“DON’T PUT ALL YOUR EGGS IN ONE BASKET” – It means not to put all your efforts in one particular area because you may lose everything. This is a piece of common advice which is given to us at various phases of life, be it career choices, or when you start to invest. Here comes the concept of investing in dynamic asset allocation funds.

We are always told to take a diversified decision.

So when it comes to investment decision making, we wish to invest in those funds which mitigate our risk with diversification and considerable returns.

Keeping this in mind, we will discuss one of the important portfolio management strategies i.e Dynamic Asset Allocation, which blends diversification and risk management strategy.

What is Dynamic Asset Allocation (DAA)?

As per the Securities Exchange Board of India (SEBIs) new fund categorization regulation,

Dynamic asset allocation funds are the hybrid funds that invest across equity and debt in such a manner so as to minimize risk based on market trends.

It is mainly used by hedge funds, mutual funds, credit derivatives, index funds, principal protected funds, and other structured investment products.

How does dynamic asset allocation fund works?

Primarily, the working of the fund directly depends on the fund manager’s ability to match the right decision of asset allocation.

So with the market low or high, equity exposure of the fund is decided.

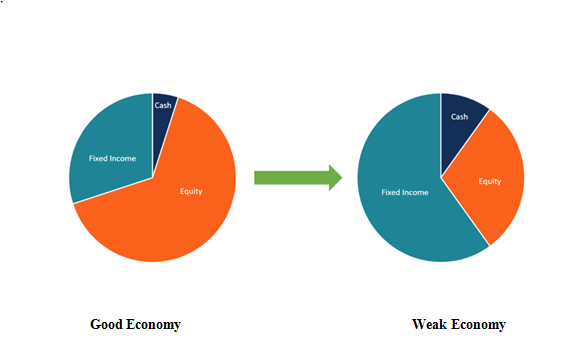

For instance: If the economy is not going good, then the investment manager using this strategy would reduce his equity exposure and would prefer more investments in interest-bearing securities or even sit on cash till the economy’s situation changes and vice versa.

In the above image, the Allocation of a different class of assets under different situations to generate better returns with low volatility.

So the THUMB RULE of DAA funds is —– Avoiding a downturn to plan a long-term successful investment strategy.

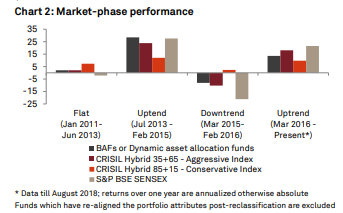

So here, we can quickly look at the Market- performance of DAA funds over the years:

So if you look at the above report, you will find that the with longer time horizon, the fund performs better and gives higher returns to the investors.

Also Read : What Is Asset Allocation And Why Is It Important?

Advantages:

- Flexible – Allocation of assets relative to market conditions

- Considerable returns due to re-balancing

- Suitable for low-risk appetite investors

- Suitable for Long term investors

- High return percentage compared to bank deposits.

Disadvantages:

- High Transaction Cost

- Time-consuming as it actively requires to be monitored and controlled by the investment manager.

Who should invest in dynamic asset funds?

These funds are best suited for the long- term Investors who though have a low-risk appetite but are ready to take a bit of risk to enjoy the returns from an equity-debt mix of assets in their portfolio.

Suggested Read : Guide to Strategic Asset Allocation

So the investors can enjoy equity kind of returns but with a balanced portfolio.

As this fund re-balances during volatility thus investors can rest in peace.

Dynamic asset funds VS Fixed Deposits

| PARAMETERS | DYNAMIC ASSET FUNDS | BANK FIXED DEPOSIT |

| RETURNS | No fixed returns | Fixed returns |

| EXPECTED RETURNS | High Inflation adjusted returns | Inflation eats the returns |

| REDEMPTION | Can be redeemed anytime | Fixed for a period |

| WITHDRAWAL | Part withdrawal is possible | Only full withdrawal with a penalty |

| COST OF INVESTMENT | Had a transaction cost for investment | Does not have any cost involved |

| RISK PROFILE | Moderate risk | No risk |

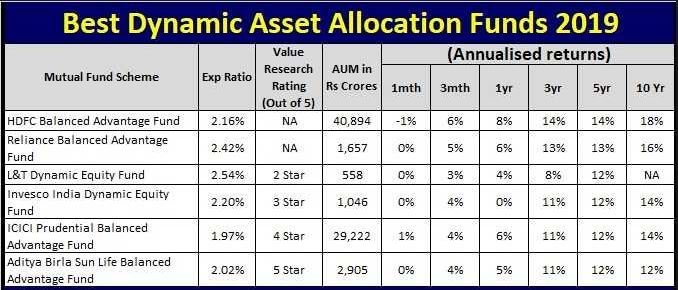

Let us give a Quick view to the best of the DAA funds 2019 here:

Tax Implication:

- The biggest advantage of these funds is that they are structured in such a way that they are taxed as equity funds for investors.

- When this fund lowers its equity exposure, it ensures that equity plus arbitrage component of the scheme is at least 65% of the corpus, which helps it, to qualify for equity taxation.

Learn from Experts : Come Let’s Invest – A Beginner’s Guide

What makes Dynamic Asset Allocation Funds even more attractive is their tax-free nature.

- Dividends from these funds and gains after one year are completely tax-free.

- Even short-term gains are taxed at 15%, which is lower than the rate applicable on pure debt funds or bank deposits.

Key Takeaways

- Dynamic asset allocation is a hybrid of active and passive investing.

- Dynamic asset allocation should be preferred for medium to long term time horizons.

- Dynamic asset allocations offer stable returns with low volatility.

- As compared to the traditional instruments, these funds offer better returns.

- These funds also remove the investor’s concern regarding the volatility of equities due to their frequent re-balancing with the market conditions

In order to get the latest updates on Financial Markets visit Stockedge