice, over a period of six months to a year, one can earn Rs. 500 from the stock market daily. So, let us discuss a few of the many ways one can earn Rs 500 daily from the stock market.

How can we earn Rs 500 from the Stock Market daily?

Below are the ways in which we can earn Rs 500 from the Stock Market daily

1. Take small profits and do multiple trades

You might wonder how much one can earn in day trading in India?

As the prime intention here is to make regular income, therefore it will be to the trader’s benefit to concentrate on small profits and do multiple trades a day.

Traders need to keep in mind that it is highly impossible to make 2-3% profit on a frequent basis in a single trade. However, implementing this strategy will help them achieve profitability by increasing the number of winners and sacrificing the size of the wins.

This is contrary to the “let your profits run” concept, where the trader has to sit through a lot of uncertain price action and may eventually end up turning his profits into losses.

So, the trader must keep booking profits whenever he gets an opportunity rather than exiting on his weakness.

The strategy revolves around three basic ideas:

(I) Exposure to the dynamic market for a small time frame will limit the probability of running into an adverse event.

(II) It is easier for a stock to make a Rs 2-4 move rather than making a Rs 20-30 move in a day.

(III) Smaller price movements are more frequent than the big ones. Even when the market is range-bound, there may be small movements that a trader can exploit.

Thus, implementing this strategy will help traders to generate multiple small wins throughout the day adding to a good amount of daily return.

This way, they can earn Rs 500 from the stock market on a daily basis.

However, this does not mean to over trade and should take position only when he is confident.

2. Trade stocks in news

Momentum in either direction is very much essential for stock to provide a significant intra-day return. This is usually fueled by news flows, which have a direct impact on the price of a stock.

News based on earnings reports, orders, upgrades/downgrades by brokerages, product announcements, FDA announcements, economic data releases, geopolitical factors and other macro and micro issues can push stock prices significantly in either direction.

Tracking daily news and comprehending the same will help traders to pick stocks with momentum and place their trading bets accordingly.

Trading in momentum stocks will increase the probability of making profits, thus adding to their daily income.

This is another way one can earn Rs. 500 daily from the stock market.

3. Stop Loss Discipline

One of the golden tips to maximize profit is to put a stop loss in trading for every intraday trade. A trader can decide upon the percentage of stop loss to be applied depending on his risk appetite and the volatility of the stock.

Application of stop-loss helps a trader in the following ways:

(I) Protects capital erosion.

(II) Helps to churn the money faster, which is essential for increasing profitability in trading.

(III) Helps a trader to reduce the concentration of positions in risky stocks for a longer period of time. Thus, minimizing the number of open positions, which are vulnerable to market fluctuations.

So, from the above it is clear that adherence to strict stop loss will limit a trader’s loss to a great extent, helping him to earn a better daily return.

4. Minimizing trading cost

This will help a trader to maximize his quantum of daily profit. A trader should keep in mind that every trade that he places comes with a cost and are incurred irrespective of profits or loss made by them.

Trading cost includes brokerage fees, Securities Transaction Charges/Commodity Transaction Charges, Turnover charges, GST, SEBI charges, Stamp charges and AMC (Annual maintenance charges) among others.

Transaction costs impact day trading comparatively more as it usually involves huge volumes and a higher number of transactions.

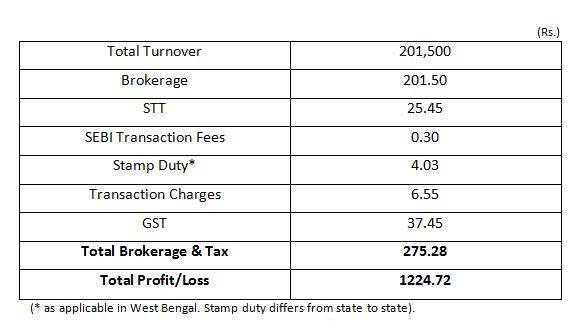

Let’s understand this through an example:

Mr Z, an intraday trader who bought shares worth Rs 1,00,000 and sold the same for Rs 1,01,500, the total volume for the day will be Rs 2,01,500

Assuming 0.1% brokerage.

Sell price – Cost price = Profit

Rs1,01,500 – Rs1,00,000 = 1,500

The actual profit earned is Rs 1,500, i.e., 1.5%.

Now, let’s calculate the return by applying the necessary transaction costs.

So, from the above, it can be understood that about 18.35% of the profit is lost due to transaction costs, brokerage being the highest.

The solution to this is:

(I) A trader can open his trading account with a Discount Broker. Discount brokers charge low brokerage as low as Rs 10/trade, irrespective of the order value. In this case, the total brokerage & tax would be Rs 83.78, according to the above table.

(II) A new concept is emerging in the market called Free Intraday Trading, where brokerage is charged a flat fee of, say, Rs 999 on a yearly basis i.e., Rs 83.25 per month. In this case, the total brokerage & tax would be Rs 157.03, according to the above table.

These will help a trader reduce his brokerage significantly and maximize his profits so that he can easily earn a daily return of Rs 500 from the stock market.

Bottomline

Assuming the market operates for 240 days a year, earning Rs. 500 daily from the stock market translates to an annual sum of Rs. 1,20,000. By applying the requisite knowledge, implementing the right strategies, and maintaining discipline, traders can work toward achieving this daily target effectively. If you’re just starting out, our Beginner’s Guide to the Stock Market is a great resource to help you build a solid foundation.

A trader should not get emotionally attached to any stock or sector; rather, they should focus only on profit and loss and should always adhere to stop loss. He should learn the art of timing the volatile & risky market and take position and book profits whenever he sees an opportunity rather than on his weakness.

He should never go against the prevailing trend of the market. He should trade in strong stocks during an uptrend and weak stocks in a downtrend to lower the potential for loss. He should keep in mind that the market is always right and it’s his capability, focus, and hard work that will help him to generate a daily income from the stock market.

Frequently Asked Questions

Is the income earned through the stock market taxable?

The advantage is that it can be applied to any kind of business irrespective of its size or capital requirement. The disadvantage is that it does not take into account the risk of depreciation in the value of the money due to the time taken by the business.

How to earn from the stock market as a beginner?

The payback period basically means when the amount invested into the business is returned back to the Businessman. That is, at what time does the Initial capital generate more capital which beats initial capital, and hence business starts generating positive cash flows.

Is it difficult to earn from the stock market?

No, as we have discussed in the blog, it is not difficult to earn from the stock market if you trade with discipline.

What is the maximum amount one can earn per day from the stock market?

The maximum amount that you can earn per day from the stock market depends on how much capital you have deployed in trade and also your risk appetite.

What is the difference between day trading and swing trading?

The main difference between swing and day trading is the time frame. Day traders work with a short and limited time frame, whereas swing traders work with a much longer time frame. If the trader is patient enough, swing trading is better. Otherwise, day trading is better

You can use StockEdge to get a cutting edge over others in both short-term trading and investing. Hence, you not only get data at one particular place but can also create your own combination scans based on your own technical and fundamental parameters. We hope that you found this blog informative and use the information to its maximum potential while indulging in intraday trading. Show some love by sharing this blog with your family and friends and help us in our mission of spreading financial literacy.

good article

Hi,

Thank you for reading our blog!

Keep Reading!!

Really helpful for bigginers… thanq

Hi,

Thank you for reading our blog!!

Keep Reading!

Practical and useful hints, designed to help a beginner.

Very Helpful 👍 thank you😊

Hi,

Thank you for reading our blog!

Keep Reading!

Quite educative article. Thanks a lot.

Hi,

Thank you for Reading!

Keep Reading!

Good explanation thank you

Thanks for sharing ideas on share trading.

Hi,

Thank you for reading our blog!!

Keep Reading!

Very Helpful … thank you

Hi,

Thank you for reading our blog!!

Keep Reading!

I like it, keep it up

Always Need to clear confusion which comes in mind

when we are reading or watching so many blog and video, some confusion comes we have to fallow whose words. I am looking always some thumb rule which is matching all Writers or video makers

Have a Nice Day

Be Happy Spread Happyness and Joy

Hi,

Thank you for reading our blog!!

Keep Reading!

Helpfull

Hi,

Thank you for reading our blog!!

Keep Reading!

Thanks for sharing.

Thanks for sharing keywords.

Nice.

Thanks for online income article. Straight to the point narration. This kind of article is rare. Thanks. I have posted this question at various forum and finally found the answer here.

HI! Thank you so much for providing some valuable information

very useful yips. Thank you for your valuable guidance.

Hi,

Thank you for Reading!

Keep Reading!

Useful blog

Hi,

Thank you for Reading!

Keep Reading!

Thank you So much Very informative knowledge

Hi,

Thank you for Reading!

Keep Reading!

Good Blog worth reading .

Hi,

Thank you for Reading!

Keep Reading!

Informative for a beginner like me

Hi,

We really appreciated that you liked our blog! Thank you for your feedback!

Keep Reading!

Good

Hi,

We really appreciated that you liked our blog!

Thank you for Reading!

Keep Reading!