In the aftermath of the Financial Crisis of 2007/2008, Credit Default Swaps (CDSs), alongside other financial products like Collateralized Debt Obligations (CDOs), were heavily lambasted by the public and tightly scrutinized by governments for their major role in causing the crisis. This report will start out by explaining what the CDS are and why it was created. The rest of it will largely focus on the role CDSs played in the financial crisis, the role it plays in the current financial markets, and how India’s Regulations affect these roles.

| Table of Contents |

|---|

| What is Credit Default Swaps? |

| The Role of CDSs in the Financial Crisis |

| The Role of CDSs in a Post Financial Crisis |

| Regulations India has placed on CDSs |

| Conclusion |

What is Credit Default Swaps?

Credit Default Swaps (CDSs) are most often simply explained as Insurance against the credit risk of a reference entity(most often Bonds and Asset-Backed Securities), where the seller of the CDS insures the credit risk, for a certain premium paid by the buyer of the CDS. The creation of the first modern-day Credit Default Swap is most often credited to J.P Morgan in 1994. They created the original contract in order to shift the credit risk of a 5 billion dollar loan to Exxon, to another entity.

This allowed JP Morgan to not devote a large chunk of their cash as reserves (to maintain the required 8% minimum Credit Adequacy Ratio (CAR)), while also maintaining client relations with Exxon. This type of contract, later labeled as Credit Default Swaps, was used by financial institutions to hedge and minimize their risk. What separates Credit Default Swaps from simple insurance products, was/is two main things: the buyer of the CDS does not have to own the reference entity which is being ensured, and the fact that the “contracts could be traded in and out of”[Terzi], much life other securities

The role of CDSs in the Financial Crisis

The first of the two aforementioned distinguishing attributes of CDSs is the main reason that CDSs are blamed to have exasperated the effects of the Financial Crisis. The fact that party A can buy a CDS without actually owning the reference entity, in essence, allows for speculative betting on the reference entity. Before 2007 the CDS market was several times bigger than the market sizes of the reference entities being ensured.

The creation of CDS contracts essentially multiplied, by several amounts, the credit risk present in the market. So in the financial crisis, where the majority of CDS contracts referenced CDOs built on a subprime mortgage, the risk of all these risky CDOs was greatly multiplied and spread to parties who were often unaware of the nature of the contract they had invested into through their banks and financial institutions.

Also Read – 22 Important Banking Terms you should know

The rapid growth and spread of selling risky CDSs contracts, prior to the Financial Crisis, could be mostly attributed to the skewed incentives of bankers, who were making a lot of money selling these contracts, and rating agencies, for whom the majority of their fees were coming from the rating of CDS and CDOs the banks were selling. Rating agencies were able to falsely rate underlying CDOs and Bankers were able to make large profits on them, due to the largely unregulated nature of the market. The CDS market had a perceived ‘lack of transparency, liquidity, and efficiency the majority of the contracts were sold over the counter to institutional investors, rather than in a regulated market.

The lack of a regulated market ties back to the initial problem of multiplying risk. With no clear regulations and central market, companies who did not have adequate capital to actually ensure the credit risk were still able to enter into CDS contracts. So if the underlying reference entity defaulted, so did many of the companies insuring the credit risk. The best example of this is perhaps AIG, which had to be bailed out by the U.S government to the tune of 182.3 billion dollars, all because of unknowingly entering into too many CDS contracts.

The Role of CDSs in a Post Financial Crisis

As one would naturally assume, the volume of CDS contracts severely declined in the aftermath of the financial crisis, decreasing from a market size of 5.1 Trillion US dollars in 2008 to 1.6 trillion US dollars in 2010. However, CDS still plays an important role in global markets. With more transparency in the CDS market post-financial crisis, CDSs have started to play some important roles in the global financial market. “CDS spreads are widely regarded as a market consensus on the creditworthiness of the underlying – corporate or sovereign-entity. This is especially useful for markets where the underlying debt is less liquid.

This nature of CDS has also been a source of ire, especially in regards to sovereign debt, where speculative CDSs contracts are blamed in making debt more expensive for sovereign nations, and also increasing the perceived chance of default. This was seen in Europe during the multiple debt crises, and eventually lead to Germany banning naked CDS. But in the same way, speculative CDS raises the cost of debt on risk securities, it can also reduce the cost of hedging for less risky securities by increasing liquidity in the market. This positive aspect of CDS was seen in the Asian bond market, where “CDS trading has had positive impacts on bond market development in terms of lowering average spreads and enhancing the market liquidity.”

Regulations India has placed on CDSs

In 2011, India allowed the introduction of CDS contracts in the Indian financial market, but alongside a strict set of guidelines created by the Reserve Bank of India. These guidelines were written to prevent the mistakes made in the financial crisis, and prevent the issue of expensive debt(corporate and sovereign) seen in Europe. However, in doing so, it seems India has limited the scope and usefulness of these contracts within the Indian Market.

The first section of regulations deals with the issue of lack of transparency and credibility of CDS contracts.

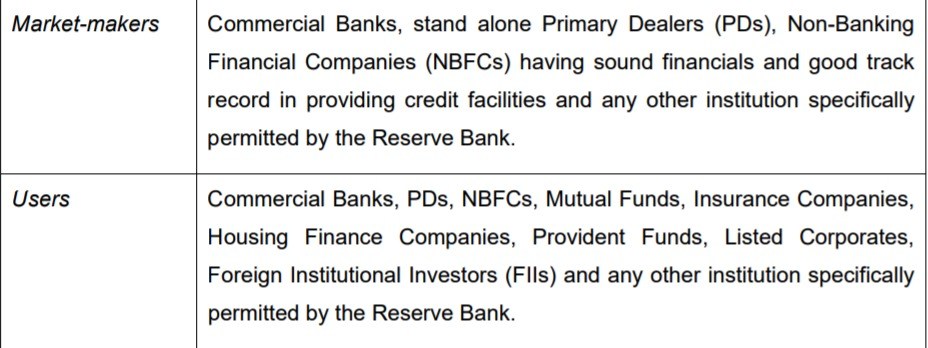

The regulations deal with the adequate capital issues by specifying, which entities can sell (ensuring credit risk) CDS contracts & or act as Market Makers, and which entities are allowed to buy CDS contracts

These Market-makers and Users themselves have regulations placed on them, to limit risk. Such regulations include:

For Banks

- Minimum CRAR of 12 percent with core CRAR (Tier I) of at least 8 percent;

- Net NPAs of less than 3 percent.

For NBFCs

- Minimum Net Owned Funds of Rs. 500 crore;

- Minimum CRAR of 15 per;

- Net NPAs of less than 3 percent;

- Have robust risk management systems in place to deal with various risks.

To eliminate the risk of Asset-Backed Securities that was seen when CDOs were the reference entities of CDS contracts, Indian regulation mandates that only rated corporate bonds can act as reference entities of CDSs.

And in order to remove any confusion and increase transparency within CDSs and the CDS market, RBI’s has placed several regulations that include:

- Standardizing CDS contracts

- Mandating pricing and pricing methodologies of CDSs be regularly validated by external validators

- Requiring all CDS trades be reported on the trade reporting platform, where any updates and changes to the contract are reported to RBI on a fortnightly basis.

So far all these regulations have dealt with the core issues of capital risk and lack of transparency, but India has placed more regulations that devoid the CDS of what differentiates it from a simple insurance contract, removing many of the perceived benefits that come with a CDS.

Indian Regulation mandates that CDSs for a certain reference entity can only be bought by a User who actually owns the reference entity and can only ensure the amount that is owned by the reference entity. It also mandates that CDS contracts cannot be traded in and out of like other securities. Instead, if the User wants to exit a contract he must discuss it with the seller and unwind the contract. He may not offset or sell the CDS contract.

These two pieces of regulation solve the issue of excessive speculation, and its effects (rise in the price of debt and the increase in the spread of credit risk), but by doing so, they single-handedly limit liquidity and usability of CDSs. It is the speculative/ naked CDSs that provide liquidity to the market, and it is this liquidity that allows for an accurately priced CDS that reflects the true credit risk of a reference entity. With these regulations, the only use of a CDS is to hedge one’s own credit risk, and without much market activity, the CDS spreads often will be higher or equal to the spread between the corporate bond and government bonds, removing any incentive for the investor to invest in corporate bonds in the first place.

Conclusion

CDSs have a short, but rich history. In only a couple of decades they have grown quickly, and with that growth, we have seen many problems. If the Indian Government wants to see a thriving CDS market with its benefits of hedging risk and increasing investments in corporate debt, It should focus more, like it already has on regulations that ensure credibility and transparency, while at the same time allowing speculative and tradable CDSs in the market to increase liquidity within the CDS and Corporate debt market so to allow better hedging and to have a debt market that accurately reflects risk.

Dizard, John. “Time to Wipe out the Absurd Credit Default Swap Market.”Financial TimesFinancial Times, 11 May 2018, www.ft.com/content/a6cd6130-542f-11e8-b24e-cad6aa67e23e.

“JP Morgan Invented Credit-Default Swaps to Give Exxon Credit Line for Valdez Liability.” ThinkProgress, ThinkProgress, thinkprogress.org/jp-morgan-invented-credit-default-swaps-to-give-exxon-credit-line-for-valdez-liability-dfe0333d25c7/.

Nicholson, Chris V. “German Ban on Naked Shorts Spurs Volatility.” “>The New York Times, The New York Times, 19 May 2010, dealbook.nytimes.com/2010/05/19/germany-bans-naked-shorts-and-c-d-s-s/.

Revised Guidelines on Credit Default Swaps (CDS) for Corporate Bonds . Royal Bank of India, 2013, Revised Guidelines on Credit Default Swaps (CDS) for Corporate Bonds .

Terzi, Nuaray, and Korkmaz Ulakay. The Role of Credit Default Swaps on Financial Market Stability . Science Direct, 2011, ac.els-cdn.com/S1877042811015941/1-s2.0-S1877042811015941-main.pdf?_tid=a92ce457-2a2d-4a1a-8b8c-847d36f64f14&acdnat=1531284965_a50708440ca76f01b6cd2b032801d38c.

To learn more about such concepts, checkout our courses in financial markets.

In order to get the latest updates on Financial Markets visit https://stockedge.com/