Divestment is defined as the action of an organization (or government) selling or liquidating an asset or subsidiary.

It is normally done in a strategic sale in order to realize some or whole part of the holding of the divested organization.

Divestment results in reducing one’s stake into some organizations and giving to some other entity.

So why Divestment?

In the current scenario, the government has about Rs 2 lakh Crs locked up in the PSUs.

Thus, the government is divesting the stake from few companies in order to utilize the funds for few things such as:

Financing the increasing fiscal deficit

Financing large-scale infrastructural development

For investing in the economy to encourage spending

For retiring Government debt- Almost 40-45% of the Centre’s revenue receipts go towards repaying public debt/interest

For social programs like health and education

The Government has increased the divestment target to Rs 1 lakh crore from Rs 90000 crore for FY20.

It plans to raise this amount from the divestment of 24 PSUs besides the budgeted divestment of Rs 1 lakh crore in FY20.

This move comes in when the centre estimated that there might be a deficit of nearly Rs 40,000 Crs in the GST collections as compared to what it budgeted in FY19-20.

With this GST collection shortfall, it might be inadequate to contain the fiscal deficit at 3.3% of GDP in FY20.

Recently, amid weak domestic market sentiment, the government had decided to forgo revenue of Rs 1.45 lakh crore in FY20 as it offered a corporate tax cut to 22 per cent from 30 per cent for reviving the economic activities in the country.

This would also put pressure on the government’s fiscal report card.

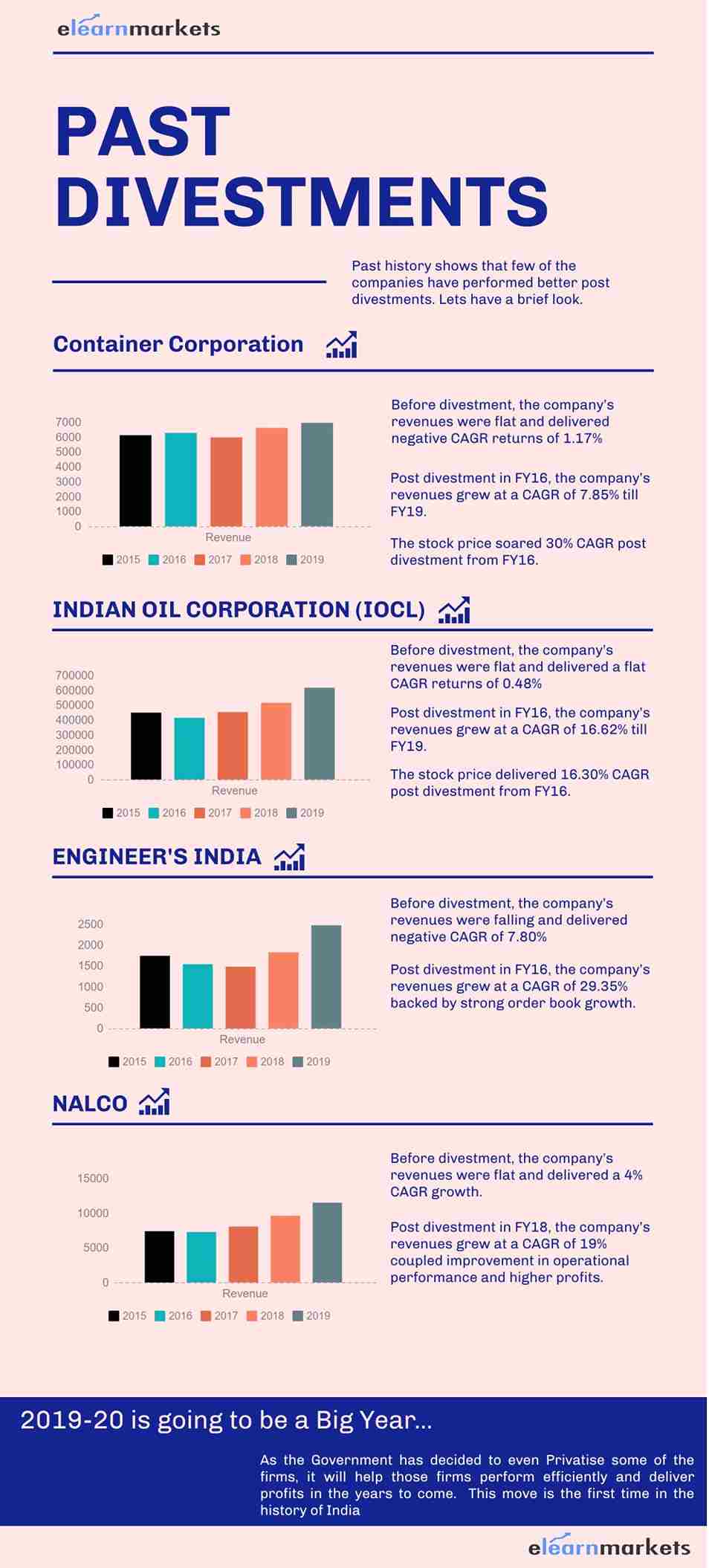

What did the past few divestments meant for the companies?

The Government has been doing these divestments since as long as 1991, when the then finance minister Manmohan Singh first floated the concept in the FY1991 budget.

So let’s have a look at few of the companies which have been divested in the past 5 years and how have they been performing post-divestment.

Container Corporation:

In the year 2015-16, the government divested ~5% of CONCOR stake via OFS (Offer for Sale) route. This stake sale fetched ~Rs 1155.20 Crs to the government. In 2018-19, the government’s shareholding stood at 54.80%.

Post divestment, the company’s revenues grew at a CAGR of 7.85% till FY19. This was on the back of increased productiveness of the company backed by increased export-import in India.

The PAT of the company also grew at a CAGR of 18.88% post divestment. This shows that the company was able to deliver better performance post divestment by the Government.

Indian Oil:

The Government decided to divest IOL’s stake in 2015-16. This deal reduced the government’s stake in the company by ~10% and brought it down to 58.57%. This divestment fetched the government ~Rs 9369 Crs. In 2018-19, the government’s stake stood at 51.50%.

Post divestment the company has been able to deliver revenue at a CAGR of 16.62% from FY17 to FY19. The company’s PAT also grew significantly in FY19, when the company’s refining margins were affected due to higher crude oil prices.

The Refineries also achieved its highest ever crude productiveness.

Engineers India:

The Government along with the above two companies also divested its stake in Engineers India by ~10%.

This divestment deal fetched the government ~Rs 642.50 Crs, reducing the government’s stake to 59.37% at the end of FY16. In FY19, the government’s stake was at 52%.

The government has been constantly reducing stake in this company since the past few years.

Post divestment in 2015-16, the company’s revenues grew significantly at a CAGR of 29.35%. It was backed by a significant growth in the company’s order books. Operations also became efficient which was evident with higher margins compared to FY17 and FY18.

NALCO:

NALCO was decided to be divested in 2017-18, where in the government sold off ~9.21% of the company’s stake via OFS route in order to realize around Rs 1191.73 Crs.

Post the company’s divestment, the company’s revenues jumped significantly and grew at a CAGR of 19.5%. The Margins also grew from FY17 on the back of better operational efficiency resulting in higher profits for the company.

Current Scenario:

The Government has planned for strategic sale of few of the state owned companies like the BPCL, CONCOR and SCI along with THDC by NTPC and PEECO by NHPC.

Till now the government has been able to fetch only Rs 12357.49 Crs from few of its deals. Hardly 5 months are left in this fiscal year, so the government has started to divest the companies aggressively in order to meet the target.

The government has also thought of privatizing few of the firms bringing down its shareholding to below 50%. This is on the back of lesser time left for this fiscal year and also in order to meet its budgetary shortage.

Will it be beneficial to the PSUs and its investors?

Past history shows that few of the companies have been able perform decently post divestment which is evident that if the government’s interference reduces, then the company has the capability to perform better. With lesser interference, the PSUs perform better.

But whether the future divestments planned out by the government will lead to better operational efficiencies of companies is just a matter of time. It is to be noted that in none of the companies did the government take out its controlling stake. This means that the government will keep on having an impact on these companies, directly or indirectly.

However, out of 11 PSUs lined up for divestments, there are few companies where the government will sell most of its investments. This means that the government will become a minority shareholder of the companies. This is the first time that the government has planned this in India.

Companies with good fundamentals and a minority shareholding of the government will boost working of few companies. More and more retail participation can be seen in these companies post divestment which would drive the share prices backed by good operational performance and profitability.

Bottom Line:

In FY20, the government is doing everything it can do meet its fiscal target and also to meet the budgetary shortage which is anticipated due to the recent tax exemption announcement.

Government divestments in the past did not always result in good operations of companies due to consistent interference in the day to day working. However, it is trying to privatize few of the companies out of the 11 lined up which would be big boost for these companies.

Investors need to choose companies with good operations and a strong management who can efficiently utilize the company’s resources in order to increase the profitability. This would ultimately reward the investors of the company and hence improve the sentiment of PSU investing.

We can expect an improvement in the divested company’s performance both in the top line and the bottom line. This would also drive the stock prices of those companies.

Keeping a track on the order book, the operational movements and management commentary regarding the companies will be an essential part in selecting and investing in the divested PSEs.